Lucid: The Upmarket Bet Is Increasingly Crowded

Summary:

- LCID’s bet on the upmarket segment may not work in its favor, especially with many legacy automakers similarly releasing premium EV line-ups.

- Its lack of profitability may pose headwinds to its valuations as well, since the management may continue relying on stock sales or debt leveraging in the intermediate term.

- With LCID about to launch its SUV Gravity by 2023 and start production by 2024, it is unsurprising that Mr. Market remains bearish due to the potential increase in capital expenditure.

- Alternatively, the PIF may actually be planning to acquire LCID, as it intended to do with TSLA in 2018.

- It would allow LCID to access the immense assets worth $607.42B, possibly bankrolling the company’s expansion over the next decade.

Michael Blann/DigitalVision via Getty Images

The Premium Thesis Is Compelling

Lucid Group, Inc (NASDAQ:LCID) has been heavily battered, after it only delivered 4.36K vehicles in 2022, compared to the original guidance of up to 14K in the FQ4’21 earnings call on February 2022. The company’s offering, Lucid Air, had also been long compared against Mercedes Benz’s (OTCPK:MBGAF, OTCPK:MBGYY) S-Class, attributed to LCID’s ambition of being a luxury mobility company.

However, we are uncertain how the story will play out moving forward, since the upmarket segment had comprised a smaller percentage of the total automotive demand thus far. For example, within the US, MBGAF only delivered 15.92K units of the Mercedes-Benz S-Class in 2022, 14.28K in 2021, and 12.52K in 2019. Globally, the company reported over 90K units in 2022, 87.06K units in 2021, and 71.7K in 2019.

It is apparent that the S-Class target market was rather exclusive, with an entry-level MSRP of $111K to the upper range of up to $200K. Therefore, it was unsurprising that these numbers comprised only 4.4% of its 2.05M global deliveries in 2022, 4.15% in 2021, and 3.06% in 2019.

On the other hand, Tesla’s (TSLA) Model S and X, priced from $91.87K onwards, had recorded improved demand with 66.7K units delivered in 2022. However, we must also highlight that these only comprised 5.1% of its global deliveries for the latest fiscal year, against 2021 numbers of 24.96K and 2.66%, and 2019 at 66.6K and 18.16% (Q1’19 at 12.1K, Q2’19 at 17.65K, Q3’19 at 17.4K, and Q4’19 at 19.45K), respectively.

These numbers tell us that demand for premium vehicles remained particularly reserved for those with deeper pockets. The pessimistic market sentiment was especially worsened by LCID’s decision to launch only upmarket models, Lucid Air is priced from $87.4K onwards and Lucid Air Grand Touring from $138K onwards.

On the other hand, while LCID may still be unprofitable and lacking in production scale now, there may be chances for a reversal moving forward, especially once the capacity upgrades are completed in Arizona. Notably, Cox Automotive chief economist, Jonathan Smoke, had mentioned that new vehicle supply had gradually eased over the past few months, suggesting a potential normalization of global supply chain issues. These may allow the company to better fulfill most of its 37K preorders indeed.

Furthermore, it is important to highlight that consumer demand for MBGAF’s premium vehicles grew tremendously at 14% YoY in FY2022. This was attributed to the excellent upmarket branding and sustained spending power of the wealthy, despite the peak recessionary fears in 2023.

MBGAF had already announced its plans to move away from entry-level luxury and focus on Top-End Luxury, with the latter to comprise 60% of its total sales by 2026. The management also expects this strategy to expand its operating margins from the current 12.2% to approximately 14% by 2025.

This suggests the greater profitability of higher-end cars with a greater focus on high performance and consumer satisfaction, without needing to chase delivery volume as TSLA has been doing lately. Therefore, LCID investors and fans may have nothing to fear about TSLA’s drastic price cuts, in attempting to qualify for the $7.5K tax rebate from the Inflation Reduction Act, since Lucid Air does not cater to this market.

However, since LCID has only been around for a relatively short time in the automotive industry, there may be headwinds to its forward execution, despite the glowing reviews thus far. The competition appears to be intense, with many legacy automakers similarly launching premium EV sedan line-ups.

