Summary:

- Amazon has dropped by half over the last year.

- And yet, its shares are far from cheap.

- Amazon experiences major headwinds when it comes to business growth and profitability, and it is not guaranteed that 2023 will be much better.

Just_Super

Article Thesis

Amazon.com, Inc. (NASDAQ:AMZN) has been a pretty bad performer so far this year, as shares have recently taken out a new 52-week low. And yet, Amazon is far from cheap at current prices. Advertising and AWS provide compelling long-term growth potential, but the retail business remains a drag on margins and profitability is under pressure due to a range of macro headwinds. With shares trading at a pretty elevated valuation, Amazon does not yet look like an attractive buy at current prices.

What Happened?

Amazon.com has seen its shares fall massively this year. On Monday, shares hit a new 52-week low, at $85 per share. That makes for a market capitalization of slightly less than $900 billion — down by around $1 trillion from the all-time highs that were hit in 2021. A $1 trillion market capitalization decline is extraordinary, but in Amazon’s case, it makes a lot of sense, as we will see in this article. A combination of a way-too-high valuation last year, a range of macroeconomic headwinds, and rising interest rates is responsible for this massive market value decline. But even today, shares are far from cheap, and might fall further over the coming year.

Waning Growth

Amazon is a growth company, but its growth performance has not been strong in the recent past. There are good reasons for that. First, with the opening of the economy, consumers started to spend more money at brick-and-mortar retailers again, relative to the pandemic years, when lockdowns boosted Amazon’s sales potential.

Second, the end of most COVID measures in many countries around the world allowed consumers to focus more on experiences again. Millennials are especially eager to spend money on experiences, such as travel, going out with friends, dining out, going to concerts, and so on. During the pandemic, that wasn’t possible in many cases, which is why consumers shifted spending from experiences to things — which can be easily bought at Amazon and other online retailers. But with spending on experiences becoming possible again, some consumers are shifting back towards experience spending again and reduce their spending on things (clothes, electronics, and so on) in order to do so.

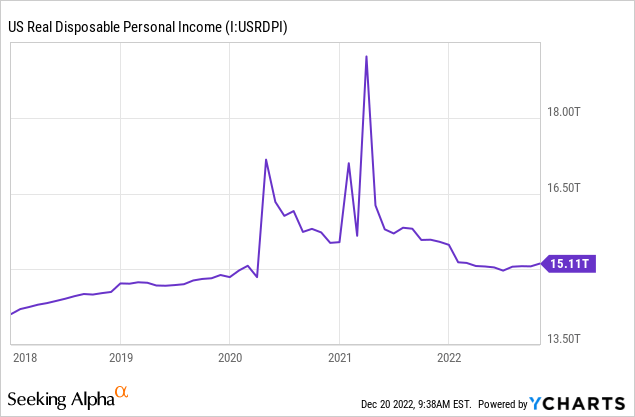

Third, high inflation means that consumers spend more money on necessities such as energy, gasoline, food, and rent/housing. These items aren’t bought on Amazon. But when consumers spend more cash to pay for these necessities, they have less cash available for the “wants” that they can buy on Amazon, such as clothing or a new TV. Inflation thus reduces the ability for (some) consumers to spend on the things that are bought at Amazon, which provides a macro headwind for Amazon’s business growth. We can see this in the following chart:

Real disposable income in the US has pulled back quite a lot from the levels seen during the pandemic, due to inflation and since there are no stimulus payments any longer. The average consumer isn’t flush with cash any longer, which is why Amazon has a hard time creating meaningful business growth in its retail segment.

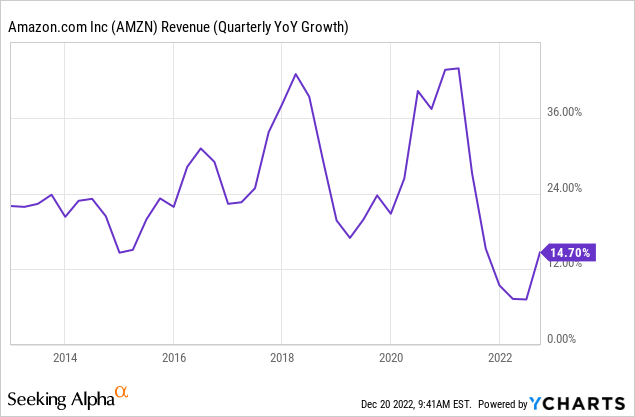

The following chart shows Amazon’s quarterly year-over-year revenue growth over the last decade:

As we can see, 2022 is the worst year in that time frame by far. While revenue growth mostly was in the mid-20s, and as high as 40% at times, revenue growth this year is significantly below that trend line. For the current year, analysts are predicting revenue growth of just 9%. When we account for the fact that inflation is still in the high single digits, real revenue growth is close to zero — not a great result for a very expensive growth stock.

