Summary:

- Amazon is set to release its Q2 2024 earnings report later tonight, with high investor expectations due to strong momentum in AWS and Ads.

- Despite a recent pullback in big tech stocks, Amazon is close to all-time highs and could surpass $200 per share with a robust performance in Q2, given reasonable valuation.

- Analysts expect Amazon to beat management guidance with steady revenue growth and positive EPS revision trends.

- Based on fundamental, quantitative, technical, and valuation analysis, I continue to rate Amazon stock a “Buy” in the $180s ahead of earnings.

4kodiak/iStock Unreleased via Getty Images

Introduction

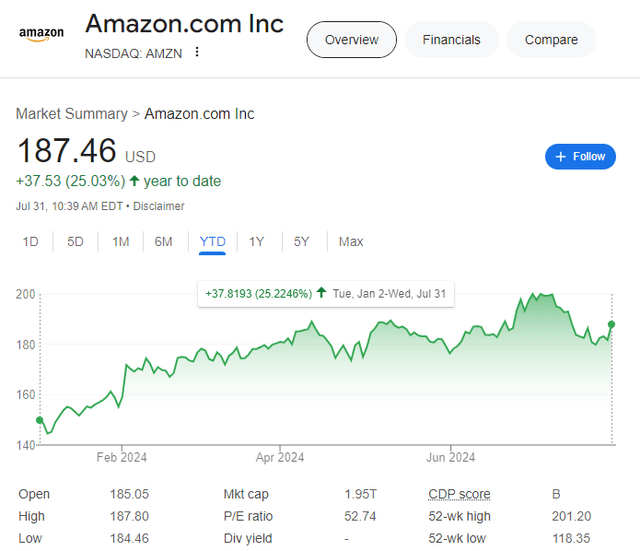

Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) is all set to release its Q2 2024 earnings report in post-market hours today. With Amazon’s twin-growth engine of AWS and Ads showing strong momentum in recent quarters, investor expectations are high, as evidenced by AMZN’s recent stock performance.

Amid a pullback in big tech stocks, Amazon has slid by ~6% heading into the Q2 print; however, we are a stone’s throw away from all-time highs of $201.20 per share and a robust showing from Jassy & Co. later this evening could propel AMZN stock above the psychological resistance level at $200.

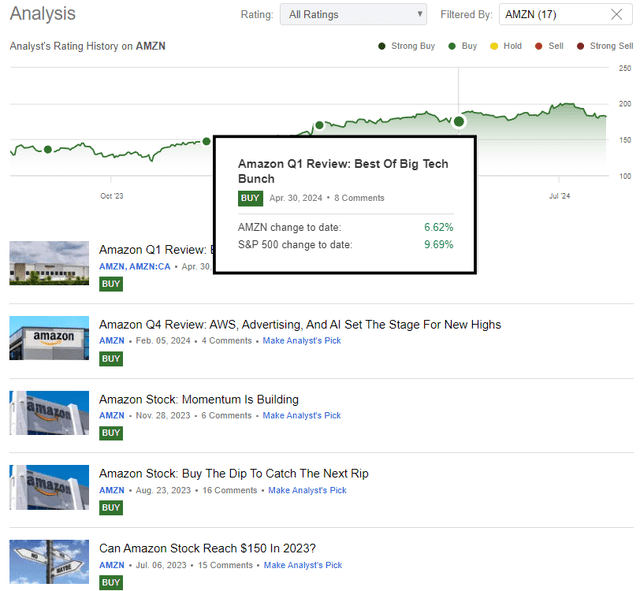

In my previous report on Amazon, I proclaimed its Q1 performance to be the best among the big tech companies and rated AMZN stock a buy in the $170s:

In my view, Amazon’s Q1 report is the best one among big tech companies so far in this earnings season. Amazon’s profitability concerns are a thing of the past; however, the ongoing revenue mix shift towards faster-growing, higher-margin AWS [cloud] and Ads businesses will likely continue to drive incremental improvements in profit margins and cash flow generation at this big tech giant for years to come.

