Summary:

- Despite trading at over 60 times its forward earnings, it appears that Amazon’s stock has all the chances to appreciate in the following quarters.

- It’s premature to say that the company’s growth story is coming to an end since there’s an indication that several Amazon businesses would continue to grow at an aggressive rate.

- As long as the global economy continues to improve after a relatively weak performance in the first half of 2022, Amazon has all the chances to create additional shareholder value.

Jeff Vinnick/Getty Images News

There’s this misconception that Amazon’s (NASDAQ:AMZN) growth story is coming to an end since the top-line growth rate of the business is gradually decreasing which for some makes it hard to justify opening a long position in the company at a time when its stock trades at over 60 times of its forward earnings. However, if we closely look at Amazon’s latest earnings report, we’ll see that not only does its cloud and advertising businesses continue to grow at an aggressive rate, but its core commerce business also has the ability to outperform expectations in the following quarters’ thanks to the potential improvement of the overall global economy. As a result, there’s a case to be made that the market is mispricing Amazon’s stock due to not seeing the bigger picture which creates a potential money-making opportunity for long-term investors at the current levels.

It’s All About The Bigger Picture

If we go through Amazon’s latest earnings report which was released earlier this month, we’ll see that despite all the macroeconomic uncertainty the company nevertheless managed to increase its revenues by 8.6% Y/Y to $149.2 billion in Q4 and beat the street estimates by $3.43 billion thanks to the strong holiday season. The latest report could also serve as an indication that things are not as bad as they were predicted which in the end could lead to a major reversal and an appreciation of Amazon’s stock after it experienced a ~35% depreciation in the last 12 months.

Amazon’s Stock Performance (Seeking Alpha)

If we also look at Amazon’s latest share price performance, we’ll see that it closely correlates with the state of the American economy that has shown a relatively weak performance in the first half of 2022 and a much better performance at the end of the year when the inflation rate began to subside thanks to interest rate hikes. This could lead to the conclusion that Amazon’s stock has all the chances to appreciate further in case we continue to receive more positive data about the state of the economy.

The latest retail data shows that consumers are eager to spend at a time when the Federal Reserve talks about the start of the disinflationary process which indicates that the revival of the broader growth story is upon us. Considering that during the latest conference call, Amazon’s management noted that the global sales e vents have outperformed their expectations while third-party sellers continue to set new records on the company’s platforms and it becomes obvious that the business has all the chances to outperform the expectations in 2023. Add to this the fact that the global economy could avoid a recession in 2023 and the bullish thesis for Amazon is becoming even stronger.

However, all of this also shows that the biggest risk to Amazon’s bullish thesis will remain the potential worsening of the macroeconomic environment. Even though it seems that things are improving, there’s also a case to be made that the Federal Reserve would be required to increase interest rates above the predicted 5% level to ensure that inflation is certainly not coming back.

If that’s going to be the case, then the recent improvement of retail data could be only temporary which would mean that Amazon’s commerce business is likely to suffer in the following quarters after a decent performance in Q4. At the same time, further tightening by the Federal Reserve could lead to a strong dollar that would also hurt Amazon’s business. The company has already noted during the latest earnings call that it has been negatively affected by foreign exchange rates and in Q1 it expects to have an unfavourable impact of approximately 210 basis points from foreign exchange rates.

However, if the inflation nevertheless is taken under control and the deflationary process continues then Amazon’s stock has all the chances to appreciate further from the current levels.

The Growth Story Is Far From Over

Even if the inflation rate once again begins to accelerate and forces central banks to raise rates above the forecasted levels, I believe that it’s still too premature to say that Amazon’s growth story is coming to an end. While the company’s core commerce business would remain volatile due to the potential worsening of the macroeconomic situation under a bearish scenario, its other businesses nevertheless are likely to continue to grow at an aggressive rate.

The company’s latest earnings report has shown that even though enterprises have been optimizing their cloud spending due to the turbulent macroeconomic environment, Amazon’s AWS business nevertheless generated $21.4 billion in revenues, up 20% Y/Y. Such an aggressive growth rate shows that it’s too premature to talk about the end of the company’s growth story.

