Summary:

- Amazon.com, Inc. stock’s recent pullback is likely attributed to macroeconomic uncertainties and competitive threats.

- Concerns about macro risks, including declining saving rates, rising delinquency rates, and a cooling labor market, may impact consumer spending.

- The rise of Buy Now, Pay Later services, such as Affirm Holdings, is contributing to the strength of consumer spending and may help sustain resilience despite credit headwinds.

- Amazon’s advertising and seller services position the company for continued growth.

- In addition, Q3 retail sales data looks good to us.

blackCAT/E+ via Getty Images

Intro

Amazon.com, Inc.’s (NASDAQ:AMZN) stock has surged 58% year-to-date, as the company continues to exhibit resilience amid economic uncertainty. A key driver has been strength in Amazon’s consumer business, with North America operating income bouncing back into positive territory in Q2. Online store revenues accelerated to 5% growth in Q2 from Q1, suggesting consumer spending has momentum heading into the back half of 2023.

However, the stock recently experienced a pullback. We believe this is due to concerns regarding macroeconomic uncertainties and competitive risks, such as Temu, which we will delve into in the subsequent sections.

Macro risks

Investors were becoming concerned about a “hard landing” that might end the party. We identify numerous noteworthy data points, which we shall describe below.

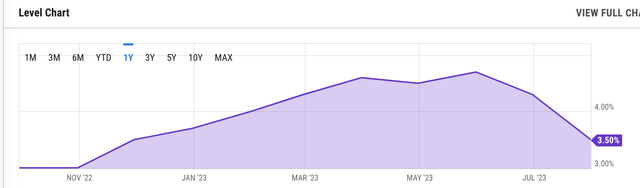

Declining saving rates

A few macro indicators point to a bleak picture for U.S. consumer spending. Due to the U.S. personal saving rate’s continuous drop and the amputated excess savings following the epidemic, consumer spending may stall.

US personal saving rate (YChart)

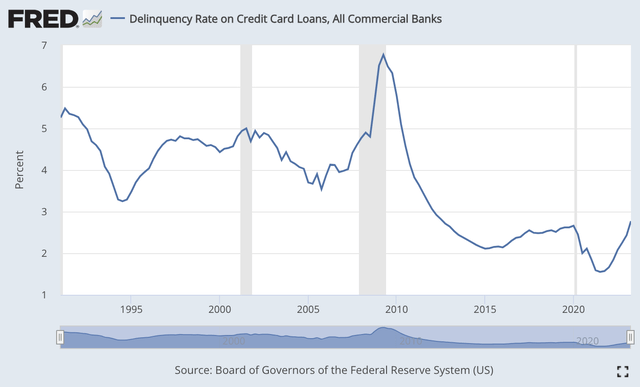

Rising delinquency rate

Additionally, the U.S. consumer credit card debt default rate is also sharply increasing and has now surpassed pre-epidemic levels. Consumer spending will be under additional strain as a result of banks perhaps being more credit-conscious.

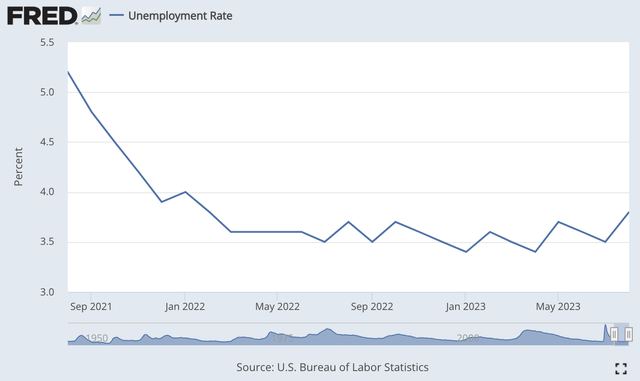

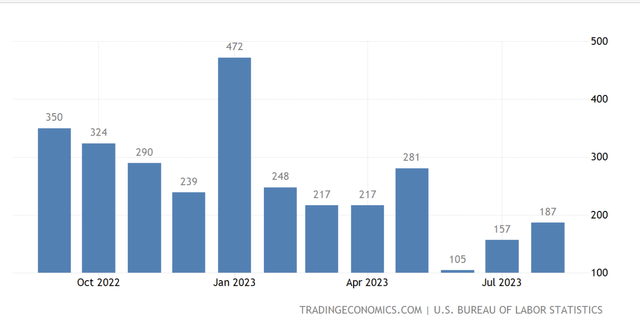

Labor market cools down

U.S. unemployment also appears to be bottoming out and ready to rise, as non-farm payroll growth has stagnated in Q3.