Barring a macroeconomic shock, I think Amazon will re-test its all-time highs sometime in 2024, with the business looking stronger than ever before. In combination with its GenAI innovations [like Q [code bot launched today] and Rufus (AI-shopping assistant)], I think Amazon’s retail ecosystem and twin-growth engine of AWS & Ads will continue to push AMZN’s revenues and free cash flows higher over time.

Amazon is a fundamentally sound business with market-leading positions in humongous secular growth markets: e-commerce, digital advertising, and cloud. Based on its improving business fundamentals, reasonable valuation, and attractive long-term risk/reward, I continue to view Amazon as a solid investment in the $170s.

Key Takeaway: I rate Amazon stock a “Buy” at $177 per share, with a strong preference for staggered accumulation.

Source: Amazon Q1 Review: Best Of Big Tech Bunch

Author’s Coverage History (Seeking Alpha)

Since then, Amazon has moved up by ~6.5%; however, with the S&P 500 (SPX) up ~9.7% during the same period, Amazon has been an underperformer relative to the broader stock market.

In today’s note, we shall preview Amazon’s upcoming report and re-evaluate AMZN stock using TQI’s Quantamental Analysis process to see if it’s a buy/sell/hold at current levels.

What Is The Earnings Forecast For Amazon?

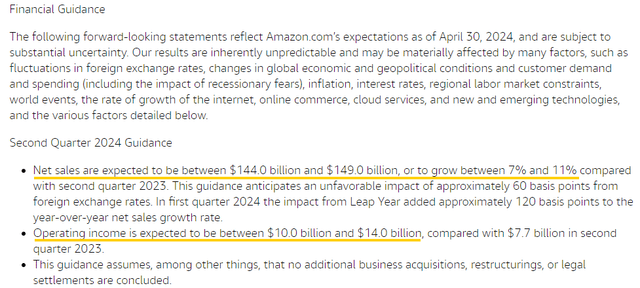

In their Q1 2024 earning press release, Amazon’s leadership guided for Q2 2024 net sales to be in the range of $144-149B [y/y growth of 7-11%, deceleration from Q1] and operating income to come in at $10-14B. Heading into the Q1 print, the consensus forecast for Amazon’s Q2 revenue stood at $150B, which meant Amazon’s management guided under Street expectations.

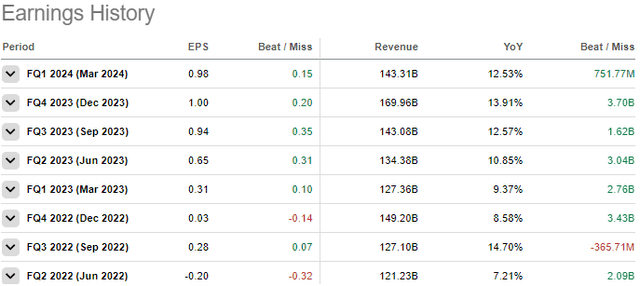

While Amazon’s sales guidance points to a sizeable moderation in growth, Amazon will likely beat these numbers, given continued economic resilience [Q2 GDP: 2.8% vs. 2.1% est.] and its management’s history of sandbagging guidance.

Amazon Earnings History (Seeking Alpha)

Now, before we look into consensus analyst estimates and revision trends for Amazon’s Q2 2024 revenue and EPS, let’s briefly review AMZN’s Q1 2024 earnings report to understand recent business trends.

How Was Amazon’s Previous Earning Report?

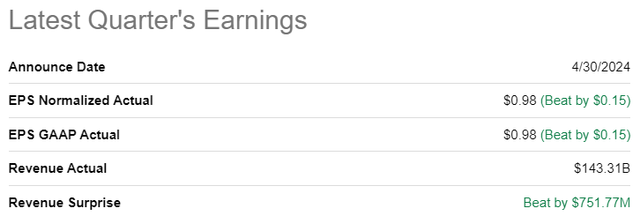

Last quarter, Amazon delivered a top- and bottom-line beat. While Amazon’s revenue beat of $752M for Q1 2024 was minuscule compared to recent quarters, Q1 EPS of $0.98 per share came in ~18% ahead of Street estimates.

