Exxon Mobil Is Running Out Of Gas

Summary:

- Exxon Mobil has been on an absolute tear this year, up 75% while the S&P 500 is down 25%.

- The stock has reached all-time highs on strong earnings and outstanding momentum.

- Nonetheless, this is precisely why I feel the stock’s rally may have peaked, and I’m not alone.

- In the following piece I lay out my bear case for current long shareholders and prospective dividend investors.

JHVEPhoto

Exxon Mobil Bear Thesis

I sold out of my Exxon Mobil (NYSE:XOM) position back in June and I’m currently bearish on oil stocks going into next year. I expect the Fed has already made a mistake and we are inn for a hard landing in early 2023. The ensuing recession will cause the macro picture to deteriorate and bring the energy sector, which has been on fire, come crashing down back to earth. What’s more, the primary reason for holding Exxon Mobil is for the dividend. Unfortunately, the massive run up in the stock has made buying into the stock for the dividend unpalatable for prospective dividend investors on the hunt for income. Let me explain.

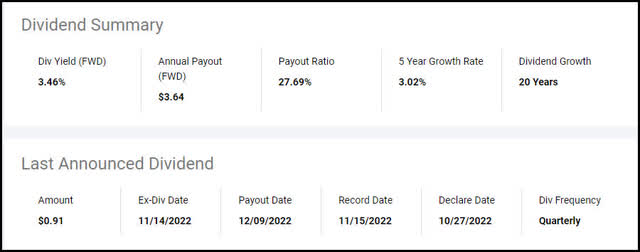

Dividend yield too low at 3.46%

The time to buy in to Exxon Mobil was back in March of 2020 when the stock was trading for $35 and the yield was 10%. I was fortunate enough to take advantage of the extreme oversold and undervalued state the stock was in at that time. Now, I see the stock in the exact same position except on the other side of the coin this time. The stock is overbought, trading at an extremely high price point, and has begun to show signs of weakness as of late.

Seeking Alpha

Dividend yield 35% lower than five-year average

Furthermore, with the dividend currently yielding a mere 3.46%, new investors would be wise to wait for a pullback making the dividend worth the risk. The stock gets a barely passing grade regarding yield as it’s currently trading for 35A% less than its five-year average. Plus, you can buy a risk free one-year CD presently for 4.5%, sit out the recession, and come back in toward the end of next year and most likely pick up shares at a much better price. Let me explain why.

Seeking Alpha

Stock trading at all-time high and rolling over

The stock is trading at all-time highs and showing signs of weakness. The stock is down on the month and broken below its 50 day SMA support level. Once a stock breaks below major support the support level becomes overhead resistance making it that much harder to push higher. Another issue to the distance the stock has traveled above its 200 day SMA.

Finviz

Stock has run to far above 200-day SMA

When a stock runs up so fast that the gap below the current price and the 200-day sma widens to an extreme level, more often than not you have what we technically call, a reversion to the mean play. Most times the stock will work its way back down to the 200-day SMA rather than the 200-day rising to reach the stock at its lofty height. This has happened previous to the stock back in 2014. Exxon Mobil stock’s momentum metrics are currently off the charts. Nevertheless, I see this as a contrarian indicator. Here’s why.

Finviz

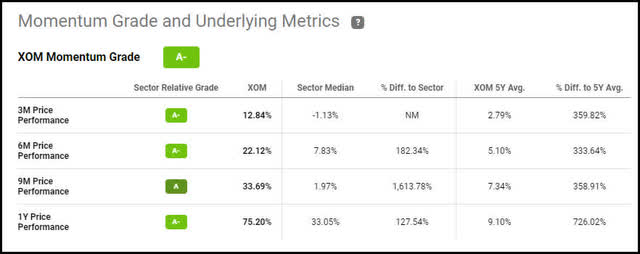

Stocks momentum metrics are off the charts

Exxon Mobil has experience one of the greatest runs in its history over the past year. In, fact it score an A- on Seeking Alpha’s momentum metrics scale. The is up 75% for the year when its five-year average is about 9% per year. This is a 726% above the norm. It’s going to be really hard for the stock to continue on this trajectory or even hold its current level I surmise. The stock is up substantially over the rest of the market.

