Suncor Energy: Turnaround Story Not Reflected In The Share Price

Summary:

- Suncor’s new management is successfully transforming the company from hazardous to safe.

- Recent results show large improvements across all metrics.

- Suncor’s integrated business model makes its free cash flow very resilient.

- An increase in shareholders’ payout is on the horizon, with a large potential for dividend growth from the current 4.25% yield.

- A 5-year projection with a DCF valuation points to a target share price of C$67 or US$49, suggesting a 31% upside in the share price, making it a strong buy.

JHVEPhoto

Investment Thesis Summary

Suncor’s (NYSE:SU)(TSX:SU:CA) new management seems to be successfully turning the company into a better future in terms of safety, operations, and financial results. The stock price has not yet reflected this new management’s achievements, and the market still seems to be waiting for the next few quarterly results.

The valuation points to C$67 or US$49, with an upside of 31% from current prices. Higher payouts to shareholders are on the horizon, and that should help the stock to get a higher valuation.

Suncor Energy

Though incorporated in 1979, Suncor has a history in oil sands since 1967, when it was still a part of Sun Oil. A Canadian integrated oil company, which even Warren Buffett included in his portfolio in the past. The C$67.5B market cap makes it currently the second-largest oil company in Canada.

Next to oil production, the company also owns a network of petrol stations, Petro-Canada, and refineries across Canada and the United States.

The Business Model – Production and Refining Profile

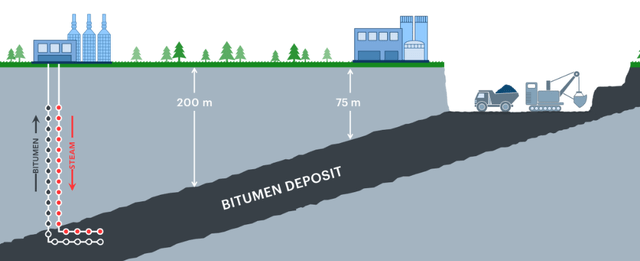

Suncor’s portfolio is predominantly (not solely) built on oil sand mining and in-situ production, producing low-valued bitumen.

Bitumen production (Oilsands magazine)

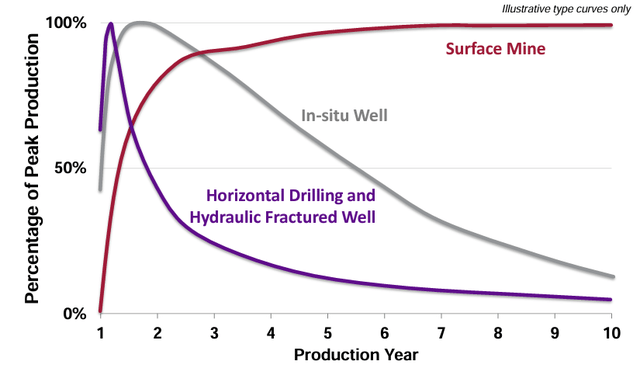

The company enjoys all competitive advantages coming from oil sands, which gives it a very low base production decline of 5% across all its assets, very low reservoir risks, and high recovery rates.

The low-valued bitumen is nearly solid at room temperature, which makes it expensive to move.

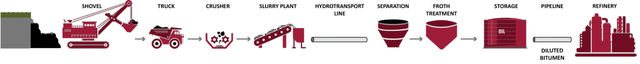

Oil sand mining to refinery (CAPP)

In most cases, producers either upgrade the bitumen to SCO (Synthetic Crude Oil) or dilute the bitumen with lighter carbohydrates to create dilbit (DIL-diluted, BIT-bitumen). After processing, these substances with lower viscosity can flow via pipelines.

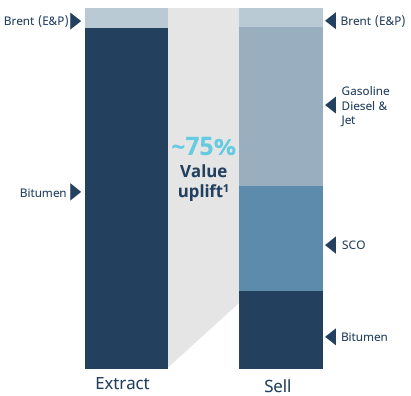

Suncor production and refining products (Suncor presentation)

Next to a small production of Brent crude from offshore, the company uplifts the value of the bitumen by ~75% by upgrading to SCO and refining it into gasoline, diesel, and jet fuels.

