Summary:

- Upgrading Amazon stock to ‘buy’ in October 2023 has resulted in a 40.1% increase in shares, outperforming the S&P 500.

- AWS, the cloud computing segment of Amazon, continues to show strong performance and high margins.

- Management expects further growth in revenue and operating profits for 2024, making a strong case for continued optimism in the company.

Brett_Hondow

As a general rule of thumb, you should never try and time the market unless you have enough data to be confident in the timing. Oftentimes, timing investments does not work out well. But every so often, you end up lucky. One company that I upgraded in early October of last year that ended up being lucky in terms of timing was ecommerce and cloud services giant Amazon (NASDAQ:AMZN). This upgrade from a ‘hold’ to a ‘buy’ was based on evidence that the firm’s cost-cutting initiatives were starting to bear fruit. In particular, the AWS portion of the company had been doing particularly well.

That upgrade happened to turn out quite well. Since writing that article, shares have seen upside of 40.1%. That’s very close to double the 20.3% rise seen by the S&P 500 over the same window of time. The big question now is whether or not further optimism is warranted. Clearly, the easy money has already been made. On top of this, a legitimate question of how much higher a $1.80 trillion company can move, exists. But when looking at the data that’s currently available, I must say that I believe that the firm isn’t done moving up just yet. I could see another 10% to 20% increase from this point on. So because of that, I’ve decided to keep the company rated a soft ‘buy’ for now.

AWS keeps getting better

In writing about Amazon, most of my emphasis has been on its AWS segment. This is the cloud computing and cloud services part of the company. The reason for this is because, in addition to growing at a nice pace, the segment operates as the firm’s cash cow. The overwhelming majority of the profits generated by Amazon currently come from AWS. Given this, it’s probably best to start there. And since the most recent data available covers the final quarter of the 2023 fiscal year, that seems to be an appropriate place for us to begin as well.

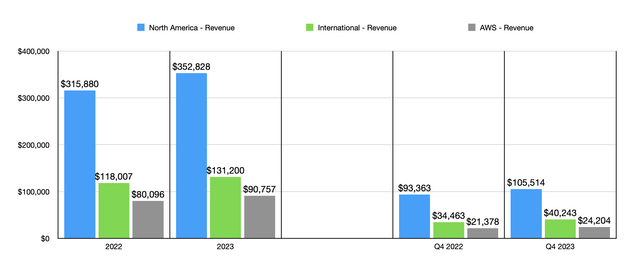

During the most recent quarter, AWS achieved rather remarkable performance. Revenue came in at $24.20 billion. This was up 13.2% compared to the $21.38 billion the company generated one year earlier. This is slightly higher than the 13% increase in revenue achieved from the firm’s North America segment, but is slightly below the 16.8% rise in revenue generated by the International segment. Not much data has been made available regarding the performance of the AWS segment. However, management attributed the increase in revenue to higher customer usage that was somewhat offset by pricing changes as more customers shifted to long-term contracts as opposed to usage-based arrangements or short-term contracts.

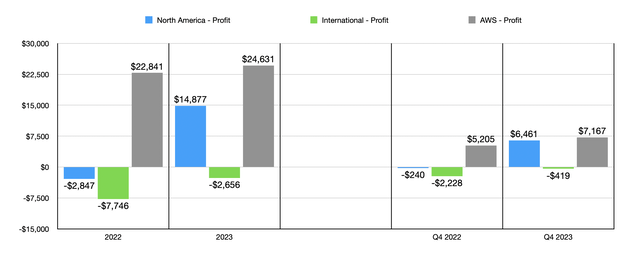

While $24.20 billion is a large chunk of money to pretty much anyone or any organization, it’s actually relatively small compared to the rest of Amazon as a whole. During the quarter, it accounted for just 14.2% of the company’s revenue. However, as I mentioned already, it’s a true cash cow. It generated $7.17 billion in operating income for the quarter. That’s 37.7% above the $5.21 billion generated in the final quarter of 2022. It’s also 54.3% of the overall profit generated by Amazon as a whole.

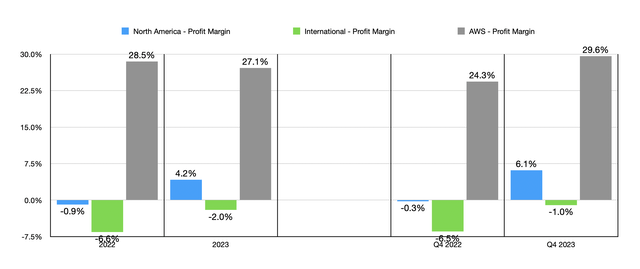

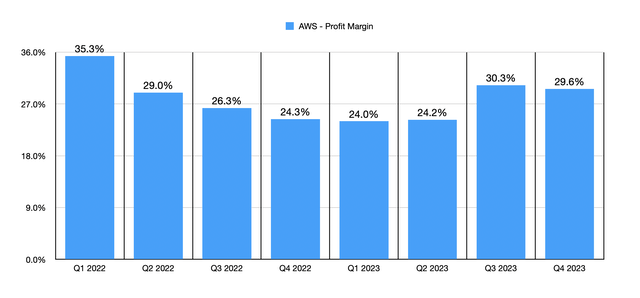

A small amount of revenue and a large percent of profit translates to high margins. And the fact of the matter is that these margins are only getting better. During the final quarter of 2023, AWS boasted a 29.6% segment operating margin. That’s up from the 24.3% generated one year earlier. This is not the only time that we have seen a margin improvement year over year. While the 2023 results in their entirety show a reduction in the segment operating margin from 30.3% to 29.6%, cost-cutting initiatives that I detailed in my aforementioned article from last year do appear to be paying off. In the last two quarters of the year, margins associated with AWS comfortably exceeded what they were the same time one year earlier.

