Summary:

- 3P revenue grew by almost +20%, ads +25%, subscription mid-teen, and 1P MSD+.

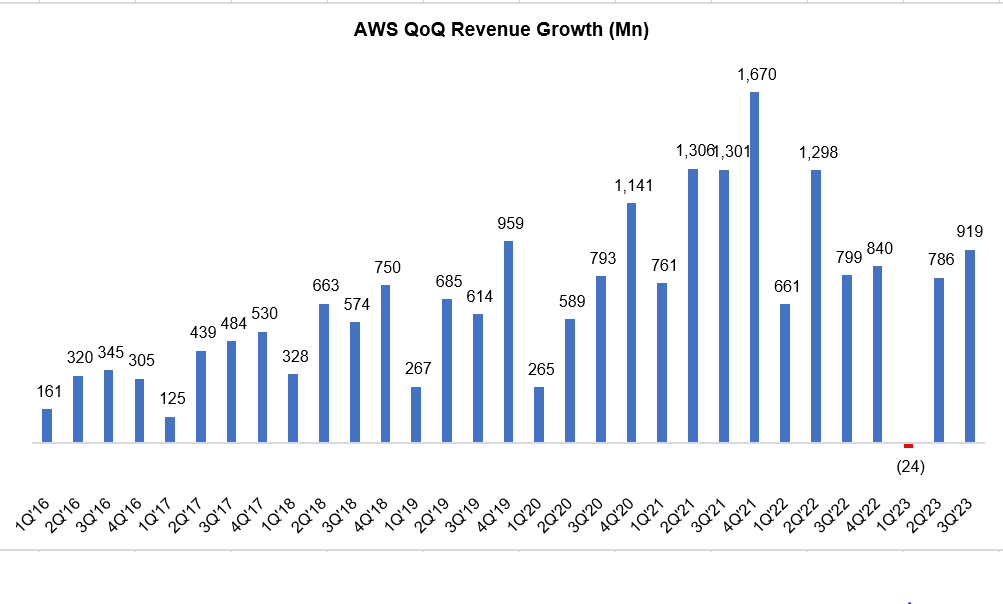

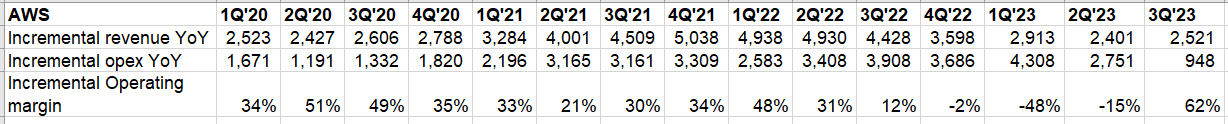

- While 12% AWS YoY growth doesn’t sound exciting, QoQ incremental revenue in 3Q’23 was the highest in the last five quarters.

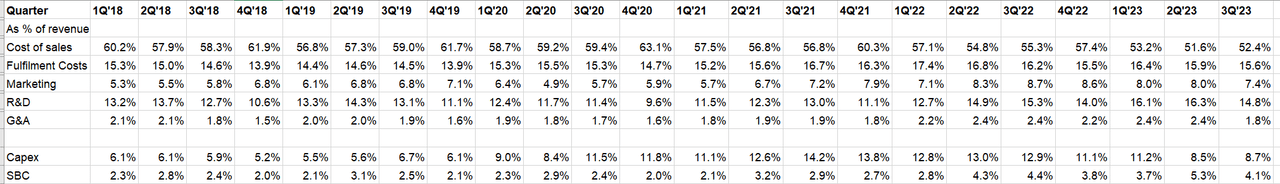

- Amazon’s cost structure is starting to show some sign of efficiency.

HJBC

Imagine opening Amazon’s (NASDAQ:AMZN) 3Q’23 earnings report 5 years from now and what do you think you might hope you paid more attention to? It’s very unlikely to be AWS topline growth rate this (or any) quarter. If I have to guess, it’s the shipping+ fulfillment costs related developments that you would find more consequential 5 years from now.

I’ll explain why but let’s first take a look at some numbers quickly before going back to that discussion.

