Summary:

- Amazon’s Q4 report shows solid revenue growth and increased profitability, ending FY23 on a high note.

- The stock appears fairly valued at present, with much of the growth for FY24 already priced in.

- Given the current macroeconomic outlook and lack of margin of safety, I find it difficult to advocate for adding AMZN shares at the present time.

- I still think the firm is well-placed for the long term and will not be selling any of my shares at the present time.

- Hold rating issued.

HJBC

Investment Thesis

Amazon (NASDAQ:AMZN) is still one of my favorite long-term picks thanks to its continuous innovation, great growth avenues and increased focus on operating efficiency.

A robust Q4 report has helped the firm end FY23 on a high, with the year being characterized by solid topline growth and great bottom-line expansion.

Nevertheless, shares appear fairly valued at the present time with much of the growth for FY24 already being priced into the current stock price.

When combined with a complicated macroeconomic outlook, I believe an insufficient margin of safety exists to continue adding shares at current levels.

Therefore, I rate Amazon a Hold at the present time and welcome the 104% gains made since my first bullish thesis on the stock back in early 2023.

Company Background

Amazon.com is one of the most influential businesses of the 21st century. Their massive presence in e-commerce, cloud computing and entertainment has made the firm a crucial element of the daily lives of almost all Western civilizations.

Continuous development and expansion of their core e-commerce platform’s capabilities have been combined with a great value-add service in the form of Amazon Prime.

The versatility of the Prime service has further boosted growth for the firm’s user base, and revenues, be it from consumers looking to watch shows and movies or get their parcels delivered quicker.

Innovation fundamentally remains at the forefront of Amazon’s growth strategy, with the firm rapidly expanding into new markets and industries such as healthcare, digital advertising and machine learning projects such as the Amazon Q generative AI-powered assistant for AWS.

The immense scale and breadth of Amazon’s operations generates a true mega-moat status for Amazon, with multiple competitive advantages helping to increase their return on invested capital and their opportunities for future growth.

I conducted a comprehensive analysis of Amazon’s economic moat last year, which I still believe to be a great deep dive into the firm’s business operations structure.

You can check out that article here. I highly recommend reading that piece to allow for a deeper understanding of the firm to be developed.

Financial Situation – Q4 & Full-Year 2023 Update

Amazon reported pretty solid Q4 and full-year results, with the quarter in particular being characterized by massive revenue growth, continued AWS strength and wonderful profitability.

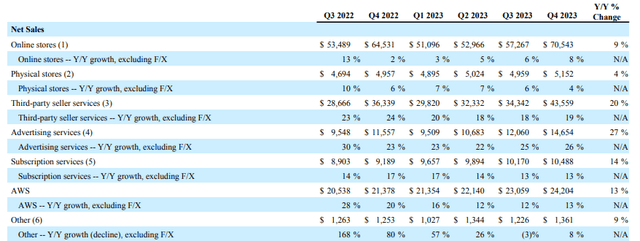

Net sales grew 14% YoY to $170B in Q4 thanks to great performance by essentially all of Amazon’s geographic segment sales. AWS also posted great performance in Q4 with 13% YoY growth being achieved by the segment.

AMZN Q4 & Full-Year 2023 Press Release

I also liked the rate at which Amazon’s digital advertising business grew in the final quarter. The 27% growth witnessed in what can be considered Amazon’s newest business segment illustrates just how apt the firm is at extracting profits from new ventures.

Amazon’s e-commerce platform is perfectly positioned to allow for significant advertising opportunities, with the addition of some adverts to Amazon’s Prime service also driving significant revenues for the firm.

What really stood out to me from these Q4 figures was the overall strength of their core e-commerce business, along with high rates of growth being achieved by AWS and their new advertising business.

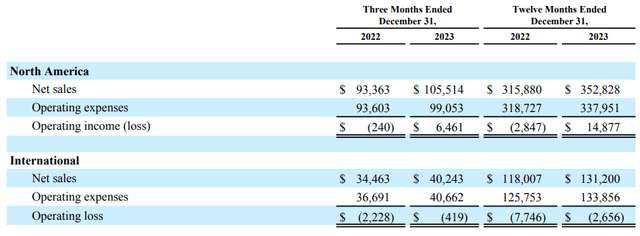

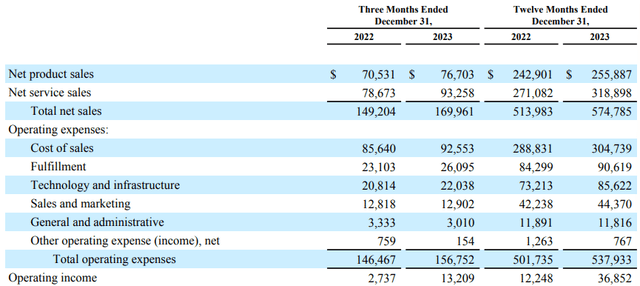

These successes culminated in massive operating income for the firm which totaled just over $13.2B for Q4 compared to just $2.7B the previous year.

