Summary:

- DraftKings operates in the hyper-growing and highly competitive industry of online betting in the U.S.

- Not every successful company needs to have a wide moat, and DKNG can still provide exceptional returns if it meets certain characteristics for hyper-growth companies.

- The Company meets the criteria of attractive growth prospects and potential profitability, but valuation is prohibitive.

spxChrome

DraftKings (NASDAQ:DKNG), one of the two largest online sportsbooks in the U.S., operates in a highly competitive industry and doesn’t have a truly wide moat.

This doesn’t mean it can’t provide exceptional returns.

Let’s dive in and understand why.

Business Overview

DraftKings describes itself as a digital sports entertainment and gaming company. In essence, they do provide entertainment and gaming, but it’s not their business.

Their business is online betting, primarily sports and fantasy. DraftKings operates online betting platforms under the DraftKings brand, which is the second-largest sportsbook in the U.S., behind FanDuel (FLUT).

While the underlying business is quite simple, the business model is more complex.

DraftKings P/L waterfall starts at gross revenue, which is the amount of dollars wagered on its book. Gross revenue minus winnings paid is DraftKings’ net revenue. The gap between gross and net revenues is a result of DraftKings’ ability to price the millions of different lines and odds in its book correctly, as well as the “juice” it needs to provide bettors to compete in the landscape.

For example, if FanDuel gives you 2-to-1 on a certain bet, and DraftKings will give you 1.9-to-1, you’ll probably book the bet with FanDuel.

So, already here, you can get a grasp of the immense competitive pressures on this business, as there are essentially zero switching costs between platforms, and technology isn’t enough of a differentiating factor.

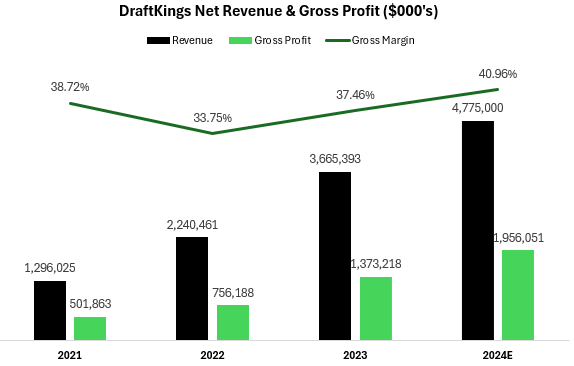

After the net revenue line is the gross profit, which subtracts costs like payment processing, direct platform costs, and revenue-share arrangements.

Created and calculated by the author using data from DraftKings financial reports.

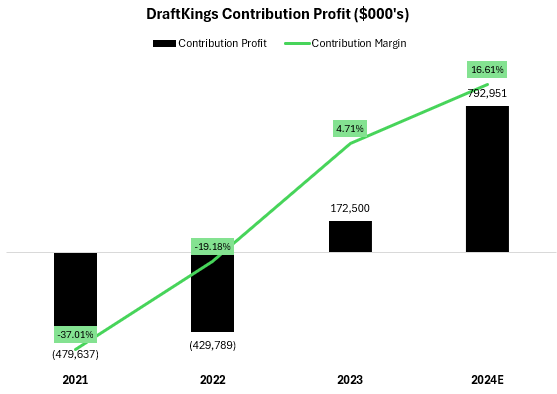

Aside from giving competitive odds, DraftKings and its competitors spend huge amounts in sales & marketing, as they provide huge incentives for first-time players. The gross profit sum minus the sales & marketing expenses is what these companies refer to as Contribution Profit.

Created and calculated by the author using data from DraftKings financial reports.

Another edge a book seeks to have is top-quality models, as it wants to optimize the balance between the dollar amount of bets placed and the expected yield of such bets. This requires extensive R&D investments, as well as personnel for constant monitoring.

Over time, as DraftKings scales, these fixed costs should become a smaller portion of total sales. For now, DraftKings is still GAAP unprofitable, with operating losses of $800 million in 2023, which are roughly 21.5% of sales, and a significant improvement from the $1.5 billion loss in 2022.

So, the bottom line is, DraftKings operates in a highly competitive environment and doesn’t have true differentiation. To acquire and keep customers, it must provide attractive odds, and invest heavily in sales & marketing, while also spending a lot in R&D in order to maintain an edge.

The company is still not profitable, it should come close to break-even in 2024 and achieve profitability in 2025.

The Gambling Industry

DraftKings operates in a hyper-growing industry. Online betting is being legalized across the U.S., which means millions of people have the opportunity to place a wager in a matter of seconds without leaving their sofa.

Gambling is one of the oldest temptations and a very common addiction. Leaving moralities aside, this means a highly engaged customer which usually becomes more and more engaged over time.