Revenue

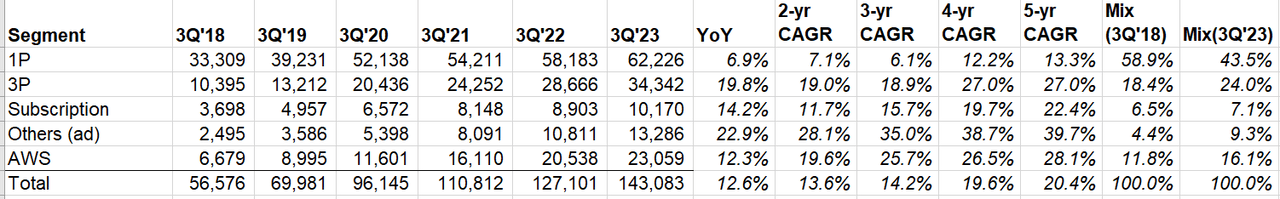

3P revenue grew by almost +20%, ads +25%, subscription mid-teen, and 1P MSD+.

AWS, which was the key focus for many, grew by ~12%. More on AWS later. Let’s start a more segment-level discussion with Amazon, ex-AWS.

Company Filings, MBI Deep Dives, Daloopa

Amazon ex-AWS

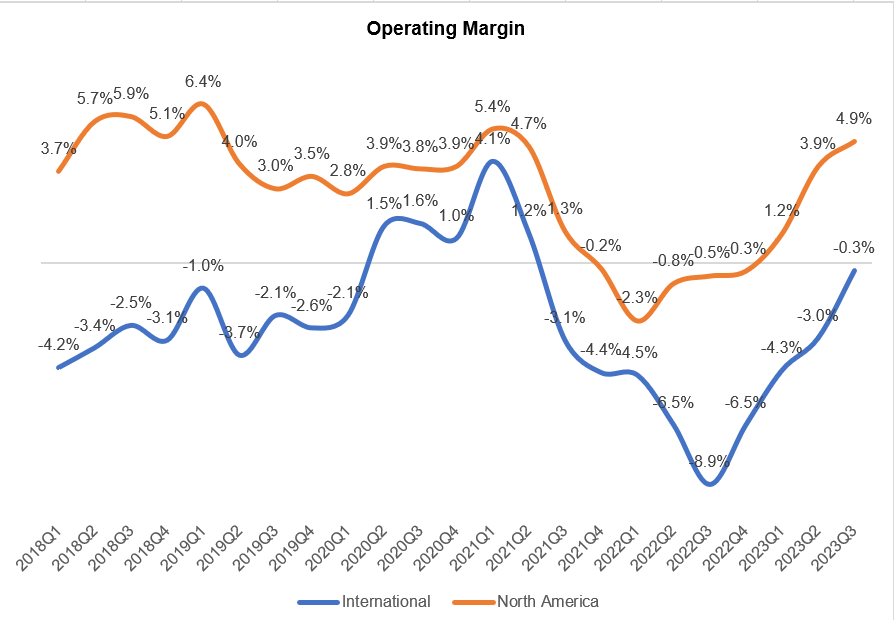

This chart is a good indication that the real story is not AWS topline growth, rather the pace of improvement or margin expansion in Amazon “Retail” (defined as everything ex-AWS). The crux of this story lies in shipping and fulfillment related costs.

Company Filings, MBI Deep Dives, Daloopa

Fulfillment+Shipping

Amazon re-architected their fulfillment network which is paying a lot of dividends:

Our move earlier this year from a single national fulfillment network in the U.S. to eight distinct regions represented one of the most significant changes to our fulfillment network in our history. This change has gone more smoothly and made more impact than we optimistically expected.

As delivery speed improved (as an Amazon retail customer living in upstate NY, I experienced the pace of improvement personally), it has unlocked new demand:

we know how important speed of delivery is to customer satisfaction and buying behavior. A good example is the significant growth we’re seeing in consumables and everyday essentials. When customers are getting items as quickly and conveniently as they are now from Amazon, they’re going to consider us more frequently for more of their shopping needs. As we’ve shared the last few quarters, we’ve reevaluated every part of our fulfillment network over the last year.

