Summary:

- AWS remains dominant in its market; however, it’s facing increased competition and its profits don’t justify the business.

- Amazon’s financials have dropped off a cliff. The company continues to have substantial share issuance expenses.

- Ultimately, we don’t see a path for Amazon to justify its valuation, which we expect will result in continued poor financial performance.

hapabapa

Amazon (NASDAQ:AMZN) is a roughly $1 trillion company that’s dropped almost 50% from its 52-week highs, even counting its recent strength. The company is known for two massive businesses, its retail segment and its AWS segment, both the leaders in their respective spaces. However, as we’ll see through this article, the company’s costs plus competition will hurt returns.

Amazon Financial Performance

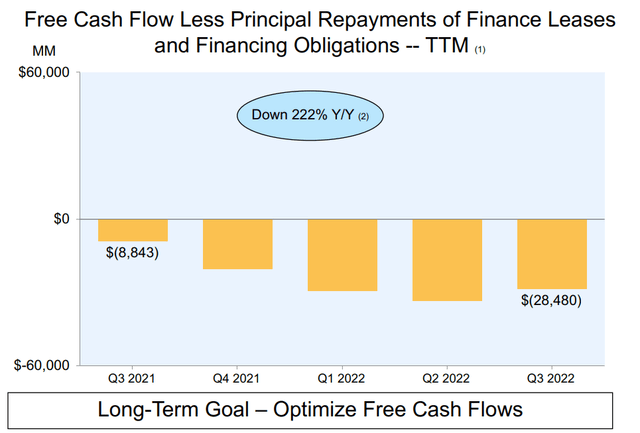

Financially, Amazon has continued to struggle despite the company’s long-term goal to optimize free cash flow.

Amazon Financial Performance – Amazon Investor Presentation

Amazon’s FCF has continued to suffer. The company’s FCF has gone YoY down 222% from -$8.8 billion to -$28.4 billion. None of this counts the company’s almost $10 billion in annual stock issuance that we’ll discuss later in this article that’s a very real cost. If the company wanted to avoid diluting existing shareholders, it’d need to be buying back that much of its stock annually.

The company’s financial performance is abysmal. To justify its valuation, the company would need to turn the above to almost $100 billion in long run annualized FCF.

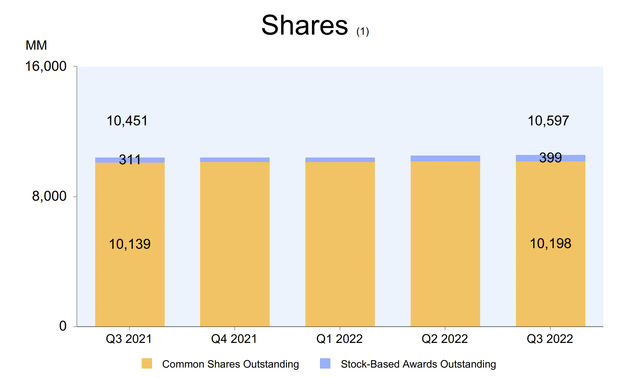

Amazon Continuous Dilution

One of Amazon’s continuous problems, that we’ve already discussed, is dilution.

Amazon Continuous Dilution – Amazon Investor Presentation

The company’s dilution will likely decrease as the recent tech layoffs minimize wages and remove employees with unvested stock. However, the company still doesn’t have a clean solution here. The company’s outstanding share count increased by 60 million shares YoY ($6 billion) and its stock-based awards outstanding increased by 90 million ($9 billion).

For the foreseeable future, even with the recent share price decrease, we expect the company’s share dilution expenses will be to the tune of ~$8 billion annualized. That’s a real expense not being accounted for in the company’s already negative FCF.

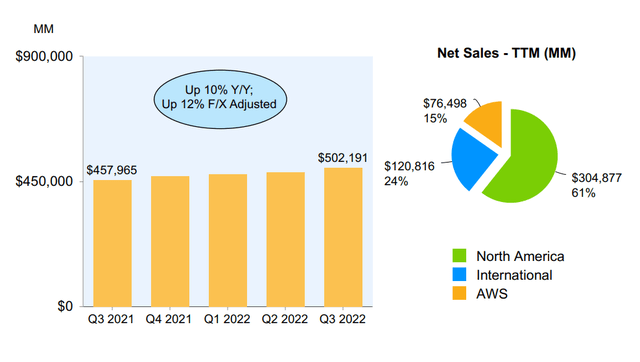

Amazon Growth

Amazon has continued to grow but it’s struggled to turn that into positive FCF.

Amazon Growth – Amazon Investor Presentation

Amazon managed to grow its revenue 10% Y/Y with North America still making up the primary aspect of the company’s business. AWS continues to remain the fastest growing aspect of the company’s business. However, in-spite of all of this, the company’s income has continued to suffer substantially, continuing to drop.

The company’s TTM operating income has dropped 54% YoY, with AWS making up for negative income on other aspects of the company’s business. The company’s AWS revenue makes up more than 20% of the company’s revenue growth.

Amazon Competition

Amazon is facing continuing competition in every segment of the company’s business.

The company’s core AWS business is facing massive competition from deep pocketed peers such as Google and Microsoft. Microsoft in particular, with its substantial commercial connections through its prior software operations, has continued to see rapid growth emerging as a clear second place in the market.

The company’s core retail business isn’t competitive, although it’s traditionally been said that the business “could” be competitive as the company needs it to be. However, the company’s large competitors such as Walmart, etc. have continued to roll out their own businesses, and they also have the logistics networks to compete with Amazon.

Additionally, in higher inflationary time periods, customers are much more price sensitive meaning companies that can leverage supplier relations for lower prices get a pricing advantage. That competition means that Amazon’s margins will suffer. That’s for a company that’s not yet profitable.

Given the company’s lofty valuation, at some point, multiple decades into its existence, it needs to be profitable.

Thesis Risk

The largest risk to the thesis is the staying power of Amazon’s customers. Amazon’s growing Prime subscriptions do show some loyalty and the company has worked through its Amazon Basics and other programs to get down costs for customers. There’s a chance that these efforts could succeed to the point that the company can earn the FCF to justify its valuation.

Conclusion

Investors look at the story of Amazon’s revenue increasing YoY along with the continued growth of AWS and a new story emerges. Amazon could be a very profitable company, however, they’re so busy reinvesting that money into the company, that those profits aren’t being returned to shareholders. That story, however, is showing cracks.

Amazon’s FCF continues to decrease as the company needs tighter margins to fight off the competition. The company’s AWS division continues to see strong profits but it’s also facing rapidly expanding new competition from technologically savvy and deep-pocketed new competition. Putting this together, it’s clear the company will struggle to justify its valuation, making it a poor investment.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.