Summary:

- Amazon’s stock price has gained ~18% since I last checked, not the last of it due to better-than-expected earnings.

- Despite labour disruptions on Black Friday, Amazon’s net sales growth remained strong and its efforts to address these challenges are steps in the right direction.

- Its financial forecasts look good too, which translate into improved market multiples compared to its own past averages.

tigerstrawberry

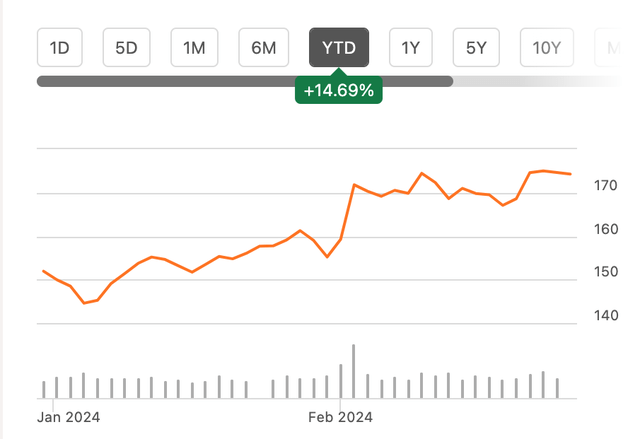

Following its final quarter (Q4 2023) and full year 2023 results on February 1, e-commerce biggie Amazon (NASDAQ:AMZN) saw a stock price rise of ~8%. This is the second biggest single-day rise in one year and brought the stock’s rise to ~18% since I last wrote about it in November last year. But the stock is hardly done its upward journey. Here are four reasons why Amazon is still a buy for 2024.

Price Chart (Source: Seeking Alpha)

#1. Ahead despite labour disruptions on Black Friday

The last time I wrote, the company was witnessing industrial action across 30 countries as workers demanded better terms on the busy Black Friday sales day. Workers in other countries joined union members of the UK’s Coventry warehouse who had been most proactive in demanding better terms, striking for 28 days.

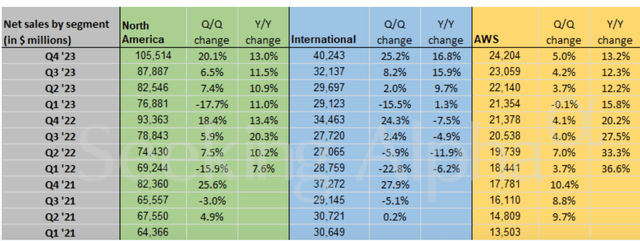

Amazon’s revenue growth by segment (Source: Seeking Alpha)

While even at that time it was evident that a single day’s strike was unlikely to impact Amazon’s numbers, it’s worth noting that net sales growth at constant exchange rates was slightly higher at 13% year-on-year (YoY) in Q4 2023 compared to the 12% in Q4 2022. International sales, in particular, accelerated to 13% during the quarter, compared to just 5% in Q4 2022 despite labour to the segment. In reported terms, they were even faster (see table above).

In fact, the company notes about the season:

Held a record-breaking Black Friday and Cyber Monday holiday shopping event…Through the entire holiday season, customers purchased more items on Amazon than during any previous holiday season.”.

#2. Dealing with the UK’s workforce related challenges

This is not to minimise the challenges that labour unrest can still pose in the months and years to come, however. The UK is a particular thorn in Amazon’s side as more strikes have happened in Birmingham and Coventry in the first two months of 2024 alone.