What’s more encouraging is Amazon sounds optimistic that they can keep improving here. The difference between Amazon’s integrated logistics experience vs. other alternatives will likely keep widening:

…don’t think we fully realize all the benefits yet and we continue to make steady improvements in fine-tuning the placement algorithms to enable even more in-region fulfillment and to further increase consolidation into fewer shipments…We have a long way before being out of ideas to improve cost and speed.

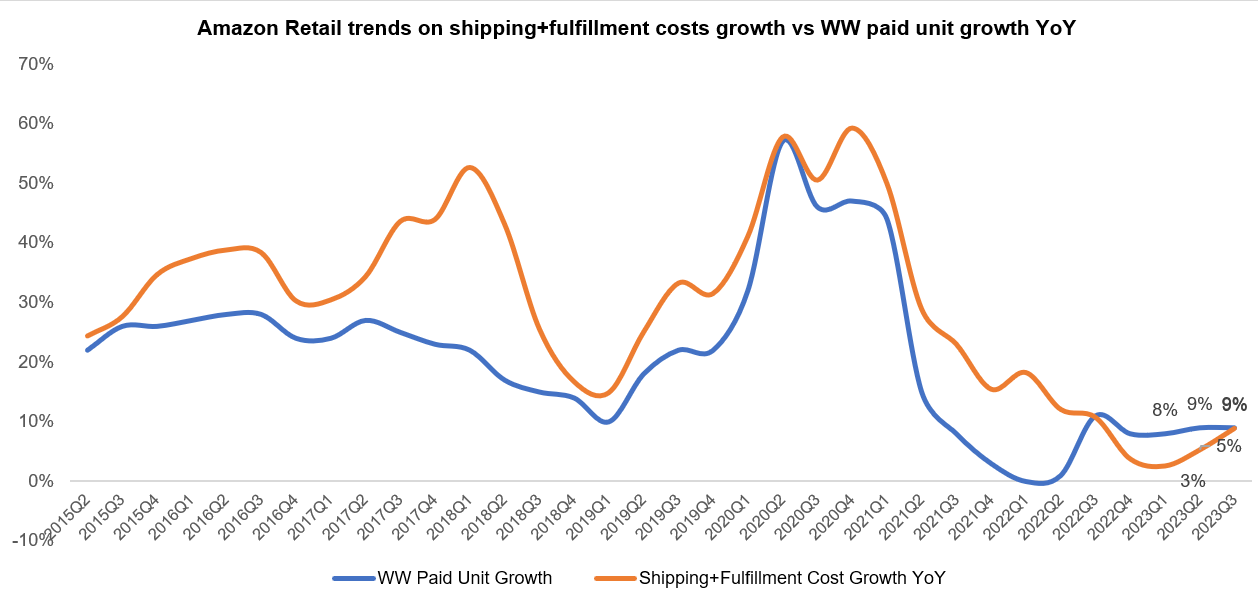

How does this manifest in numbers?

If you look at worldwide paid unit growth vs. shipping+fulfillment cost growth, you would notice that the latter has consistently outpaced the former pretty much all the time since 2015 until a year ago. Since then, unit growth is faster (was at par in 3Q’23) than shipping+fulfillment costs, indicating some leverage in their logistics footprint.

