Summary:

- PayPal’s current valuation is seen as a mispricing, presenting an attractive value investment opportunity.

- The company’s stock buyback of $5 billion and the introduction of a new CEO may lead to a rebound.

- PayPal’s key priorities include increasing consumer engagement, expanding commerce share, and growing transaction margins.

- By applying a ~16X multiple, this stock should trade around $105 per share, providing long-term investors ~70% upside from current trading price.

Justin Sullivan

Investment Thesis: PayPal’s (NASDAQ:PYPL) current valuation in my view represents a huge mispricing of the stock. Oversold stock provides an attractive value investment opportunity.

Key indicator:

- Stock Buyback of $5B

- New CEO might present a meta rebound story

Let’s delve deeper into this investment thesis:

PayPal Key Priorities and announcement:

Management’s key focus areas are:

- Increasing consumer engagement

- Expanding commerce share in both branded and unbranded businesses

- Growing transaction margins

- PayPal’s success in gaining margin share in its PSP (Payment Service Provider) business with notable customers like Live Nation, Uber, and BetMGM serving as evidence.

- Strategies to enhance PSP business margins: Targeting SMBs (Small and Medium-sized Businesses); Expanding sales in international markets such as Europe, Asia, and Brazil; Cross-selling value-added services.

- No specific timeline provided for sustainable operating margin expansion and transaction margin improvement.

- Introduction of PayPal Complete Payments, enabling a wide range of payment methods at checkout, including Google Pay and Apple Pay, improving integration and optimizing the checkout process.

- WooCommerce’s adoption of PayPal Complete Payments resulted in a 40% increase in checkout conversion and a 10% boost in Pay Later activations for the company.

- Plan to inform 110 million users that they are preapproved with specific spending limits to reduce friction in the Buy Now, Pay Later (BNPL) checkout process.

- Anticipation of introducing several new products and advancements during the summer/fall, including:

- Passkey/device biometrics

- Early fraud detection

- Venmo Commerce

- Gen AI partnership, leveraging data from card networks to enhance the checkout experience.

Let’s delve deeper into the implications for major players in the e-commerce arena. PayPal, a prominent name in online payments, experienced a growth rate of 6.5% in its branded checkout service during the first quarter of 2023. Furthermore, looking at its performance over the entirety of FY22, we observe a steady 5% growth. It’s worth highlighting that this growth likely mirrors the trajectory of non-store retail sales when we exclude contributions from colossal e-commerce platforms like Amazon, where PayPal doesn’t have a significant presence.

Competition:

Visa: Visa reported a 7% growth in card-not-present transactions, excluding travel-related spending, for the month of May. This represents a noteworthy shift from the 12% growth observed in the first quarter of 2023. The fluctuation in these figures suggests dynamic consumer behavior and a rapidly evolving e-commerce landscape.

Mastercard: Mastercard Spending Pulse for April to May showed a sustained pattern of double-digit growth in e-commerce. This data paints a more optimistic picture, indicating that, on the whole, e-commerce continues to thrive, with consumers increasingly turning to online channels for their shopping needs.

Recent performance: (All data from Q2 Earning Financials)

- PayPal reported a non-GAAP EPS (Earnings Per Share) increase of 24% year-over-year, reaching $1.16. This result exceeded the Street’s expectation of $1.15.

- PayPal’s FXN (Foreign Exchange-Neutral) net revenues experienced an 8% growth, reaching $7.29 billion. This was slightly above the Street’s projection of $7.27 billion. One notable highlight was OVAS (Other Value-Added Services) revenue, which surged by an impressive 37%, primarily driven by interest on customer balances.

- Total Payment Volume (TPV), both reported and FXN, increased by 11%, reaching $377 billion. This exceeded the Street’s estimate of $369 billion. However, the growth rate for Cross-border Trade TPV slowed to 3%, down from the 4% seen in the first quarter of 2023.

- The number of active accounts remained relatively flat in 2Q/23, indicating a slowdown from the 1% growth observed in 1Q/23. Nevertheless, transactions per active account increased by a healthy 12%, albeit slightly lower than the 13% growth reported in the previous quarter.

