Summary:

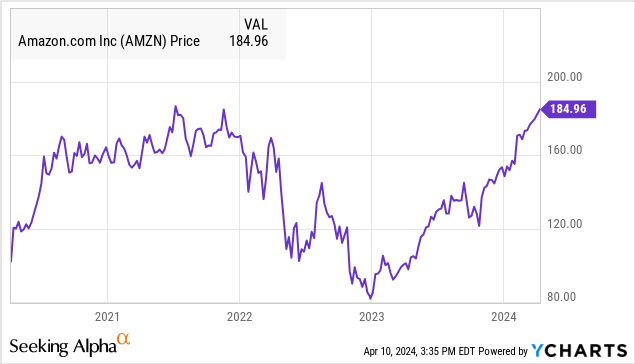

- Amazon has climbed back to near its all-time high ahead of its Q1 earnings report later this month.

- We see room for caution amid a more complex macro backdrop, while expectations remain high.

- Expect renewed volatility in shares, with risk for a bigger correction going forward.

Justin Sullivan

Amazon.com, Inc. (NASDAQ:AMZN) has quietly climbed back to within a few points of its all-time high with shares more than doubling in value from its 2022 cycle low. The e-commerce giant has benefited from the resiliency of the U.S. and global economy as well as the emergence of AI as a new growth driver. We cited these themes when we covered the stock with a bullish article last year.

That being said, we’re updating our rating today eyeing some new headwinds ahead of the company’s Q1 earnings report. A backdrop of stubbornly high U.S. inflation with an outlook for interest rates to remain higher for longer has important implications for Amazon as one of the world’s largest retailers.

Ultimately, the risk is for downside to earnings estimates into the second half of the year. Following what has already been a massive rally, there’s a case to be made that expectations need to be rolled back as the macro picture warrants caution.

AMZN Q1 Earnings Preview

While a date has not yet been confirmed, Amazon is likely to release its Q1 results later this month. The setup into this earnings report is for a continuation of the 2023 trends, which marked an important turnaround compared to the more challenging 2022.

The story in Q4 was surging operating income that reached $13.2 billion, up from just $2.7 billion in Q4 2022. Efforts by management to rationalize costs through operating efficiencies have paid off, evidenced by sharply higher margins and free cash flow.

We mentioned the strength of economic conditions on the demand side for the retail business, AWS sales have also re-accelerated with management citing new customer engagements and a high level of interest related to generative AI opportunities.

The latest update was a letter to shareholders coinciding with the group’s annual meeting. CEO Andy Jassy touched on several points for investors to consider in 2024 including:

- Optimism towards growth in key international markets

- Momentum in the advertising business, up 27% y/y to $47 billion last year.

- The expectation is for further cost savings, focusing on fulfillment efficiency.

- Ongoing expansion of AWS infrastructure targeting demand for AI features.

All of these factors should be in play this quarter where management previously guided for net sales growth between 8% and 13%. According to consensus, the market is looking for EPS of $0.85, which represents a 174% increase compared to $0.31 in the period last in the context of depressed earnings at the start of 2023 resulting in a favorable comparison.

Seeking Alpha

Room To Be Bearish On AMZN

In truth, we’re not too concerned about Amazon’s Q1 report. There’s a good chance the company exceeds estimates in the backdrop of a U.S. economy that has emerged stronger than expected to start the year.

At the same time, AMZN is up more than 20% year-to-date with the market likely already incorporating these factors. The more pressing issue is the forward outlook, which we believe has been muddled by a more complex macro situation.

The stock has reached our price target of $190, and it’s time to reassess. The following 3 factors are why we see room to be bearish on AMZN.

1) A higher for longer inflation and interest rate environment may hold back consumer discretionary spending on the retail side.

The big surprise over the last few months has been the string of data suggesting the disinflationary wave that defined 2023 has stalled. This dynamic has pushed back on what was the overriding narrative entering the year that the Fed would move to aggressively cut interest rates, offering some relief to consumers by kickstarting a round of credit growth.

This is a problem for Amazon as consumers and potential retail customers will see their discretionary spending constrained. In our view, the longer interest rates remain elevated, the greater the chance for a recession emerging which becomes a risk looking out into 2025.

2) Operating margins face a headwind from climbing oil and fuel prices adding to fulfillment costs.

One of the trends we are watching is the climbing price of oil and fuel, which has historically represented an important cost for Amazon. While the company has made efforts to reduce its carbon footprint, including the major push into electric vehicles for last-mile delivery, existing exposure to the broader freight and logistics infrastructure remains significant.

The setup here would be to see a new round of cost pressures on the side of fulfillment, limiting the savings potential the company was targeting for 2024.

3) Strengthening U.S. Dollar impacts international sales and earnings.

We also note that the U.S. Dollar has gained strength across a basket of global currencies, up more than 6% to start the year. The impact here on Amazon sales and earnings is twofold.

First, less favorable foreign exchange rates over the next few quarters add to volatility in headline results given the extensive international business. Second, there is a consequence toward emerging market countries recognized as high-growth opportunities for Amazon facing an economic slowdown.

Overall, the takeaway here is that various high-level macro trends are moving in the wrong direction.

source: Finviz

For as strong as Amazon’s trends have been over the last few quarters, the second half of 2024 and 2025 may be more difficult.

If it becomes apparent the global economy is deteriorating, or not quite as strong as previously anticipated, forward estimates getting revised lower are part of the bearish case for the stock.

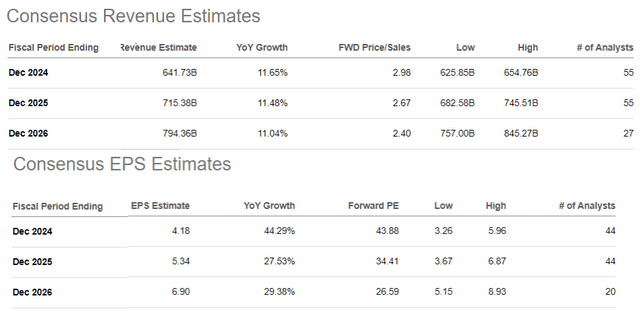

The current consensus forecasting 2024 revenue growth near 12% this year while EPS accelerates by 44% could prove too optimistic. We’d also expect a scenario of risk aversion to narrow valuation multiples.

Seeking Alpha

Seeking Alpha

Final Thoughts

We rate AMZN as a sell with a price target for the year ahead at $145, implying a ~35x multiple on the current 2024 consensus EPS of $4.18. In many ways, our call here reflects a macro view where Amazon’s global size and scale uniquely expose the business to shifting economic conditions.

We believe it’s a good opportunity for current investors to reduce risk and trim exposure, while anyone looking at the stock today may find a more attractive entry point lower down the line.

On the upside, it will be important for the inflation picture to improve with more clarity toward lower interest rates to support the next growth phase. Monitoring points for the Q1 earnings report include the operating margin, cash flow, and updated management guidance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.