Summary:

- Amazon beat earnings expectations for Q1 with earnings of $0.98 per share and $143.3B in revenue.

- Strong growth in e-Commerce and Amazon Web Services drove very good results. The guidance for Q2 is strong.

- Despite positive momentum in two of its core businesses, Amazon’s valuation is not exactly cheap.

- AWS has a catalyst as far as adoption of the company’s generative AI solutions is concerned.

Getty Images/Getty Images Entertainment

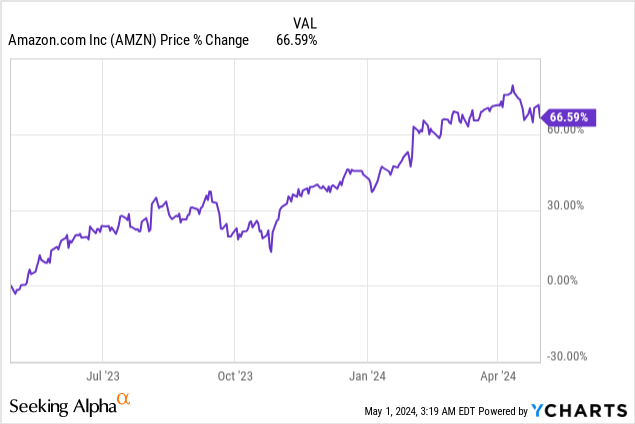

Amazon (NASDAQ:AMZN) delivered a bottom and top-line beat for its first-quarter, driven by strong e-Commerce and Amazon Web Services results, on Tuesday. Amazon continues to see solid momentum in both of its core businesses, in terms of both revenues and operating income, and submitted a robust-looking forecast for the second fiscal quarter as well. Although shares of Amazon have seen a significant revaluation last year, the momentum in e-Commerce is promising and I believe the risk profile remains widely favorable for growth investors!

Previous rating

I rated shares of Amazon a buy in February — A Major Narrative Shift — due to a powerful and sustainable rebound in the e-Commerce business especially. This momentum continued in the first fiscal quarter, and my outlook remains favorable for Amazon in a lower-inflation world. Given Amazon’s consolidated operating income momentum, I continue to see room for growth for the e-Commerce company in FY 2024.

Amazon beats earnings for the first-quarter

Amazon managed to beat consensus earnings expectations for the first-quarter by a considerable margin and the company easily sailed past top-line estimates as well. Amazon earned $0.98 per-share on revenues of $143.3B in Q1’24, meaning the e-Commerce company beat adjusted earnings estimates by 15 cents per-share while revenues came in $0.8B better than the consensus forecast.

Strong results in Amazon’s core businesses

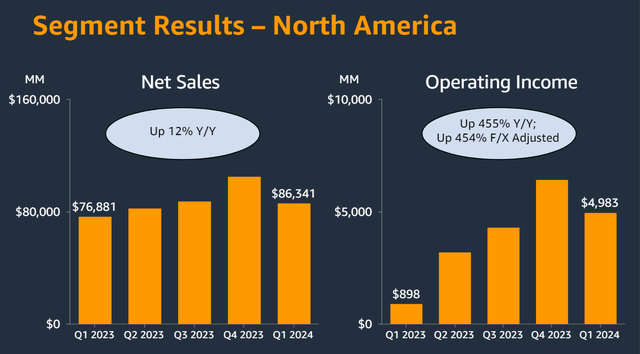

Amazon reported $143.3B in revenue for the first fiscal quarter, which implied a year-over-year growth rate of 13%. Amazon’s top-line growth was both driven by e-Commerce as well as Amazon Web Services. The first segment, e-Commerce, still accounts for the majority of Amazon’s revenues (83%), and continues to see spending-happy customers both in the U.S. and abroad. The North American e-Commerce segment especially is seeing strong revenue and operating income growth which is driven by high consumer spending, strong economic growth as well as overall moderating inflation.

The segment’s revenues increased 12% year over year to $86.3B in Q1’24 while its operating income grew to $5.0B in Q1’24, showing 455% year-over-year growth. The drop-off in revenues and operating income, relative to Q4’23, is explained by the fact that the Christmas shopping season is included in the firm’s fourth-quarter results, so typically e-Commerce companies tend to see a decline in revenues/operating income on a Q/Q basis at the beginning of the year. However, Amazon’s revenue growth trajectory in e-Commerce is very encouraging and with the U.S. economy providing strong tailwinds, I believe Amazon could reach new highs this year.

Amazon

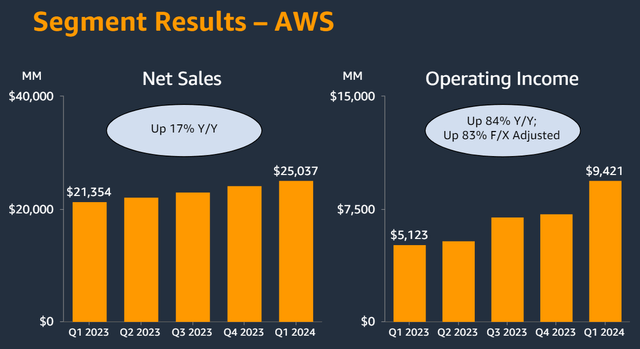

As far as Amazon’s Cloud business is concerned, the company has upside momentum here as well: Amazon Web Services, which is the number one public cloud infrastructure service platform by market share, generated $25.0B in revenues, showing 17% year-over-year growth… which was the fastest revenue growth rate of all segments in Q1’24.