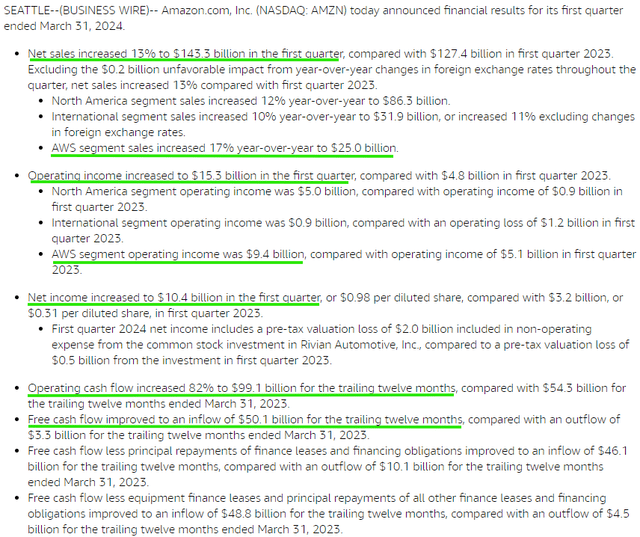

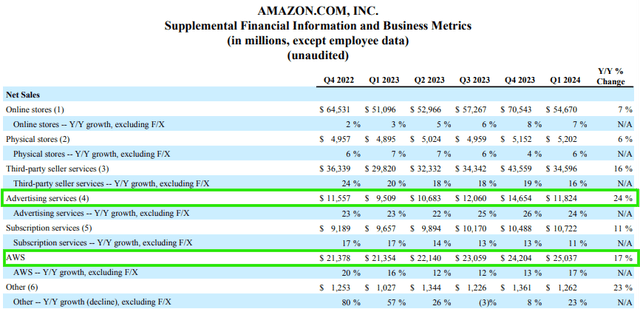

In Q1 2024, Amazon’s net sales rose +13% y/y to $143.3B, driven by a stronger-than-expected growth re-acceleration at Amazon Web Services (“AWS”) [+17% y/y] and continued momentum within Ads [+24% y/y] and the retail ecosystem.

As you may know, my investment thesis for Amazon has been centered around its twin growth engine of AWS and Ads. Hence, I was naturally pleased with an acceleration in AWS revenue growth to 17% y/y.

With AWS contributing nearly ~61% of Amazon’s operating income in Q1, the importance of Amazon’s cloud business cannot be understated. For a while now, the market narrative has been that Microsoft Azure (MSFT) is the big winner among cloud hyperscalers in the era of GenAI; however, Amazon’s cloud business expanding faster than Microsoft in dollar terms is a sign that AWS can defend its market share, and stay the leading hyperscaler in the future!

For Q2, Microsoft has already reported growth deceleration for Azure Cloud, and so, if Amazon were to report further acceleration in AWS growth rates later tonight, I think we could see a good bit of capital moving away from MSFT to AMZN stock in the near future. Amazon is the leading hyperscaler, and as a long-term investor, I want this to be the case over the long run. We’ll see if this data point turns into a trend in the next few quarters.

Now, AWS is central to the Amazon investment case; however, Amazon’s Ads business is equally important. While AWS is already a $100B ARR business, Amazon Ads business is growing faster [+24% y/y to $11.8B in Q1 2024] and looks on track to reach that $100B ARR milestone in the next few years.

