Summary:

- Amazon.com stock has been punished for many reasons.

- However, another large issue is probably looming.

- I think the conditions are in place for AWS to see a large slowdown soon, I explain why.

Noah Berger

Amazon.com’s (NASDAQ:AMZN) stock has been under significant pressure. So much pressure, that it now even stands below its pre-COVID levels, and has regressed all the way back to levels it first attained in 2018.

Certainly, there are many possible causes for this fall from grace, both connected to the overall market’s weakness, and the fear of an economic slowdown dead ahead, as well as overinvestment in its retail infrastructure.

However, I’ll put forth in this article that the greatest threat to the stock, which the stock is likely trying to discount with its weak behavior, is different. The true threat is that of a large slowdown to happen at AWS, and possibly to happen soon.

The AWS Relevance

The entire market knows that AWS is very relevant for Amazon.com’s valuation. That’s been the case for a long time. However, even then, if we look at one specific number, it’s hard to overemphasize just how much AWS matters.

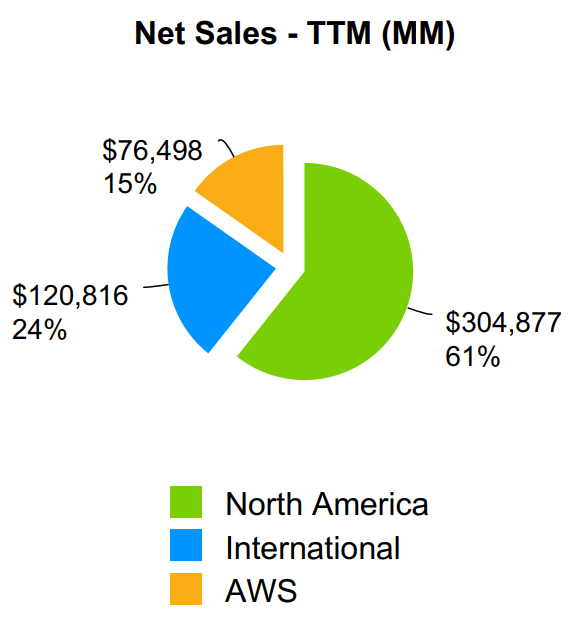

You see, AWS represents just 15% of Amazon.com’s TTM (Trailing Twelve Months’) revenue.

Amazon.com

Yet, at the same time, AWS answers for a much larger slice of Amazon.com’s operating profit. How much larger? Well:

- Amazon.com, as of Q3 2022, had $12.97 billion in TTM operating income.

- And as of the same Q3 2022, AWS had $22.93 billion in TTM operating income. That is, AWS had TTM operating income representing 177% of Amazon.com’s TTM operating income in the same period.

You read that right. At this point in time, AWS represents more than Amazon.com’s entire operating profitability. Meaning, everything else ex-AWS is running at a large loss – though it’s a certainty that within the remaining segments some are highly profitable, like advertising or the 3P marketplace.

Now, Why Would AWS Suddenly Slow Down?

In the context of AWS being so important for Amazon.com, it would be very worrying for investors if there was something on the horizon which could suddenly lead to a significant slowdown in AWS’ growth. And I don’t mean just your generic economic slowdown. The problem is, such a thing does exist.

Already, AWS’ revenue growth slowed slightly in Q3 2022, from 39%/40% yoy (year-on-year, excluding FX effects) growth rates in Q3 and Q4 2021, to 33% yoy in Q2 2022, to 28% yoy in Q3 2022.

But the issue is, there’s reason to believe growth will decelerate further, perhaps even significantly and immediately or almost immediately. Why? Let me explain …

AWS’ customers are spread out across industries and sizes. But typically, the biggest consumers (as a group, not individually) of computing services will be pure internet growth companies. eCommerce retailers, Apps, all kinds of SaaS enterprise services, etc.

Now, these companies are often young (start-ups) or not profitable, or at least not very profitable. When in such a condition, these companies need financing, and financing for such companies comes mostly from the stock market and from venture capital.

Hence, it becomes important to see how much money is flowing into such companies, from the stock market, and from venture capital.

Market Behavior Of Internet Companies Outside The Tech Megacaps

It’s common knowledge that the market hasn’t been kind to tech growth stocks for a while. What’s less well understood is how large the mayhem has been, outside of the tech megacap space.