This is not to say that other parts of the company are not improving. At this point in time, both of the other segments of the business are improving as well. During the final quarter of 2023, the North America segment generated $6.46 billion in profits. That gave it a 6.1% operating profit margin. That compares to a loss of $240 million, amounting to 0.3%, for what was seen one year earlier. Meanwhile, the International segment of the company reported a loss of $419 million. That gives it a margin of negative 1%. That compares to the $2.23 billion loss, or negative 6.5%, seen in the final quarter of 2022.

There’s a very high probability, I would argue, that 2024 and its entirety will be much better than what 2023 ended up being. Management expects revenue in the first quarter of this year to be between 8% and 13% higher than what it was last year. That would imply sales of between $138 billion and $143.5 billion. No breakdown of how much of this AWS will be was given, but given how fast it grew last year and considering how large the market opportunity for cloud computing is, I would be shocked if it doesn’t see some nice expansion.

The bottom line for the company as a whole for the first quarter of 2024 is also expected to improve. Management is forecasting operating profits of between $8 billion and $12 billion. At the midpoint, this is more than double the $4.8 billion generated for the first quarter of 2023. This is further evidence that cost-cutting initiatives are proving beneficial since it is hard to imagine a revenue increase of between 8% and 13% leading to more than a doubling of profits.

Even ignoring the prospect of 2024 in its entirety looking better than 2023 was, shares of the business are not terribly pricey. To be clear, they’re not the cheapest either. But everything is relative. And when you are looking at the global leader in ecommerce and one of the two large players in cloud computing, a bit of a premium is warranted on shares. This is especially true when you consider how rapid overall growth for the company remains. For instance, look at results over the prior two years.

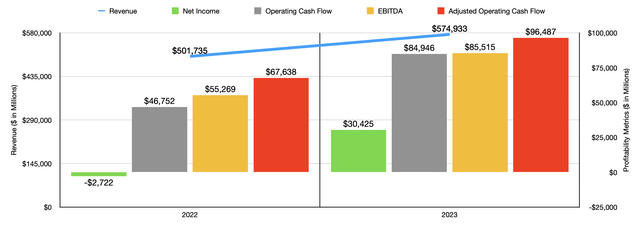

Revenue of $574.93 billion in 2023 came in 14.6% above the $501.74 billion generated in 2022. All three segments contributed to this. And they also contributed to the company’s bottom-line improvement, with net income turning from negative $2.72 billion to positive $30.43 billion. Operating cash flow expanded from $46.75 billion to $84.95 billion, while the adjusted figure for this, which adjusts for changes in working capital, grew from $67.64 billion to $96.49 billion. Meanwhile, EBITDA for the company expanded from $55.27 billion to $85.52 billion.

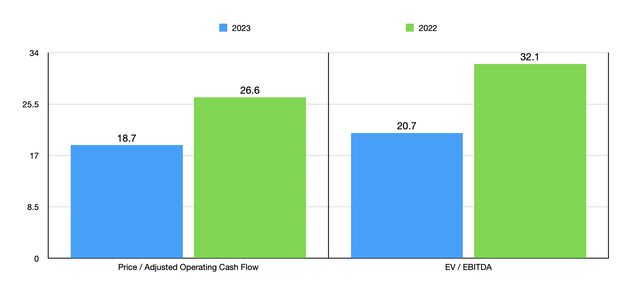

Taking these profitability metrics, valuing the company is quite easy. In the chart below, you can see that the firm is trading at a price to adjusted operating cash flow multiple of 18.7 when using data from 2023. This is a meaningful improvement from the 26.6 reading that we get for 2022. The EV to EBITDA multiple, meanwhile, has fallen from 32.1 to 20.7. These are some rather nice changes. Even if we assume that profits increased by 15% year over year, that would bring the price to adjusted operating cash flow multiple down further to 16.2, while the EV to EBITDA Multiple would drop to 18.3. Add on top of all of this that the firm has cash that exceeds debt in the amount of $28.47 billion, meaning that the risk profile of the enterprise is also very low, and investors have plenty of reasons to be optimistic.

Takeaway

All things considered, the ride higher that shares of Amazon has seen has been remarkable. However, I don’t see that ride being over just yet. I think the easy money has certainly been made. But when you look at current guidance for the first quarter of 2024, and you factor in the improvements the company has seen, especially when it comes to AWS, since I last wrote about the firm, it’s difficult to be anything other than bullish on the business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!