Summary:

- The high-tech sector has become much cheaper after the 2022 correction.

- Two companies operating in the same sector are popular picks among investors.

- One of these stocks is China’s giant, Alibaba Group Holding Limited, whilst the second one is a U.S. corporation, Amazon.com, Inc., although both of the companies can be called international.

- One of these companies offers better value for money than the other one.

- In this article I will explain why one of these companies is a value pick, whilst the other one is not.

HJBC

Amazon.com, Inc. (NASDAQ:AMZN) was one of the few companies to survive the dot-com bubble and flourish, making some of its investors truly rich. Alibaba Group Holding Limited (NYSE:BABA), popularly known as the Amazon of China, is also one of the leading high-tech stocks on the Chinese market. Both of the stocks got substantially cheaper last year. But, in my view, BABA is much better value for money than its American peer. Let me explain why.

BABA stock, the company’s news, and fundamentals

I recently wrote a few articles about Alibaba and the fact this Chinese e-commerce giant seems to be seriously undervalued. Indeed, investors have had plenty of reasons to worry about this e-commerce giant of China. The Chinese authorities’ regulatory pressures, the slowdown in the company’s sales growth, and the suffering net profits made investors stay away from that stock. Only due to the GAAP accounting standards have Alibaba’s net profits been negative for a while. The company holds certain investments that have depreciated due to the Chinese market sell-off. Obviously, this has been showing up as net profit losses for a while.

At the same time, most of the sales growth decline was due to the suffering Chinese economy. Note that there was no sales decline. Only the growth pace has slowed down. This is still quite an achievement, given the complicated external factors.

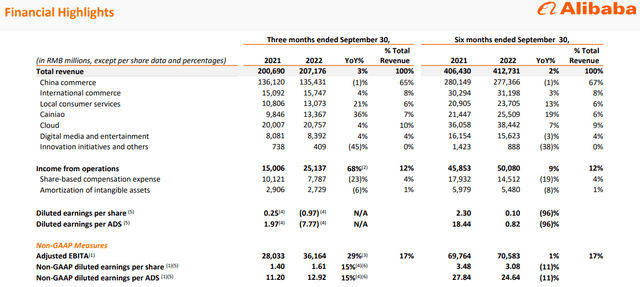

As can be seen from the recent earnings presentation above, Alibaba’s best-performing segment was Cainiao. This department earns revenue from domestic and international one-stop-shop logistics services and supply chain management solutions. The reason for this increase in revenue from domestic consumer logistics services was the service model upgrade in late 2021. The company also took more duties to better serve its consumers and enhance consumer experience and international fulfillment solution services.

Also good is Alibaba’s local consumer services sector. This department generates revenue from “To-Home” and “To-Destination” businesses such as Ele.me, Amap, and Fliggy. The recent earnings improvement was primarily due to strong growth of Amap orders, and higher average order value, and more efficient use of subsidies that were contra revenue of Ele.me.

In other words, Alibaba has departments that perform well. There is more earnings potential, however, from departments that are not performing well. The biggest source of BABA’s sales is Chinese e-commerce which has been performing quite poorly for the last couple of years. This was mainly due to the fact China’s economy has been suffering from lockdowns. So, the demand for consumer goods was quite low.

Now that the country’s economy is reopening, this should stimulate Chinese e-commerce as well. There was also too much panic regarding Xi Jinping’s reappointment, which does not seem to have much ground, really. Some investors thought Xi’s reelection in autumn 2022 would mean more regulatory tightening for China’s tech sector. However, the Chinese leader confirmed that the country’s economy would be his top priority. The tech sector, in turn, is obviously accountable for innovations and many jobs. This makes too many regulations of the tech sector irrational.

All that means that BABA has growth stimuli, both internal and external. The company is also facing a number of threats. I will explain these later on in this article. But the Alibaba Group Holding Limited stock price takes these into account, in my view.

Amazon stock, the recent developments, and fundamentals

Amazon.com, Inc. stock’s post-pandemic gains have also been erased. In 2020-2021 the Federal Reserve printed plenty of cash to support the U.S. economy and to fill the financial markets with liquidity. Obviously, this made many high-tech stocks just like the general stock market soar. As concerns Amazon, lots of consumers increased their online purchases during the spring 2020 lockdown. All that made AMZN stock soar. But what is happening now?