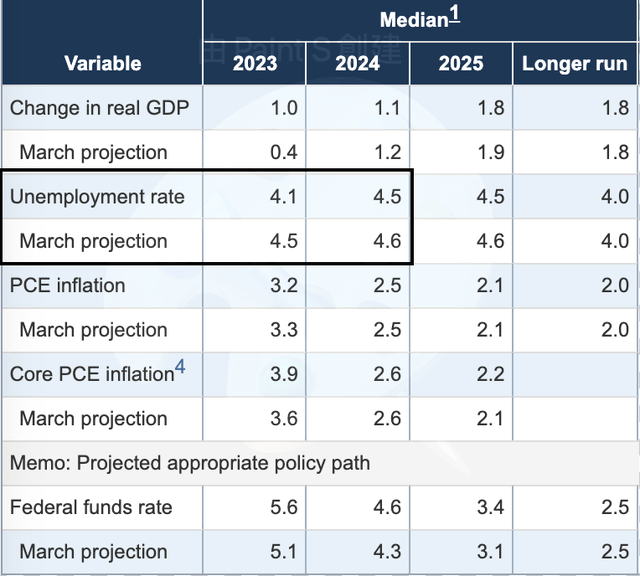

Despite the unemployment rate being revised down to 4.1% in June, the Fed still expects it to reach 4.5% in 2024.

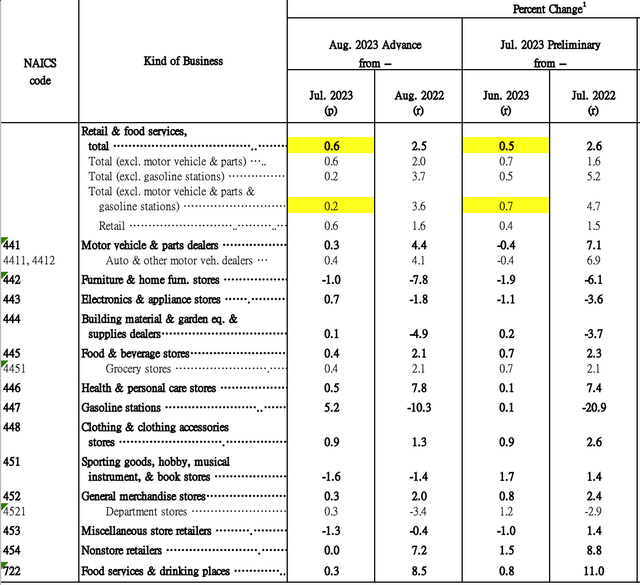

US Retail Sales Growth

However, even as personal savings decline, unemployment ticks up, and delinquencies rise – all headwinds for consumer spending – U.S. retail sales growth actually accelerated in August 2023 compared to July.

The Rise of BNPL

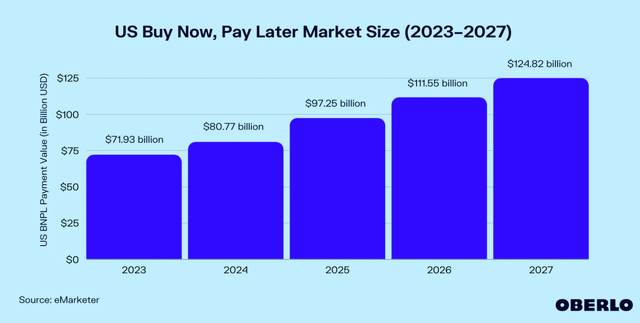

We believe there was an additional factor contributing to the continued strength of consumer spending. As reported by Oberlo, the Buy Now, Pay Later (“BNPL”) service constituted 5% of all online transactions in 2022 and is projected to experience a CAGR of 7% by 2027.