Here are my thoughts on Amazon’s profitability, cash flow generation, and potential capital return program from last quarter:

During Q1, Amazon’s operating income increased to +$15.3B, driving TTM operating cash flow higher to $99.1B (up +82% y/y). Over the last twelve months, Amazon has generated free cash flows of $50.1B, and in my view, the operating leverage story at Amazon is going from strength to strength. A lot has been made about Amazon’s valuation multiple, but based on current pricing, Amazon is trading a P/FCF multiple of ~36x, which is not excessive for a company growing sales at a healthy clip and expanding margins rapidly.

Ahead of earnings, the fervor of a potential dividend from Amazon was quite high, but I see no indication of a capital return program in the Q1 report. That said, given Amazon’s scale and profitability, I continue to think that it is only a matter of time before Amazon transforms from a cash cow to an “infinite buyback pump” [a capital return machine] for its shareholders.

Source: Amazon Q1 Review: Best Of Big Tech Bunch

In my view, Amazon’s twin-growth engine is building momentum. While management’s Q2 guide was lighter than expected, Amazon’s business fundamentals are moving in the right direction. With all this information in mind, let’s review consensus estimates for Q2 now.

Is AMZN Expected To Beat Earnings?

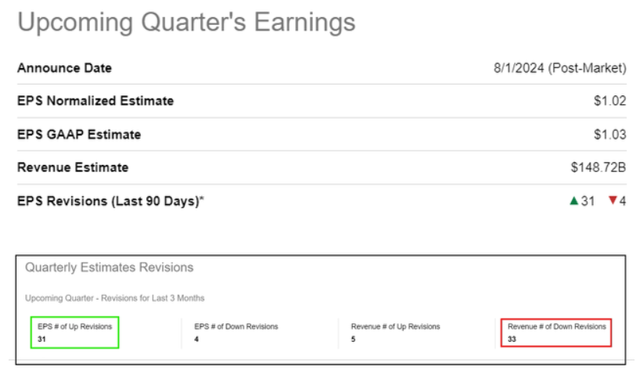

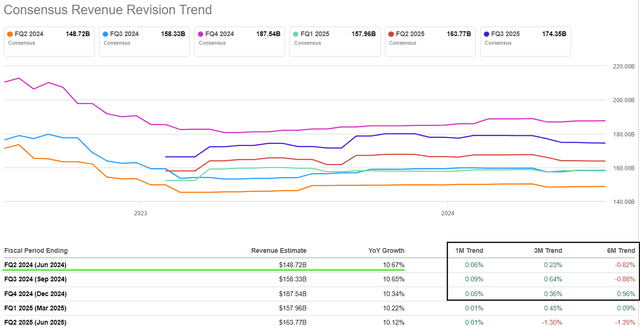

According to consensus estimates, Amazon is projected to deliver total revenues of $148.72B (+10.7% y/y) for Q2 2024, and the range of these estimates is from $146.53B-151.18B. With the lower end of analyst estimates above the midpoint of management’s guidance range of $144-149B, Wall Street analysts are clearly more bullish about Amazon’s business prospects than management’s guidance would suggest.

Amazon Earning Estimates (Seeking Alpha)

With Amazon’s management guiding below Street estimates last time around, analysts have been scrambling to adjust their revenue forecasts over the past three months, as reflected by 33 Down Revisions vs. 3 Up Revisions for Q2 2024 revenue. Interestingly, the revision trends look pretty stable.

As of today, the consensus analyst estimate for AMZN’s Q2 revenue sits at $148.72B, a little more than $2B above the midpoint of management’s guidance range. Beyond Q2, analysts expect Amazon’s sales growth to remain steady above 10% for the foreseeable future.

