Summary:

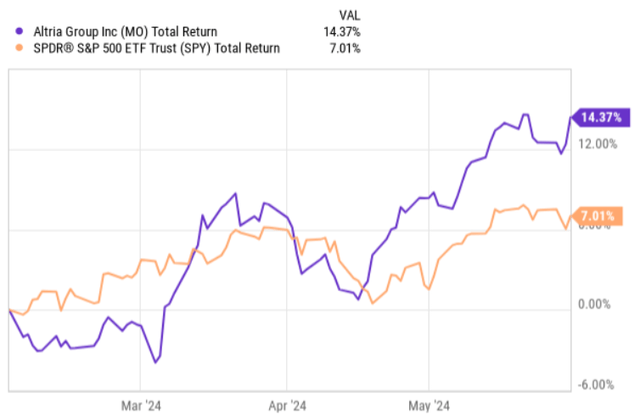

- Altria Group, Inc. has been one of my favorite dividend picks, and since the publication of my first bull thesis back in February this year, the stock has outperformed the market.

- This could signal that potentially the Company has now landed in a territory of overvaluation.

- In this article, I dissect the recent earnings report and share the reasons why I am consistently reinvesting the dividends and adding to my position in Altria.

PM Images

Right at the start of February this year, I wrote an extensive piece on Altria Group, Inc. (NYSE:MO) – “Altria: The Demise Of This Dividend King Is Overexaggerated, I’m Betting Big Now.”

As the title implies, I provided several reasons that have motivated me of going long MO, making it one of the largest positions in my portfolio. The key essence of the buy thesis boiled down to the combination of the following factors:

- Juicy dividend yield, which at that time stood at ~ 9.1%

- Depressed valuations as the P/CF multiple was just below 9x.

- Consistently growing EBITDA since 2022.

- Very robust capital structure – e.g., interest coverage ratio above 10x and net debt to EBITDA below 1.9x.

- Cash flow payout ratio of ~ 60%, which leaves huge volumes of cash in the books enabling MO to further de-risk its balance sheet, buy back shares or keep growing the dividend.

So far, after the publication of my bull thesis, Altria has clearly outperformed the market, registering strong total return performance.

One of the consequences of this kind of share price run-up is that the dividend yield has dropped by circa 150 basis points, and, theoretically, one could question whether there is still a decent upside left for MO to realize.

Please let me know explain why, in my opinion, Altria still remains a solid buy and why I continue to reinvest and add more capital to the existing position.

Thesis review

The answer to why MO remains a buy lies in the details of the Q1 2024 earnings report. In a nutshell, the new data points that emerged from this report fully justify the recent increase in MO’s share price.

The key segment that is set to drive MO’s growth and offset the structural decline in the conventional cigarettes business in the future is NJOY. In the first quarter, MO kept registering new distribution channels, which have now surpassed the 80,000 store mark. The expectation by the Management is to end 2024 with 100,000 stores.

There are two specific nuances that are worth contextualizing with the growing store count:

- More than 70% of the contracted stores have opted for premiums positioning of NJOY, where the majority of the required fixture resets have not yet been executed. The expectation is that these investments will be carried out during H1, 2024, thus boosting the sales (via enhanced product visibility) further from the achieved levels so far.

- MO is still in the process of rolling out a NJOY’s first large-scale retail visibility / trade program, which should introduce an additional tailwind for NJOY.

On top of these positive dynamics, which clearly support the growth potential here, MO has already made decent progress in the current result. The retail share of NJOY continued to advance for several quarters in a row. For example, the retail share of NJOY reached 4.3%, which translates to an increase of 0.6% (a meaningful rate of change considering the level of base value / share).

