Summary:

- Altria Group offers a potential upside of over 30% and has an estimated fair price value of $54 per share.

- MO has a large dividend yield nearing 10% and has achieved the golden dividend king status by increasing distributions for over 54 consecutive years.

- Despite the decline in traditional smoking, MO has successfully adapted to the market shift by focusing on the e-cigarette market and maintaining healthy profit margins.

- The dividend yield sits above the 4-year average. This is an opportunity to add more income to your portfolio. Additional dividend increases are very likely due to OCI margins.

krblokhin

Overview

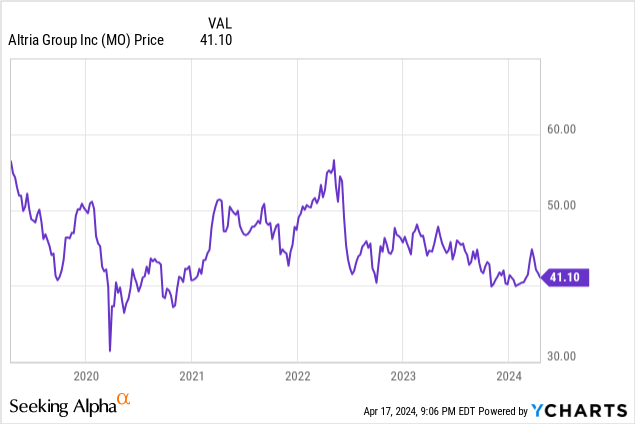

In my initial coverage of Altria Group, Inc. (NYSE:MO), I stated that there was a potential upside of over 30% and an estimated fair price value of $54 per share. When I previously covered MO, I was in the perspective that total return would come from eventual share appreciation and income. The price has recently floated between the $40 – $50 per share range and I believe that entry near this $40 mark is more ideal. As I reassess the company and ideals around the typical MO investor, I want to discuss how MO can also be utilized efficiently by investors only looking to prioritize income received. I plan to accumulate more shares at this level and increase my annual passive income total through MO.

This is totally understandable when you consider that MO has a large dividend yield nearing 10% and the company managed to increase distributions for such a long streak that they achieved the golden dividend king status. After all, this is the most tax-efficient income you can get here with their distributions being classified as qualified dividends. Most importantly, Altria has been able to continue growing the dividend in an environment that’s actively been pushing for the ban and limiting of their products for nearly two decades now.

Despite the challenges, MO has navigated through all headwinds and found ways to adapt through these changes. Their profitability metrics and margins are so healthy that they can still safely distribute dividends without the threat of a cut or reduction. With that, this first dig into the stats around the decline of traditional smoking, how the market is shifting, and how Altria is navigating these shifts.

Risk Profile – Smoker Decline

We’ve all seen numerous amounts of ad campaigns against smoking throughout the last decade. While I am not a smoker myself, I do understand the severity of the health effects caused by smoking. I’m sure most of you reading this have either been affected directly or know of someone that’s lost a family member due to the results of prolonged smoking. I know that the ethical morality of investing in a company like MO is always debated here for this reason.

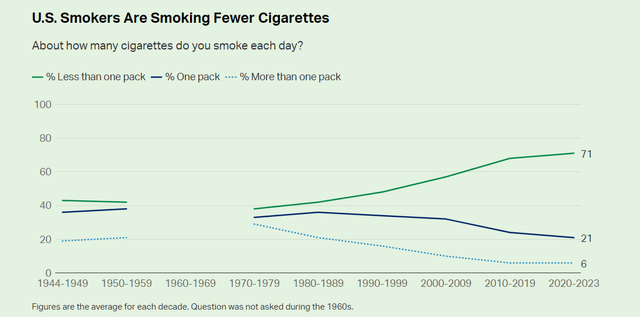

All the ad campaigns were successful over time if we look at the trends of how frequently someone smokes. We can see that amount of people smoking one pack or more per day has drastically decreased since the early 2000s. A survey compiled by Gallup shows that more people are smoking less than one pack.

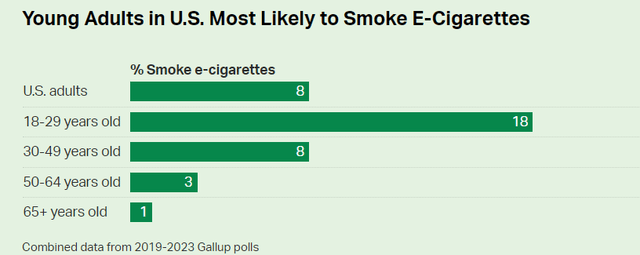

So how exactly do you remain profitable in an industry with a decreasing customer base? Well, the thing is that even though the customer base for cigarettes may have decreased, there has been an increase in the e-cigarette market. The same survey shows us that young adults are more likely to smoke e-cigarettes instead. Naturally, businesses in this space started to adapt with Altria being one of the companies leading the transition to this smokeless segment.

