Lucid: The Next Fisker? (Rating Downgrade)

Summary:

- Lucid Group reported higher-than-expected delivery and production volumes for Lucid Air in Q1, but price cuts have likely driven gains.

- The risk profile for smaller EV players like LCID is unappealing, especially after Tesla’s payroll cuts and warnings about challenges in the global EV market.

- With Fisker fighting against bankruptcy, smaller EV companies face an uphill battle for survival in FY 2024.

Khosrork

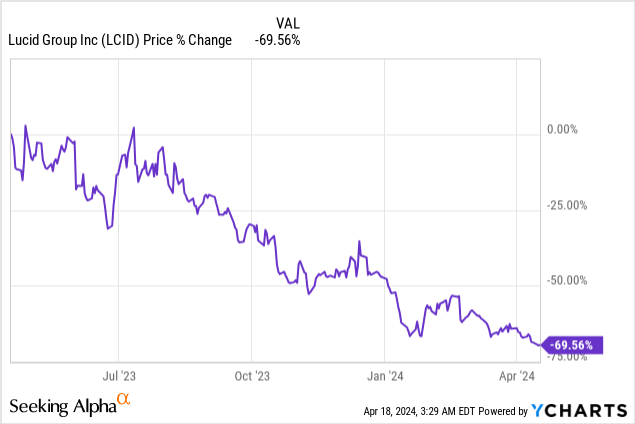

Lucid Group (NASDAQ:LCID) last week reported first-quarter delivery and production volumes for the Lucid Air, which came in ahead of expectations. However, delivery gains have been driven in part by price cuts, so while deliveries have surged relative to the first-quarter of last year, I believe the company is set to see growing margin pressure when it releases earnings for the first-quarter next month. After Tesla (TSLA) drastically cut its payrolls and warned of challenges in the global EV market this month, the risk for smaller EV players, like Lucid, is only increasing. I believe the risk profile has further deteriorated lately. With Fisker fighting for survival and Lordstown already going out of business, Lucid faces an uphill battle in FY 2024!

Previous rating

I rated Lucid a sell in February after the release of fourth-quarter results because the electric vehicle company continued to see an expansion of net losses and it submitted a weak production outlook for FY 2024 that implied a total production volume of only 9k electric vehicles. Considering that Lucid raised even more capital at the end of March and that recent delivery gains were likely boosted by price cuts, I believe the risk profile remains exceptionally weak.

Significant top-line estimate revision risk

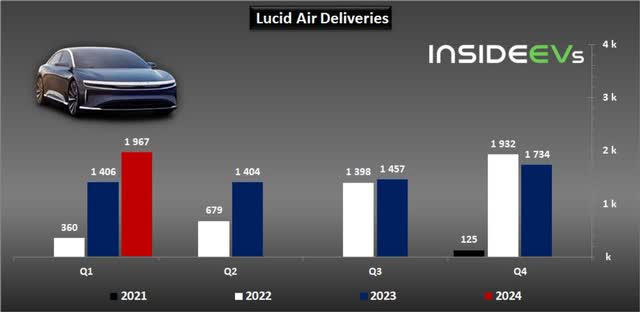

According to Lucid’s update for first-quarter production and deliveries, the electric vehicle company produced 1,728 electric vehicles and delivered a total of 1,967 EVs between January and March, which beat the delivery estimate of 1,745 electric vehicles. However, due to demand challenges in the EV market in the first-quarter, the electric vehicle maker announced price cuts, which likely explain at least some of the increase in deliveries in the first-quarter. In Q4’23, Lucid delivered 1,734 vehicles, which calculates to a 13% Q/Q/ growth rate. These price cuts are set to eat into Lucid’s margins in the upcoming Q1’24 report, and could also lead to a serious number of top-line estimate revisions after the EV maker presents its earnings.

Another equity raise

Lucid has one strength compared to other EV makers and that is that the company is backed by Saudi Arabia’s sovereign wealth fund PIF (‘Public Investment Fund’).

