Summary:

- MO’s turnaround from the Juul fiasco has been highly successful indeed, as observed in the growing NJOY sales across devices/ consumables and expanding retail share.

- PM ZYN’s ongoing shortage has also been a boon, as observed in on!’s high double digit volume growth and oral tobacco market share in the US.

- MO’s prospects are also significantly aided by the promising Vision and 2028 Enterprise Goals, funded through $600M in cumulative cost savings from the Optimize & Accelerate initiative.

- We have already observed promising early results in its performance and financial metrics, with it signalling its renewed growth opportunity as a well-diversified tobacco company.

- Combinedwith the still rich dividend yields and robust double digit capitalappreciation prospects, MO remains a compelling Buy despite the recent rally.

PM Images

We previously covered Altria (NYSE:MO) in August 2024, discussing its robust prospects through the unexpected US FDA marketing approval of NJOY’s menthol-flavored e-cigarette products, with the NJOY acquisition highly accretive to its existing tobacco portfolio.

Combined with the robust QoQ/ YoY growth in its oral tobacco pouches sale, on! and H2’24 likely to bring forth similarly great numbers, we had continued to rate the stock as a Buy then, significantly aided by the management’s raised FY2024 adj EPS midpoint guidance, leading to our reiterated Buy rating then.

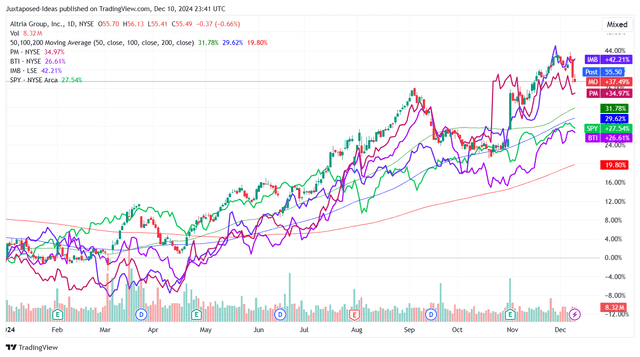

MO YTD Stock Price

Since then, MO has continued to outperform with a total return of +10.1%, compared to the wider market at +8.6%, with the same optimism also observed in its tobacco peers in varying degrees.

Part of the rally is naturally attributed to the market rotation in July/ August 2024, along with the promising numbers observed in their FQ3’24 earning results.

For MO, the biggest win is naturally attributed to the promising early success in its non combustible segment, as observed in the excellent volume growth observed for NJOY consumables at +15.6% YoY and NJOY devices at +100% YoY in FQ3’24.

Combined with the growing retail share in the U.S. multi-outlet and convenience channel to 6.2% (+2.8 points YoY/ +3.2 from pre-acquisition levels in March 2023), it is apparent that the management’s aggressive plan to accelerate NJOY’s retail presence from 34K stores in June 2023 to 100K stores by December 2024 has been highly successful indeed.

At the same time, MO has been able to tap on the growing demand for nicotine pouches as Phillip Morris’ ZYN (PM) continues to face supply shortage issues, as the latter’s “on! maintained momentum in the marketplace” and reports +46% YoY growth in volumes sold in the latest quarter.

The same has been observed in on!’s oral tobacco category market share expansion to 8.9% (+0.8 points QoQ/ +2 YoY), with it underscoring why the management’s original plans of doubling its smoke-free revenues in 2028 and growing its volume by 35% not to be overly ambitious indeed.

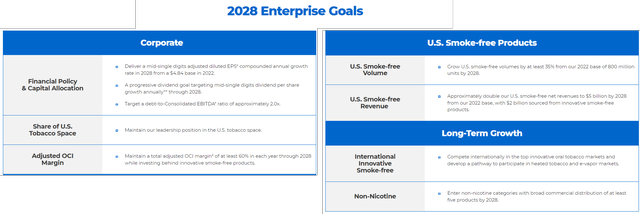

MO’s Vision and 2028 Enterprise Goals

These efforts continue to underscore MO’s highly successful turnaround from the prior Juul scandal, as the management also pledged to achieve their Vision and 2028 Enterprise Goals, funded through $600M in cumulative cost savings from the Optimize & Accelerate initiative.

