Applied Materials: Strong Growth Cycle Up Ahead

Summary:

- Buy rating recommended for Applied Materials as the worst of the semiconductor downcycle is over and growth is expected to accelerate.

- Strong growth catalysts like high-bandwidth memory and gate-all-around technology will support AMAT’s growth.

- AMAT’s recurring revenue stream from service agreements enhances its resilience, although there is a risk of dependence on Chinese customers.

Monty Rakusen

Investment action

Based on my current outlook and analysis of Applied Materials (NASDAQ:AMAT), I recommend a buy rating. I believe the worst of this semi-down cycle is over, and AMAT’s growth should see acceleration ahead in the next industry growth cycle. There are also strong growth catalysts that should further support growth acceleration, like HBM and GAA technology inflection.

Basic Information

AMAT is a big player in the semiconductor industry with more than 55 years of operating history, where they develop and manufacture semi-con wafer fabrication equipment and related spare parts. According to the company’s fact sheet, they are the leader in materials engineering solutions used in virtually every new chip and advanced display in the world. AMAT sources the majority of its revenue from outside the US (85% vs. 15% in the US). As of FY23, AMAT generates $26.5 billion of revenue, more than 3x more than since the subprime crisis in FY08, when the business only had a revenue size of $8 billion. Balance sheet-wise, AMAT has managed to turn the business back to a net cash position on a LTM basis ($7.5 billion in cash and cash-equivalents and $5.9 billion in debt including lease liabilities) after dipping into a net debt position in FY18.

Review

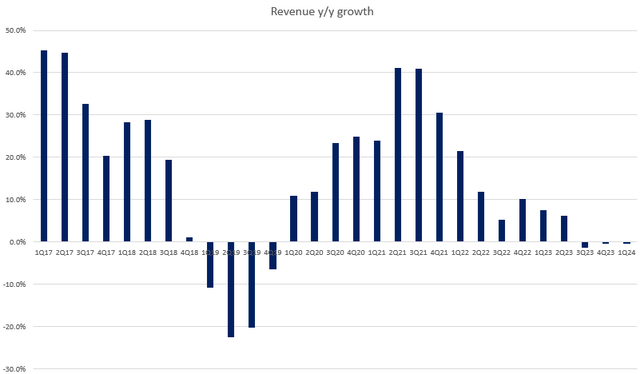

I believe the worst of this current semi-con downcycle is over (started in 2022), and AMAT is going to see growth acceleration in FY25 and beyond. Firstly, is the 1Q24 performance, where AMAT generated revenue of $6.7 billion, flattish vs. 4Q23 and 1Q23? On a y/y growth basis, over the past few quarters, growth has seen massive deceleration, and this is the first quarter of flattish growth, which I see as a sign of stabilization.

Secondly, there are very strong growth catalysts ahead. Namely, the strong demand for high-bandwidth memory [HBM], which management expects to quadruple its HBM packaging business to ~$500 million in FY24 (as per the 1Q24 earnings call), The demand for HBM is basically tied to the growing demand for generative AI, a secular trend that I expect to continue for the long term as the value proposition for AI adoption is too strong for businesses to ignore. Currently, HBM DRAM makes up only about 5% of DRAM output, but the management guide expects this to grow at a 50% CAGR over the coming years. Aside from HBM, there are other major technological inflections in leading-edge foundry and logic, such as Gate-All-Around [GAA], that would drive growth for AMAT. As we reach the physical limits of a chip, leading chipmakers will eventually need to adopt GAA to improve efficiency. According to 3rd party research, the GAA technology market is expected to see over 30% growth CAGR from 2024 to 2030. Despite seeing some delays in certain advanced foundry/logic programs (as per 1Q24 earnings call), management still believes that leading-edge logic/foundry will grow in CY24 as GAA and new investments start to ramp towards the back half of the year, offset by some digestion in mature node spending.