Seeking Alpha

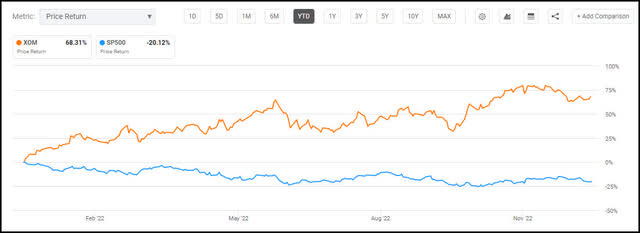

Something’s got to give

Exxon Mobil’s stock is up 75% while the rest of the market is down 25%. That’s tremendous! Yet, sooner or later something’s got to give. Either the market will come up to meet Exxon Mobil, or Exxon Mobil will fall down to the level of the market, or most likely, they will meet somewhere in the middle. No sector continuously outperformed the macro market overtime. Further, if they do meet somewhere in the middle, we’re looking at a decline in the stock of approximately 25%-30%. That’s not chump change, and when a recession more likely than not, odds are its going to happen sooner rather than later. We haven’t even touched on the fact that oil is down significantly over the past six months while oil stocks haven’t budged off their highs.

Seeking Alpha

Oil down substantially while oil stocks remain high

In normal times, Exxon Mobil’s stock performance is highly correlated to the price of oil. You can see this by reviewing the comparison chart below. As you can see Exxon Mobil’s stock and oil’s price were tracking perfectly until about July when oil began to fall and Exxon’s stock continued to rise. One of the reason I see for this is the fact that most analysts and pundits alike are still bullish on the energy sector. If you watch CNBC or any of the stock market channels almost every talking head on TV and Wall Street analyst are still bullish on energy stocks. This gets my contrarian juices flowing. I do not like to follow the herd and take the consensus view. Plus, there are signs things could be about to change with a recession in the works as inflation wanes.

CNBC

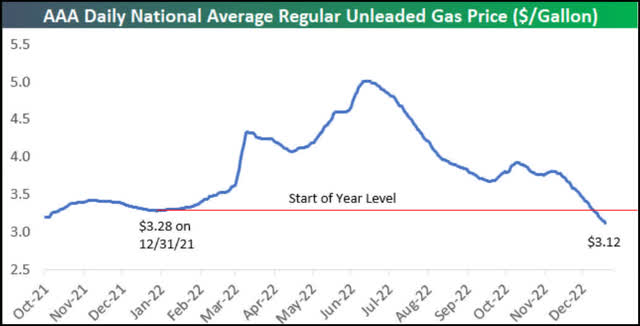

Gas prices lower than at the first of the year

According to Bespoke,

“Gas prices, now at $3.12/gallon nationally according to AAA, have fallen every day since 11/9 and are now down 16 cents since the start of the year ($3.28).”

With gas prices falling to levels below where they were at the first of the year and Exxon Mobil’s stock still trading 75% above where it was at that time, the risk doesn’t seem worth the regard to continue holding the stock. What’s more, year-over-year comparisons are going to look extremely ugly.

Bespoke

2023 Earning are expected to fall

There’s no doubt Exxon Mobil has been hitting the ball out of the part this past year as far as earnings are concerned. Even so, that just makes it that much harder for the stock to continue outperforming when you look at year-over-year comparisons. earnings are expected to be down next year and actually substantially less in the second half of 2023 compared to 2022. This is not a positive set up for continued strength in the stock.

Seeking Alpha

Now let me wrap this up.

The Wrap Up

Exxon Mobil’s stock seems to be running out of gas as of late. The stock has basically been rolling over for the past month and showing the first signs of weakness. There’s nothing out of the ordinary about this. The commonly used mantra to describe this situation in investing is “trees don’t grow to the sky.” meaning stocks always need some time to backfill and consolidate. Another analogy I’d like to imbue is that of mountain climbing. As you climb up the side of the mountain the air becomes thinner the higher you go in altitude. When you reach the summit, it’s much harder to perform everyday tasks as there isn’t as much oxygen so it takes more of an effort to get things done. When a stock reaches such heights, as Exxon Mobil has, there are far fewer buyers left in the market which makes it that much harder for the stock to continue roaring higher. Everyone is already in, and there’s no one left to buy. This is where I believe Exxon’s resides at present. There’s no other direction but down from here. I’m not the only one who thinks this, even though the contrarians are still definitely in the minority. Exxon Mobil made Citi’s list contrarian bull and bear stock calls for 2023. If you’re contemplating buying into Exxon Mobil at current levels I would definitely later in to reduce risk. If you’re a long-term buy and hold type investor maybe sell some covered calls to protect your position and collect a premium. I’m not saying I think you should buy or the sell stock here. I’m merely providing my insights for you to take or leave. Those are my thoughts on the matter, I look forward to reading yours.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Join the #1 fastest growing new dividend income service! Our 6% SWAN and 12% High Yield Income Portfolios are substantially outperforming the market

We have opened up an addition 50 heavily discounted Charter memberships and they are going fast! We have 10 FIVE STAR reviews in the first two months!

~ Quality High Yield Income – Current Yield – 12%

~ SWAN Quality Income – Current Yield – 6%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).