Summary:

- Google reported a strong start into 2023, beating analyst consensus estimates with regard to both revenue and earnings.

- The better-than-expected earnings numbers were driven mostly by cost rationalization, but also a solid top-line performance, especially for cloud.

- Google will likely continue to enjoy the tailwind of a strengthening search advertising business going into Q2 and beyond.

- I update my EPS expectations for Google through 2025, and I now calculate a fair implied target price of about $165/share.

Justin Sullivan

Going into Google’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Q1 2023 reporting, I argued that the tech giant will likely top analyst estimates with regards to both revenue and earnings, which may catalyze a rally. Now, after Google indeed beat analyst estimates, I am looking forward to the next argument of my thesis to unfold — a rally to above $150/ share.

Reflecting on Google’s strong earnings report, paired with an unwavering commitment to cost control and investment in AI, I revise my EPS projections for Google until 2025; and I now calculate a fair implied target price of $165.77/ share.

For reference, Google stock is outperforming the broader market YTD by a factor of x2. Since the start of 2023, GOOG shares are up close to 21%, versus a gain of less than 10% for the S&P 500 (SPY).

Google’s Q1 2023 Results

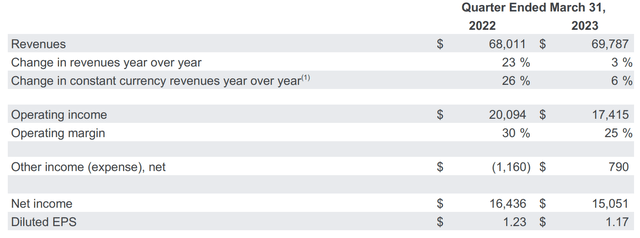

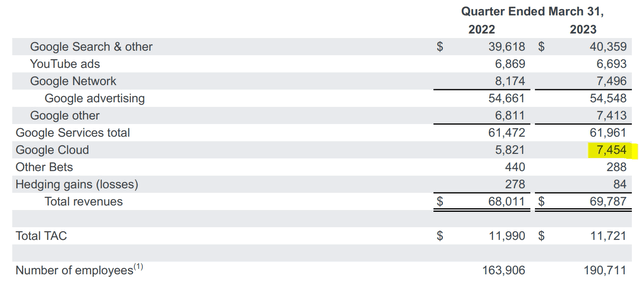

On Wednesday 25th after market close, Google reported results for Q1 2023, beating analyst consensus estimates with regards to both revenue and earnings. During the period from January to end of March, the conglomerate that owns the world’s most popular search engine recorded about $69.8 billion of revenues, up from $68 billion for the same period one year earlier (3% YoY growth, and significantly above the $68.8 billion estimated by consensus (~$1 billion top line beat).

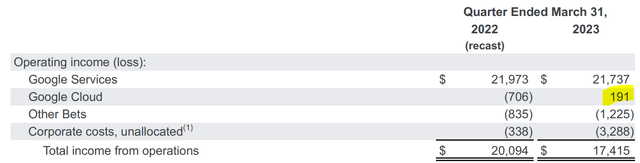

With regards to profitability, Google’s operating income came in at $17.4 billion, falling by close to 15% versus Q1 2022 on a 500 basis point margin contraction (25% operating margin in Q1 2023 vs. 30% in Q1 2022). Google’s post-tax net income came in at around $15.05 billion ($1.17/ share), falling about 5% YoY, but beating analysts’ estimates by close to ~1.3 billion.

Notably, Google’s Q1 beat was supported not only by a stronger than expected advertising business, which defended a top line and operating income in line with Q1 2022, but also by an excellent performance from Google cloud, where revenues expanded by about 30% YoY, to about $7.5 billion, and operating profits expanded to a gain of $191 million, versus a loss of $700 million for the same period one year prior.

I would also like to point out that Google’s profitability numbers for Q1 2023 reflect approximately $2.6 billion of ‘charges related to reductions in our workforce and office space’, implying that without the non-recurring expense accounting, Google’s profitability for the period would have been in line with Q1 2022.

Google Q1 2023 reporting Google Q1 2023 reporting

Reflecting on a solid Q1 2023 performance, Sundar Pichai, CEO of Alphabet and Google, commented:

We are pleased with our business performance in the first quarter, with Search performing well and momentum in Cloud. We introduced important product updates anchored in deep computer science and AI. Our North Star is providing the most helpful answers for our users, and we see huge opportunities ahead, continuing our long track record of innovation

And Google’s CFO Ruth Porat added that:

Resilience in Search and momentum in Cloud resulted in Q1 consolidated revenues of $69.8 billion, up 3% year over year, or up 6% in constant currency. We remain committed to delivering long-term growth and creating capacity to invest in our most compelling growth areas by re-engineering our cost base.

