Summary:

- Amazon reported Q4 earnings and closed 2022 on a minor note, while the AWS segment on a stand-alone basis remained resilient.

- Following the strong growth in data center systems, the focus of global IT expenditures is now expected to shift to cloud solutions, benefiting the AWS business.

- E-commerce activity might seem normalizing since the pandemic boom, but the secular drivers remain intact.

- The valuation of Amazon is in the middle point now, and I believe we could still evidence a reversion up to the historic mean, rather than down to the current sector’s median.

FinkAvenue/iStock Editorial via Getty Images

Amazon.com, Inc. (NASDAQ:AMZN) has disappointed investors with its Q4 2022 earnings by exhibiting lower growth amid worsening macro indicators. This has led to a drawdown in operating profit against the aggressive growth in the past few years. Additionally, depreciation of the investment in Rivian Automotive, Inc. (RIVN) also hurt AMZN’s net income.

The strong long-term focus, evidenced by CAPEX outlays, secures the company with a wide moat for driving dominance in the cloud market with the AWS division in one arm, and meets the growing online commerce behavior with a solid e-commerce business in the other. I believe Amazon could ride the tailwind, succeed in cost control, and achieve improvements in profitability going forward.

Overview and outlook

Amazon’s management is well-known for placing its long-term growth and profitability focus in the forefront, which in turn exerts pressure on quarterly financial results. Investing in the promising areas to maintain a leadership role in the market unquestionably improves the company’s long-term prospects, but it doesn’t mean that quarterly results can be sacrificed to achieve the longer-term goals.

Typing an Amazon in the browser search bar gives the following:

However, the company itself needs to Spend less in order to make the investment community Smile more when looking at financial results.

The solid top-line growth in the last 2 years was accompanied by elevated capital expenditures and staff expansion. CAPEX increased by 3.6x in 2021 compared to the pre-pandemic year, as the infrastructure for e-commerce wasn’t able to cope with a pandemic-induced e-commerce surge. The increased fixed costs led to deterioration in the efficiency of the e-commerce business due to over-investment in logistics and order fulfillment systems.

At the end of 2022, order fulfillment costs accounted for 25% of e-commerce revenue, while in the 2018-2019 period, this parameter was around 20.5%. Considering the low profitability of the retail business, such an increase restrained the operating profitability, and needs significant optimization to strengthen the e-com business going forward. In addition, macro forecasts weighed on operating profit because of the decreased purchasing power and a strengthening dollar.

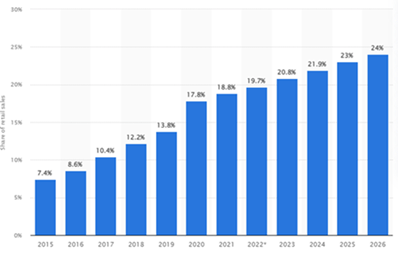

Retail e-commerce sales worldwide (Statista)

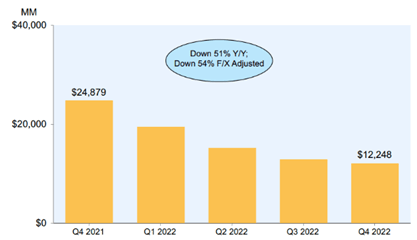

For 2022, Amazon marked a 9% YoY increase in net sales, while operating profit halved to a $12.2 billion. On the bottom-line, AMZM finished 2022 with a $2.7 billion loss, of $0.27 per share, compared to $3.24 per share a year ago.

However, I believe that the long-term investment secures the company a strong moat against the competition, and should pay out with the secular trend in e-commerce of shifting consumer preferences. I will share some thoughts about e-commerce prospects from my piece on DHL:

While the reasons for the rise of e-commerce during the first year of Covid in 2020 are apparent, in my view, the shift to shopping online is a behavior that almost everyone could evidence in himself. On the one hand, the sales are normalizing and stabilizing compared to the exceptional Covid year, while on the other hand, consumers should be more careful with their spending.

Retail e-commerce sales worldwide (Statista)

Nevertheless, thanks to the development of payments and logistic infrastructure which improves the consumer experience, online sales account for nearly 20% of all retail activity in 2022 worldwide. But the growth is not done, and the share is expected to increase sustainably up to 24% going further.

We witnessed not only the e-com increase, but spending on digital business initiatives in response to the economic turmoil.