MO has completed the acquisition with NJOY to integrate the lineup into their family of companies. While the acquisition was finalized back in June 2023, it’s worth mentioning as this is MO’s main strategy to pivot and grow their market share in this smokeless segment. NJOY’s products can be summed up as e-cigs that are vapes or pods. These products give you the buzz of smoking cigarettes without the smell or smoke. These vapes have swappable flavor pods and even come in convenient disposable packs if you prefer that.

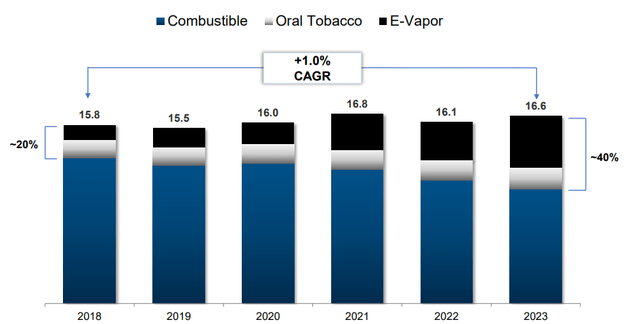

It’s hard to estimate out decades into the future, but it definitely seems like e-vapors are the direction that the market will continue going. Just from a practical standpoint, it makes the most sense; no bad smells left on your clothing or hair, less likely to have “cigarette breath”, and more portable, and better-tasting variety. MO projected there to be a 1% CAGR (compound annual growth rate) in the volume of sales in the nicotine space. As we can see, the share of combustibles has steadily decreased while e-vapors have increased. Oral tobacco products and e-vapors accounted for 20% of the volume in 2018 and now have grown to account for 40% of the volume.

MO has been able to take advantage of this growth by shifting their focus and maintaining large profit margins between operating costs and sales pricing. This is measured by their adjusted OCI (operating company income) margins. One of the reasons that MO has been able to continue paying a high distribution is because their margins are really beneficial. Their adjusted full-year OCI margin increased by 0.9%, up to a total OCI margin of 59.9% for 2023. OCI is a measure of the earnings generated from MO’s core operations after adjusting for non-recurring expenses, accounting for currency rate changes, and other operating costs that go into each product.

The oral tobacco products segment saw an even higher increase in OCI margin. For Q4, the adjusted OCI margin for oral products grew 1.8%, up to 63.1%. These are huge margins that can be further increased with additional pricing changes. So while the tobacco industry has seen a fewer amount of people buying these products, the pricing changes and high OCI margins help keep MO profitable and offsets the lower volumes.

While we are yet to know how sustainable price raises can continue to be, my bet is that we see a growth in smokers in the e-vape category. The e-vape market was valued at $15B in 2020. This market is expected to grow at a CAGR of 28% through 2028. The most popular driver of this growth is that the introduction of e-vapes brought in a ton of new flavor profiles that were once not available. As Altria continues to pivot and increase shipments of their e-vapes segment, I believe that the company will continue to adapt to the changing environment and remain profitable.

Tax-Efficient Dividend Income

As of the most recently declared dividend of $0.98 per share, the current dividend yield is 9.6%. The dividend has been increased for over 54 consecutive years and with a payout ratio of 78%, future raises are likely. Since the price has come down, the yield now trades above its normal level. For reference, the average 4-year dividend yield is closer to 8%. With the yield now sitting above this average, I plan to deploy additional capital as well as reinvest any dividends received.

While shares are cheap, the company also announced share buybacks to commence. Implementing this at price lows is extremely beneficial as it allows them to buy the most amount of shares possible while simultaneously signaling confidence in their own company and abilities to remain profitable. This increases the likelihood of a boost to EPS as it reduces the number of outstanding shares which in turn increases the chance to see a bit of price appreciation.

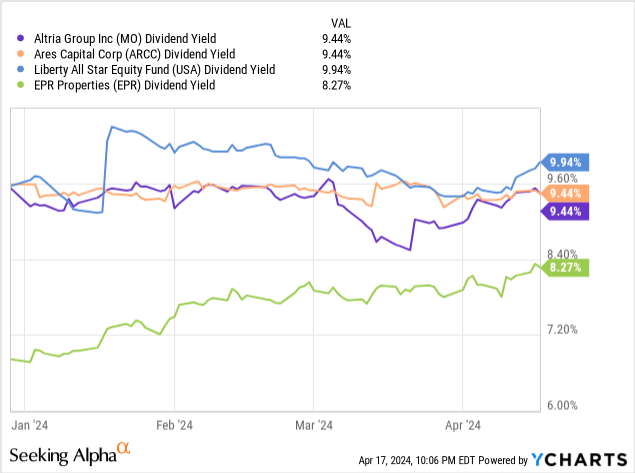

However, this hypothetical price appreciation isn’t what people hold on to their MO shares so tightly for. They stick with MO because of the ability to continue paying a high yield in a tax-efficient manner. MO’s high yield of 9.6% rivals some of the best BDCs (business development companies), REITs (real estate investment trusts), and CEFs (closed-end funds) that typically offer similar high yields. However, the yields from these different asset classes are more frequently classified as ordinary dividends which are taxed more aggressively.