Company Filings, MBI Deep Dives, Daloopa

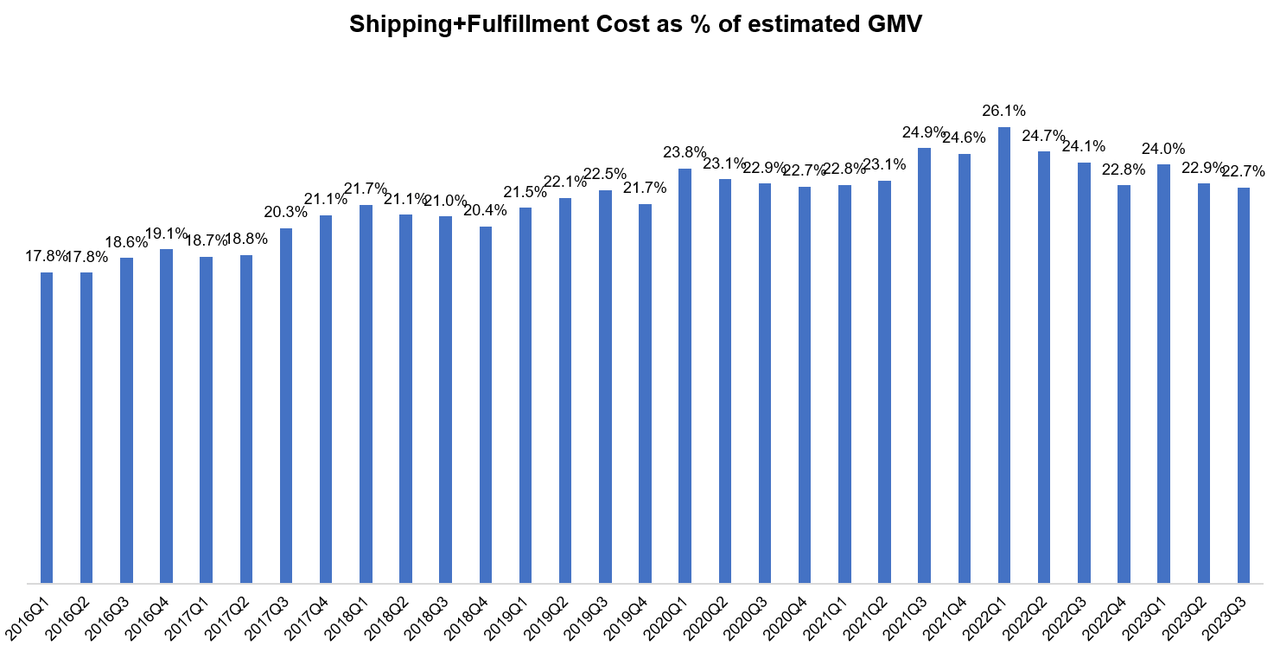

Why is this a much bigger deal? In 1Q’22, shipping+fulfillment costs as % of GMV peaked at 26.1%. Since then, this number has been coming down almost every quarter to reach 22.7% in 3Q’23.

If we give some credence to Amazon management’s claims that there is ample room for cost improvement here, naturally a question comes to mind about the extent of this potential improvement.

Back in 2016, this number used to be ~17-18%, so almost ~500-600 bps lower from current level. I estimate Amazon will have ~$800 Bn GMV this year (defined as online sales+ (3P sales/25%)). So every 100 bps improvement leads to ~$8 Bn profit to Amazon at 2023 estimated GMV level.

Now, I don’t quite expect this to happen anytime soon. Amazon didn’t have the 1-day shipping program in 2016, and their international presence was minimal back then compared to today, which has important implications here since those countries are at a different cost trajectory than more established markets (recently launched countries would have a much higher shipping+fulfillment expenses as % of GMV compared to Amazon US).

On the other hand, Amazon’s further investments in robotics may be an added tailwind to cost curves that didn’t exist back then:

We have a very substantial investment of additional robotics initiatives. I would say many of which are coming to fruition in 2024 and 2025 that we think will make a further additional impact on the cost and productivity and safety and our fulfillment service

If you look forward to 5-10 years when much of Amazon’s retail will be near maturity, this number can very likely go back to the high-teen level.

There’s an enormous operational leverage embedded in building these logistics and fulfillment network and as GMV increases over time, every 100 bps improvement will have a quite consequential lift to the bottom line.

Frankly speaking, I pay much closer attention to this than AWS topline growth on a quarterly basis.

Company Filings, MBI Deep Dives, Daloopa

AWS

Okay, now let’s talk about AWS.

While 12% YoY growth doesn’t sound exciting, QoQ incremental revenue in 3Q’23 was the highest in the last five quarters.

