Summary:

- Amazon.com, Inc. remains a valuation conundrum, even for themselves.

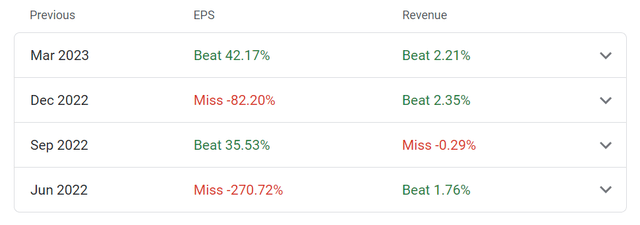

- 2023 Q1 earnings was the first time in a year that the company beat on both EPS and revenue.

- While cost-cutting moves are welcome, I suspect there is still more room.

HJBC

Amazon.com, Inc. (NASDAQ:AMZN) reported its much-awaited Q1 earnings report after-hours on Thursday, April 27th as Seeking Alpha covered here. The stock soared after-hours initially to $122 before crashing back to close the week at $105. That makes me believe there should be plenty of good and bad news in the report/conference call for a behemoth like this to have a 15% swing in stock price.

Let’s get into Amazon’s edition of Good, Bad, and Ugly after its latest earnings report.

Good

- Amazon beat on both EPS and Revenue for the first time in a year, as shown below. The big EPS beat came on the back of cost-cutting primarily (covered below) as revenue beat only by a small margin. One can say this was a manufactured EPS beat, but as an Amazon long, I will take it after some less-than-stellar reports in the previous few quarters.

AMZN Earnings History (Google Finance)

- Advertising: I may be reading too much into this, but the fact that CEO Andy Jassy talked about the strength of the advertising business before moving onto Amazon Web Services (“AWS”) may be more than just a coincidence or strategy. Advertising revenue of $9.5 Billion showed a 21% growth, and that is not the only good part. The margin is rumored to be between 40% and 50% in this segment and at that rate, advertising is not far from AWS’ bottom-line (covered below) despite much lesser CapEx as this segment primarily leverages Amazon’s existing infrastructure.

“Our Advertising business continues to deliver robust growth, largely due to our ongoing machine learning investments that help customers see relevant information when they engage with us, which in turn delivers unusually strong results for brands.“

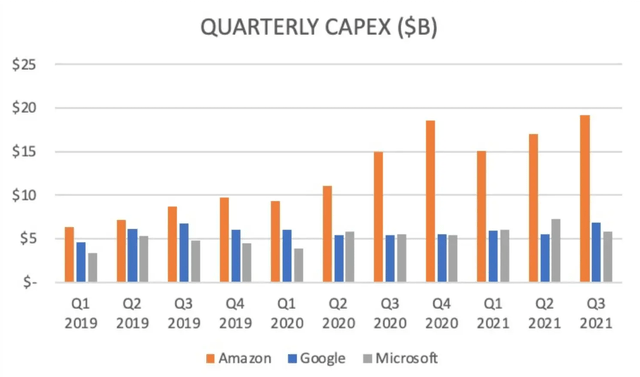

- Cost: Amazon continues eliminating redundant jobs in other business segments as well, after the well-publicized elimination in key business segments. The company is being an equal opportunity employer with cost-cutting across the board including but not limited to rescinding offers, eliminating positions, pausing HQ2, and cutting down on Restricted Stock Units (“RSU”) awards. After more than doubling headcount in two years and shooting CapEx through the roof till 2021, this is a welcome move and I’d bet Amazon has much more room to cut expenses when you see charts like the one below or that the company spent more in a week than Oracle Corporation (ORCL) spent in a year.