- The transaction take rate experienced a decline of 11 basis points year-over-year, settling at 1.74%, which fell short of our estimate of 1.81% and the Street’s expectation of 1.79%.

- Non-GAAP operating income grew by 20%, reaching $1.56 billion. This result was slightly below the Street’s projection of $1.59 billion.

Why the new CEO matters and how his experience can rebound PayPal.

PayPal announced recently Alex Chriss, who currently runs the Small business and self-employed group at Intuit, as the new CEO of PayPal.

Chriss’s leadership role at Intuit, where they actively engaged with small and mid-sized business (SMB) clients, represents a valuable asset for PayPal. This experience is poised to play a pivotal role in helping PayPal achieve its strategic goals, specifically in igniting demand among SMB clients for its array of services.

Small and mid-sized businesses are a dynamic and crucial sector of the market, and catering to their unique needs requires a nuanced approach. Chriss’s firsthand knowledge of these clients at Intuit equips them with insights into the intricacies of this client segment. Such insights could be instrumental in shaping PayPal’s product offerings, marketing strategies, and overall engagement with SMB clients.

The introduction of PayPal Complete Payments Solution, a cutting-edge solution offered through Braintree, underscores PayPal’s commitment to serving SMB clients more effectively. With Chriss’s expertise, PayPal is better positioned to fine-tune this offering, ensuring that it aligns seamlessly with the needs and aspirations of small and mid-sized businesses.

Share buyback of ~$5B

In Q2 2023, PayPal achieved its revenue and earnings projections, but it grappled with persistent issues related to non-GAAP operating margin and transaction take rate. While unbranded processing saw substantial growth, there was a temporary slowdown in branded checkout, which later rebounded. This decline in transaction margin was a result of the rapid expansion of unbranded processing. The adjusted Free Cash Flow for the quarter amounted to $869 million, and the company reiterated its full-year target of $5 billion. PayPal also announced plans to increase share buybacks to around $5 billion in 2023. CEO Dan Schulman highlighted the stabilization of the e-commerce market. Despite these concerns, PayPal’s potential for 20% EPS growth in 2023 and mid to high teens growth beyond 2023 suggests it is undervalued, with a trading multiple of 13 times the estimated 2024 EPS. The forthcoming CEO selection represents a pivotal catalyst for the company.

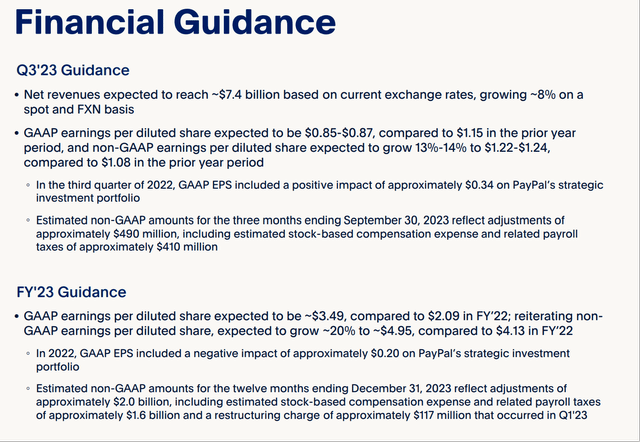

Looking ahead to the third quarter of 2023 (3Q/23), PayPal’s management is targeting net revenue growth of approximately 8%, outpacing the Street’s expectation of 7%. Additionally, they anticipate non-GAAP EPS in the range of $1.22 to $1.24, implying a growth rate of 13-14%, compared to the Consensus estimate of $1.21.