As you can see, there is no gas in the production mix, but running the production requires gas. It’s not significant, but this makes Suncor’s net short of gas with an additional cost of ~C$150M if AECO rises by C$1/GJ.

New Suncor Looks Promising

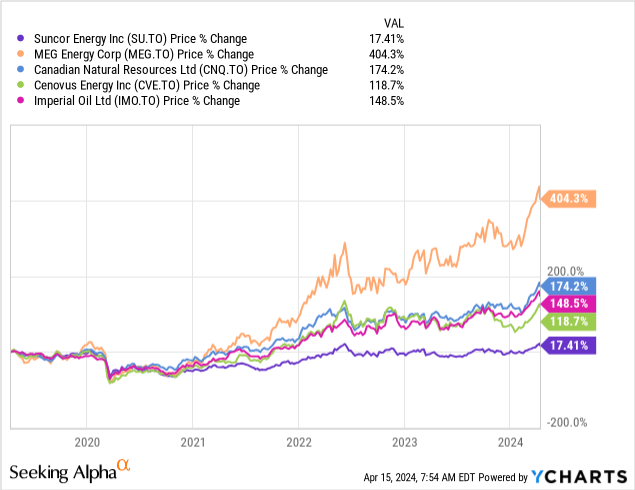

With operational, reputational, and safety issues, Suncor was by far the worst performer in the oil sands during the last five years.

Suncor has had a new CEO, Rich Kruger, since last year, which gave investors a lot of hope in the turnaround.

Cost Cuts & Narrowing Focus

Committed to cutting costs and simplifying the company structure, the new management decided to sell U.K. assets, Norwegian operations, wind and solar assets, and North Sea assets.

I consider this very significant, as it narrows the focus to the oil sands, which is the most important asset for the company. Making sure that oil sands are running smoothly and filling their refineries is the alpha-omega for future returns.

Further to cost cutting, the company reduced the workforce by 1,500 people and acquired the remaining interest in Fort Hills.

With 50+ years of operational history in Base Plant, the Life of this asset is expected to run out during the next decade. It is uncertain if Suncor will receive an extension permit due to environmental concerns. These newly acquired Fort Hill assets should significantly help them offset the decline when it comes to the extension of the Base Plant. These assets come with ~50 years of reserve life with lower production costs.

Safety

Due to 12 worker fatalities between 2014-2022, Suncor made a bad reputation for itself. According to Global News, that’s more than all other oil sands peers combined.

Their reputation is further damaged by pollution incidents in their refineries.

With the new management, Suncor has changed to one of the safest places to work, with last year being the safest in the company’s history. It was the first year since 2015 with no life-threatening injuries.

Recent Results, Financials, Capital Allocation & Shareholders Return

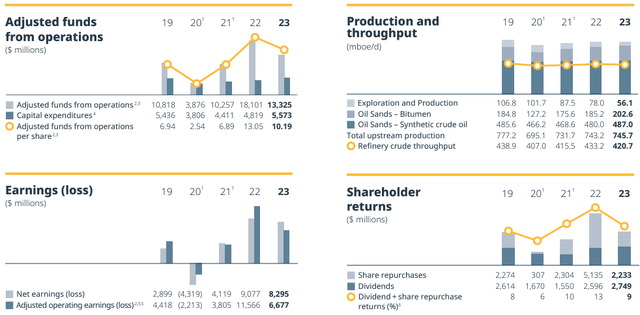

In 2023, we witnessed the second-highest production numbers with 745,700 bbl/d. What’s even more impressive was the last quarter with 808,000 bbl/d. The management targets growth in output of 6%, but the last quarter suggests it could be even more.

Suncor’s refining capacity of 466 mbpd across Canada and the US makes it the second-largest refiner in Canada. The refining utilization achieved a 90% in 4Q2023. When asked by analysts, the new management did not forget to take credit for the utilization improvement.

Financials (Suncor’s financial report)

The company returned C$5B to shareholders via buybacks and dividends and increased the base quarterly dividend to C$0.545 (currently 4.25% yield).