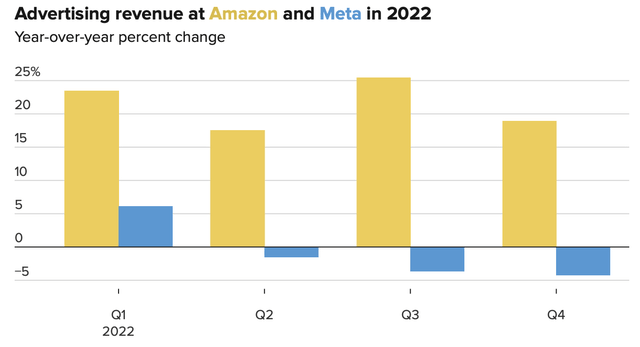

At the same time, Amazon continues to disrupt the digital advertising business and grab some market share from companies such as Meta Platforms (META) and Google (GOOG)(GOOGL). In Q4, Amazon’s advertising revenues increased by 19% Y/Y to $11.6 billion at a time when its direct competitors are not able to significantly improve their performance which indicates that the company’s overall growth story is far from over as enterprises and advertisers are likely to continue to use various products and service within its ecosystem.

Advertising Revenue at Amazon and Meta in 2022 (CNBC, Amazon and Meta Earnings Reports)

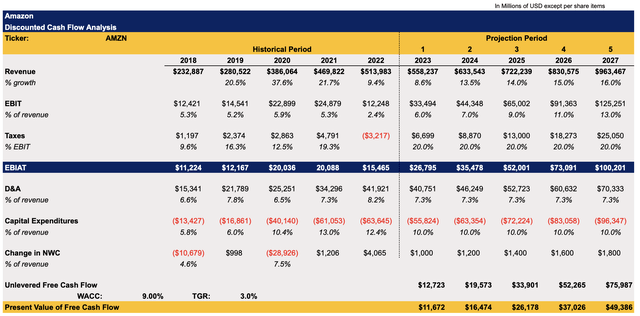

Considering all of this, it makes sense to figure out Amazon’s fair value by building a DCF model based on the assumptions that correlate with the growth thesis that’s presented above.

In the model below, the revenue forecast for the next couple of years is in line with the street estimates after which it gradually returns to the double-digit rate as was the case in most of the previous years’ thanks to the potential improvement of the macroeconomic situation. The EBIT as a percentage of revenue also is increasing in the following years in the model as the high-margin cloud and advertising businesses begin to play a greater role within Amazon. My recent models showed that the EBIT as a percentage of revenue ranges from ~25% for a cloud and advertising business such as Google to ~35% for a pure digital advertising play such as Meta Platforms, which indicates that Amazon has room for improving its margins that could realistically lead to greater earnings in the foreseeable future.

Taxes in the following years are raised to a standard rate of 20%, the D&A as a percentage of revenue is the average of the previous three years while the change in net working capital is minimal so that it doesn’t greatly affect the overall performance as was mostly the case in previous years. The capital expenditures are capped at 10% of the company’s revenues. The terminal growth rate in the model is 3% while the WACC stands at 9%.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

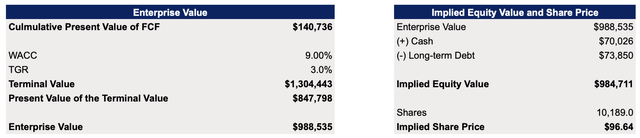

This DCF model shows Amazon’s enterprise value to be close to $1 trillion while its fair value is $96.64 per share which is close to its current market price.

Amazon’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

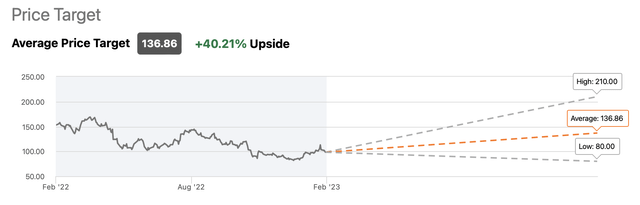

While this valuation is below the street consensus of ~$136 per share, we shouldn’t forget that even at the current levels the company trades at ~65 times its forward earnings and as such it could be even considered as significantly overvalued at this stage. Seeking Alpha’s own Quant system gives Amazon a solid D rating for the valuation.

However, a potential improvement of the macroeconomic environment could lead to a greater growth rate as was the case a few years ago which would subsequently make the revenue assumptions in the model look conservative. In such a scenario, the valuation would be significantly higher and likely close to the street consensus. This would make Amazon’s stock a BUY for patient investors with a moderate risk tolerance level.

Amazon’s Consensus Price Target (Seeking Alpha)

Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!