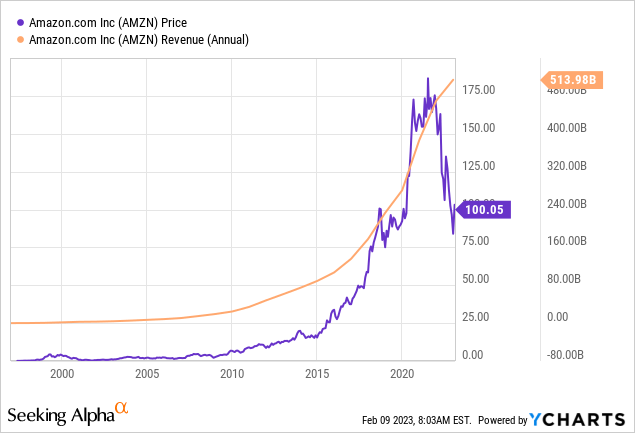

Amazon is still a growing business in terms of sales. This is true if we look at the history of the annual sales below.

The quarterly net sales also showed quite a good result, managing to rise by 9% or even 12%, if adjusted for any currency fluctuations.

Amazon’s Q42022 presentation

It all looks good on the surface. But how about the net profits? After all, this the most popular way to measure a company’s efficiency, effectiveness, so stock valuation necessarily involves looking at its profits.

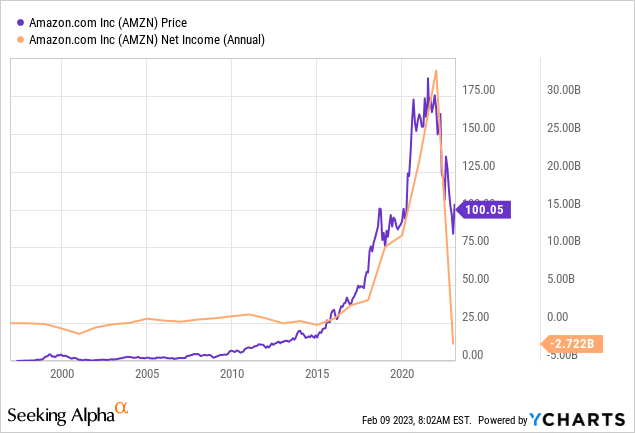

Annual net profit history – Amazon

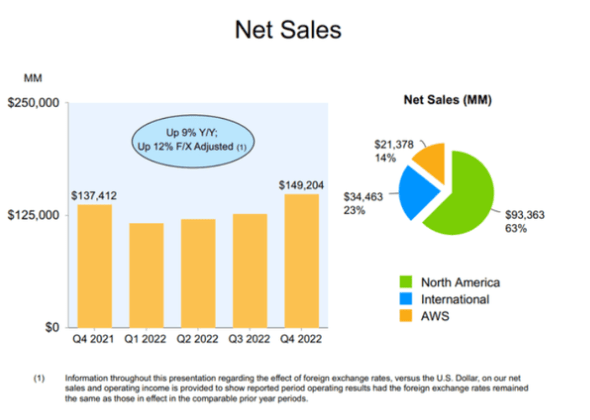

After the brilliant net profit surge between 2015 and 2021, the company’s net earnings turned negative.

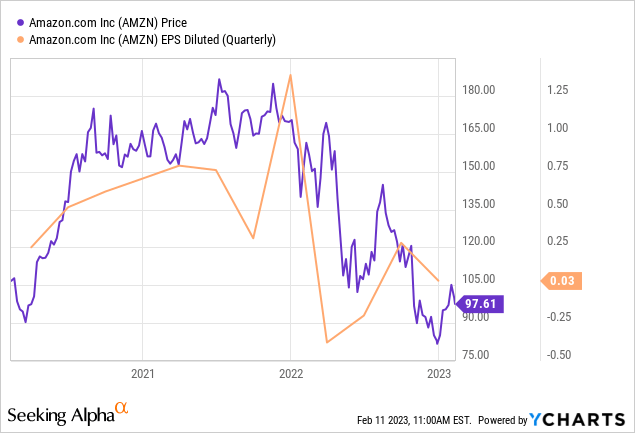

But let us look at the quarterly figures as well.

