Summary:

- Amazon is the market leader in ecommerce and cloud infrastructure with AWS.

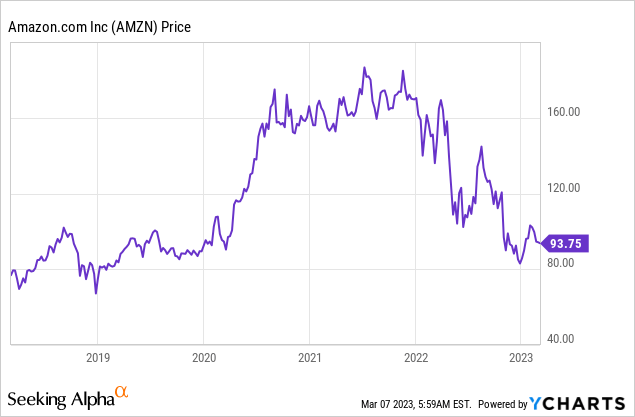

- The company reported mixed financial results for Q4’22 as it beat revenue growth estimates but missed on earnings.

- Amazon’s Alexa program has faced a wave of job cuts and the overall hardware division lost ~$10 billion in 2022, according to Business Insider data.

- AWS is still growing rapidly, with an ~20% growth rate in Q4’22 and a high operating margin of ~24%.

- My discounted cash flow valuation model and forecasts indicate Amazon stock is close to 50% undervalued at the time of writing.

HJBC

Amazon (NASDAQ:AMZN) is the world’s largest e-commerce company and a technology titan. Jeff Bezos originally established a culture of “experimentation” in the business, in which he was not afraid to make “bold bets”. However, not all “bets” Amazon made have been successful (or profitable) over the years. Examples include the Amazon Fire Phone, Amazon Destinations (a hotel booking website that closed less than 6 months after launch in 2015), Amazon Tickets, and many more. Many people would call these projects “failures”, but in the words of the legendary basketball legend Michael Jordan, “I’ve missed over 9,000 shots”, and “I’ve failed over and over again, which is why I succeed”. I believe Amazon embodies this philosophy, and Bezos himself has stated in past interviews that “one winner can pay for dozens and dozens of failures”. An example of a major success is Amazon Web Services (AWS), which has grown rapidly to become the market-leading provider of cloud infrastructure and is the true profit engine of Amazon with $5.2 billion in operating income generated in Q4’22. Recently, the new Amazon CEO Andy Jassy announced layoffs that aim to impact up to 18,000 people. Approximately 2,000 in Amazon’s hardware division have already been let go as a result of the job cuts, with a focus on the Alexa program, thus could that program be another “failure” to add to Amazon’s list, or is the market overlooking its potential? In this post, I’m going to break down these details before diving into my valuation model for the stock and reviewing the technical charts. Let’s dive in.

Alexa: Failure, Success, and AI potential?

Amazon’s Alexa software and Echo (hardware device) were launched in 2014. The original idea behind the product was inspired by the computer voice system on the Starship Enterprise in Star Trek. It started as a simple “smart speaker” but Jeff Bezos had bold visions that this would become a new user interface for interaction. This would involve users using their voice to order products via Amazon and to order food through its partnerships with Domino’s Pizza (DPZ), etc.

Since that point, Alexa has risen to become the “dominant” player in the smart speaker industry and had ~69% market share according to data from a 2021 study. Amazon hasn’t released a detailed breakdown of its Alexa (Echo)specific sales, but estimates indicate ~65 million units were sold in 2021. According to Amazon, cited by FT, “Alexa engagement increased by over 30% in 2022. In addition, over 50% of Alexa customers are using the product to shop.

Therefore, you may consider Alexa and the Echo devices to have been a success. Well, not exactly. Amazon’s Alexa division is part of Amazon’s “Worldwide Digital Group”, which includes Prime Video. This unit reported an eye-watering operating loss of $3 billion in the first quarter of 2022, according to internal data cited by Business Insider. The hardware team was also estimated to have lost $10 billion in the full year of 2022, with the “vast majority of losses” blamed on Alexa. If these numbers are accurate, that would mean Amazon would effectively have made a healthy profit of greater than $6.