According to Statista, the online gambling market amounted to $19.1 billion in 2023, and it’s expected to grow at a whopping 11% CAGR until 2029.

Within this market, online sports betting was $7.6 billion, and it’s expected to reach $17 billion in 2029, reflecting an extraordinary 18% CAGR.

DraftKings and FanDuel, which is owned by Flutter, are the two largest sportsbooks in the U.S., representing a combined ~80% of the total market.

They’ve separated themselves from the pack through superior technology, first-movers advantage, and huge investments in marketing (if you are a sports fan, I’m sure you encounter their logos or hear their names every day in one form or another).

So clearly, it’s a large industry with unparalleled secular growth ahead, the question is, can we make money from investing in it?

Not Every Successful Company Needs To Have A Wide Moat

Investors got accustomed to looking for companies with a “wide moat“. The idea of investing in only exceptional high-quality companies makes a lot of sense, and when executed correctly, can lead to above-market returns with below-market risks and volatility.

I try to stick to such companies as much as I can, and they represent a large chunk of my portfolio. However, occasionally, I’m tempted to invest in a hyper-growth name which inherently comes with more risk.

I described this notion in my Nu Holdings – Top 2024 Pick (NU) article and covered several companies which I believe fit this criterion, including, TransMedics Group (TMDX), Celsius Holdings (CELH), and MercadoLibre (MELI).

In short, I believe there are attractive opportunities in companies that don’t have a wide moat, but for me to invest in one, I want it to have three attributes.

First, it needs to have very attractive growth prospects in the near to mid-term. I’m talking about 20%+ growth for several years.

Second, it needs to be GAAP profitable, or a few quarters away from that.

Third, it needs to have a compelling near-term upside based on simple valuation metrics. In addition, I must sell the stock if it’s no longer compelling based on near-term valuation.

For example, I started buying Nubank when it was already profitable, traded at a 0.5x PEG, and was expected to grow more than 40% in both revenues and EPS. I bought TransMedics at around $75-$80 a share and sold my position last week. I bought Celsius when it traded at a similar EV/Sales like Monster Beverage (MNST), despite much higher growth expectations, and trimmed most of my position in the $90s.

On the less successful side, I bought MercadoLibre in the $1,700s where there was no sensible reason to do so, and that turned out to be an awful decision.

Does DraftKings Fit My Criterion?

DraftKings is expected to grow revenues at a ~22% CAGR over the next four years. It isn’t profitable, but it should get there in 2025. That’s a “soft” check on the first two attributes.

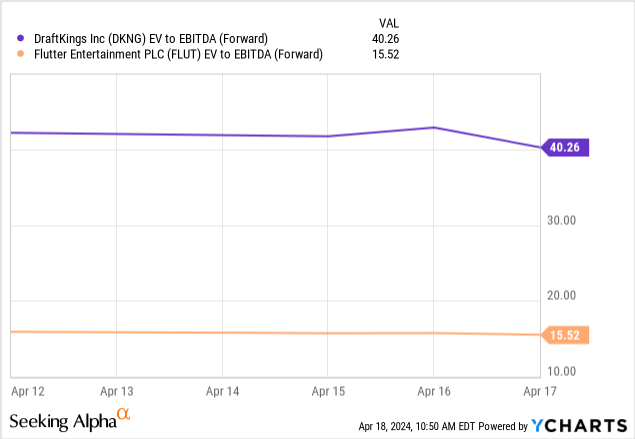

The problem is valuation. The company guided for $460 million in adjusted EBITDA for 2024. Of course, that excludes stock-based compensation expenses, which were almost $400 million in 2023, but for the sake of convenience, let’s stick with the adjusted EBITDA metric.

Based on management’s guidance for 2024, DraftKings trades at an astounding 44x EV/Adj. EBITDA. Management also guided 2026, and 2028, based on which DraftKings trades at 15x and 10x multiples.

Those are so high, I couldn’t even come up with a decent comparable. For context, Flutter Entertainment, owner of FanDuel, trades at 16x EV/EBITDA based on 2024 expectations, and it isn’t expected to grow that much slower than DraftKings. Although Flutter owns several mature businesses worldwide which are inflating its numbers, the gap is still huge.

For me, DraftKings’ valuation is too prohibitive.

Conclusion

DraftKings operates in a highly competitive yet very fast-growing industry, where it’s one of two clear leaders that separated themselves from the pack.

While the stock could respond well to better-than-expected results in the near term, I don’t think it can provide market-beating returns from these levels, trading at an astounding 44x EV/Adj. EBITDA multiple.

The company is not yet profitable and will need to continue investing heavily in sales & marketing and R&D to maintain its leadership.

I believe there’s more that could go bad than good, and therefore rate the stock a Hold.

I would rate it a Sell, but I don’t think it’s smart to short a stock that should continue to grow revenues at a high pace while expanding margins.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.