Notably, Amazon introduced Affirm to its platform on June 7, 2023, offering it as its BNPL payment option. With buy now pay later leveraging the power of merchant marketing dollars to stimulate consumer buying, we believe that the relationship with Affirm Holdings (AFRM) can give additional consumer purchase momentum. Buy now, pay later differs from standard credit cards in that the service provider may collaborate with the retailer to offer consumers with good credit a 0% interest loan payment alternative. In this arrangement, the retailer pays Affirm out of its marketing budget while the consumer benefits from an interest-free loan. Additionally, BNPL helps merchants avoid deep discounting to drive promotions.

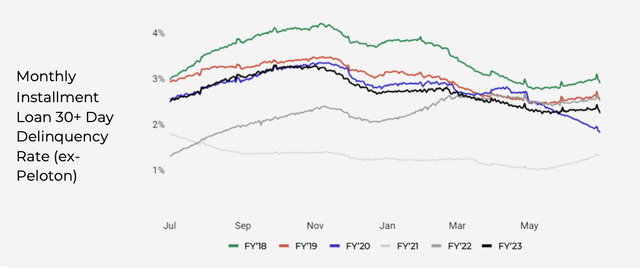

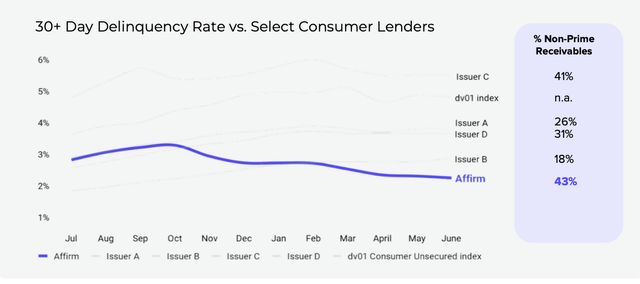

Affirm has demonstrated good delinquency discipline – its rate is currently lower than FY2022 and some peer lenders like Bread Financial, Capital One, Discover, and Synchrony.

Unlike traditional banks funding credit card loans from deposits, BNPL providers partner with institutions and package their loans into asset-backed securities. Affirm underwrites these ABS for investors seeking yield. Affirm’s relatively strong risk controls make their ABS products popular with institutional investors in the current environment.

With inflationary pressures on disposable income, BNPL gives eligible consumers a way to optimize cash flow. We expect that Amazon’s partnership with Affirm positions it to benefit from the growing BNPL trend, potentially sustaining consumer resilience despite traditional credit headwinds.

Amazon’s advertising and seller service

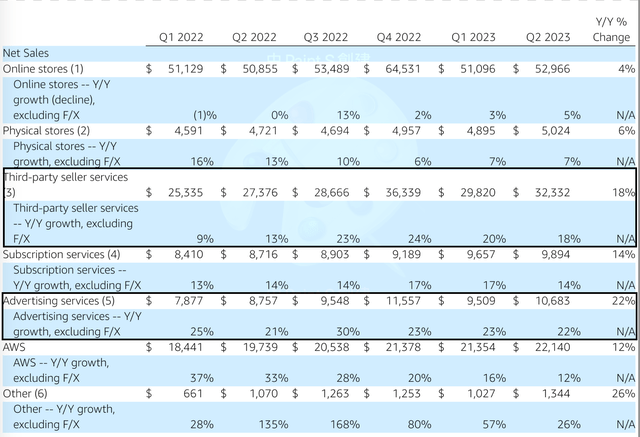

Amazon also appears to be in the early stages of monetizing its seller base, with seller services and advertising revenues still growing at high-teens and 20%+ rates respectively.

One of the keys is Amazon’s large Prime Video subscriber base. According to SellCell, Prime Video reached 220 million subscribers, surpassing Amazon’s 150 million Prime members and nearing Netflix’s scale. It is expected to reach 265 million by 2028.