The management’s FY2024 adj EPS guidance of $5.11 at the midpoint (+3.2% YoY), recent dividend hike by +4.1% (to be further discussed in next segment), and a healthier balance sheet with a net debt to adj EBITDA of 2.1x (inline YoY and down from 2.54x in FY2019) further demonstrate how the robust sales metrics have been translated into its financial performance.

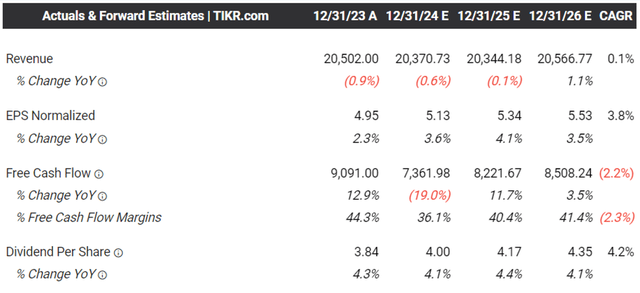

The Consensus Forward Estimates

These may also be why the consensus have moderately upgraded their forward estimates, with MO expected to generate an improved top/ bottom-line growth at a CAGR of +0.1%/ +3.8% through FY2026, with it building upon the YTD numbers of -0.9%/ +1.6% respectively.

This is compared to the original estimates of -0.2%/ +2.82%, while nearing the historical growth at +0.9%/ +4.4% between FY2018 and FY2023, respectively – with it signaling its renewed growth opportunity as a well-diversified tobacco company.

So, Is MO Stock A Buy, Sell, or Hold?

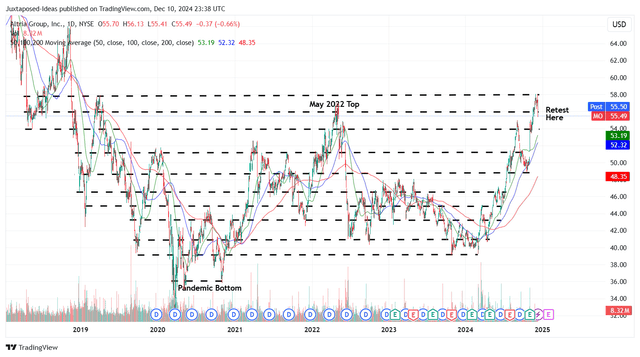

MO 6Y Stock Price

For now, MO has already charted an impressive rally by +41.3% since the 2024 bottom, with the stock consistently running away from its 50/ 100/ 200 day moving averages.

The capital appreciation has naturally contributed to the tobacco stock’s lower forward dividend yields to 7.30%, compared to the March 2024 peak of 9.67% and the 4Y average of 7.97%.

Even so, we believe that MO’s dividend investment thesis remains rich when compared to its tobacco peers, including PM at 4.20%, BTI at 7.91%, and IMBBY at 5.94%, despite the recent rally.

This is significantly aided by the recent dividend hike by +4.1% to an annualized sum of $4.08 per share, with it mirroring the 5Y growth rate at a CAGR of +4.1% and coinciding with the management’s plan to grow its dividend per share at mid-single digits annually through 2028.

This is especially since the Fed has already commenced their rate normalization with an outsized pivot by 50 basis points in the September 2024 FOMC meeting and by 25 basis points in November 2024, as the market prices in another 25 basis point cut in December 2024.

Combined with the cooling inflation on a YoY basis and the resilient labor market, it is unsurprising that the US Treasury Yields have moderated to between 4.11% and 4.38%, compared to the peak of 4.95% and 5.51% observed in October 2023.

This is on top of the potential upgrade in MO’s FWD P/E valuations nearer to its 10Y mean of 13.38x, up from the March 2024 levels of 7.87x and current levels of 10.89x, albeit still discounted from the sector median of 17.67x.

Combined with the consensus FY2026 adj EPS of $5.53 (expanding at a CAGR of +3.8%), there may be a rich upside potential of +33.1% to our bull-case long-term price target of $73.90 as well.

Combined with the ongoing share retirement by -8.6% of its float since FY2019 and the rich dividend/ capital appreciation investment thesis, we are reiterating our Buy rating for the MO stock here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.