Summary:

- AMZN remains a buy despite near all-time-high prices, driven by AWS growth and innovative AI technologies like Bedrock and Trainium.

- I also expect these technologies to help the company better control its capex costs and thus further enhance its profit margins.

- These positives can justify its expanded P/E.

- Finally, accounting P/E ratios tend to exaggerate the valuation of firms whose capex is more geared toward growth.

Jonathan Kitchen

AMZN stock: Previous thesis and new developments

My last work on Amazon (NASDAQ:AMZN) was published by Seeking Alpha on Oct. 17, 2024. That article was titled “Amazon: Cheaper Than You Think” and rated the stock as a strong buy based on these following factors:

I used to be concerned about AMZN stock’s retail segments. The recent Prime Day success and margin expansion have dispelled this concern. Its valuation ratio is much lower than what’s on the surface when based on owner’s earnings. Accounting earnings underestimate Amazon’s true owners’ earnings by ~20% due to its recent growth capex investments (mostly AI related).

Since then, a few key parameters have changed around and motivated a reexamination on the stock. First and foremost, the stock price has rallied substantially (more than 20%) since my last writing and pushed up its accounting P/E (to about 44x as of this writing). Admittedly, such a material P/E expansion has weakened my strong buy thesis. But the price rally was offset by a few other factors, and it’s my goal to explain in the remainder of this article that the stock remains a buy despite near record high prices. Besides the discrepancies between accounting P/E and ownership P/E (the focus of my last article), I will detail the two factors in my assessment that can justify its current P/E and the buy rating. These factors include the latest development with its AWS (the Bedrock platform in particular) and also its internally developed AI chip, Trainium.

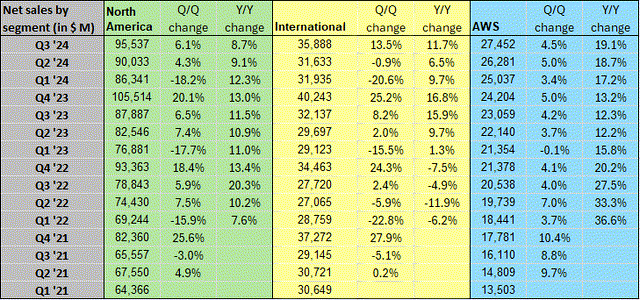

AWS has been demonstrating accelerated growth. In the latest Q3’24, AWS generated $27,452 million in net sales, representing a significant 19.1% year-over-year growth as you can see from the following table. This growth rate is greater than the already-stellar rate of 18.7% in Q2, which was in turn higher than the 17.2% growth rate in Q1. Next, I will explain why this upward trajectory is very likely to continue for years to come given the Bedrock and Trainium catalysts.

Seeking Alpha

AMZN stock: Bedrock and Trainium in focus

Let me start with a quick introduction of the jargon here for readers new to it. Amazon Bedrock and Trainium are both innovative technologies – in my view at least – that are specifically targeting the expansion of AI applications on the AWS platform.

The Bedrock solution provides tools and large language models for developers to build and deploy on AWS’ cloud infrastructure. It provides access to a diverse range of models, including text, image, and code generation, enabling a large number of developers to create their own AI solutions without relying on experts. Trainium is a custom-built processor designed specifically for machine learning. Trainium is now being used to power AWS’ many AI-related services, such as Amazon SageMaker and Amazon Lex.

The Trainium chips are admittedly not as powerful as Nvidia’s (NVDA) GPUs, but they are much less expensive. They provide such an attractive performance/cost ratio that some other prominent technology companies, such as the private Databricks, are also using Trainium to help customers build their own models. Furthermore, having these in-house AI chips also gives AMZN better control of its infrastructure expansion and costs (more on this in a minute).

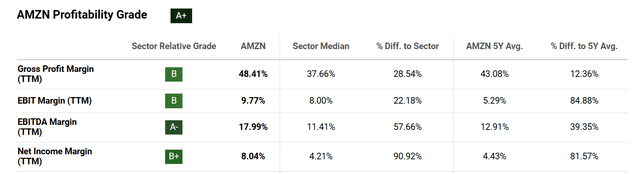

I thus expect the combination of Bedrock and Trainium to not only fuel AWS’ further growth but also to lower the costs and expand AMZN’s profit margins. AMZN already boasts strong overall profitability as reflected in its overall grade of A+ below. The company’s gross profit margin sits around 48%, which is significantly above the sector median of 37% and also its own historical average of 43%. Moving down the income statement, its EBIT margin, EBITDA margin, and also net income margin are all vastly above sector medians and also its own five-year averages as seen. As the company keeps improving its operational efficiency and cost control (such as via Bedrock and Trainium), I expect further enhancements in its profitability.

Seeking Alpha

Other risks and final thoughts

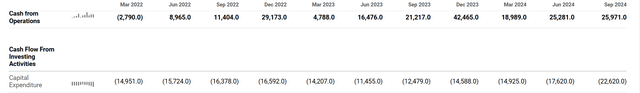

In terms of downside risks, the infrastructure expansion projects just mentioned above are on the top of the list. Major tech firms are currently in an arm’s race to build their AI capabilities and AMZN is not immune as you can tell from its recent cash flow statement, as shown below. On the positive side, its cash from operations has been robust and reached almost $26 billion in the most recent quarter, a significant increase compared to the same period in 2023 (about $21 billion). However, the bad news is that Amazon’s capital expenditures have been increasing even faster, primarily due to the needs of AI-related infrastructure (with other technology and content creation as additional causes). In the latest quarter, capital expenditures reached $22.6 billion, almost doubling the expenditures in the same period in 2023 (about $12 billion). Again, going forward, I expect the capex increase to stabilize or even start decreasing as Bedrock begins to enjoy the scale of economy and also the in-house Trainium chips.

Seeking Alpha

I mentioned the valuation risks earlier on which was a factor that prompted my rating downgrade (from my earlier strong buy to the current buy). No matter how much l love the business model and the profit catalysts, the lofty P/E ratios are off-putting. As seen from the table below, AMZN’s FY1 P/E stands at 44.34 currently. This is not only lofty by absolute standards, but also quite high even by the FAANG standard. As seen, AMZN’s current FY1 P/E significantly exceeding the P/E ratios of Meta (META) at 27.58, Apple (AAPL) at 32.85, and Alphabet (GOOG) (GOOGL) at 22.10. Among this group, Netflix (NFLX)’s 47.13 P/E is the only one higher than AMZN.

However, as stated at the beginning of this article, I see several factors that can justify its current P/E. AWS’ strategic position in the burgeoning cloud/AI space is a leading factor. I expect AWS’ high growth to sustain or even further accelerate, thanks to the combination of Bedrock and in-house AI chips. In the meantime, I also expect these catalysts to help the company better control its costs, leading to better margins. Finally, as detailed in my last article, the accounting P/E tends to exaggerate the valuation multiples for companies (like AMZN) whose capex is primarily toward growth capex.

Seeking Alpha

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.