Margin Headwinds

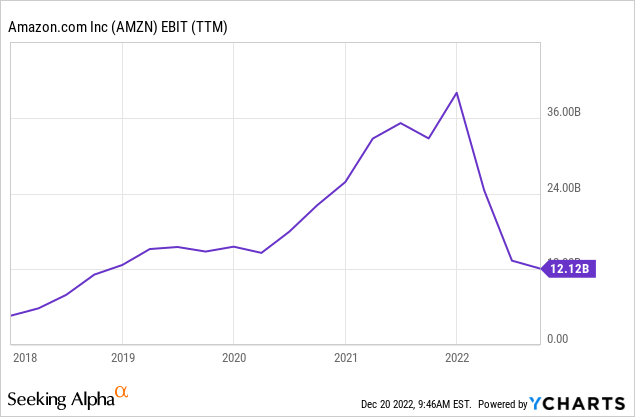

Amazon has never been especially profitable, as the retail segment always was a low-margin business. At the same time, weak profitability in the international segment and heavy growth investments further pressured Amazon’s profitability. But things got even worse in 2022, relative to prior years:

Over the last year, Amazon generated EBIT (earnings before interest and taxes) of $12 billion. That’s less than one-third of the peak that was hit in 2021, and it’s comparable to the EBIT Amazon generated in 2018. Profits are now considerably weaker than the profit that was generated in 2019, the year before the pandemic. Despite growing sales during the pandemic years, Amazon has not managed to grow its profits — those moved in the other direction. Revenue growth is good, of course, but ultimately, profits are what counts — profits allow companies to acquire other companies, profits allow for debt reduction, profits allow for growth investments, and profits allow for shareholder returns via dividends and buybacks. With Amazon’s profits dropping considerably this year, Amazon is not well-positioned to generate a lot of shareholder value in the near term.

Pressures on profitability come from several directions. Higher employee compensation costs play a large role, both when it comes to workers at Amazon’s warehouses and when it comes to the high-paid engineers at Amazon’s offices. When rising spending on employees occurs at a time when revenue growth is weak, margins are hit especially hard, as is the case this year. Amazon has recently announced that it would invest a billion dollars in its warehouse employees over the next year by raising the average wage to more than $19 per hour. While that is good news for Amazon’s workers, it will put even more pressure on profitability, especially since I believe that similar wage increases will occur in other countries, too.

But profitability also comes under pressure from high transportation costs and fuel expenses (although that has gotten better, to some degree, in recent months), and due to the fact that Amazon itself has to pay more to the suppliers of the goods it sells.

The fact that Amazon is losing billions of dollars with purported growth drivers such as Amazon Alexa isn’t encouraging, either. To me, it looks like Amazon has been too eager with some of its ventures in the past, possibly a result of a “cheap money” mindset in a low-interest-rate environment. But when those growth ventures are only generating revenue and no profit, or even generate net losses, they are not creating any value for investors.

Somewhat surprisingly, the profit headwinds even exist at AWS, which used to be Amazon’s profit growth driver. While AWS revenue was up 27% year over year during the most recent quarter, operating profit at the unit grew just 10%, to $5.4 billion, from $4.9 billion one year earlier. While that is still an increase, margins are clearly compressing. Growing competition from Microsoft (MSFT) and Alphabet (GOOG) is likely one factor, while higher employee compensation also plays a role. No matter what, when AWS is now growing its profits at a smallish pace only, it is unlikely that the unit will boost company-wide profits by a lot in the near term. Some analysts have speculated or argued that AWS alone could be worth more than the company’s entire market capitalization today. Calculating with an operating profit run rate of $22 billion and a 20% tax rate, which gets us to $18 billion of net profits, I do not believe that a $800+ billion value for AWS is realistic at all. Put a 25x multiple on the $18 billion of net profit, which seems appropriate for a business generating 10% earnings growth, and the unit would be valued at $450 billion — which still leaves another $400 billion or so for the non-profitable remainder of Amazon.com.

