Summary:

- Amazon had a year to forget in 2022, with shares tumbling 40% as the company struggled against inflation and a faltering economy.

- Amazon’s crown jewel, AWS, continued to shine, but growth now appears to be decelerating sharply.

- The company just released its Q4 results and beat analysts’ estimates on both revenue and operating income.

- Unfortunately, weaker-than-expected guidance coupled with a drastic slowdown in AWS resulted in shares falling 5% when the market opened.

- Was this a thesis-busting report from Amazon? Or just a bump in the road to long-term investing success?

Joaquin Corbalan/iStock Editorial via Getty Images

Investment Thesis

Before diving into Amazon’s (NASDAQ:AMZN) Q4 results, I’ll quickly outline my AWS-centric thesis behind my investment: AWS is a fast-growing, highly profitable business with powerful moats. This should propel Amazon to new heights, and I think AWS would be a great standalone business in its own right. The additional bonus with Amazon is everything else; this is a company with innovation running through its veins, and there’s no telling which of their next avenues could create the next AWS for the business. Amazon also has plenty of potential to expand on its retail margins, which will provide an additional boost to the bottom line in the future.

With that said, let’s take a look into exactly what sent Amazon shares down more than 5% following the company’s latest earnings report.

Amazon’s Q4 Earnings Overview

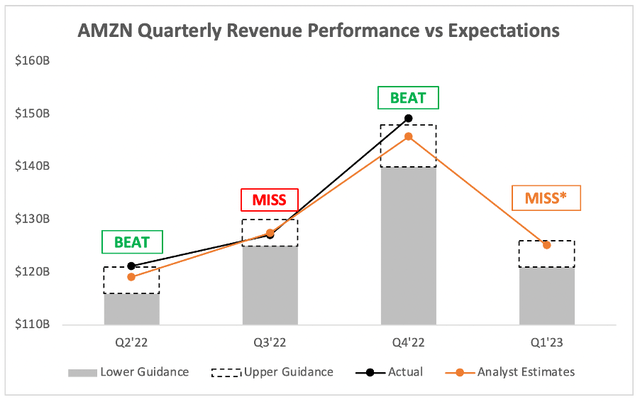

Starting from the top, Amazon’s Q4 revenue grew 9% YoY to $149.2B, coming in quite comfortably ahead of analysts’ estimates of $145.8B.

Unfortunately, analysts weren’t too happy with management’s forward guidance. Amazon expects to see Q1’23 revenue between $121-$126B, with the midpoint of $123.5B being below analysts’ estimates of $125.1B. Perhaps more disappointing was the fact that Q1 revenue of $121-$126B implies a YoY growth rate between 3.9% and 8.2%, which is nothing to celebrate.

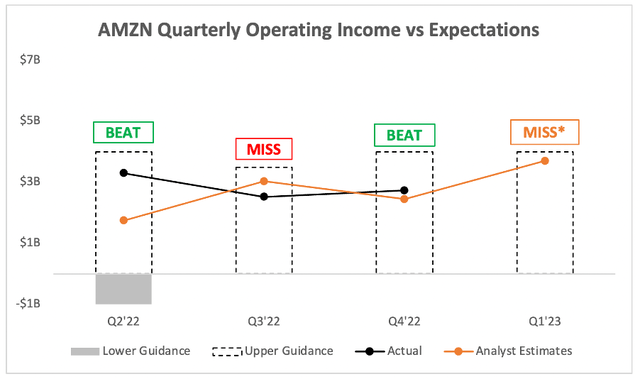

Moving further down the income statement, and Amazon delivered another beat on its operating income. The company reported EBIT of $2.74B, representing an EBIT margin of 1.8% and a 21% fall compared to Q4 of 2021; however, this did come in ahead of analysts’ $2.45B consensus estimates, which is a positive for shareholders.

Once again, the guidance let investors down with its operating income. Wall Street was looking for Q1’23 EBIT of ~$3.70B, but the midpoint of management’s $0.0-$4.0B guidance falls far short of these expectations.

