American Airlines Earnings Preview: Decent Q1, But Risky Stock

Summary:

- American Airlines is expected to report Q1 results unaffected by major operational issues, unlike its competitors United Airlines and Alaska Air Group.

- Modest revenue growth of 3% is expected due to a 7.5% increase in capacity, offset by a 4.5% decline in per-unit revenues.

- The company’s inferior cost structure and high leverage make it a risky investment in the volatile airline industry.

Boarding1Now

American Airlines (NASDAQ:AAL) is expected to report Q1 results and hold its earnings conference call on April 25, ahead of the closing bell. Because the Texas-based airline “dodged the Boeing (BA) bullet” this time, since it does not operate 737 MAX 9 aircraft, its key Q1 numbers should be largely unaffected by major operational issues, unlike United Airlines’ (UAL) and Alaska Air Group’s (ALK).

Today, I address some of the main earnings-related topics of conversation that should matter to AAL investors. I will finish by explaining why I think that an investment in this airline’s equity is particularly risky, if not an outright bad idea.

On American’s Q1 results

Starting from the headline numbers, American Airlines is projected to deliver modest revenue growth of 3% in the quarter. This would be the result of two opposing trends that net out to a small top-line tailwind: a guided increase of 7.5% in capacity (measured by available seat mile, or ASM), at the midpoint of the range, and a guided decline of 4.5% in per-unit revenues (measured by total revenue per available seat mile, or TRASM).

The former will likely be driven by the post-COVID catchup efforts at returning capacity to pre-pandemic levels, including via new aircraft deliveries. Worth noting, American Airlines was the only among the Big 3 (and possibly the only in the entire US airline industry) to post 4Q’23 ASM below 4Q’19 levels, albeit only slightly so.

The decrease in per-unit revenues, on the other hand, could be driven primarily by lower fares, as “post-COVID revenge travel” eases, but it could also be a function of lower occupancy – American’s load factor dipped in 4Q’23 relative to the quarter that preceded the start of the pandemic by 110 basis points, the most among legacy carriers.

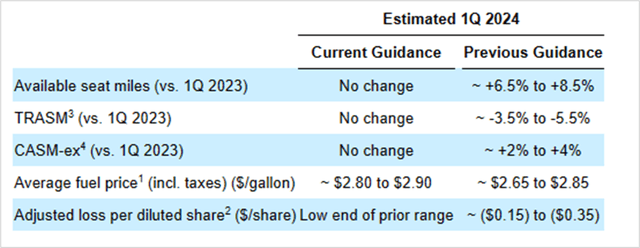

Further down the P&L, expect margins to look unimpressive due to several factors. First, Q1 is a traditionally slow quarter of travel, so some loss of scale is expected. Second, fuel costs have inched higher, even causing American Airlines to revise its EPS guidance lower. See the table below.

American Airlines

On AAL stock

Considering Q1 guidance that was recently revised, I believe there will be little about the results of the quarter that will make much of a difference in the stock. In the immediate term, the outlook for Q2 could be a share price mover. But even here, the guidance is likely to align with (1) a largely optimistic view that American’s management team shared with analysts and investors about its plans for 2024 and (2) peer Delta Air Lines’ (DAL) upbeat take on travel demand for the balance of the year.

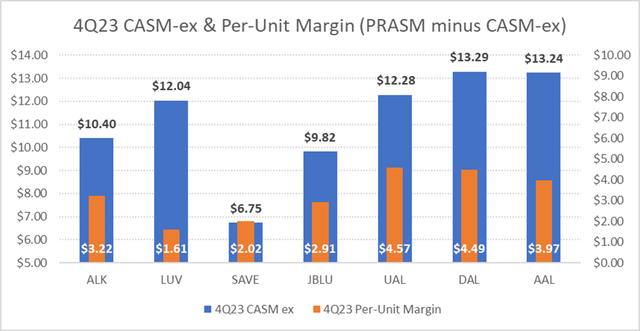

More fundamentally, I dislike AAL as an investment due to what I perceive to be the company’s inferior cost structure and balance sheet. On the former, American continues to produce the lowest per-unit op profit (ex-fuel and items) among US legacy airlines, which I calculate to be PRASM minus CASM-ex, as the chart below depicts. This issue seems to be more chronic than temporary, as the same was true before the pandemic.

DM Martins Research

On the latter, American continues to be the most leveraged airline in the US, and by a good bit. Net debt excluding pensions and leases adds up to about 40% of total assets, much more than runner-up Spirit Airlines’ (SAVE) 25%. As a result, American’s net interest expense in 2023 amounted to a whopping 38% of GAAP operating profits, vs. 14% for Delta.

The above does not mean that AAL stock is uninvestable, but that it is one of the riskiest bets in an already risky and volatile industry. For this reason, I take a pass on American Airlines ahead (and likely after) the company’s earnings day.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.