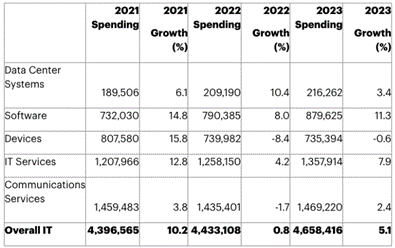

Worldwide IT spending (Gartner)

The table shows that there was a significant increase in Amazon data center systems spending in 2022, which outperformed the software ones. Software spending rate increased by 8% in 2022 and is expected to follow with 11.3% growth in 2023. This represents a good prospect for Amazon Web Services (“AWS”), since the widened moat, excavated by significant investments, is well-positioned to meet the increased demand for software and cloud solutions.

Valuation

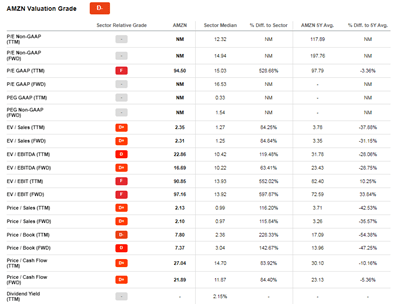

When switching to the AMZN valuation screener on Seeking Alpha, the obvious inference is that everything is quite red. Indeed, Amazon is trading at about 2x across all the valuation measures compared to sectors’ median multiples.

Valuation screener (Seeking Alpha)

The only bright point here is that AMZN is quoted well below its 5Y history. The current P/S ratio of 2.1x implies that the company is trading at a more than 30% historical discount. The same is relevant for Enterprise value ratios (to EBITDA or Sales) as well. The reversion to the historical mean values could result in a significant upside gain from current levels, and I believe there are some trigger points for that.

OPEX. Improving the efficiency of fixed costs and reducing the rate of hiring will help strengthen the profitability of e-commerce, hence the company as a whole. Since the beginning of the year, Amazon has slowed down the pace of hiring, even reducing the staff to optimize costs. Going forward, as far as the company manages its logistics capacity in line with the secular tailwind, e-commerce performance could improve.

CAPEX. A slowdown in capital expenditure growth will help bring free cash flow back to the positive levels. The total CAPEX in 2022 was slightly higher than last year ($63.6 billion; +4.2% YoY). However, Amazon management plans to reduce investments in e-commerce infrastructure in favor of IT spending, which will support the high-margin AWS that is now generating operating income.

Revenue mix. Increasing the share of services in revenue will strengthen profitability and will allow AMZN to fuel the top-line through the fast-growing AWS segment, which occupies more than 30% of the global IaaS segment. The prospects for the IaaS sector will be associated with emerging technologies like metaverse, which aim to improve customer experience and will require significant infrastructure to meet the growing demand for storage and compute power.

The company has never paid a dividend in its history, but in March 2022 it announced a share buyback, and doubled the repurchase cap to $10 million, replacing the $5 billion authorization announced in 2016.

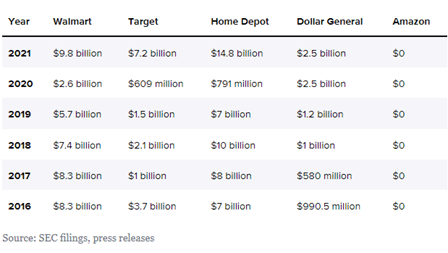

History of buybacks (retaildive.com)

Since the beginning of 2022, Amazon has bought back its own shares worth $6 billion, which broke the many years of returning capital to operations, trying shareholder patience. This is a signal that Amazon is ready to spend more of its profits on shareholders now after years of putting it back into operations.

Risk factors

The large portion of risk to the prospect of Amazon relates to the highly competitive landscape in the retail and IT services segment. Further decrease in purchasing power due to high inflation could switch consumer’s preferences (e.g., to discounters) and restrain AMZN’s e-commerce business. In addition, the labor cost exhibits a significant pressure on the company’s operating profitability, since Amazon is among the largest employers in the world. Also, the dilution risk shouldn’t be ruled out.

Conclusion

The strong long-term focus has pushed Amazon into a favorable position to benefit from the growth trends in e-commerce and cloud business. With operating profitability coming primarily from the AWS segment now, improvement in the macroeconomic environment should reinforce AMZN’s e-com segment and profitability on the EBIT line.

After a strong fulfillment network expansion, investments in new technology, services, and staff, Amazon.com, Inc. appears to have passed through the peak of the capital spending cycle and shifted its focus to balancing operational investment with shareholder returns, thus offsetting incremental dilution every year. I am for a Buy, as I believe that Amazon.com, Inc. is more likely at the foothill of the historical mean, rather than at the steep mountainside of the sector’s median level.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.