To summarise, these headline numbers were actually not that bad, especially during an earnings season where expectations are fairly low. Amazon’s beat on revenue and EBIT were two positives, and although the midpoint of management’s guidance fell below analysts’ expectations, these expectations were included within the guidance range – so clearly Q1 isn’t going to be much worse than expected.

Yet there was one big issue with Amazon’s Q4 earnings, as it’s crown jewel began to lose its shine.

AWS Is Facing A Sharp Slowdown

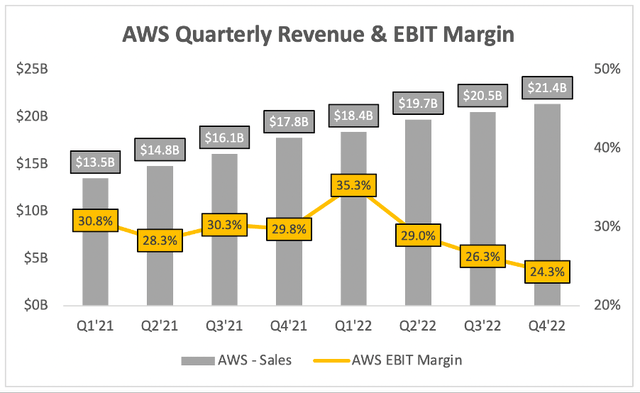

AWS has always impressed me thanks to its extraordinary growth rates, dominant market position, and incredibly strong operating margins. Unfortunately, a number of these enticing qualities are looking less and less attractive as each quarter passes.

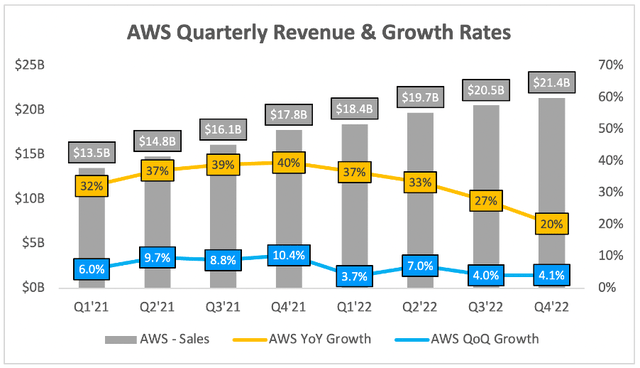

Starting with the revenue growth rate, and although AWS took in a more-than-healthy $21.4B in Q4, this represented only 20% YoY growth. That may sound impressive in this difficult macroeconomic environment, but just look at that slowdown from the 40% growth AWS saw in Q4’21.

Clearly the trend is not heading in Amazon’s favour, but one reason to be slightly more optimistic is the fact that AWS grew 4.1% QoQ, compared to 4.0% in Q3.

CFO Brian Olsavsky gave some more detail about AWS on the Q4 earnings call, but there was one line in particular that may have shaken Amazon’s stock price:

Some of the key benefits of being in the cloud compared to managing your own data center are the ability to handle large demand swings and to optimize costs relatively quickly, especially during times of economic uncertainty…

As we look ahead, we expect these optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters. So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens. That said, stepping back, our new customer pipeline remains healthy and robust, and there are many customers continuing to put plans in place to migrate to the cloud and commit to AWS over the long term.

AWS’s YoY revenue growth in the mid-teens for January 2023 would be an enormous slowdown, and a continuation of this rapid deceleration that’s already been experienced by AWS over the past few quarters. It’s not a complete surprise, as enterprises rein in their spending during these uncertain macroeconomic times, but it’s certainly not what shareholders want to see.

Perhaps management is being overly cautious, since this report implies that cloud growth in 2023 should remain robust:

Infrastructure as a service is forecast to experience the highest end-user spending growth in 2023 at 29.8% while cloud application infrastructure services and software as a service will also see continued growth. Gartner predicted growth rates of 23.2% 16.8% for PaaS and SaaS respectively in 2023.