Company Filings, MBI Deep Dives, Daloopa

Azure vs. Google Cloud vs. AWS

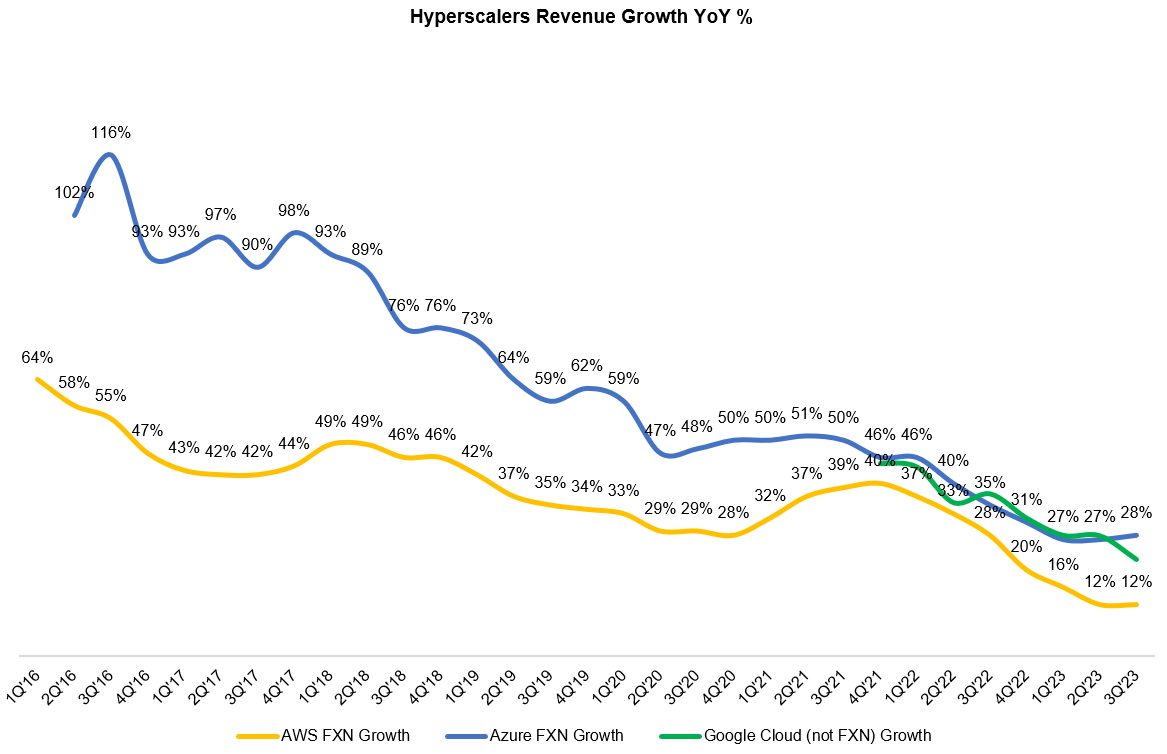

Of course, 12% sort of pales in comparison with Azure (MSFT) or Google Cloud’s (GOOG) (GOOGL) growth number, Amazon believes they continue to enjoy the highest absolute growth over their competitors (hard to validate since others don’t disclose exact numbers).