AMZN Q4 & Full-Year 2023 Press Release

This massive jump in profitability came thanks to Amazon’s North American segment’s income jumping from a small loss at the end of last year to over $6.5B in income in FY23. A similar reversal was achieved by the International segment, which saw a YoY operating income improvement of over $1.8B.

Amazon’s ability to grow revenues at a much faster pace than total operating expenses illustrates that the firm’s businesses are well positioned to generate massive profitability for the firm, even despite a complicated macroeconomic environment.

AMZN Q4 & Full-Year 2023 Press Release

Full-year results for 2023 were very encouraging, with total revenues growing 12% YoY and operating income expanding over 200% to $36.9B.

ROIC expanded to 9.82% for FY23 compared to 0% in FY22, while net operating margins increased a great 4pp to 6.41%.

I believe the core drivers behind these quantitative successes in FY23 came thanks to outstanding qualitative developments across Amazon’s various business segments.

For example, 2023 saw the introduction of a new add-on health care service being offered to exiting Prime subscribers, which allows customers to purchase healthcare products and have consultations through Amazon’s platform.

Amazon also entered into a partnership with Hyundai to sell their new vehicles through amazon.com in 2024. This could see a significantly increased volume of sales occurring through the site, along with another opportunity for cross-selling to occur.

I also really like the firm’s devotion to further developing their rapid delivery services, be it through adding more trucks and depots to their infrastructure network in Europe or through the testing of new autonomous delivery drones in an even larger number of regions.

Integration of generative AI into AWS also presents the possibility for the platform to return to even greater levels of growth, with their newest generative AI offering being capable of doing massive amounts of AWS related work in the blink of an eye.

While similar generative AI integrations are being pursued by the likes of Microsoft (MSFT) and Alphabet’s Google (GOOG) (GOOGL), Amazon has begun a rapid expansion into the AI space with multiple new avenues of development for their own large language models.

New AWS Trainium2 chips should deliver four times faster machine learning training for generative AI applications than the first-generation chips, while a partnership with Nvidia for the GH200 Grace Hopper superchips should enable more advanced AI infrastructure across Amazon’s projects.

While no exact figures have been given about Amazon’s investment into AI or R&D specifically, the firm continues to spend around 15% of total revenues on “Technology & Infrastructure”.

New AI features are being integrated into AWS, amazon.com, Prime Video and the digital advertising business with a core objective of Amazon’s AI strategy centered around the firm’s core ethos: improving the customer experience.

Overall, Amazon has produced robust Q4 and full-year results which saw the firm return to massive profitability, with great topline revenue growth being complemented by wonderful improvements in operating efficiency.

Management forecasts Q1 FY24 revenue growth to be around 10% YoY, with operating income expected to fall between $8B and $12B. These massive operating incomes would represent even in the most conservative case, an 80% YoY increase, which would be great to see.

I expect Amazon to be able to achieve these growth targets in Q1 thanks to the continued growth of their AWS and digital advertising segments in particular.

While a continuously softening consumer spending environment may dampen the rate of core e-commerce sales, I believe these concerns may materialize later in the year closer to the election.

Valuation – Q4 & Full-Year 2023 Update

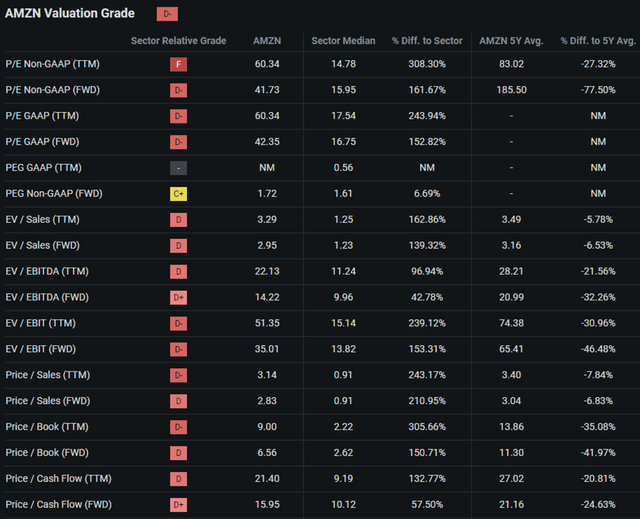

Seeking Alpha | AMZN | Valuation

Seeking Alpha’s Quant continues to assign Amazon with a “D-” Valuation rating. I am still inclined to disagree with this rating, as I find it to be an excessively pessimistic representation of the value present within Amazon shares.

Current P/E GAAP and Price/Cash Flow TTM ratios of 60.34x and 21.40x are around 24% down from their respective 5Y averages.

