Coca-Cola: Economic Castle Continues To Grow, With $106.1B In Brand Value (Rating Upgrade)

Summary:

- Mr. Market has turned pessimistic on the Beverage sector, similarly observed in KO’s depressed valuations, trading at its lowest in five years, barring the start of the pandemic.

- As KO attempts to maintain its gross margin through price hikes at a time of rising inflation, the elevated prices also contribute to the decline in its sales volumes.

- However, we are not overly concerned for now, since the inflation has cooled, with the Fed likely to introduce another rate freeze in the upcoming FOMC meeting.

- Coca-Cola has also reclaimed its spot as one of the Top Ten most valuable brands globally “for the first time in seven years,” thanks to the intensified marketing efforts.

- Then again, since KO has underperformed its Beverage peers over the past five/ ten years, even after including dividends, anyone who adds here must also temper their expectations.

3quarks/iStock via Getty Images

There Is A Reason Why Coca-Cola Remains One Of The Most Valuable Brand Globally

We previously covered Coca-Cola Company (NYSE:KO) in January 2023, discussing the management’s strategic focus of being the “world’s smallest bottler” while also improving its marketing efficiency globally.

This was on top of the high volume-lower pricing mix in developing markets and the high pricing-lower volume mix in developed markets, in order to improve its brand penetration and grow market share, while generating sustainable profitability.

In this article, we will be discussing KO’s uncertain prospects as the inflation cools and Mr. Market turns pessimistic on the Beverage sector, as observed in the stock’s depressed valuations, trading at its lowest in five years, barring the start of the pandemic.

However, we maintain our optimism, since Coca-Cola has been able to reclaim its spot as one of the Top Ten most valuable brands globally “for the first time in seven years,” thanks to the management’s intensified marketing efforts and robust economic moat.

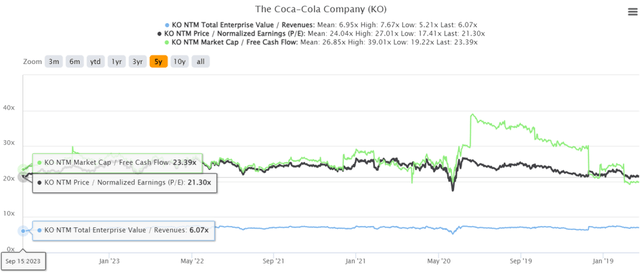

KO 5Y EV/Revenue, P/E, and Market Cap/ FCF Valuations

For now, it appears that Mr. Market has discounted KO’s valuations as the market wide/ tech rally occurred since the start of the year. At the time of writing, the stock trades at NTM EV/ Revenues of 6.07x, NTM P/E of 21.30x, and NTM Market Cap/ FCF of 23.39x.

These numbers are notably lower compared to its 1Y means of 6.60x/ 23.60x/ 25.75x, and pre-pandemic means of 6.78x/ 22.78x/ 29.72x, respectively.

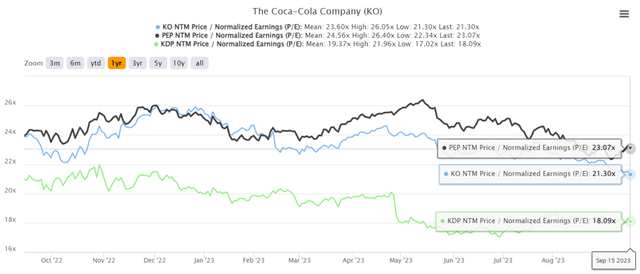

Beverage Sector Valuations

The same instance has also been observed in KO’s peers, such as PepsiCo (PEP) at NTM P/E of 23.07x and Keurig Dr Pepper (KDP) at NTM P/E of 18.09x, compared to their 1Y means of 24.56x/ 19.37x, respectively.

It appears that as KO attempts to maintain its gross margin of 59% ( -1.7 points QoQ/ +1.6 YoY) through price hikes at the time of rising inflation, the elevated prices have also contributed to the decline in its sales volume by -1% in the North American region and -5% in the EMEA in FQ2’23

The same has been highlighted in the recent August 2023 CPI as the index for nonalcoholic beverages moderate by -0.2% MoM, though still elevated at +4.8% YoY.

However, we are not overly concerned for now, since the inflation has cooled with the KO management guiding the end of price hikes in the US and the EU.

The stock has been able to maintain its premium valuation compared to the beverage sector median P/E of 18.09x as well, implying that the correction may be an interim market wide trend.

In addition, we believe that the pessimism reflected in KO’s valuations has been over done, since the consensus has estimated FY2025 adj EPS of $3.03, expanding at a CAGR of +6.9%, compared to its 3Y pre-pandemic CAGRs of +3.4% and 3Y hyper-pandemic CAGRs of +5.5%.

This suggests the beverage company’s ability of generating profitable growth, no matter the cyclical nature of the economic market and the Fed’s eventual pivot once the inflation is tamped down to the target rate of 2%.

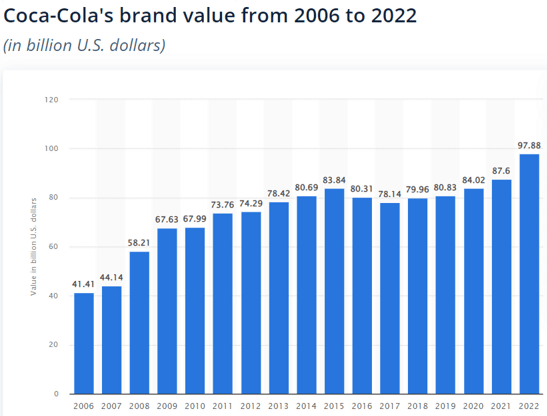

Coca-Cola’s Brand Value Since 2006

Statista

In addition, despite the uncertain macroeconomic outlook, Coca-Cola has been able to record growing brand value of $106.1B (+8.4% YoY) by mid 2023, expanding at a CAGR of +5.69% since 2006.