AMZN Stock: Still Expensive

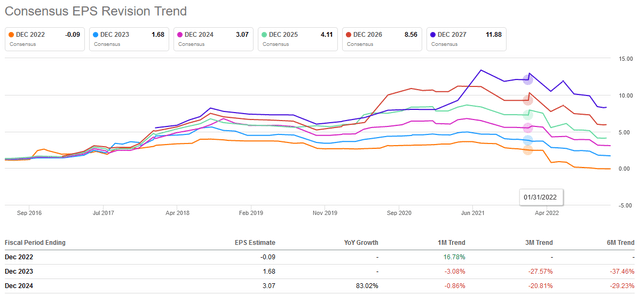

This gets us to the next point, which is valuation. In 2022, Amazon will likely lose money on a net profit basis — at least that’s what analysts are forecasting. Let’s thus look at 2023 instead, when Amazon is forecasted to earn $1.68 per share. This estimate should be taken with a grain of salt, however, as earnings have continuously been revised downward over the last year:

Seeking Alpha

At the beginning of 2022, analysts still predicted that Amazon would earn $2.50 this year, while they are forecasting a small net loss now. Likewise, estimates for 2023, 2024, and beyond have trended down as well. Even over the last month, estimates for the upcoming two years have dropped further, thus it seems possible that there will be further downward adjustments as the macro picture isn’t really improving. Especially when the US enters a recession, profit estimates have significant further downward potential, I assume.

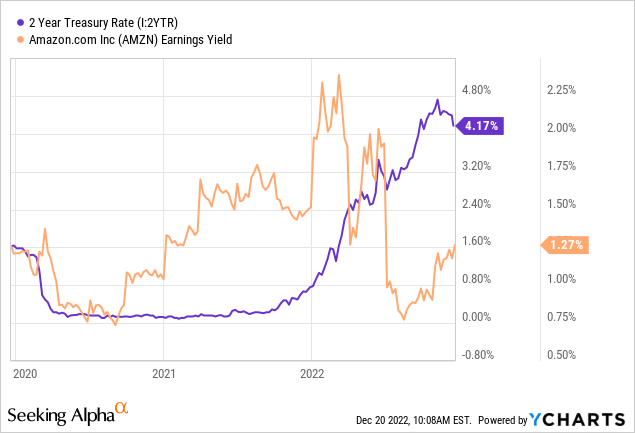

Let’s still assume that Amazon will earn $1.68 per share, no matter what. That makes for an earnings multiple of 51 at current prices, which translates into an earnings yield of just below 2%. Is that attractive? I don’t think so.

The above chart shows the 2-year treasury yield and Amazon’s trailing earnings yield (GAAP net profit). We see that, at times, Amazon’s earnings yield was substantially higher than the yield one could get from treasuries, such as during all of 2021. But today, the earnings yield is pretty slim relative to what investors can get from treasuries. At the same time, treasuries are absolutely risk-free and there is no execution risk at all. When investors had the choice between investing in Amazon for an earnings yield of 1% or 2% and investing in treasuries with a yield of 0%, it’s not surprising to see that many opted for Amazon. But when investors have the choice between investing in ultra-safe 4%+ yielding treasuries and investing in Amazon with an earnings yield of less than 2%, with considerable execution risk and recession vulnerability, it’s hard to make a case for Amazon, I believe. While Amazon has growth potential going forward, unlike treasuries, Amazon still seems too expensive today at a 2023 earnings multiple of more than 50, considering we are no longer in a low-interest-rate environment.

Takeaway

Amazon has widely underperformed the market in 2022, and has now destroyed around $1 trillion of market capitalization relative to the peak. But that makes sense, as the company experiences major growth headwinds while its profits are getting squeezed. Even when we assume that 2023 will be much better than 2022 — which is not guaranteed — Amazon does not look like a bargain. I do not believe that shares are a buy yet, although improving profitability, especially at AWS, could change what I think about Amazon at the current share price.

Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!