Summary:

- Amazon.com, Inc.’s e-commerce is maturing, and expectations of exponential growth are unreasonable for a segment of this size.

- Generative AI is unlikely to change AWS’ growth trajectory in 2024. We also don’t see a transformative impact of Generative AI in the e-commerce segment.

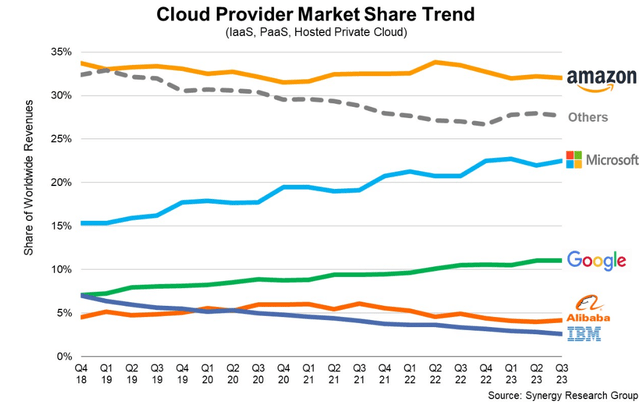

- The main driver of Amazon’s share price is likely to be its diminishing strategic position in the public cloud market.

Daria Nipot

Investment Thesis

Going into 2024, we believe that Amazon.com, Inc. (NASDAQ:AMZN) will grapple with the realities of a maturing e-commerce market and intensified competition in cloud computing, particularly from Microsoft (MSFT) Azure, which is better positioned to capitalize on AI trends. Our analysis suggests that in 2024 and beyond, AMZN’s market cap premium over its peers will likely narrow.

Growth: Flawed Narrative

The widespread enthusiasm for AMZN’s net income growth is somewhat misguided. In the nine months ended September 2023, the net income stood at approximately $20 billion, a significant leap from the $2 billion reported in the same period a year earlier. This surge has prompted accolades from various quarters, including Quant ratings bestowing “A” for growth and positive nods from analysts. However, this perspective overlooks critical context. The modest net income in 2022, and by extension the rebound in 2023, was largely due to extraordinary factors. In 2022, AMZN aggressively expanded its capacity in response to the shortages experienced in 2021, leading to increased fixed and variable costs.

In 2023, management fixed the overcapacity issue by reorganizing its fulfillment and delivery operations, and profitability reverted back up. It is important to recognize that the year-over-year growth rate observed is not a reliable indicator of future performance. The period we’re looking at is exceptional, and investors should remain cautious in their interpretations.

Why Does it Feel Like a Mature Market?

Investors often discuss AMZN as a growth opportunity, citing factors such as market consolidation, increased market share and expansion into international markets. Similar enthusiasm surrounds its Public Cloud segment, AWS, which benefits from the ongoing cloud migration trends.

In 2023, the company boosted its sales by $52 billion on a trailing twelve-months “TTM” basis, an amount comparable to the GDP of Alaska. However, this increase represents a growth rate of just 11%. Thus, while the company’s revenue growth is evident, it’s crucial to weigh the impact of the “Laws of Big Numbers,” especially when assessing valuation. This principle suggests that as companies reach a certain size, their potential for exponential growth diminishes, which is a critical factor for investors to bear in mind during valuation assessments.

This 11% sales increase also loses some of its luster when adjusted for 6.5% inflation and %2.6 GDP growth during the same period. This is evident even when segmenting AMZN’s revenue. For example, in the nine months ended September of 2023, North American e-commerce sales increased a mere 11%, while International and AWS sales increased 9% and 13%, respectively. We just can’t see AMZN delivering extraordinary growth above the market, at least in 2024. It just feels like a mature market, and while AWS might have been impacted by Cloud price discounts, at the end of the day, investors, regardless of the reason, haven’t received what they bargained for when they bought AMZN shares at a 50x P/E ratio.

Who is Claude? Azure Catching Up Fast

Azure has been steadily closing the gap with AWS in the cloud computing space, and Microsoft’s partnership with OpenAI is only accelerating this trend.