Amazon

Amazon Web Services’ growth is driven chiefly by companies spending more money on the scaling of their IT services and moving workloads to the Cloud. Going forward, I expect Amazon Web Services to build on its current momentum, especially in generative AI.

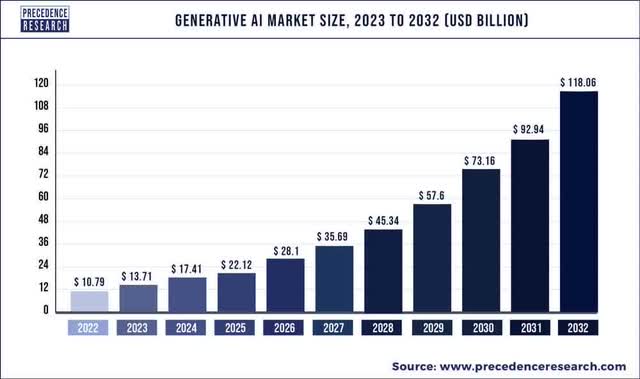

Generative artificial intelligence is the next growth frontier for Amazon, in my opinion, with the market size for generative AI solutions set to expand from just $13.7B in FY 2023 to $118.1B by FY 2032, representing an average annual growth rate of 27%. The opportunity for Amazon here is to expand its relationships with corporations that use AI applications in order to optimize their businesses and drive efficiency gains by leveraging Amazon Web Services’ Cloud strength. Firms like Siemens, Phillips and Accenture are now using AWS to scale AI technologies with Amazon Bedrock, a service that is focused on scaling generative AI applications.

Precedence Research

Amazon’s valuation

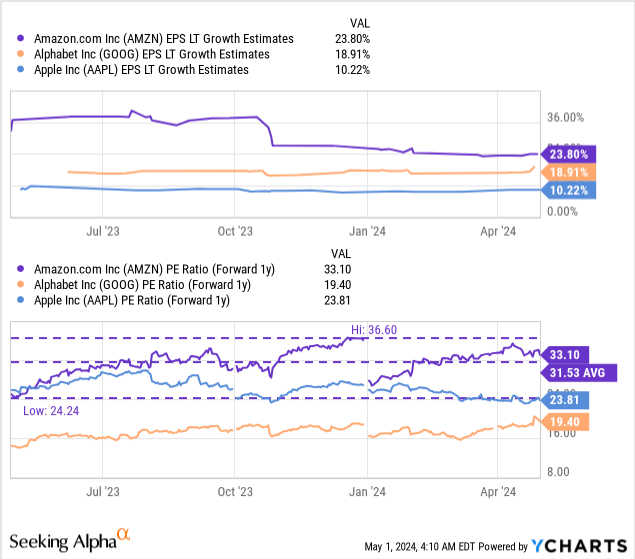

Amazon is currently valued at a price-to-earnings ratio of 33.1X, which is not necessarily cheap. However, Amazon is growing much more quickly than other large-cap tech-focused U.S. companies like Alphabet (GOOG) or Apple (AAPL). Amazon is expected to deliver long term EPS growth of 23.8% which is more than twice as high as Apple’s estimated growth, and the e-Commerce company is also well ahead of Google. Amazon is also trading slightly above its 3-year average P/E ratio of 31.5X, but I believe the company is uniquely positioned to benefit from consumer spending growth in a rising economy and falling inflation could also be a boost for the company. According to Amazon’s revenue projection, the company expects a top line of $144-149B in Q2’24, implying up to 11% Y/Y growth. With continual revenue momentum and strong operating income growth, I believe my fair value P/E ratio of 35X is still very much justified (as discussed in my last work) as is my previously determined fair value of $200.

Risks with Amazon

The biggest risk that I see for Amazon right now is a potential slowdown in the e-Commerce operation, which is a notoriously competitive, low-margin business. The segment saw declining profitability in FY 2023 due to headwinds to consumer spending in a high-inflation world, and some of those effects had been offset by the company’s Cloud operations. A recession, higher inflation and deteriorating job prospects in the U.S. are likely to weigh heavily on consumer spending and could represent a serious headwind for Amazon’s valuation going forward.

Final thoughts

Amazon delivered a strong earnings sheet for the first-quarter which included double-digit top-line growth, growing operating income profitability in the core North American e-Commerce segment and an encouraging trajectory in Amazon Web Services. The second-quarter outlook also shows that the e-Commerce company remains optimistic about its near term revenue growth potential. While shares of Amazon are not a bargain, the company is well-run, has strong economic support and generative AI trends in AWS could be a growth catalyst for Amazon going forward!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.