Norwegian Cruise Line: Ride Recovery Even Higher

Summary:

- Norwegian Cruise Line Holdings has reported stellar earnings, with total revenue of $8.5 billion surpassing 2019 levels by 32%.

- NCLH plans to slow down capacity growth and focus on fixing its balance sheet, with a goal of increasing capacity by only 28% through 2027.

- The cruise line stock trades below 10x normalized earnings in the years ahead, as interest expenses are cut from paying down debt.

Lisa Maree Williams

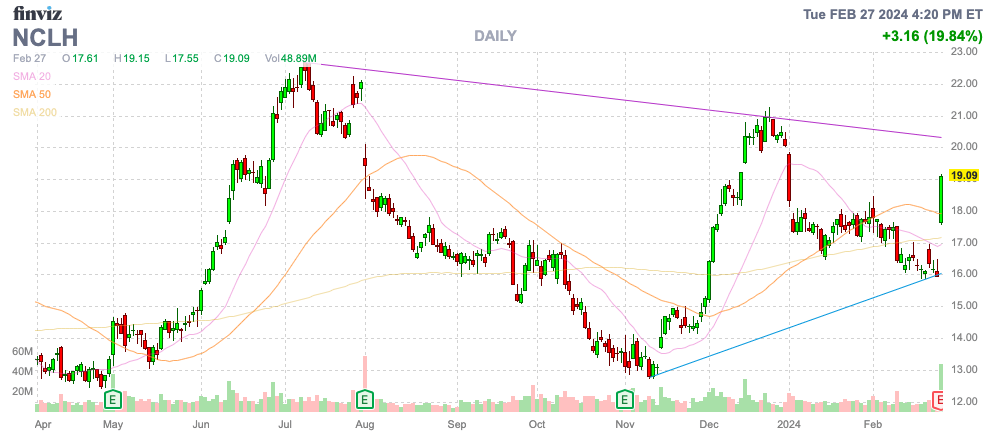

After stellar earnings, Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) has surged back towards the recent highs. Oddly, the cruise line stock had dipped again towards $16 despite stellar numbers from peers with signs that 2024 bookings are at record levels. My investment thesis remains Bullish on the stock, though investors should’ve loaded up at much lower prices over the last few years.

Source: Finviz

Big 2024 Ahead

At one point, investors thought the cruise lines would never fully recover. Now, Norwegian just reported a year where total revenue of $8.5 billion topped 2019 levels by 32% due in part to an 18% capacity increase from adding 3 new ships in 2023.

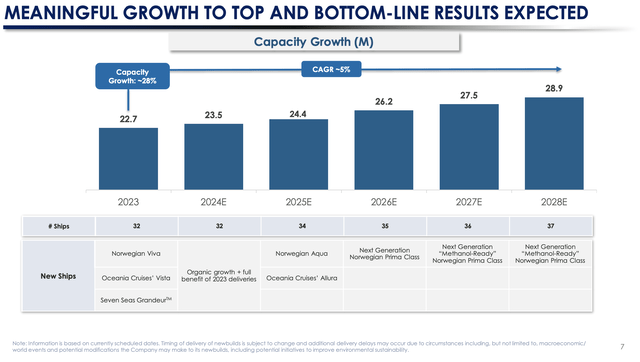

The company will embark on much slower capacity growth in the years ahead, with a goal of only increasing capacity by ~28% through 2027 via adding 5 new ships. The next ship won’t be added to the fleet until 2025, only contributing modest 3% growth for the next few years to allow Norwegian a period to finally fix the balance sheet.

Source: Norwegian Cruise Line Q4’23 presentation

The company has substantially higher costs and diluted shares outstanding to limit the EPS metric, but Norwegian has more than fully recovered the business. The only question going forward is where the normalized EPS trends, as the debt level is cut back to more normal levels.

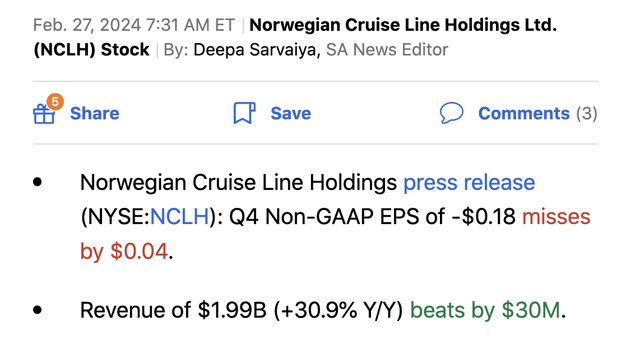

Norwegian reported the following quarterly results for Q4’23:

The December quarterly numbers weren’t overly impressive, due in part to the ongoing conflicts in Israel and the Red Sea. Norwegian had ~7% of the capacity in Q4’23 and 4% of the 2024 capacity expected to visit the Middle East.

