Summary:

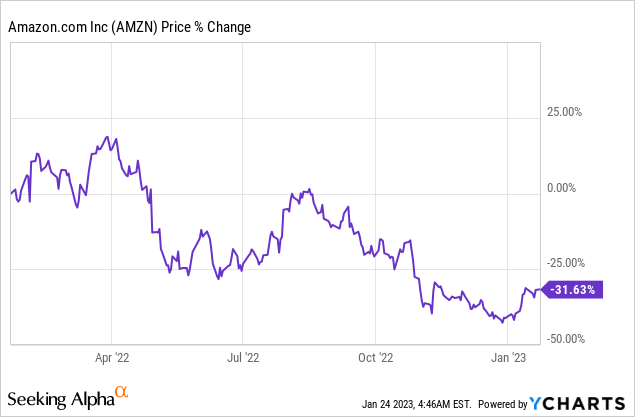

- Amazon’s shares have been stuck in a downward trend for about a year.

- Slowing business growth and a weak outlook for Q1’23 are key risks for Amazon.

- Amazon’s valuation remains too high given the reality of moderating topline growth.

HJBC

Amazon (NASDAQ:AMZN) is going to report earnings for its fourth quarter on February 2, 2023 and I believe results are more likely to surprise to the downside than the upside. Estimates have continued to fall in the last couple of weeks, which reflects analysts’ growing concerns about Amazon’s topline growth in a deteriorating macro environment, a concern that I share. While Amazon Web Services can be expected to put up solid growth numbers for Q4’22, Amazon’s consolidated topline growth is likely to show a continual deceleration. The recent upwards momentum in Amazon’s shares is therefore likely a bull trap, and investors should carefully manage the downside!

Amazon Web Services likely to be a bright spot again, but topline growth set for further moderation in FY 2023

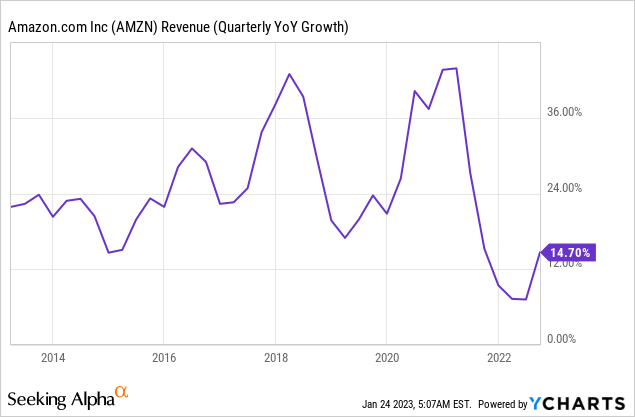

Amazon guided for 2-8% topline growth for the fourth quarter and given the persistent challenge of high inflation – which likely further weakened consumer spending throughout the fourth quarter – I believe Amazon will report topline growth in the low- to middle-single-digit range of this guidance on February 2, 2023.

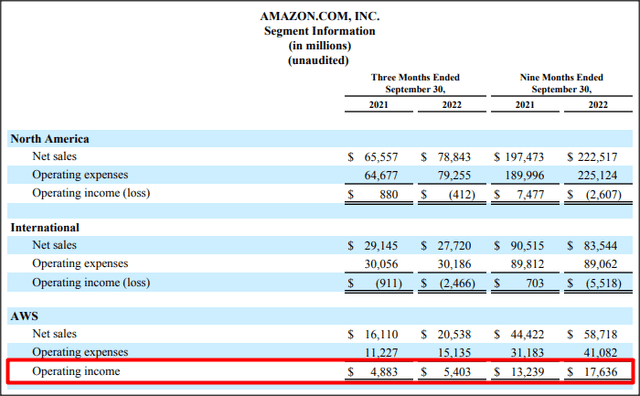

Despite moderating topline growth, however, Amazon Web Services is likely to remain a bright spot for the struggling e-Commerce company. I expect Amazon Web Services to report Q4’22 revenue growth of 26-30% due to growing product adoption by large corporate accounts, which would put AWS revenues into a range of $22.4B to $23.1B. Besides robust topline growth, I also expect AWS to report solid operating income for the fourth quarter. Since the segment was the only business that generated positive operating income in the third quarter, AWS will likely once again contribute all of Amazon’s operating profits in Q4’22. Amazon’s operating income projection for Q4’22 ranges from $0 to $4.0B.