Q2 23 PayPal Financial Guidance

Valuations:

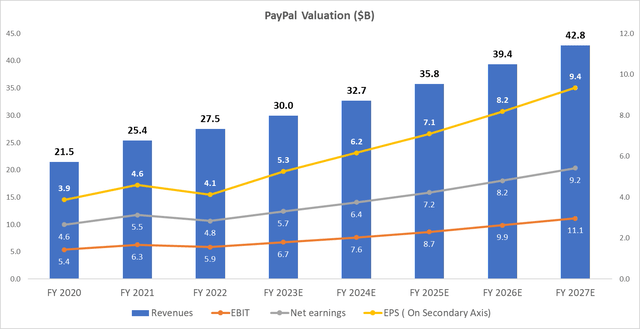

By applying a ~16X multiple, this stock should trade around $105 per share. (Providing long-term investors ~70% upside from current trading price). My price target for PayPal is based on a multiple of 16 times the estimated Free Cash Flow (FCF) for the year 2025, discounted back to the present. This valuation approach reflects our confidence in PayPal’s growth potential and the expectation that it will continue to adapt and thrive amid changing industry dynamics.

Chart made by Author using company data and forecast

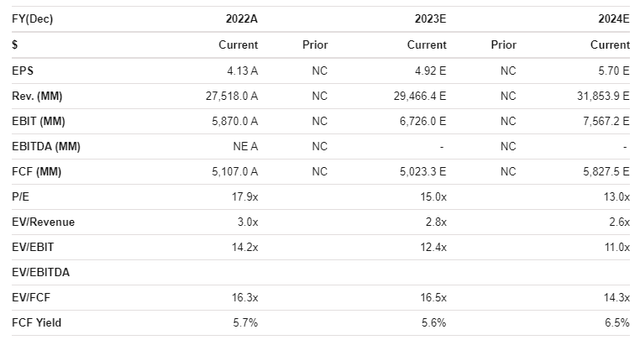

I am using a conservative multiple of 16X for valuation purposes. This is relatively lower compared to the historical trading range of the stock over the past 5 years, where the median ratio has been around 22-24X. Despite being on the lower end of historical valuations, I believe this lower multiple is justified due to anticipation that the market will begin compressing the multiple. This expectation is based on the substantial increase in earnings I foresee in the upcoming quarters. Here are the EV/FCF multiple for 2022A and my estimates for 2023. I am using this as base to forecast for FY 2024 and FY 2025.

Source: Company Data, Author estimates

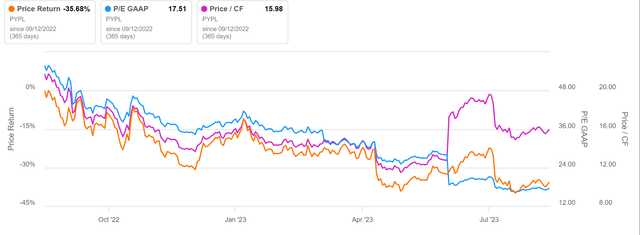

Seeking Alpha

Conclusion:

As industry giants like PayPal, Visa, and Mastercard navigate this evolving landscape, it is clear that understanding these intricate trends and consumer behaviors will be crucial in shaping their strategies for the future. The e-commerce industry, marked by its resilience and adaptability, remains a significant force in the retail world, and its evolution will continue to shape the way we shop and transact in the years to come. The forthcoming CEO selection represents a pivotal catalyst for the company.

Risk Statement:

PayPal shares are down ~75% since its peak in 2021 primarily due to increasing competition in payment space (with so many fintech and BNPL players like Klanra, Square, Apple Pay etc), management changes, and current interest rates environment. This drop has emerged as a lucrative opportunity for long term value investors. Some key risks which investors keep in mind are:

Economic Vulnerability: PayPal’s fortunes are intricately linked to consumer spending patterns and the expansion of the e-commerce sector. If there’s a downturn in the overall economy, it’s likely to result in diminished revenue and profits for the company.

Mergers and Acquisitions Challenges: Given PayPal’s aggressive acquisition strategy, there’s a notable risk that the company might struggle to realize its internal revenue and cost-saving goals associated with these deals.

Regulatory Uncertainty: Ongoing regulatory oversight in the financial industry, especially concerning card transaction fees and Buy Now, Pay Later services, poses a potential long-term threat to PayPal’s operations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.