According to an Amazon marketing executive cited by FT, “Our goal was not to make the Alexa program profitable”. Amazon’s hardware VP David Limp also confirmed this in an interview with CNBC, he states “We try to sell our products roughly at break-even, sometimes a little bit more.”.

The idea of the Echo and Alexa products was to encourage users to use the devices daily to shop on Amazon, which ultimately was expected to drive benefits for the overall company. However, measuring the success and direct benefit of this strategy has proven to be challenging, according to two people familiar with the matter, cited by FT.

Therefore, it looks as though monetization has been a major issue for Amazon and its Alexa program. It’s fine to run these low-margin (or no-margin) programs during the “good times”, but when investors are demanding profitability, these programs are more intensely scrutinized.

AI Chat Bot Revival?

Microsoft CEO, Satya Nadella, has recently (March 2023) called the previous generation of AI chatbot devices such as Siri, Alexa, and even its own Cortana as “dumb as a rock”. He believes the next generation of AI chatbots is poised to take over. This is hard to dispute given the viral adoption of ChatGPT, which became the fastest-growing application in history. Microsoft then went on to invest $10 billion in ChatGPT and integrate it into its Bing search engine, rivaling Google search for the first time in decades. If Microsoft decides to add a voice interface to ChatGPT, then this could be the nail in the coffin for Alexa. However, let’s not forget, Alexa is also an “AI-Powered” conversational agent and a leader in NLP or natural language processing. Therefore, Alexa could experience a revival if Amazon still has the ability to “invent” and utilize its vast AI power (the world’s largest infrastructure provider) to improve and potentially rebrand Alexa.

Valuation and Financial Forecasts

In my previous post on Amazon, I discussed its financials for the fourth quarter in detail. Here is a quick recap along with my forecasts for future growth.

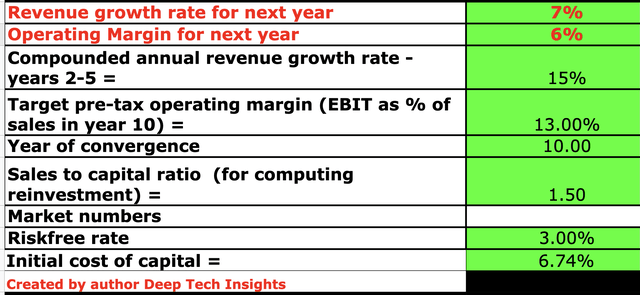

For Q4’22, Amazon reported $149.2 billion in revenue, which surpassed analyst forecasts by $3.43 billion and rose by approximately 8.59% year over year. Its revenue growth was impacted by a ~3% or $5 billion headwind related to foreign exchange rates, from a strong U.S. dollar relative to most other currencies. A positive is the currency markets tend to be cyclical by nature, and the USD dollar has corrected down versus most other currencies since October 2022. Therefore, I expect the impact from exchange rates to be lower moving forward into 2023. For the full year of 2023 (labeled) as “next year” in my model, I have forecast a growth rate of 7%. This is based on the top end of management’s guidance (for Q1’23), which I have extrapolated out for the full year. I have chosen the high end as some economists are predicting a U.S. recession will start later than planned, and given inflation is still falling, it may not be as bad as many are expecting. In years 2 to 5, I have forecast a faster growth rate of 15% per year. I forecast this to be driven by improving macroeconomic conditions, which should help cause a rebound in e-commerce demand. In addition, I forecast AWS to continue to grow at a solid rate of ~20%, which was the same as Q4’22 where the segment generated revenue of $21.4 billion.