Amazon was unable to report positive operating income in both the North American and the international e-Commerce segment in the first three quarters of FY 2022 as revenue growth slowed after the COVID-19 pandemic. Unless Amazon gets a grip on its e-Commerce performance in FY 2023 – which would likely require steep cost cuts and further lay-offs that go beyond the 18,000 headcount reductions already announced – e-Commerce operations are likely to continue to produce operating losses this year.

The combined operating loss from Amazon’s e-Commerce operations in the first nine months of FY 2022 was $8.1B of which 68% came from the international e-Commerce segment. Amazon’s total operating income in the first nine months of FY 2022 was $9.5B… all of which was contributed by Amazon Web Services, which posted total operating income of $17.6B.

Revenue challenges are real, and they are the top reason for the downside revaluation of Amazon’s shares, despite the presence of the fast-growing AWS business.

Revenue estimate trend remains negative

In the last couple of weeks, revenue estimates for Amazon have continued to trend down, a sign that analysts are getting increasingly bearish about Amazon’s topline potential in a slowing economy plagued by high interest rates and inflation. In the last 90 days, Amazon’s FY 2022 EPS has seen 30 downward revisions compared to just 7 EPS upward revisions. I believe Amazon will under-perform EPS expectations for the fourth quarter due to headwinds to e-Commerce growth (inflation, slowing economic growth), a strong USD, and the persistence of inflation which is weighing on consumer spending.

Moment of truth: Amazon’s growth outlook for Q1’23

The most interesting part of Amazon’s upcoming earnings sheet will be the revenue outlook for Q1’23. The e-Commerce company reported revenue growth of 15% to $127.1B in Q3’22, but the guidance for Q4’22 was widely seen as a major disappointment: Amazon has guided for $140.0B to $148.0B in Q4’22 revenues, implying as little as 2% year-over-year growth.

I don’t believe Amazon has seen, or will see, a fundamental improvement in its e-Commerce operations as long as consumers remains financially under pressure from higher consumer prices. For this reason, I expect that the moderation of topline growth, despite a positive AWS impact, will continue in FY 2023. For Q1’23, I estimate that Amazon will see low-single-digit growth in its revenues and 6-7% growth for the full fiscal year.

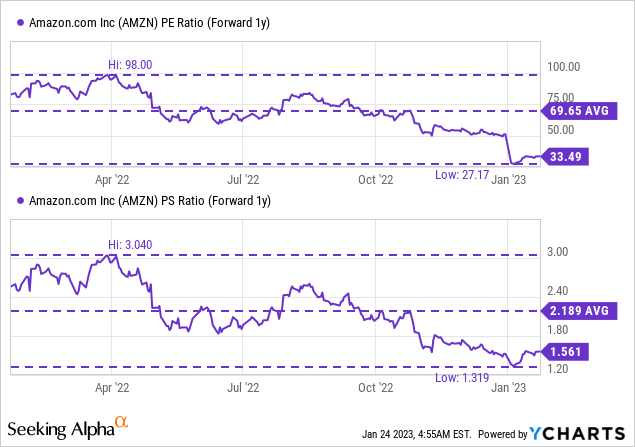

Amazon’s valuation

After Amazon’s shares have lost about a third of their value in the last year, one would expect the valuation to be much more compelling, but it isn’t. Shares of Amazon are still trading at a forward P/E ratio in excess of 33 X which is a very high earnings multiplier factor for an e-Commerce company that is looking at the very real possibility of reporting single-digit revenue growth in FY 2023.

Risks with Amazon

The revenue growth outlook Q1’23 is what could make or break Amazon’s stock in the short term and push shares back into a new down-leg. The company is also dealing with profitability issues in its e-Commerce business to which Amazon has not yet found a solution besides headcount reductions. A successive slowdown in e-Commerce operations in FY 2023 is likely to weigh on Amazon’s valuation factor, considering that Amazon still achieves 84% of its revenues from e-Commerce.

Final thoughts

Amazon is nearing a moment of truth: the e-Commerce firm is going to release its Q1’23 revenue outlook on February 2, 2023 and a successive slowdown, potentially paired with low-single-digit revenue growth in Q4’22, would likely be seen as a major issue for the stock. Since Amazon is valued as a growth stock with a high P/E of 33 X, I believe a deteriorating growth outlook will force Amazon’s shares into a new down-leg post Q4’22 earnings!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.