Company Filings, MBI Deep Dives, Daloopa

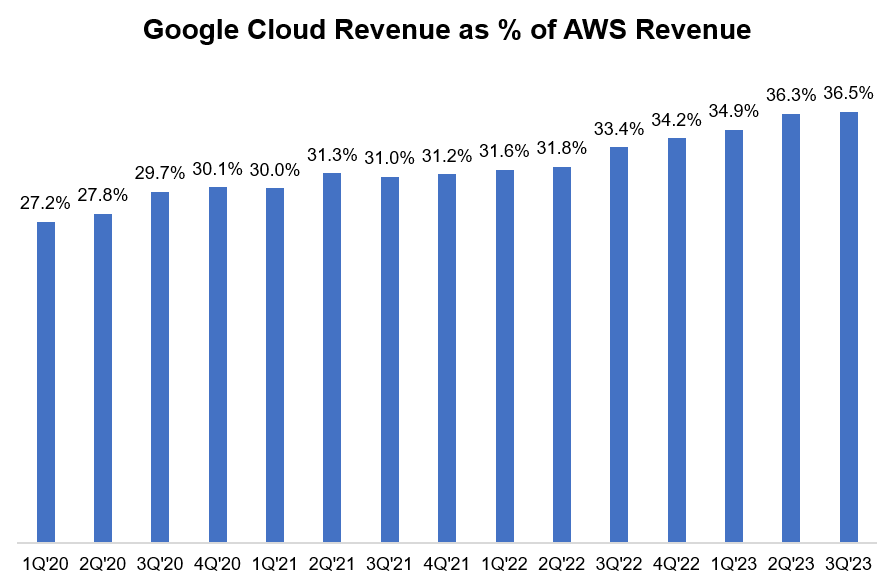

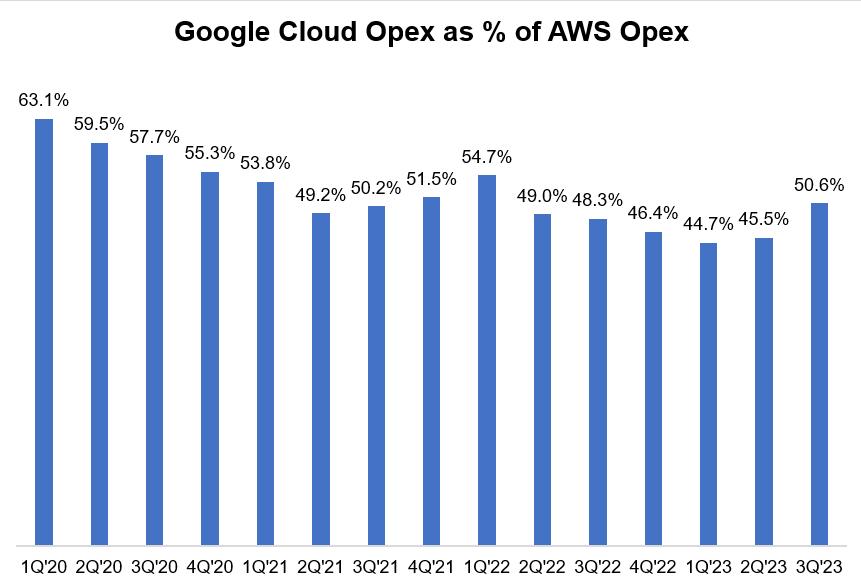

One thing I would like to track is Google Cloud’s operating performance trajectory against AWS. While Google Cloud’s revenue somehow managed to maintain its gradual momentum against AWS, opex trajectory really went haywire for Google Cloud.

While that’s disappointing for Google, it’s important to remember it’s just a quarter. So we may need a couple of quarters to assess whether this trend is rather sticky.

Company Filings, MBI Deep Dives, Daloopa Company Filings, MBI Deep Dives, Daloopa

Back to AWS.