Amazon Revenue Estimates (Seeking Alpha)

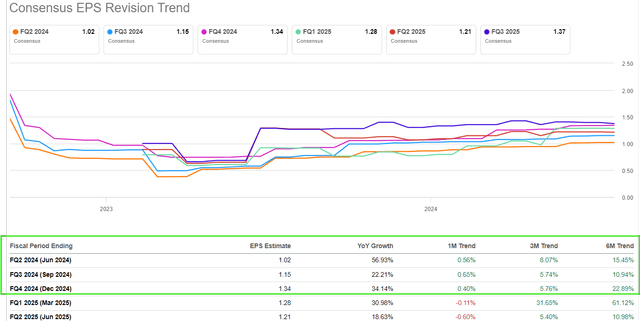

On the earnings front, recent revision trends appear to be positive, and the consensus outlook calls for ~57% y/y EPS growth in Q2. While Amazon’s EPS growth rates are likely to moderate in H2 2024, the margin expansion story is far from over, and the ongoing revenue mix shift towards AWS and Ads will likely continue to drive margins higher for a long time to come.

Amazon EPS Estimates (Seeking Alpha)

Based on recent business trends, management’s guidance, consensus estimates, and earning revision trends, I expect to see another double beat from Amazon this quarter. That said, is AMZN stock a good buy ahead of earnings? Or, is this the right time to lock in some gains? Let’s find out!

Is AMZN Stock A Buy, Sell, or Hold?

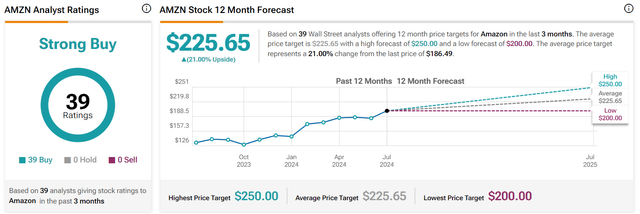

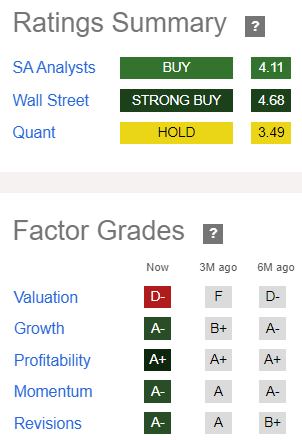

Heading into the Q2 print, Wall Street analysts remain bullish on AMZN stock, with all 39 covering AMZN stock rating it a “Buy” right now. With the average 12-month price target sitting at $225.65 per share, Amazon’s stock has a potential upside of 21%, according to Wall Street.

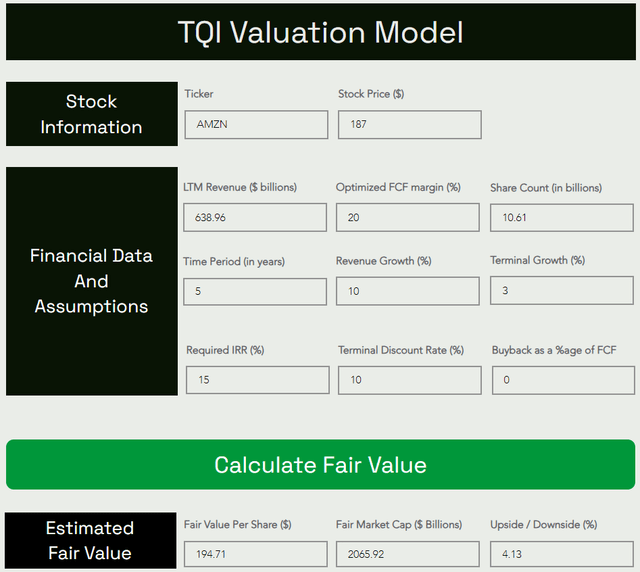

Using reasonable assumptions for future growth [5-year sales CAGR: 10%] and steady-state margins [optimized FCF margin: 20%] in our proprietary valuation model, we determined that AMZN’s fair value is ~$195 per share or ~$2.1T in market cap. With the stock trading at ~$187 per share, AMZN is slightly undervalued, and you know we couldn’t say the same thing about most of AMZN’s high-flying “Magnificent 7” big tech peers [with the exception of Meta Platforms (META)].