Amazon stock valuation 1 (Created by author Deep Tech Insights)

Amazon’s profitability is where the business is struggling. In Q4’22, the company reported operating income of $2.7 billion, which declined by an eye-watering 21% year over year. Earnings per share (EPS) was $0.03, which came in below by minus $0.313. A positive is the majority of Amazon’s expenses in the quarter look to be “one-off” expenses, which resulted in an eye-watering increase of $2.7 billion in extra costs. This includes details related to employee severance packages, operating leases, and insurance costs. Therefore, I expect the majority of these expenses to be short-lived, and given AWS is highly profitable (with a 24% operating margin), this should help to drive improved margins long term. I have forecast a 13% operating margin over the next 10 years. This has also been enhanced by the R&D investments, which I have capitalized, which lifted the operating margin from 2.48% to 6.32% for 2022.

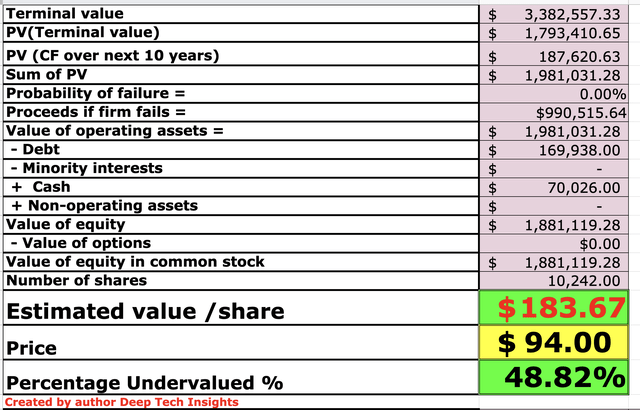

Amazon stock valuation 2 (Created by author Deep Tech Insights)

Given these factors, I get a fair value of $117 per share. The stock is trading at ~$94 per share at the time of writing, and thus, is close to 49% undervalued intrinsically. Thus, the stock is close to “deep value” territory in my mind, assuming it can hit the forecasted numbers.

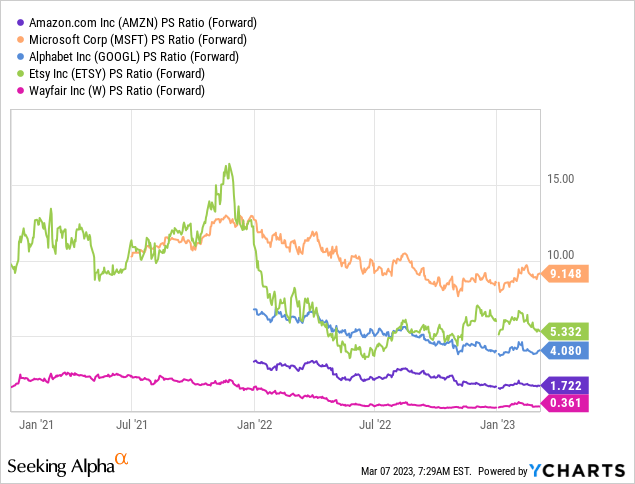

Amazon also trades at a price-to-sales ratio = 1.7, which is close to 49% cheaper than its 5-year average and substantially cheaper than its large technology peers and even smaller e-commerce players such as Etsy (ETSY).

Risks

Recession/Lower E-commerce Demand

As mentioned prior, many analysts have forecast a recession for 2022; therefore, I wouldn’t be surprised to see lower e-commerce demand and high fulfillment costs due to the inflationary environment.

Final Thoughts

Amazon is the king of e-commerce and a company with a strong culture of “experimentation” and “invention”. The company is experiencing headwinds from the macroeconomic climate. Its Alexa program looks to have faced the brunt of the recent job cuts and is “burning cash”. Its market position could also be attacked from ChatGPT with a voice interface. However, given Amazon is the leading cloud infrastructure provider (which includes AI environments) and Alexa is also built on AI using NLP, the fight isn’t over yet. In addition, Amazon’s cloud business is still growing rapidly and poised to benefit from industry growth trends such as “digital transformation”. My valuation model and forecasts indicate the stock is undervalued intrinsically and relative to historic multiples, thus it could be a great long-term investment.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.