The discount suggested by these metrics in AMZN stock relative to historic averages most likely has arisen as a result of the significantly increased earnings in FY23 and the accompanying growth in operating income.

While both of these metrics are still very elevated and not immediately representative of a deep-value opportunity with huge upside, I view AMZN stock more as a GARP opportunity given the company’s still significant growth prospects.

This view appears to be supported by investors at the present time, with the firm’s Price/Sales TTM of 3.14x illustrating just how much growth is already baked into the share price.

Therefore, it is difficult to develop a real understanding of any value that may lie in Amazon’s stock just from these simple valuation metrics, given the complexities of valuing a growth stock without directly considering future earnings.

Seeking Alpha | AMZN | 5Y Advanced Chart

Considering a running 5Y timeframe, Amazon’s shares have generated great returns of around 104% for its shareholders. Compared to the popular S&P 500 tracking ETF SPY (SPY), AMZN stock has outperformed the index by almost 30%.

However, it is important to note that Amazon’s volatility has been significantly greater, with the stock currently having a beta value of 1.14x.

Seeking Alpha | AMZN | 1Y Advanced Chart

Much of Amazon’s recent performance has come as a result of a 1Y bull run that has seen shares appreciate by over 86%.

This investor appetite for AMZN shares has come on the heels of Amazon generating great revenue growth and superb operating incomes as compared to the immediate post-pandemic period.

The Value Corner

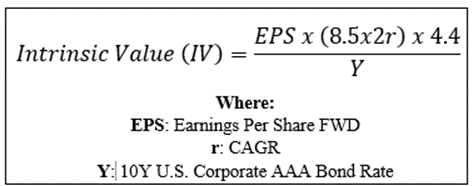

By utilizing The Value Corner’s Intrinsic Valuation Calculation, we can better understand what value exists in the company from an objective perspective.

As inputs, we will use Amazon’s current share price of $174.64, an estimated 2024 EPS of $4.19, a realistic “r” value of 0.18 (18%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.87x. These values generate a base-case IV of $170, suggesting a fair valuation at the present time.

When using a more pessimistic CAGR value for r of 0.13 (13%) to reflect a more recessionary macro environment where Amazon struggles to meet its growth targets, shares are valued at $131, suggesting a substantial 33% overvaluation in shares.

In the short term (3-12 months), I find it difficult to comment on the direction of the stock.

The massive difference between my base and bear case scenarios illustrates just how much growth is already priced-in to the current stock price for AMZN. Any underperformance in the short term relative to these expectations could send shares downwards.

Macroeconomic shocks such as a recession or new geopolitical conflict could also sour investor sentiment and the ability of consumers to spend on the products and services sold by Amazon.

In the long-term (2-10 years), I believe Amazon still presents itself as a compelling GARP opportunity thanks to its massive scale, breadth of operations and continuous drive for innovation.

Amazon.com Risk Profile

Amazon still faces real risk from its exposure to a cyclical market environment along with some acute ESG concerns.

Recessionary business environments could see Amazon’s core e-commerce platform’s revenues fall as consumers are less willing and able to spend their disposable income.

While I do see the AWS and digital advertising businesses as being more isolated from the cyclicality of the consumer discretionary markets, growth in these segments would almost certainly also slow down during a recession.

Failed execution of new innovations also generates risk for the firm. While innovation and the creation of new ideas will always have some failures, any future expensive missteps such as Amazon’s Fire phone could harm profitability and investor sentiment towards the firm.

From an ESG perspective, Amazon still faces real social risk arising from the allegations of anti-union behavior from the firm along with substandard working conditions being present at the firm’s warehouses.

Just a couple of months ago, Amazon witnessed firsthand the problems their massive scale can cause with regard to governance concerns.

The EU’s threatened blockage of Amazon’s acquisition of iRobot illustrates the difficulty many of the current mega-caps may face when looking to further expand their business operations into new areas.

Considering these ESG concerns, I believe Amazon has excessive risk to be considered a solid pick for a more ESG conscious investors.

Of course, I implore you to conduct your own research into Amazon’s unique risk structure and exposure to ESG concerns, should these issues be of concern to you.

Summary

A strong Q4 earnings report rounds off what has been a pretty impressive year for Amazon. The firm has shown its ability to extract real income from its operations while simultaneously continuing to innovate and grow its multiple business divisions.

While the current outlook for Q1 FY24 is solid, I find the current stock valuation to have already priced in the majority of gains expected to be earned by the firm in 2024.

Given this fair valuation in shares, I believe there is insufficient upside opportunity and margin of safety to warrant adding exposure to AMZN stock at the present time.

Therefore, I rate Amazon shares a Hold at the present time. While I will not be selling any of my shares at the present time and remain optimistic about the long-term future of the stock, I do not think now is a good opportunity to add more shares to the e-commerce giant.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.