These include MBGAF releasing a premium EQS model from $105.45K onwards, BMW’s i7 (OTCPK:BAMXF) from $119.3K onwards, Audi’s (OTCPK:VWAGY) 2023 e-tron GT family from $104.9K onwards, and 2023 Porsche Taycan (OTCPK:DRPRY) from $86.7K onwards, amongst others.

Despite the increasingly crowded upmarket segment, LCID contrarily guided for 500K in annual productions from the AMP-1 plant in Arizona by 2025 and another 155K from the AMP-2 in Saudi Arabia by 2025. These coincided with the sequential growth of its capital expenditure by 224.8% to $906.87M over the LTM, with up to $1.2B guided for FY2022.

The increase may be partly attributed to LCID’s Project Gravity as well, a luxurious SUV model likely priced higher than its sedan cousin, with market watchers projecting a range between $90K and $250K. Consequently, we project that the management may need to increase capital investments ahead of the 2024 launch, in order to expand the manufacturing line.

The Public Investment Fund of Saudi Arabia [PIF] had consistently pledged support for LCID, with up to $3.4B of incentives for AMP-2 over the next fifteen years. This was on top of the multiple capital raises, which already increased PIF’s stake to 64%.

There had been rumors buzzing around as well, with market analysts speculating about an acquisition by the PIF, which triggered an impressive 30.5% rally for the auto stock over the past few days. Although neither side had confirmed the deal, we believe LCID may benefit from having access to PIF’s assets worth $607.42B indeed. Especially considering the PIF had repeatedly indicated an interest in helping Elon Musk take TSLA private back in 2018.

However, assuming that the takeover deal does not occur, it remains to be seen how the LCID management may choose to fund its operations moving forward, with a Free Cash Flow [FCF] generation of -$2.79B (+89.7% YoY) over the LTM.

With market analysts not expecting LCID to report any EPS profitability through FY2026, the management may rely on a combination of capital raises and debt leveraging. However, investors need not fret, since TSLA only reported GAAP net income profitability by 2018, since the first release of its Roadster in 2008.

Lastly, many legacy automakers also reported elevated long-term debts, with MBGAF recording automotive debts of $10.1B in the latest quarter, TSLA $543M, Ford (F) $19.07B, and General Motors (GM) $20.84B, against LCID’s $1.99B at the same time. These teething issues have been common enough in the automotive industry.

So, Is LCID Stock A Buy, Sell, Or Hold?

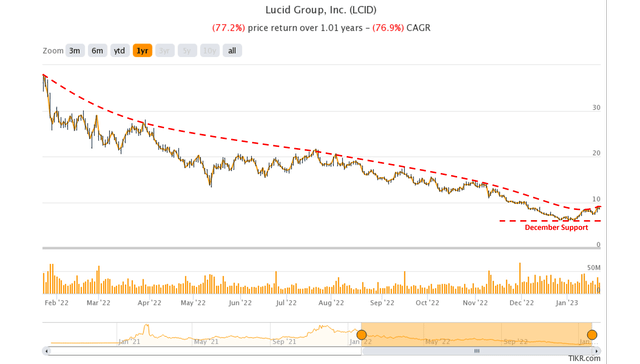

LCID 1Y Trading Level

Due to LCID’s lack of meaningful profitability, it is naturally hard to place a price target on the stock. For now, consensus estimates remain optimistic about its forward execution, with the price target of $15.50 suggesting a tremendous 75.74% upside potential from current levels.

Nonetheless, we must highlight the notable -84% plunge from the peak stock price of $55.21 in November 2021, especially worsened by an elevated 25.86% of short interest at the time of writing. This may imply more intermediate-term volatility indeed, since it is uncertain if the December support level will hold over the next few months.

LCID reported $3.34B of cash/ investments in the last quarter, significantly bolstered by the $1.51B in capital raise through stock sales completed by December 2022. However, investors may have been diluted by 8.5% QoQ to 1.81B of shares outstanding by FQ4’22, otherwise by 49.5% since its IPO in July 2021.

We must also point out the elevated Stock-Based Compensation [SBC] expenses of $502.8M over the last twelve months, exceeding the $376.87M of revenues at the same time.

Combined with our uncertainty about its prospects in the increasingly crowded upmarket segment, we prefer to rate the LCID stock as a Hold for now. The stock may remain volatile for the foreseeable future indeed, further compounded by the worsening macroeconomic outlook through 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.