The investment fund has repeatedly participated in capital raises and owns approximately 60% of the California-based electric vehicle marker. At the end of March, Lucid entered into yet another agreement with an affiliate of the Public Investment Fund, Ayar Third Investment Company, which laid out terms for the investment of $1.0B in convertible preferred stock.

The equity raise is set to boost Lucid’s capital reserves. The EV maker had $4.3B in cash on its balance sheets at the end of the fourth-quarter. Assuming $480M in operating cash outflows in the first-quarter (excluding CapEx), which would be about equal to the Q4’23 level, Lucid will still have a very comfortable cash position, at least compared to smaller EV players that don’t have a PIF in their corner. As a result, I believe the electric vehicle maker has access to approximately $4.8-4.9B of cash which should be enough to ensure the financing of all operating expenses in FY 2024, including expenses related to the launch of the Gravity Sport Utility vehicle that is set to go into production later this year.

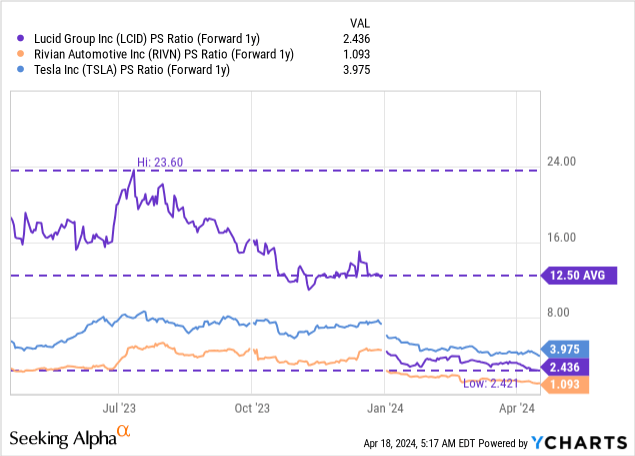

Lucid’s valuation

Shares of Lucid are currently valued at a price-to-revenue ratio of 2.5X, which is a big difference compared to the 1-year average P/S ratio of 12.5X. The reason behind the massive downfall of Lucid’s valuation is the company’s much-slower ramp in production and deliveries, and weaker than expected consumer demand for electric vehicles. Lucid is set to report a cash balance of approximately $4.85B after the March capital raise from PIF, which translates to an approximate cash value of $2.10 per share, which is where I am anchoring my fair value estimate for now. Currently, shares of Lucid trade at $2.42, and I doubt that the Q1’24 report will see major financial improvements. As a result, I would not be surprised to see Lucid go the way of Fisker especially if the Gravity SUV turns out to be a dud.

Risks with Lucid

There are a number of risks that affect an investment in Lucid and the biggest one obviously is that the market (including me) overestimated the demand for electric vehicles in the United States and that includes the luxury segment in which Lucid is operating. Due to slowing EV demand, Fisker is fighting for its survival (and lowering EV prices), and Tesla is cutting 10% of its global workforce in order to adjust its cost structure. The biggest risk, as I see it, is continually weak demand for electric vehicles, which should weigh much more heavily on Lucid’s top-line revenue estimates as the year progresses.

Final thoughts

Last week, Lucid reported a nice upswing in deliveries for the first fiscal quarter, but these delivery numbers were likely boosted by lower sales prices. As a result, I expect expanding losses for Lucid in the first-quarter earnings report next month, as the EV company likely “bought” this growth by suffering margin declines. While the $1.0B capital raise with an affiliate of the Public Investment Fund boosted the firm’s capital position, I continue to see serious risks for start-ups, especially if the Lucid Gravity SUV results in weak customer interest. In this case, Lucid may go the way of Fisker and face a much more serious fight for its survival. Lucid’s shares continue to have a highly unfavorable risk profile and with EV demand broadly waning, the short-term outlook remains very challenging for Lucid.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.