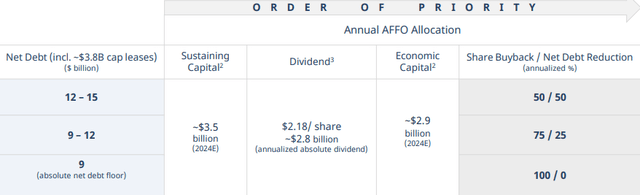

Capital allocation scheme (Suncor’s presentation)

The company has a clear plan in place for rewarding shareholders. Once the debt is reduced below C$12B, the payout will increase to 75% of free funds flow.

Suncor issued new debt in 2023, so overall, there was no reduction in debt. According to my calculation with US$80-WTI, they should switch to a 75% payout in the middle of this year.

The next increase to 100% payout should happen by the end of next year. I would not take it as a given because management is in the process of observing further investments into cost cutting; they might decide to allocate more into Capex, which could delay the 100% payout.

Oil Peak Demand Vs. Oil Sands Reserves Longevity

One common feature across the oil sands sector is the very high longevity of the reserves. While oil sand mining requires a large amount of capital invested upfront, it can enjoy a long period without declining production. In Suncor’s case, the reserve life index is 26 years.

Oil sands production life (CAPP)

The peak demand for oil is a controversial topic, with varying opinions from Western energy agencies and OPEC+. When estimating the demand peak, one has to calculate the expected growing demand from Africa, India, Latin America, and the rest of Asia, as well as the target of switching to a cleaner energy mix.

Most agree that even if we see demand peaking within this decade, the demand should not make any sharp decline but rather stay flat for longer.

I was wondering about how much value one should assign to the longevity of oil sand reserves. I concluded that it is dependent on how the market approaches this controversial topic, which is fully dependent on the future of world political will.

If the future economy is strong and there is a political will to switch to renewables faster, the consequences for oil sand producers could be worse than for conventional producers, as oil sands require more capital to clean the ecological consequences of deforested land from mining.

5-Years Projection & Valuation

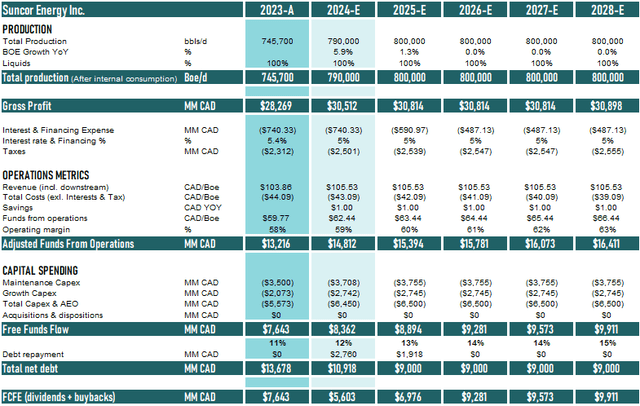

I am building a simplified model for the next five years. These are my assumptions:

- Capital spending – The management is guiding for C$6.4B Capex spending. This capital is spread across upstream and downstream.

- Costs – Management has a cost-cutting plan with a target to lower them by C$5 per barrel. They mentioned several examples where they plan to cut costs further but didn’t disclose the whole plan. During the Q4 call, management mentioned that they should prepare an investors’ call this year, where they disclose more details. This should give investors more confidence in the turnaround story. I am currently projecting a C$1/bbl cost cut every year for the next five years.

- Production growth – I am following the guidance of 6% growth for this year, with a nearly flat production going forward. This might be pessimistic, but I expect most of the growth capital to go to cost cuts, not output growth.

- Refining utilization – I am projecting 90% utilization going forward. If Suncor achieves higher numbers as in 4Q2023, the upside in share price will be higher.

- TMX impact – Transmountain expansion should narrow the WCS-WTI discount. I do not give much credit to Suncor for that, as most of its production is already being upgraded to SCO.

- Oil prices – It is all dependent on oil prices. I will give you a scenario analysis, but for the base case, I am using US$80-WTI, which is close to the current strip pricing.

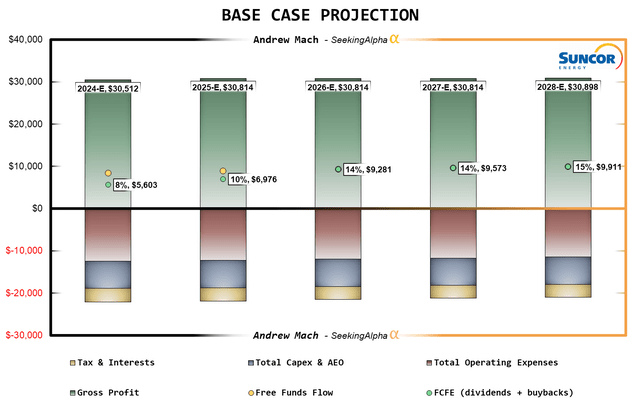

My projection table with a graph for simple orientation is below.