Bad

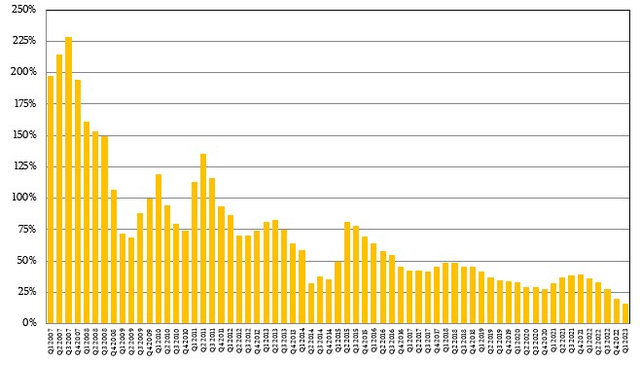

- AWS: The elephant in the room, is the slowdown of Amazon Web Services (“AWS”). Or the slowing growth rate of AWS to be precise. The optimistic way to look at this is that AWS revenue still grew at 16% to $21.40 Billion. The pessimistic way to look at this is to use the chart below, where the AWS growth rate has fallen from 225% to 16% over the last 15 years. Of course, this is an exaggeration in the sense, who even knew AWS in 2007? But the moderate way to look at this is to acknowledge that while the Total Addressable Market (“TAM”) may still be lucrative and AWS is likely to remain a cash cow, the law of large numbers has caught up with Amazon here.

- That Conference Call: Come on, Andy Jassy. How did you manage to tank the stock by about 15% the moment you started talking on the conference call? I wrote about the contrast in Intel Corporation (INTC)’s conference call and Amazon’s when it came to the tone of the management. The market loves clarity, even if the underlying message is bad. Once again, I am not saying management should mislead investors. Far from it. But words matter. I am paraphrasing here in the next couple of sentences. While Intel’s management said “PC weakness is hurting us but we maybe at the end of that cycle”, Amazon said, “AWS is slowing down, and we don’t know when it will stop and that reflects in our wide guidance range”.

Ugly

- Amazon Minus AWS: As dissected in this article, Amazon reported total sales of $127.36 Billion in Q1. With AWS reporting ~$21 Billion in revenue, the rest of the company brought in a revenue of $106 Billion. AWS’ operating income was $5.1 Billion for the quarter, while Amazon, in total, reported $4.8 Billion. It doesn’t take a rocket scientist to figure out that the rest of Amazon is still losing money after decades in business when you take out AWS and Advertising. Obviously, a company is the sum of all its parts, but the larger point is the over-reliance on two business units and they both have competition aplenty.

- Valuation: Despite the stock losing much of its gloss over the last year or two, Amazon’s valuation remains a mystery, if not outright overvalued. Even if 2024’s earnings estimates hold true, the stock is trading at a forward multiple of 42. How does one justify that multiple when the company’s cash cow is growing revenue at 16%? Read that again, revenue by 16% and not profit. It is not just analysts that struggle to value Amazon’s stock. Even the company struggles with this. For example, they guided for operating income between $2.0B to $5.5B vs. $4.7B consensus. With that wide range of either beating by 20% or missing by more than half, Amazon is saying “We don’t know, Mr. Market”.

Conclusion

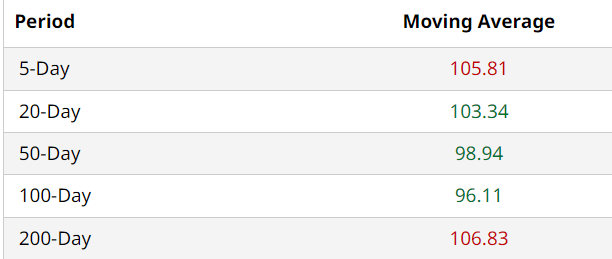

Despite the weakness in price action on Friday, Amazon’s stock is in decent shape technically, as the stock is above or extremely close to all the commonly used moving averages. The 200-Day moving average, for example, is only 2% away. It is safe to say that at $105, the stock’s short to medium-term downside looks limited unless the market in general weakens due to macro conditions, including but not limited to the Federal Reserve policies and inflation.

AMZN Moving Avgs (Barchart.com)

I still believe in the company’s ecosystem strength. I still rate the stock a buy, but only if you are in the game for long-term. Amazon’s revenue used to beat the pants out of inflation (despite profit concerns) but now even the revenue growth pales in comparison to inflation. I don’t believe the company and the stock are quite done adjusting for previous excesses, and that may present enticing opportunities for the long-term.

What do you think about Amazon’s Q1 and its future? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.