For example, look at how the dividend yields of Ares Capital (ARCC), Liberty All-Star Equity (USA), and EPR Properties (EPR) compare to MO. Each one of these different vehicles has yields around the same range but what makes MO stand out is the qualified status of the dividend.

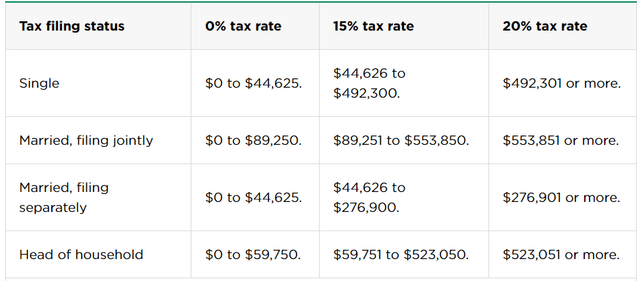

The power of MO lies in the ability to pay zero taxes on the income, based on where you fall. Let’s pretend you only held MO in a taxable brokerage account. This is your only investment, and you have $800,000 invested into the company. This means you’d be collecting $76,800 in tax-free dividend income, if married. If married, you can technically collect up to $89,250 based on the most recent tax rates for qualified dividends in the US.

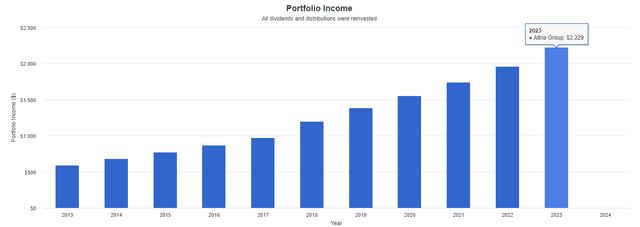

This high level of income has the power to pay your bills and fund your lifestyle. The current yield is so high that even a smaller investment of $20,000 produces enough cash flow to pay some of your bills for the year. The consistent high growth and dividend raises from MO also have the power to snowball your income stream over time. Using Portfolio Visualizer, we can see how an initial $10,000 investment would have grown your income over the last decade. This calculation assumes that no additional capital was deployed since the initial investment. The calculation also assumes that all dividends were reinvested.

In year 1, your dividend income would have equaled a modest $597. In year 10, your dividend income would now have grown to $2,229 annually and your position value would now be worth over $26,000. This can be attributed to the dividend growth experienced. Over the last 10-year period, the dividend has increased at a CAGR of 7.51%. Even on a smaller time frame of 5 years, the dividend increased at a CAGR of 4.6%. These numbers are impressive for a company that already consistently averages a dividend yield above 8%. This high level of cash flow makes MO a great position to own in down markets where even though prices are falling, you are still collecting those dividend payments every quarter that helps add peace of mind and makes it easier to hold on to your position.

Financials

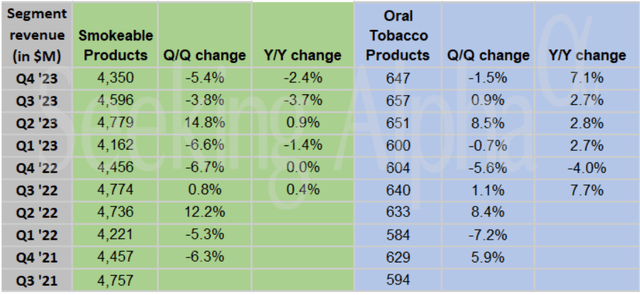

A quick look at MO’s Q4 earnings shows us that revenue slightly decreased by 1.2% from the prior year’s Q4. As seen in the table below, smokeable products saw a decrease in net revenue due to lower sales volume. In addition, the decrease was due to an increase in promotional spending. The decline in sales will likely continue to be offset by marginal price increases over time. The decrease in the smokeable segment was offset by a 7.1% YoY growth in the oral tobacco segment.