Five Years Projection (Author’s Calculation)

Base case projection (Author’s Calculation)

My base case projection results in an 8% expected FCFE (dividends+buybacks) yield for this year. This is when I expect the company to pay almost C$3B in debt principal repayments. The yield should go to 10% in 2025 and 14% in 2026, when the company should be fully switched on 100% payout to shareholders. This is still when I expect the company to invest in further cost-cutting.

If the company switches to no-growth mode and only spends capital to sustain the operations, the payout yield could reach 19% in 2028.

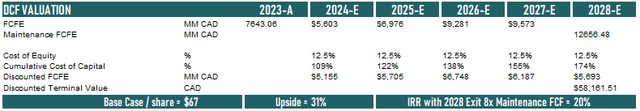

When applying a simple DCF model on the free funds flow and discounting by 12.5%, we get a target share price of C$67 or US$49, which suggests a 31% upside in the share price.

DCF Valuation (Author’s Calculation)

Risks

Turnaround story is by nature more risky. I gave the management some credit for the promised cost cuts, but only the future will show how the story plays out. Hopefully, we will soon see an announcement on the next Investors’ Day, where management will go deeper into the details, which would derisk the investment.

Political risk is there as well. This is still a dirty business, and one needs to be ready for future changes in tax and environmental legislation. I don’t want to go deep into politics. Still, many Canadian oil investors now seek the upcoming Canadian elections, hoping for government changes with a realistic chance of uplifting the valuation of the whole Canadian O&G industry.

The new management narrowed focus on oil sands, which, in my opinion, reduces the risks.

Reducing costs, on the other hand, might result in higher safety risks. You cannot reduce the costs for the sake of reducing costs. We need to trust the new management that they will not compromise safety for the cost cuts.

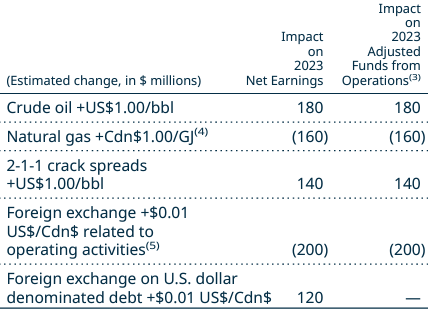

For commodity producers, the largest risk comes from commodity prices. Suncor is not hedging, so I will now conduct a sensitivity analysis.

Sensitivity

Sensitivities (Suncor Presentation)

As for its peer, Cenovus Energy (CVE)(CVE:CA), the integrated business model makes Suncor’s free cash flow very resilient compared to its upstream peers. I am running a simplified model with sensitivities for Oil and Gas prices.

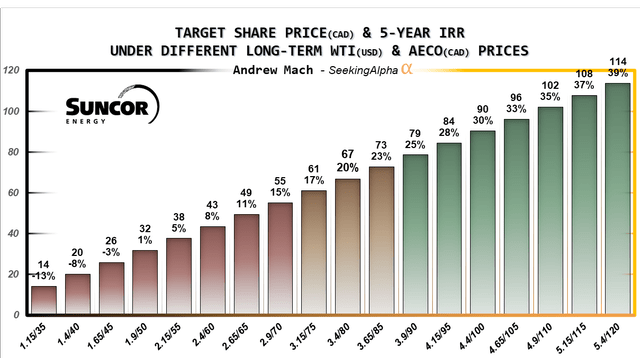

With the same assumptions as in the base case valuation, I am running the model at different O&G prices.

Scenario valuation (Author’s Calculation)

Investment Decision

So far, the new management achieved very big improvements and great results. I believe the market is now waiting for the next few quarters to see if they can continue delivering.

I am looking forward to more details about the cost-cutting and hoping that by then, it won’t be too late for me to buy.

For such a large stock, the valuation appears cheap. For those believing in the turnaround story, I am assigning a strong buy to the stock, with a price target of C$67 or US$49.

I believe the downside is very limited, but there is a strong potential upside in operations and valuation with the growing payout ratio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SU:CA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.