In recent years, cloud-native services emerged as a critical battleground between Azure and AWS as MSFT slowly expanded its geographical footprint, improved its server microchips, and adjusted its prices.

Azure’s collaboration with OpenAI has significantly impacted the cloud services landscape, compelling both AMZN and Alphabet (GOOG, GOOGL) to accelerate their efforts in Generative AI. AMZN’s recent partnership with Anthropic, introducing Claude to AWS, is a direct response to this challenge. At the same time, Google is also investing in Claude alongside its internal development of Bard to safeguard against potential shortcomings in its AI offerings.

This strategic maneuvering in the industry underscores a shift in competitive dynamics, with Azure repositioning itself from playing catch-up to the forefront of innovation in cloud services. This move is reshaping the market’s perception of Azure, particularly compared to AWS. For years, AWS has maintained a first-mover advantage in cloud services, but this edge appears to be diminishing.

E-commerce: Law of Big Numbers

A key question is whether AI can be a game changer for e-commerce growth. Currently, e-commerce giants are exploring Generative AI applications, but looking at the narrative of potential uses, we see Generative AI as having an incremental impact on e-commerce in 2024.

AMZN is testing AI for virtual cloth fitting, and alongside Alibaba (BABA, OTCPK:BABAF), they’re experimenting with AI to help sellers write product descriptions. Another area is using AI for international e-commerce, facilitating real-time translation. PDD Holdings Inc. (PDD), formerly Pinduoduo, alluded to integrating its AI chatbots for customer service.

We believe that these ideas are great, but we don’t see a transformative impact of AI on e-commerce in the short run. In 2024, AI’s role appears to be gradual instead of a transformative catalyst. We believe that the primary driver for AMZN’s share price is likely to be its diminishing strategic position in the Public Cloud market.

Little Money in Cloud Generative AI

Generative AI pioneers decided to democratize the technology, allowing the public as broad access as possible. This is mirrored in an accessible pricing strategy, with Azure charging between $0.0015 to $0.06 per 1000 tokens (~750 words), depending on the ChatGPT version used.

The U.S. book industry is a good case study to put these figures into perspective. In 2023, the U.S. produced 4.9 million new books, from children’s picture books to fiction novels. Even if all books in the U.S. were created by ChatGPT Azure service, and assuming 45,000 words per book, MSFT’s sales would increase between $0.5 million and $17.6 million, barely moving the needle for Azure consolidated sales.

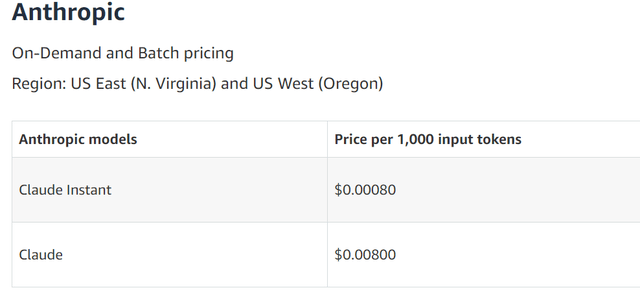

Claude, as a less popular service, is even priced at a steeper discount to Azure’s ChatGPT, between $0.0008 – $0.0024 per 1000 tokens.

Thus, investors should be mindful that AWS’ Generative AI services are unlikely to be growth drivers in 2024, potentially disappointing AMZN’s growth-oriented shareholder base.

Summary

Amazon’s e-commerce segment’s profitability recovered from the 2022 lows. The rebound is mainly due to the correction of 2022’s overexpansion in response to 2021’s shortages, which led to increased fixed costs. While the recovery is positive, investors should consider the influence of these exceptional circumstances on Quant ratings. Looking ahead, we see normalization in profitability growth for the segment.

The introduction of Generative AI in e-commerce, while innovative, is unlikely to significantly impact AMZN’s short-term growth trajectory for either its e-commerce or public cloud. Considering these factors, we believe that growth will increasingly mirror mature market dynamics, warranting a recalibration of AMZN’s market cap premium over its peers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.