In the graph above we can clearly see that at the beginning of 2022, the company’s EPS crashed substantially. In fact, according to the recently published earnings results, Amazon reported a net loss of $2.7 billion in 2022, or $0.27 per diluted share, compared with a net income of $33.4 billion, or $3.24 per diluted share, in 2021. You might argue that it was all due to a decrease in the value of its investments in Rivian Automotive, Inc. (RIVN). But the operating profit plunged as well. It decreased to $12.2 billion in 2022, compared with $24.9 billion in 2021.

As concerns its revenue sources, Amazon’s best-performing division is Amazon Web Services (“AWS”). Many analysts consider AWS to be the company’s growth stimulus. I agree with my fellow Seeking Alpha contributor Trapping Value that there is nothing to be too excited about. This segment’s sales rose by 20%, but its operating income plunged by 10% when adjusted for currency fluctuations.

All is well and clear. After all, the whole tech sector is not going through its best days. BABA is not doing fantastically well either. But the main question here is which company is more undervalued.

Valuations

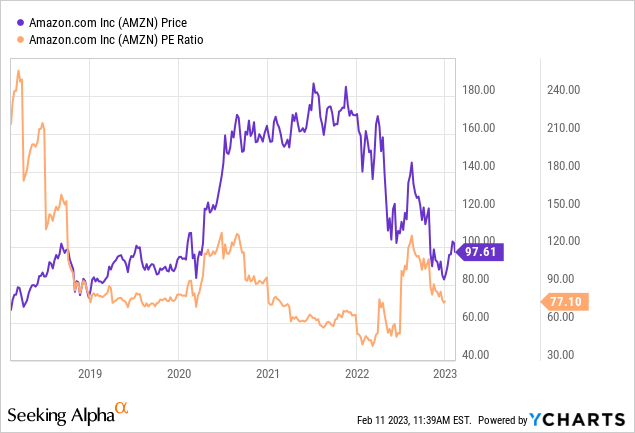

Amazon’s valuations are very high.

In order to be fair, I would say they are not at their all-time highs. In 2018, the company’s price-to-earnings (P/E) ratio, for example, used to be above 250(!). Now, if we are to take the company’s market cap of approximately $1 trillion and divide it by the total adjusted net profit figure for 2022 of $10 billion (I decided to disregard the effect of Rivian’s valuations), we will get a P/E of 100. Not a value stock, for sure.

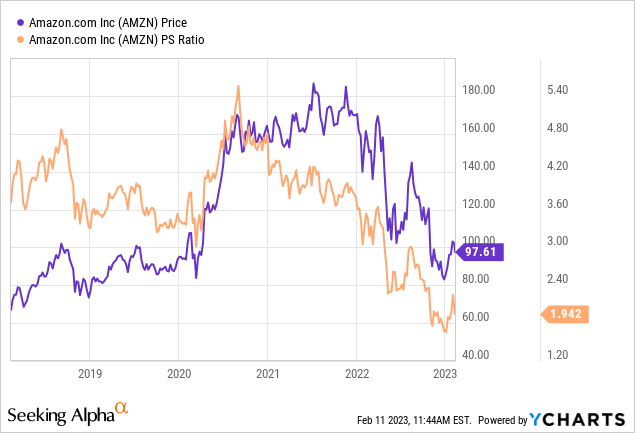

Amazon’s price-to-sales (P/S) ratio of about 2, meanwhile, is quite good. But this is explainable. After all, the company has been recording sales growth for a while.