As a result, we posit that things may lift in the intermediate term, thanks to the KO management’s intensified Selling & Marketing expenses of $4.45B (+5.9% sequentially/ +11.2% from FY2019 levels) over the last twelve months, with $327M dedicated on its flagship brand, Coca-Cola, in 2022.

This is compared to PEP’s overall Selling & Marketing expenses of $20.2B (+5.9% sequentially/ +11.2% from FY2019 levels) over the LTM, with $204M spent on its namesake brand, Pepsi in 2022.

Based on these numbers, it is unsurprising that Coca-Cola has been able to maintain its robust economic castle, otherwise known as moat, with a leading market share of 43.7% in the global non-alcoholic beverage sales, as similarly expounded by Warren Buffett in 2013:

I came up with this term 40+ years ago because in capitalism, you have these economic castles. You need 2 things – a moat around the castle, and you need a knight in the castle who is trying to widen the moat around the castle. How did Coca-Cola build their moat? They deepened the thought in people’s minds that Coca-Cola is where happiness is. The moat is what’s in your mind. (Professor David Kass, University of Maryland)

While KO’s NTM Market Cap/ FCF valuation has also been temporarily moderated compared to its historical trend, investors need not fret, since the company has been able to generate stellar cash flow from operations of $4.46B by the latest quarter (+13.9% YoY).

Combined the management’s FY2023 guidance of cash flow from operations at $11.4B (+3.5% YoY) and capital expenditure of $1.9B (+28.3% YoY), the company may still generate an impressive FCF of $9.5B (inline YoY), indicating the safety of its dividends moving forward.

So, Is KO Stock A Buy, Sell, or Hold?

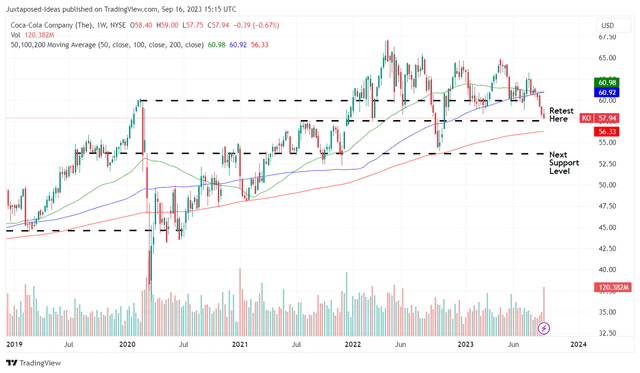

KO 5Y Stock Price

Based on the multiple factors discussed above, we believe the recent correction observed in the KO stock is only temporary, with this dip triggering opportunistic entry points for interested income investors.

Depending on how market sentiments develop over the next few weeks, we may see the embedded pessimism further worsen like it does in October 2022, potentially triggering a further retracement to its critical support level of $53s, implying a downside of -8.5% from current levels.

However, those depressed levels may also unlock expanded forward dividend yield of 3.47%, compared to its 4Y average of 3.02% and sector median of 2.67%.

Based on KO’s normalized P/E of 25x and the consensus FY2025 estimates, we are also looking at a long-term price target of $75.75, implying an excellent upside potential of +42% from those levels.

As a result of the highly attractive risk reward ratio, we are rerating the KO stock as a Buy with no specific entry point, since it really depends on individual investors dollar cost averages.

However, due to the strength of KO’s execution thus far and its expanded bottom line through FY2025, we do not expect the stock to dramatically retrace to its hyper-pandemic bottom of $44 as well.

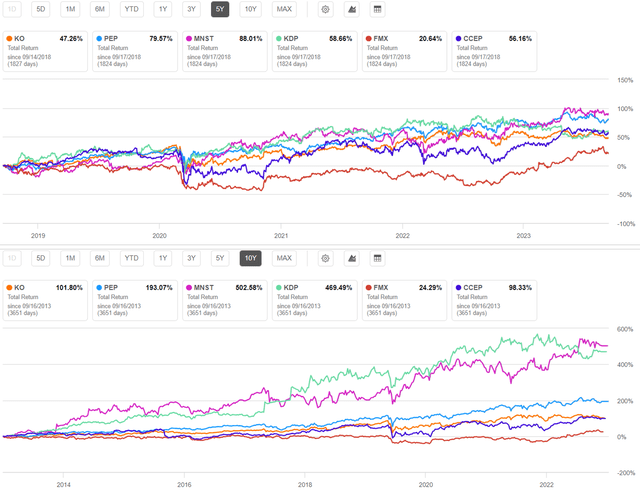

KO’s 5Y And 10Y Total Returns, Including Dividends

However, investors must also note that KO has underperformed its Beverage peers over the past five and ten years, even after including dividends. The same has been observed against the SPY returns of +66.44%/ +211.59% and QQQ returns of +111.78%/ +412.36%, respectively.

While past performance may not be indicative of future results, anyone who adds here may want to temper their expectations.

KO may have been a dividend aristocrat with 60 years of consistent payout growth, however, income investors may want to include the stock as part of their diversified portfolio instead, to reduce their reliance on any single stock. Simply put, do not put all of your eggs in one basket.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.