Additional Q1 Takeaway

During Google’s Q1 2023 conference call with analysts, much of the management discussion revolved around the Google’s opportunities and progress in AI–specifically how AI is, and could, being utilized to improve both internal productivity and new commercial products. With that frame of reference, management highlighted plans to more seamlessly integrate LLM experiences into core search, rather than having it serve as a complementary product alongside Bard. In my opinion, this decision implies Google’s focus on AI as a core component of multiple Google’s products and services.

Relating to OPEX discipline, Google’s management maintained their commitment to slowing the pace of hiring and restructuring the company’s cost base. The goal is to ensure that cost growth does not surpass revenue growth in the future. But in line with my pre-Q1 2023 thesis, I believe there is significant upside for Google to expand margins on the backdrop of addition work-force reductions, as the search giant is lagging the discipline shown by Meta Platforms (META).

A Note On Share Repurchases

In light of Google’s solid Q1 results, investors are likely not surprised that Google continues to buy back shares at an attractive pace: In the January quarter, Google repurchased $14.6 billion worth of equity, up from $13.3 billion in Q1 2022. This move clearly highlights Google management’s confidence in its own financial stability and growth prospects, and may serve to further bolster investor confidence in the company. Furthermore, with a substantial cash and securities reserve of $115.1 billion at the close of Q1 2023, Google is in an excellent position to continue repurchasing shares: On April 19 2023, for reference, Google authorized the repurchase of additional equity, up to $70.0 billion worth of its Class A and Class C shares.

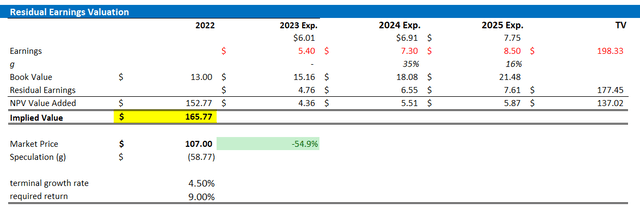

Valuation Update: Raise TP

Reflecting on Google’s solid Q1 2023 report, I update my EPS expectations for Google through 2025: While I now lower my estimates for 2023 to a range of $5.2 to $5.6, as compared to $6.01 prior, on the backdrop of discipline OPEX management at group level and margin expansion for Google cloud, I raise my EPS expectations for 2024 and 2025, to $7.3 and $7.75 respectively.

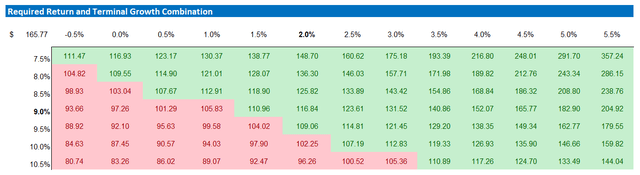

I continue to anchor on a 4.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth), as well as on a 9% cost of equity.

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for Google equal to $165.77/ share, estimating approximately 50% upside.

Company Financials; Author’s EPS Estimates; Author’s Calculation

Below also the updated sensitivity table

Company Financials; Author’s EPS Estimates; Author’s Calculation

Risks

Google investors should be aware of the following two sentiment-related risks: First, some of Google’s appeal is supported by the hype surrounding Artificial Intelligence. That said, AI technology/ commercialization might develop at a much slower pace than expected. Or in general, the AI potential (for Google) might turn out less impressive than expected. Second, much of Google’s current share price volatility is driven by investor sentiment towards risk and growth assets. Thus, investors should expect price volatility even though Google’s business outlook remains unchanged.

Conclusion

in line with my expectations, Google reported a solid Q1 2023, beating analyst estimates with regards to both revenue and earnings. Now, in line with my fundamental long-term thesis that Google operates one of the most sticky and profitable business model in the tech/ communication sector, I am excited about the likelihood of a share price appreciation, as I see multiple rally-supporting arguments. Specifically, I would like to point out the following: 1) monopoly on search and competitive moat supports long term value accumulation, 2) earnings upside on improving advertising business, OPEX discipline and Google cloud margin expansion, 3) the buyback bonanza continues supporting the share price, 4) Google’s work with AI may capture new business opportunities and revenue streams (think of it as a free implied call option embedded in the stock), and 5) Google is intrinsically undervalued.

Post Q1 2023 reporting, I update my EPS expectations for Google through 2025; and I now calculate a fair implied target price of $165.77/ share. I reiterate a ‘Buy’ rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice: this article is market commentary and a reflection of the author's opinion only

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.