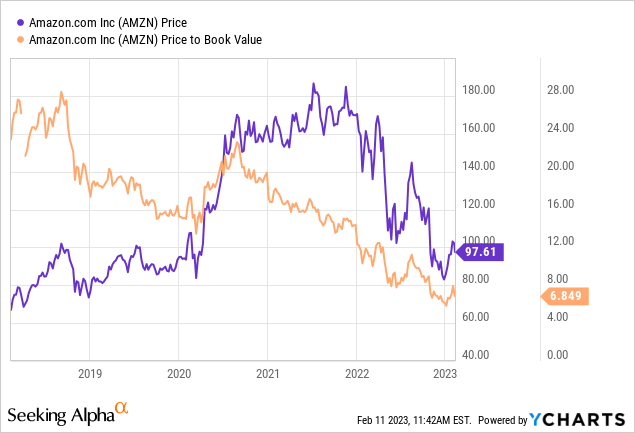

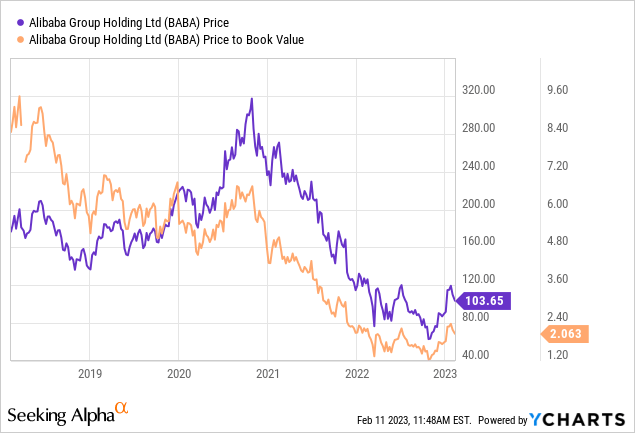

Amazon’s price-to-book (P/B) of 7 is high, indeed. In spite of the fact it is substantially off its high of almost 24 in 2021, it is far above the “good” range of 1 to 3.

I did not compose the P/E graph for Alibaba because, as you know, the company has been recording losses for a while.

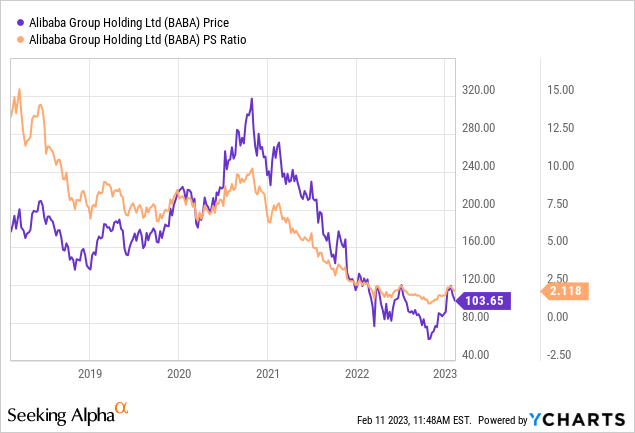

As concerns BABA’s P/S ratio, it is almost the same as Amazon’s, currently standing at about 2. You might be wondering why, then, I consider BABA to be more of a value stock.

Please have a look at BABA’s P/B ratio and also its stock price fall. The Chinese giant’s P/B ratio totals 2, more than 3 times lower than Amazon’s. As concerns Alibaba’s stock price, it is trading at about a third of its peak reached at the end of 2020.

Amazon’s stock, meanwhile, has not even halved from its 2021 highs.

So, on the balance it seems that Alibaba is more of a value stock now than is Amazon.

Alibaba stock risks

- To start with, Alibaba is a Chinese company. Although China allowed U.S. auditors to check Chinese companies’ accounts, some U.S. investors might still want to think twice before buying a Chinese stock.

- The U.S.-China relations are deteriorating, it seems. The Chinese “spy balloon”, for example, was recently shot down by the U.S. The planned visit to China of Blinken, the U.S. State Secretary, was therefore canceled. The deteriorating US-China relations may provoke another sell-off of Chinese stocks, which will also affect BABA.

- There is still a risk the Chinese government might pressurize the country’s tech sector. As I have mentioned before, this is not my base-case scenario. But there is such a risk.

- A recession is likely ahead. Many analysts predict an economic decline due to many central banks’ monetary tightening. Most companies, including BABA, will be affected in this case.

Amazon stock risks

- Net profits have stopped growing but the company is still positioned as a brilliant high-growth company.

- The valuations are high. There are also higher valuations because Amazon is a US company as opposed to Alibaba.

- The hawkish Fed is also a big risk for companies with high valuations, including Amazon.

Conclusion

The tech sector is suffering. Some investors do not want to touch it but some view this as a buying opportunity since many stocks have plunged in value. On balance, I would say that Alibaba Group Holding Limited stock offers more value for money than that of Amazon.com, Inc. Both companies are not going through their best days though. True, Amazon would not be much affected should the U.S.-China relations get worse. American investors might also feel more comfortable if they buy a U.S. company. At the same time, Alibaba’s stock seems to be cheaper than Amazon’s.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.