High-bandwidth memory or HBM made up only about 5% of DRAM output in 2023 but is expected to grow at a 50% compound annual growth rate over the coming years. 1Q24 call

One more important point to touch on is that AMAT is now a lot more resilient than in the past, given the steady growth in installed base revenue from Applied Global Services [AGS]. For the AGS business unit, most of the revenue is generated through subscriptions, and there are very few churn rates (<10%). Although AGS revenue was flat sequentially in 1Q24, note that it grew 8% annually to $1.48 billion, now representing ~22% of total revenue, and this marks the 18th consecutive quarter of annual growth for this business unit. Remarkably, this is despite the industry downturn. What this means is that as AMAT grows, its revenue should get less volatile and more reoccurring, and this should push valuation multiples higher.

A significant portion of AGS revenue is generated from subscriptions. We have almost 17,000 tools under service agreements up 8% year-on-year and these agreements have a very high renewal rate over 90%. 1Q24 call

Valuation

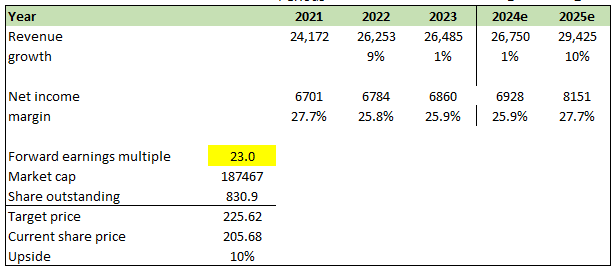

Author’s work

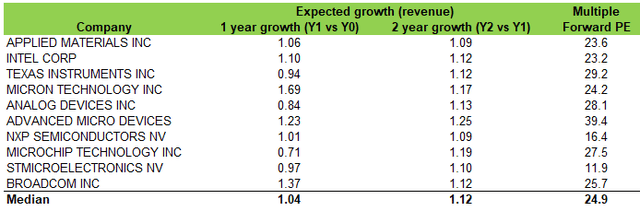

I believe AMAT is going to see growth accelerate as the cycle recovers and growth catalysts (HBM and GAA) materialize ahead. For FY24, I expect growth to be relatively flat vs. FY23 as the remaining impacts from this downcycle end (note 1Q24 was flattish too). However, in FY25, growth should accelerate to at least 10%, following the same rate that AMAT experienced in the last cycle (FY20 saw 10 to 20+% growth). Growth recovery would carry a high incremental margin as volume picks up, driving margin back to its previous height of 27.7% (same as in FY21). The visible outlook for growth warrants a premium multiple, which the market seems to be pricing in already at 23x forward earnings (higher than the FY20 peak). In the near term, this multiple should be easily sustained as the market looks forward to the next growth cycle. Also, historically, AMAT has traded in line with other semi-con peers (as listed below), and in the past 12 months, average peers’ multiple has gone up from ~15x forward PE to the current ~25x forward PE, which I think is reflective of the market being optimistic of the next up cycle.

Risk

Despite China’s low semiconductor self-sufficiency ratio, AMAT’s Chinese customers may temporarily halt or reduce their WFE spending if manufacturing yields increase or the local demand environment continues to worsen. With 45% of total revenue coming from these Chinese customers in 1Q24, this is a significant risk. Geopolitical risk is another major risk to consider, as the semi-con industry supply chain is deeply integrated across multiple continents/regions. In particular, the potential conflicts in Europe and East Asia could spark another round of supply chain constraint, which will dampen AMAT near-term ability to grow despite a recovery demand.

Final thoughts

My recommendation is a buy for AMAT due to its strong position for the upcoming growth cycle in the semiconductor industry. The recent quarter’s flat growth suggests the downturn is ending, and catalysts like HBM and GAA technology will fuel future acceleration. AMAT’s growing recurring revenue stream from service agreements also enhances its resilience. While there are risks from its dependence on Chinese customers, the potential growth justifies a premium valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.