Another positive factor to underscore is some encouraging signals at the broader policymaking end. In the most recent earnings call, Billy Gifford – Chief Executive Officer – gave a nice color in this context

There is still significant work ahead that we saw some encouraging actions in the first quarter. In the first quarter alone, the FDA, in collaboration with the US Customs and Border Protection, issued over 450 e-vapor related import refusals, up from 348 during all of last year. The agency also continued to levy civil monetary penalties and send warning letters to manufacturers, retailers, and wholesalers of illicit products.

Besides the excellent trajectory of NJOY’s growth, the other two segments of MO also performed in a somewhat decent manner. The oral tobacco category grew by 4.6% in terms of the underlying OCI generation. The adjusted OCI margin came in also a bit better than in the previous quarter – expanding by 0.2%. The smokable category, however, as expected, continued to register declining volumes (e.g., the adjusted cigarette volumes declined by 10% in the first quarter). Yet, what helped offset the negative impact of a sharp decline in sold volumes was MO’s pricing policy, where it achieved a net price realization of 8.5%, which is materially above the Q4, 2023 statistics at 5.5%. So, the net effect of worsening smokable category was not that significant and in the context of solid performance at NJOY and oral tobacco end, the total results came in at solid levels (i.e., a minor decline, which is explained by the seasonality factor).

As a result of a strong momentum in MO’s growth segments, the Management has revised the guidance by increasing the bottom-line result of 2024 by 1%.

If we look at the capital allocation front, the balance sheet remains robust at debt to EBITDA of 2.1 times. Plus, since MO managed to monetize part of its stake in ABI, the share buybacks have been quite notable during this quarter. In addition, MO expanded its share repurchase program to $3.4 billion from $2.4 billion was already implemented under the accelerated share repurchase program. Also, because the cash payout ratio is so conservative, MO was able to utilize part of the retained cash in further debt reduction activities, retiring $1.1 billion of notes that came due in the first quarter.

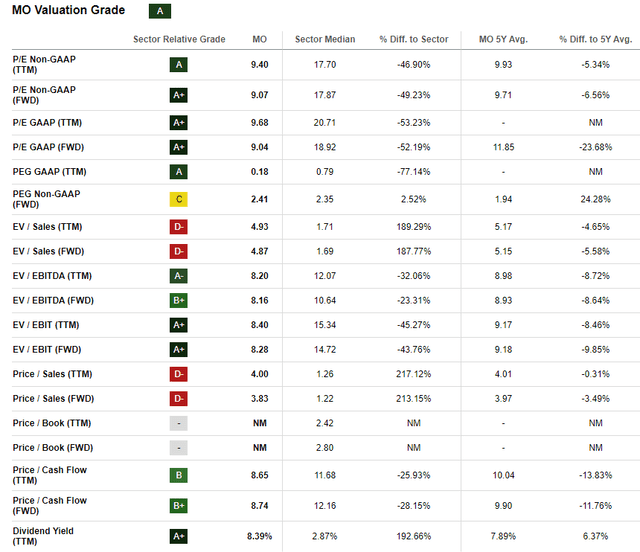

Finally, despite the recent run-up in the share, MO’s valuations still look enticing across the board, with the FWD P/CF remaining at 8.7x.

The bottom line

The Q1, 2024 results clearly confirm the attractiveness of MO’s investment case. Based on the current fundamentals and the financial performance, in my opinion, there is a sufficient basis of data for us to conclude that MO is not just about high yield, but also about a rather solid price appreciation aspect as well.

From the pure dividend investor’s perspective, the Stock is very attractive as the current yield is still attractive enough at ~ 8.4% and underpinned by a fortress balance sheet and stable cash flows.

Yet, the growth aspect of MO is also there as we can infer from the fact that MO retains roughly 40% of its cash generation, which could be channeled towards incremental share buybacks, debt reduction or organic growth opportunities. It is also encouraging to see that NJOY is gaining the right traction and that the cash flow profile remains solid despite the multiple, which typically at these levels is associated with either very speculative businesses or businesses, which suffer a decrease in the cash generation.

As a result of this, Altria continues to be one of my favorite dividend stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.