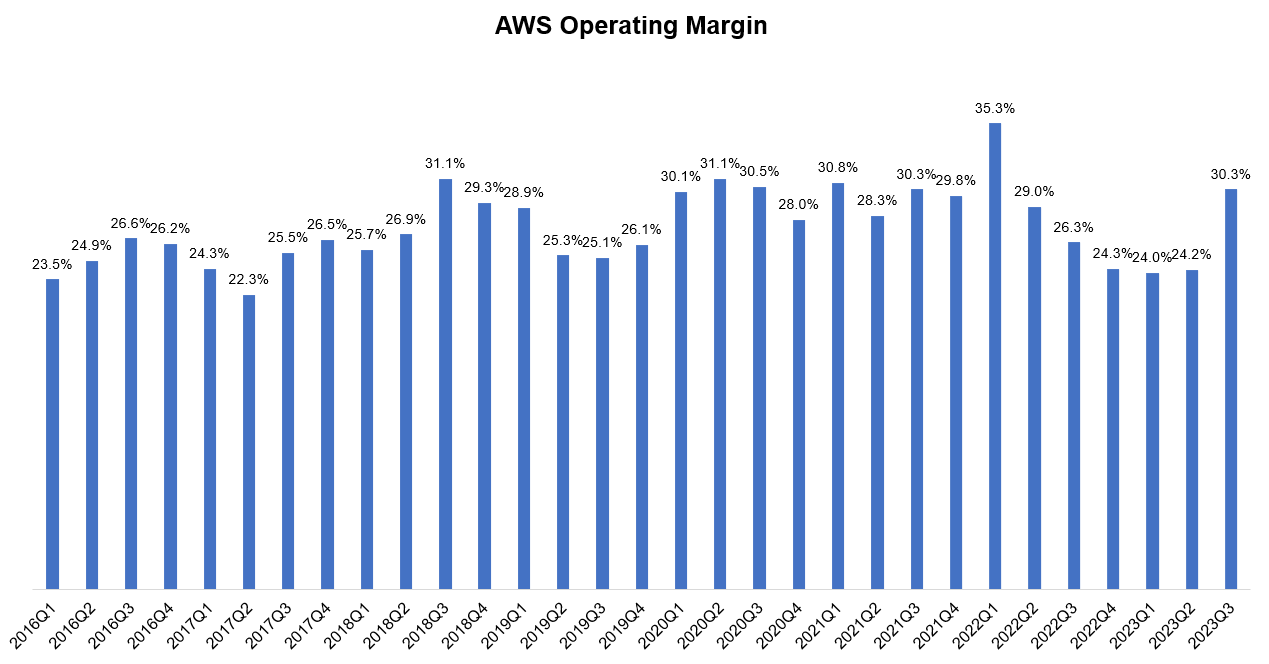

AWS incremental operating margin finally turned around. Operating margin returned to ~30%.

Company Filings, MBI Deep Dives, Daloopa Company Filings, MBI Deep Dives, Daloopa

While management reiterated margins can fluctuate a bit, the reason cited for margin expansion this quarter was “increased leverage on headcount costs”.

Management mentioned optimization is starting to “attenuate”. They used the word “attenuate” 6 times during the call. They also highlighted that some optimization is actually good for both customers and Amazon:

AWS’ year-over-year growth rate continued to stabilize in Q3. And while we still saw elevated cost optimization relative to a year ago, it’s continued to attenuate as more companies transition to deploying net new workloads.

…while optimization still remain a headwind, we’ve seen the rate of new cost optimization slowdown in AWS, and we are encouraged by the strength of our customer pipeline…When we look at the fundamentals of the business, we believe we are in good position to drive future growth as the rates of cost optimization slow down.

You also see a lot of customers who are moving from the hourly on demand rates for significant portions of their workloads to 1- to 3-year commitments, which we call savings plans. So those are just good examples of some of the cost optimization that customers are making in less certain economies where it’s really good for customers short and long term, and I think it’s also good for us.

Amazon seemed to be really eager to assuage the concerns on AWS being a potential laggard on Gen AI:

we’re seeing the pace and volume of closed deals pick up, and we’re encouraged by the strong last couple of months of new deals signed. For perspective, we signed several new deals in September with an effective date in October that won’t show up in any GAAP reported number for Q3, but the collection of which is higher than our total reported deal volume for all of Q3.

…In these early days of generative AI, companies are still learning which models they want to use, which models they use for what purposes and which model sizes they should use to get the latency and cost characteristics they desire. In our opinion, the only certainty is that there will continue to be a high rate of change.

…Our generative AI business is growing very, very quickly, as I mentioned earlier. And almost by any measure, it’s a pretty significant business for us already.

Opex+Capex

Amazon’s cost structure is starting to show some sign of efficiency.

Company Filings, MBI Deep Dives, Daloopa

Other Bets

Amazon hasn’t given up on Alexa yet:

We continue to be convicted that the vision of being the world’s best personal assistant is a compelling and viable one and that Alexa has a good chance to be one of the long-term winners in this arena.

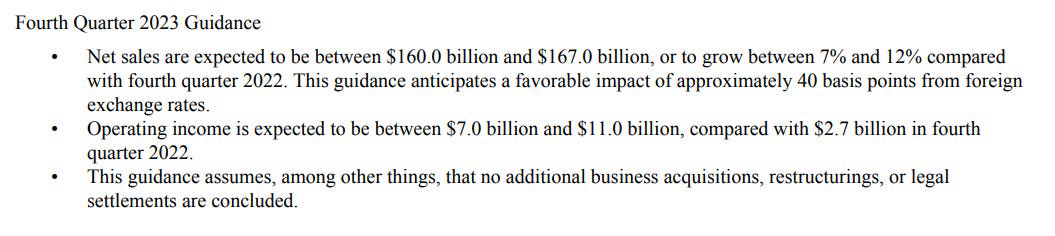

Outlook

Amazon’s guidance for 4Q’23 is below:

Company filings

Disclosure: I own Jan 2025 $55 call options of Amazon

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.