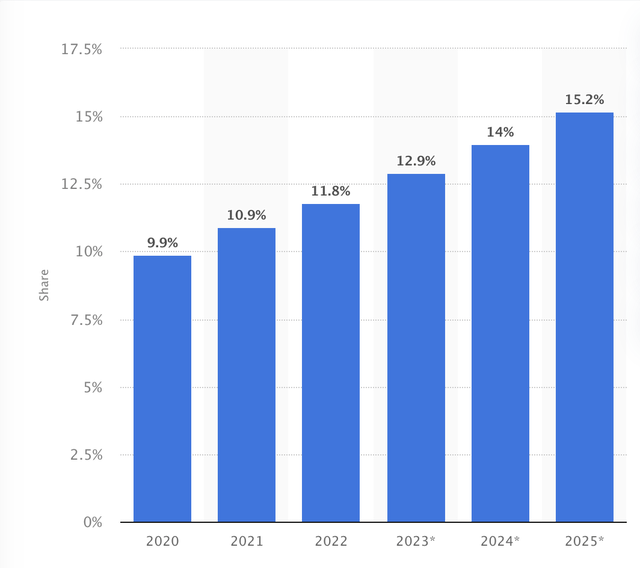

Amazon spent $16.6 billion on content to sustain this base. As a result, Amazon now has additional avenues for generating advertising money. Amazon’s advertising revenue penetration rate increased during the previous three years and reached 11.8%, placing it third globally after Google (GOOG) and Meta Platforms (META). Amazon can more effectively monetize the userbase with the advertising industry by creating its own ecosystem.

Temu – A Real Threat?

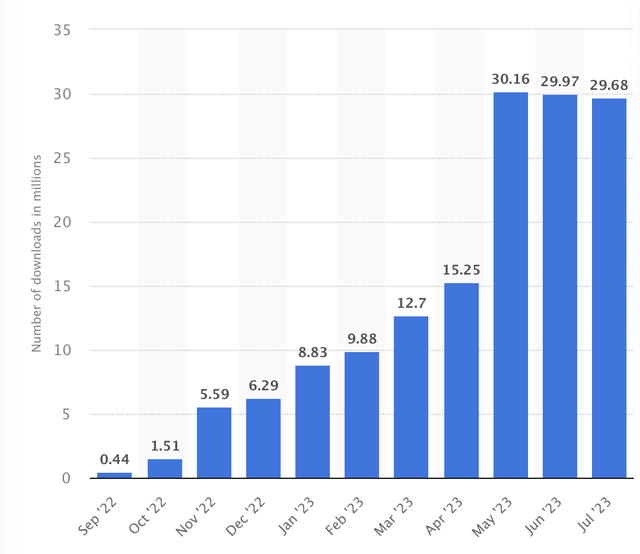

Some investors expressed concerns over the competition from Temu, an app recently popularized by the Chinese e-commerce titan, PDD Holdings (PDD) aka Pinduoduo. It is notable for its extremely competitive pricing and was ranked first in iOS app downloads in Sep 2023, respectively, according to Similarweb data. Below is the historical trend showcasing the global downloads of Temu.

Number of global downloads of shopping app Temu (Statista)

Unlike its parent company, Pinduoduo, which operates on a marketplace model, Temu follows a consignment approach. Temu charges a commission fee and handles pricing, marketing, and logistics services for its merchants.

Although investors are concerned about Temu as a competitor, we don’t believe the threat is real. Even though Temu is growing fast, it’s still small compared to Amazon. It made only about $400 million in April 2023. Further, Chinese sellers on Temu don’t earn as much as those on Amazon. So, many use Temu mainly to clear out old stock instead of making big profits. Also, Temu lacks its own shipping system, which makes its delivery costs higher than Amazon’s. The reason products on Temu are cheaper is due to the promotional strategies of its parent company, Pinduoduo. According to Pinduoduo’s Q2 earnings, even though revenues increased by 66%, profits only increased by 46%, which was hindered by a 135% increase in costs of revenues.

This month, Amazon launched its “Supply Chain by Amazon” service to rival Temu, albeit with a 25% fulfillment fee discount that may raise costs.

With Supply Chain by Amazon, Amazon will pick up inventory from manufacturing facilities around the world, ship it across borders, handle customs clearance and ground transportation, store inventory in bulk, manage replenishment across Amazon and other sales channels, and deliver directly to customers—all without sellers having to worry about managing their supply chain. The new solution allows sellers to spend more time building great products, delighting customers, and growing their business, while Amazon handles the logistics, improves delivery speed, and reduces costs for sellers.

Overall, Temu does not appear to be a material threat currently given its lack of profitability and sustainable infrastructure relative to Amazon’s scale and logistics network. We will monitor market share shifts, but Amazon looks well-positioned competitively for now.