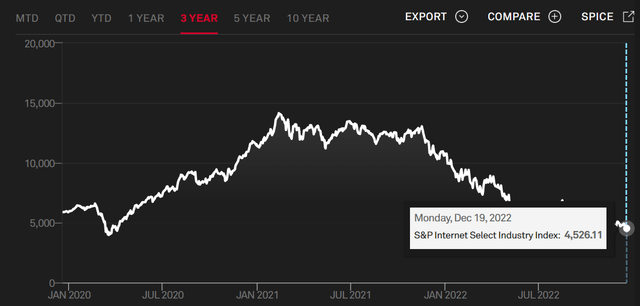

For instance, we could use the behavior of the S&P Internet Select Industry Index as a proxy for how smaller tech companies have performed. This index is down 68% since peaking in February 2021. The drop has been particularly aggressive since late November, 2021.

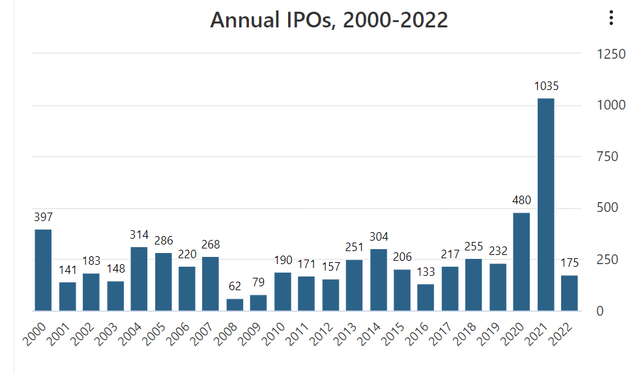

The market drops have been terrific, and the market has all but closed for these companies to finance themselves issuing equity or IPO’ing. Here’s how IPOs have done (by number of IPOs, to December 2022):

IPOs Drying Up – The Significance

Now, IPOs (and selling in the secondary market) are the main methods through which venture capitalists exit their startup investments. If IPOs collapse, then the ability to unload venture investments also collapses.

This is predictable. On Chart 5 of this Pitchbook.com article, you can confirm that exit activity has dried up in 2022. In Q2 2022 and Q2 2023 the exit activity was down by more than 90%.

Now, if venture capitalists can’t exit their investments, and if in general public market valuations on growth investments are collapsing, what happens next? Well, they fund fewer firms with less money.

This can also be verified. On the same Pitchbook article, on Chart 1, we can see the recent collapse in number of deals and deal value. This drop is very recent, only Q3 2022 was already ugly, down around 50% from last year. It’s quite likely that:

- The deal values (and number of deals) will keep declining.

- The declines will become steeper.

Now, the cash inflows from IPOs, secondaries and venture capitalists is drying up into firms which consume a lot of AWS services. Moreover, the firms themselves know this is happening, so they have to become more conservative and try to limit cash burn even before cash runs out.

This all spells what’s going to happen soon: AWS will see a significant drop in demand from startups and unprofitable or low profitability tech growth companies, whose financing has dried up.

Mix Effects Might Be A Problem As Well

Taking into consideration how AWS prices its services, it’s rather obvious that smaller customers are more profitable than larger ones. Very large customers will even negotiate prices aggressively., leading to tight margins Yet, it’s exactly the largest customers which are most likely to stay put or continue increasing their AWS consumption.

At the same time, startups and unprofitable or low-profitability tech companies will be smaller in scale (but larger in number). They are likely higher-margin for AWS. And it’s in this segment that we can expect AWS consumption to decline the most.

We might already be seeing some of this effect. While AWS revenue growth rates slowed down some (as said before, from 39-40% yoy to 33% yoy to 28% yoy), operating income growth declined much faster. From 40-56% yoy one year ago, to 28% yoy to just 1% yoy in Q3 2022.

Although Q3 2022 might have been something of an anomaly, it’s to be expected that this unfavorable mix effect will make itself felt further, alongside a rapid decline in revenue growth.

Conclusion

Amazon.com has seen many headwinds, and perhaps a level of overinvestment in its retail operations as well. However, the biggest threat the market needs to worry about right now is how AWS seems vulnerable to a large growth slowdown that’s likely to happen soon.

This slowdown will, in my opinion, be caused by the very poor stock market performance of a subset of its customers. These customers are seeing both stock market and venture capital financing drying up. In the immediate future this subset of customers is likely to reduce its AWS spending significantly as a result. This will be an immediate headwind for AWS’ revenue growth rates.

The impact on operating profit might also exceed the impact on the revenue growth rate, as these customers, being smaller, are likely higher-margin for AWS (that said, the Q3 2022 operating income growth rate already seemed very penalized, so the downside there might not be linear).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Idea Generator is my subscription service. It’s based on a unique philosophy (predicting the predictable) and seeks opportunities wherever they might be found, by taking into account both valuation (deeply undervalued situations) and a favorable thesis.

Idea Generator has beaten the S&P 500 by around 51% since inception (in May 2015). There is a no-risk, free, 14-day trial available for those wanting to check out the service.