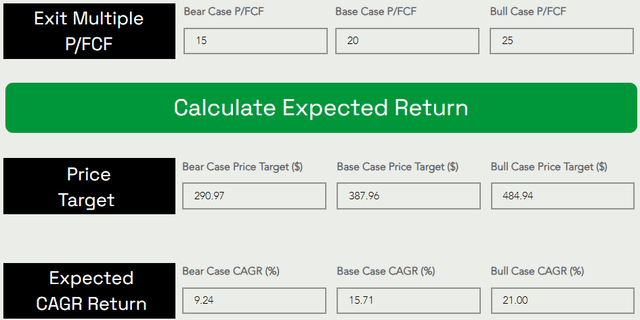

TQI Valuation Model (Free to use at TQIG.org)

Predicting where a stock will trade in the short term is impossible; however, over the long run, a stock will track its business fundamentals and obey the immutable laws of money. If the interest rates were to return to artificially low levels (i.e., ZIRP), higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x (P/FCF).

Assuming a base case exit multiple of 20x P/FCF, we get to a 5-year price target of ~$388 per share, which implies a CAGR return of ~15.71%.

TQI Valuation Model (Free to use at TQIG.org)

With AMZN’s base case expected CAGR exceeding my investment hurdle rate (of 15%) and long-term market (S&P 500) returns (of 8%-10% per year), I continue to view Amazon stock as an attractive investment at current levels.

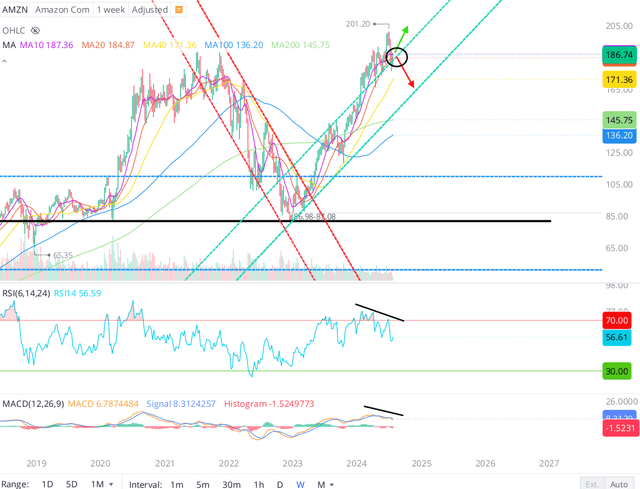

Technically, AMZN stock is still holding above key short-term moving averages [10-week and 20-week MA], i.e., momentum is intact. However, with weekly RSI and MACD rolling over, a deeper pullback cannot be ruled out.

AMZN Stock Chart (WeBull Desktop)

Furthermore, AMZN’s quant factor grades remain unsupportive for fresh buying, with an SA Quant score of 3.49/5. While I agree with these grades for Growth, Profitability, Momentum, and Revisions, the “Valuation” grade of “D-” is too harsh, and in my view, a reflection of Amazon’s earnings getting masked by a heavy CAPEX spending cycle which the tech giant is currently exiting.

AMZN Quant Factor Grades (Seeking Alpha)

Considering AMZN’s fundamental, quantitative, valuation, and technical data, I am sticking to my “Buy” rating for Amazon heading into its Q2 2024 report.

Concluding Thoughts

From a technical perspective, Amazon could suffer a deeper pullback if we lose short-term momentum [break below 10-week and 20-week moving averages]. However, from a fundamental perspective, Amazon is an incredible business with market-leading positions in humongous secular growth markets: e-commerce, digital advertising, and cloud. Based on its improving business trends, reasonable valuation, and attractive long-term risk/reward, I continue to view Amazon as a solid investment.

Key Takeaway: I rate Amazon.com, Inc. stock a “Buy” in the $180s.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – "The Quantamental Investor" – to help you build a robust investing operation that can fulfill and exceed your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.