Q3 data looks good

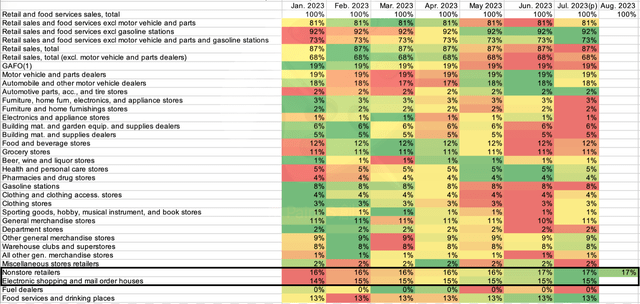

U.S. retail data also indicates online retailers are still outpacing overall retail sales growth. The penetration of non-store retailers continued to increase in July and August. These results indicated that Amazon is probably going to keep growing through Q3.

Q4 hiring plan

On September 19th, Amazon announced hiring 250K more workers to prepare for the holiday season, planning an additional $1.3 billion investment in fulfillment and transportation. It also raised average hourly pay to $20.5, indicating Amazon still sees strong consumer demand through year-end.

The hiring plans, wage increases, and infrastructure investments show Amazon remains confident in continued growth in its e-commerce segments despite macro concerns around consumer spending. The retail sales data corroborates the ongoing shift towards online shopping, which Amazon is well-positioned to capitalize on as the dominant player. We expect the holiday season to further highlight the resilience of Amazon’s consumer business.

Valuation

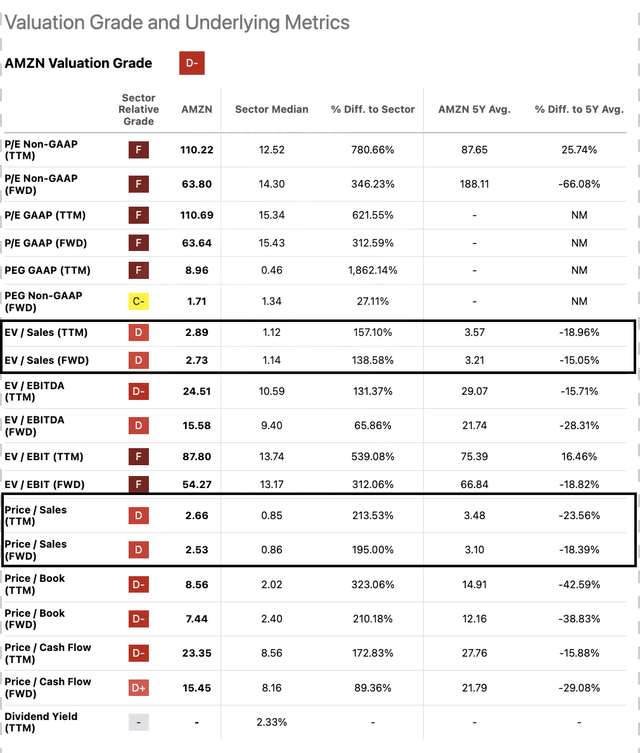

As noted previously, a sum-of-the-parts analysis is best for evaluating Amazon given its diverse business segments. However, valuation multiples can also be useful if applied appropriately. With Amazon growing its consumer ecosystem through investing in new offerings, EV/Sales or P/Sales are more relevant multiples than EV/EBITDA or P/E.

Looking at historical sales multiples, Amazon stock appears 15-20% undervalued currently. As the company returns to accelerating growth in Q2, the valuation seems attractive.

Conclusion

While investors anxiously await tomorrow’s Fed minutes for clues on the economy’s trajectory and portfolio implications, we are relatively comfortable with Amazon’s positioning given its multiple growth drivers.

Even with macro concerns around inflation, interest rates, and unemployment, Amazon appears resilient thanks to the strength of its core consumer business, expanding monetization of services like advertising, and new alternative financing options like the Affirm partnership.

Given the reacceleration in online stores and early progress monetizing Amazon’s ecosystem, we believe the current valuation does not fully reflect these growth opportunities. We upgraded our rating on Amazon to Buy as the company seems poised to outperform the broader economic pressures.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.