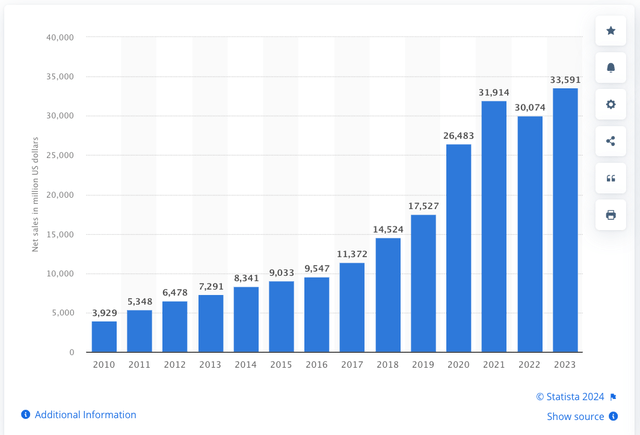

The market has a share of ~6% in the company’s net sales in 2023 and sales in the UK also rose by 11%, in line with the international sales growth. In other words, it’s a non-trivial and growing market for Amazon, making the labour situation one to watch.

Amazon’s UK Revenues (USD million) (Source: Statista)

In response, Amazon has increased investments in the UK workforce by USD 170 million. With the minimum starting hourly wage rate expected to rise from USD 12.3 to USD 13 per hour by April 2024, the company has increased wages by 20% in the past two years. It remains to be seen whether the step is enough to assuage the unions, though it’s in the right direction.

Moreover, the investment itself will not reflect significantly on the company’s numbers, since it’s just 1.3% of the Q4 2023 operating income. At the same time, it’s essential to see how the story evolves as the company is still loss-making in its international sales segment. In fact, the operating loss on the segment increased sequentially to USD 0.4 billion in Q4 2023 from USD 0.1 billion in Q3 2023.

#3. Margins and earnings growth expected to stay strong

For now, though, Amazon is positive on its operating margin, which is expected to stay firm in Q1 2024. It has a revenue guidance of USD 138-143.5 billion and an operating income guidance of USD 8-12 billion for the quarter. At the midpoint of the guidance range, the margin would come in at 7.1% (Q1 2023: 3.8%). This is slightly lower than the 7.7% margin seen in Q4 2023, but still better than the 6.4% level seen for the full year 2023.

This in turn can be a positive for net income as well, after the company’s diluted earnings per share [EPS] came in at USD 2.9 for the full year 2023, higher than analysts’ expectations of a USD 2.71 figure. To estimate the net income for 2024, I have made the following assumptions:

- Revenues will grow at the stated midpoint rate for Q1 2024 of 10.5%.

- The operating margin for the full year will stay the same as that for the quarter at 7.1%.

- Net income as a percentage of operating income will stay constant at 2023’s level of 82.5%.

This results in a net income of USD 37.2 billion, which is a 22.4% year-on-year increase. Analysts’ estimates available on Seeking Alpha are even more optimistic about EPS growth, pencilling in a 44.6% increase this year.

#4. Market multiples improve further

Following from this, the forward non-GAAP price-to-earnings (P/E) ratio is at 41.7x, which is lower than the 55.3x it was when I last wrote. Even my net income estimates result in a forward P/E of 48.6x, also lower than where it was three months ago. The forward P/E is also lower than the stock’s five-year average of 185.5x. Similarly, the non-GAAP trailing twelve months [TTM] P/E is at 60.25x, compared to 83x for the past five years.

What next?

The last time I was slightly nervous about how Amazon might deal with its labour challenges, even though the stock looked good otherwise. There are two positive developments in this regard. First, the labour challenges haven’t impacted its numbers in Q4 2023, with its international sales in particular continuing to show healthy growth. Second, it’s taking steps to address workers’ issues in the UK, where the industrial action is heightened. The challenges can continue, so it’s still a story to watch, but there’s progress in the right direction.

Even with increased investments in the workforce, the absolute number is small and Amazon’s expected operating margin in Q1 2024 looks good. In fact, if the trend continues into the full year 2024, the company’s earnings can see solid growth this year. This in turn has reduced the forward P/E since the last I checked and continues to be competitive compared to its own past average.

In sum, there’s nothing about the Amazon story that has turned for the worse. Quite the contrary. I’m reiterating a Buy on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—