The cruise line missed Q4’23 EPS estimates, with revenues above estimates by $30 million. The big key is that 2024 numbers won’t face the same capacity problems and Norwegian is heading back towards record numbers.

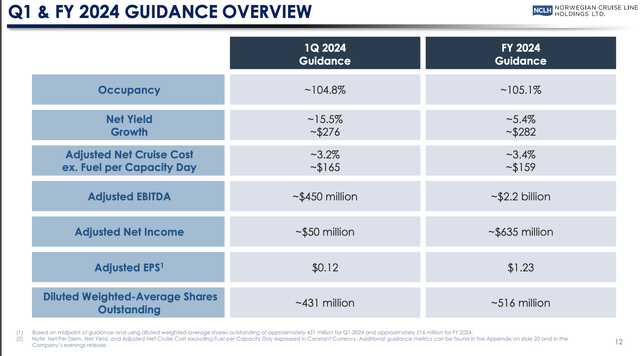

The guidance is for adjusted EBITDA of ~$2.2 billion and net income of $635 million. Due to the massive share count boost during the COVID-19 losses, Norwegian only forecasts a $1.23 EPS, though the 516 million share count is elevated due to the accounting treatment for exchange notes due in 2027.

Source: Norwegian Cruise Line Q4’23 presentation

EPS Catalysts

The cruise line still won’t approach record income levels in 2024. Norwegian produced 2019 net income of $1.1 billion, with an EPS of $5.09. The cruise line was even guiding for a 2020 EPS of $5.40 to $5.60 before COVID-19 hit.

The diluted share count was only 215 million at the end of 2019. Just as important, interest expenses were only $273 million compared to $728 million in 2023.

The basic difference between the net income figures is the $455 million increase in interest expenses. Norwegian will see a big boost in cash flows during 2024 and the repayment of debt is a big part of the story in boosting EPS going forward with a roughly $1 EPS boost from just current interest expenses.

The cruise line just repaid $250 million in 9.75% senior secured notes due in 2028, eliminating nearly $25 million in interest expenses. The company can now use these savings to repay even more debt, providing an immediate boost to earnings.

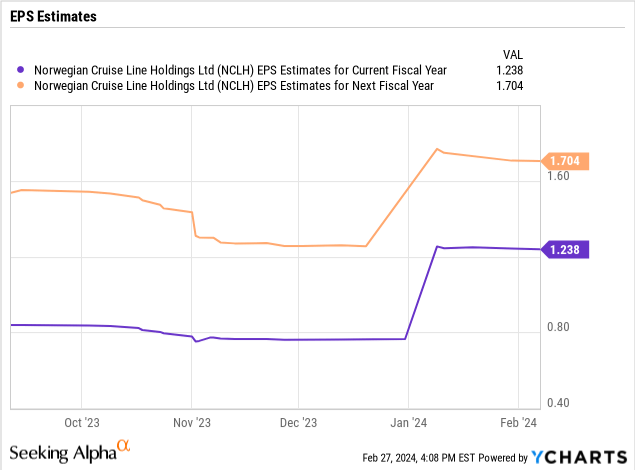

The consensus estimates forecast substantial EPS gains in the years ahead, with a target of a $1.70 in 2025. Only a few analysts have estimates for 2026, but the EPS targets are up at $2.44.

As mentioned above, the cruise line only needs to repay a portion of the $14 billion in debt with cash flows to provide immediate EPS boosts. Norwegian will only spend $0.4 billion on new build capex in 2024, allowing for sizable balance sheet improvements, before shifting to spending $2.1 billion on 2 new ships in 2025.

The cruise line generated $2.0 billion in operating cash flows in 2023 and numbers are expected to jump this year. The major difference in reducing debt is capex spending, after Norwegian paid $2.75 billion on cruise ships last year and boosted the PP&E to $16 billion.

Takeaway

The key investor takeaway is that Norwegian remains exceptionally cheap here, with plenty of levers remaining to boost cash flows and EPS in the years ahead. The cruise line is still seeing record bookings at higher prices, and the debt position can be easily paid down over the next few years to boost both financial metrics.

Investors should remain bullish on the stock still trading below $20, which is below 10x normalized EPS targets for the years ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to start finding the best stocks with the potential to double and triple in the next few years.