So maybe investors will be in for a bit more joy in the back half of 2023 when it comes to AWS, but for now there is going to be some macroeconomic-induced pain for this cloud leader.

The other issue within AWS this quarter was its operating margin, which fell to 24.3%; a big drop off from its recent peak of 35.3% in the first quarter of 2022.

Whilst management doesn’t give too much information on the exact reason for this decline, a quick look through Amazon’s 10-K implies that these margins have been falling due to: increased payroll and related expenses; spending on infrastructure to support growth; foreign exchange headwinds; and slowing revenue growth.

In my view, this is not a long-term concern yet. I believe that AWS can reach and surpass its previous levels over time, especially when it comes to EBIT margins, but even this strong business is not immune from recessionary fears.

Investors should prepare for more pain in the quarters that follow, but that does not necessarily mean they should be running scared – shares have fallen quite substantially, and if you believe this to be a temporary, macro-driven slowdown, and that AWS will turn back around, well… it could be time to add Amazon to your watchlist.

Quick Take: Amazon’s Financial Trends

Given that it’s the end of 2022, it’s a good time to take a look at exactly what’s happening with the figures for Amazon. I won’t talk too much about them, so feel free to read through the below numbers and draw your own conclusions.

My main concern with these figures is the drop in Amazon’s net cash combined with the company’s cash burn driven by excessive spending on infrastructure across both its Retail and AWS segments. Going forward, I would expect this capex spend to be fairly flat YoY, as the company pivots away from the insanely high demand of the 2020/21 economy towards the much more muted demand of the 2022/23 economy.

It’s clear that management is already starting to right-size the ship, with capital expenditure only growing 4% YoY from 2021 to 2022; in fact, capex only grew 1% YoY in Q4’22.

I’m happy as long as Amazon’s financial picture remains reasonable during this difficult period. Cutting back on all investments would be a wasted opportunity, as this company is still a financial powerhouse that should be capitalising on this weaker economy by acquiring new facilities (and more) at cheaper prices, but investments should be responsible, and only done whilst maintaining a healthy balance sheet.

AMZN Stock Valuation

As with all high growth, innovative companies, valuation is tough. I believe that my approach will give me an idea about whether Amazon is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

Given the uncertain macroeconomic outlook, I have decided to be more cautious in my base case scenario than I was previously, and have stuck fairly close to analysts’ forward estimates because, let’s face it, they have far more resources than I do when forecasting financials for a company as huge as Amazon.

In my bull case scenario, I am assuming that Amazon returns to strong growth rates fairly rapidly as macroeconomic uncertainty lifts and the company starts firing on both its AWS and non-AWS cylinders. This return to growth and profitability in the Retail division should provide a big boost to operating margins, which is reflected in my model.

My bear case scenario essentially assumes the opposite. That is, Amazon will continue to struggle for growth as macroeconomic difficulties take hold, and the Retail business in particular will continue being a drag on margins.

Put all that together, and I can see Amazon shares achieving a CAGR through to 2027 of 5%, 21%, and 41% in my respective bear, base, and bull case scenarios.

Bottom Line

In my results preview article, I came to the following conclusion:

I’m certainly not expecting a great earnings report from Amazon this week, as I think the company will continue feeling some macroeconomic pain. But we are now in a market where businesses are not being punished for falling short of expectations; in fact, as long as companies’ earnings aren’t too bad, shares have been rising.

However, I don’t really care what the shares do after this earnings report; I believe that right now is a fantastic opportunity to add some shares of a high-quality business with multiple tailwinds and powerful economic moats at a rather attractive price.

Whilst I stick by this sentiment, the sharpness of the AWS slowdown, particularly into Q1’23, has taken me slightly aback. I still think the current share price provides a really enticing risk/reward, however I’m now less certain about just how deep the impact of this economic slowdown will be on Amazon.

For that reason, I am downgrading my rating on Amazon from ‘Strong Buy’ to ‘Buy’.

Disclosure: I/we have a beneficial long position in the shares of AMZN, ETSY, SHOP, DOCN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.