Peer company Philip Morris International Inc. (PM) saw an increase in smoke-free sales and I anticipate the same to be true for MO in this upcoming earnings report. MO plans to hold their Q1 2024 earnings call on April 25th. I think that MO will continue to show strength in their oral products and e-vapor segments, and I am basing this off on the growth that PM has recently reported.

We are pleased that smoke-free products reached nearly 40% of our total net revenues and over 40% of our gross profit in the fourth quarter. This was led by the continued growth of IQOS, which has now surpassed Marlboro in terms of net revenues – PM CEO, Jacek Olczak

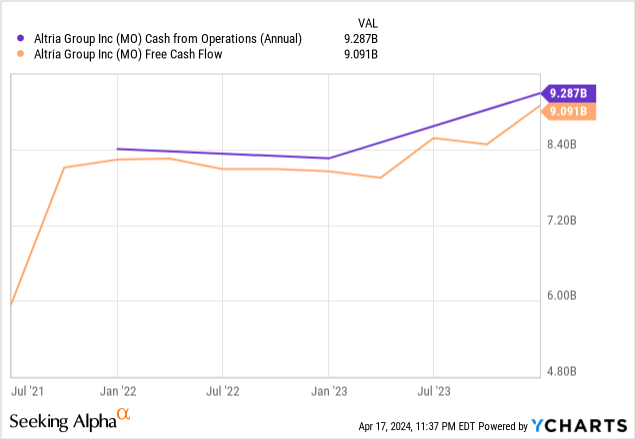

While the businesses are parallel, we should only take this with a grain of salt as MO has a different product lineup. MO’s consensus EPS estimate for the fiscal period ending in 2024 is 5.07. Management recently raised their EPS guidance for the fiscal year to a range of $5.05 – $5.17. The balance sheet should get a nice buff from the partial sale of the Anheuser-Busch InBev SA/NV (BUD) stake as well. At the moment, MO has cash from operations totaling $9.3B which can help navigate through any transitions. We can see increases in both free cash flow and cash from operations over the last 3 years.

Valuation

The average Wall St. price target sits at $46.64 per share. This represents a potential upside of 13.5%. The highest price target is $73 per share and the lowest is $36.50 per share. When I first covered MO, I gave an estimated price target of $54.38 based on a DCF (discounted cash flow) calculation. I’d like to reassess this previous target with some updated metrics and financials. In terms of valuation, MO trades at a current price-to-earnings ratio of 8.2x, compared to the 5-year average P/E of 10x.

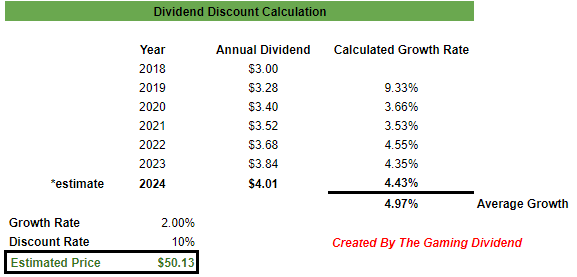

This time around I will be conducting a dividend discount model to get an estimated fair price. First, I compiled all the previous annual dividend amounts dating back to 2018. Then I used the estimated full-year payout of $4.01 per share for 2024. This results in an average growth of 4.97% per year in the dividend. Management expects an adjusted EPS growth rate between 1 – 4% for the next fiscal year.

However, I think that a 2% growth rate is a bit more realistic given the historical data and based on the current shape of the economy. With higher interest rates, high inflation, and tightening consumer spending, we may see slower growth and this is why I choose a more conservative outlook. For reference, MO averaged a revenue growth of 1.6% over the last 5 years.

Author Created

With these metrics in mind, I come to an estimated fair value of $50.13 per share. This represents a modest upside potential of 22%. When you combine this with the high dividend yield of 9.6%, we get a total return potential nearing 32%! I do believe that we have an opportunity to add attractive valuation metrics here and max out our income in the process. Perhaps when interest rates are cut at the end of the year, we can revisit the potential for price appreciation as this would be the first major catalyst to encourage additional consumer spending.

Takeaway

Atria Group continues to offer extreme value to shareholders at this price level. The dividend is currently above the 4-year average and valuation currently points to an estimated fair price of $50.13 per share. When you look at the potential upside and dividend together, we get the possibility of achieving a high level of total return. However, the potential price appreciation isn’t the reason that most investors stock with MO. The high distribution is tax efficient and has the power to snowball into a huge income stream over time through continued dividend raises.

With such large operating company income margins, I expect the dividend raises to continue into the future as MO continues to prepare for the increased volumes in the e-vape segments. The increase in ‘smokeless’ products is slowly taking over the combustible segment. While campaigns to stop smoking have been persistent, MO has found a way to pivot its revenue source and stay profitable. I therefore maintain my Buy rating on Altria.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.