Summary:

- Amazon stock reported mixed results for fiscal 2022 and while the top line could still grow, the company had to report a loss once again.

- While AWS could still report solid results, “North America” and “International” both reported an operating loss.

- Amazon is investing a lot in the future, but compared to Meta Platforms or Google, it has trouble being profitable.

- In my opinion, Amazon is still overvalued.

hapabapa

Last week, most of the major technology companies reported quarterly results and while Meta Platforms (META) rallied after earnings, Amazon (NASDAQ:AMZN) declined following the quarterly earnings release. And when comparing the quarterly results, I would not say that Meta Platforms reported better results than Amazon – at least Amazon could report a solid top line growth. The difference must be found somewhere else – and while Meta Platforms was a clear investment in the last few months (still is, despite the rally), Amazon has not reached a price level yet where I would buy the stock.

Valuation Multiples

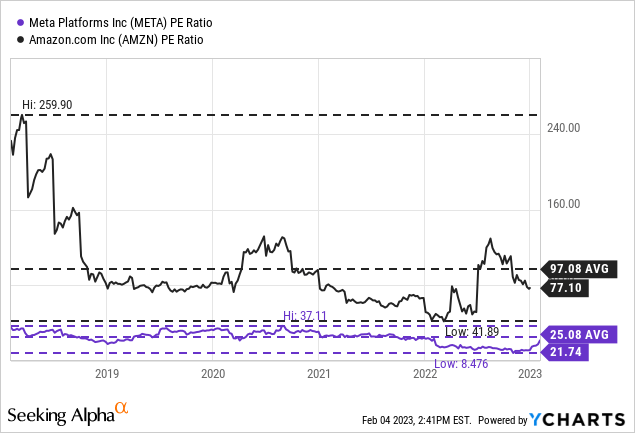

The major difference between Amazon and Meta Platforms was the stock price performance in the last few quarters – and as a result the valuation multiples. Amazon was always trading for much higher valuation multiples than Meta Platforms. When looking at the last five years, Meta Platforms was trading on average for a P/E ratio of 25, while Amazon was trading for an average P/E ratio around 100 (after earnings release, we can’t calculate a useful P/E ratio anymore as the TTM EPS is negative again).

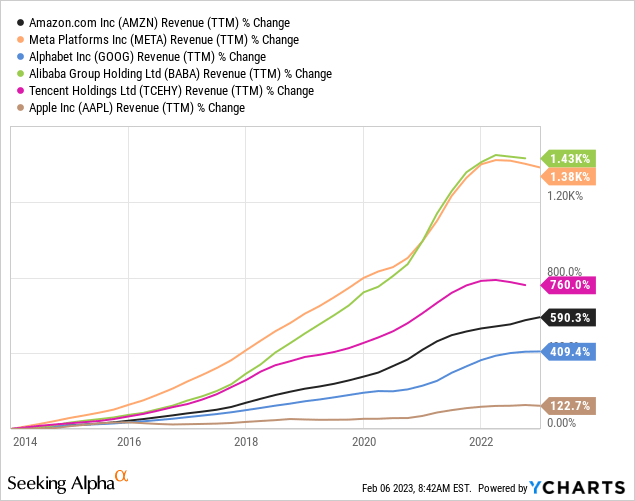

One might argue that Amazon is deserving a higher valuation multiple as it is growing with a higher pace. However, when looking at the past years that is not necessarily true. Of course, the timeframe we pick is making a huge difference, but when looking at the last ten years, Meta Platforms actually grew revenue as well as operating income with a higher pace (I did not pick earnings per share or free cash flow as both metrics are kind of messy in case of Amazon).

|

10-year revenue CAGR |

10-year operating income CAGR |

|

|

Amazon |

25.60% |

39.97% |

|

Meta Platforms |

36.78% |

48.96% |

And while the two businesses might therefore be similar regarding past growth rates, the valuation multiples for which the stocks are trading are not the same. Meta Platforms has been really beaten down and especially a few months ago it was trading for a low valuation multiple that one might have feared the company is close to bankruptcy. And although the P/E ratio more than doubled for Meta Platforms, Amazon is trading for an almost 6 times higher P/E ratio. And therefore, we must rather question if the current stock price for Amazon is justified (or if it should trade for a lower stock price), while we can be rather bullish about Meta Platforms.

Quarterly And Annual Results

Now let’s look at the quarterly and annual results, which were not great, but not terrible either. In the fourth quarter of fiscal 2022, Amazon could beat on revenue expectations and generated $3.43 billion more revenue than expected, but it missed on non-GAAP EPS by $0.14.

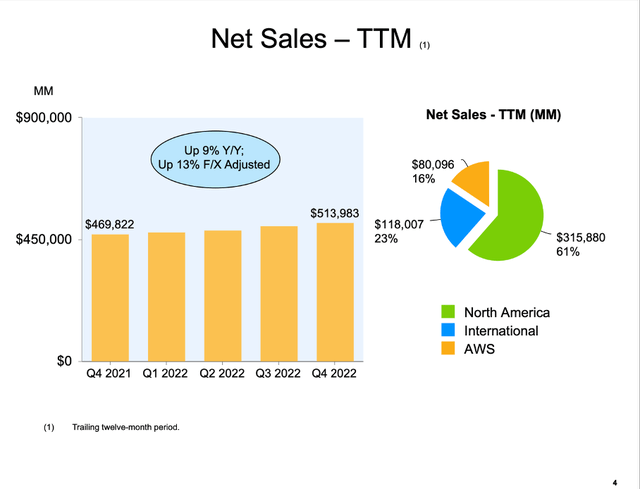

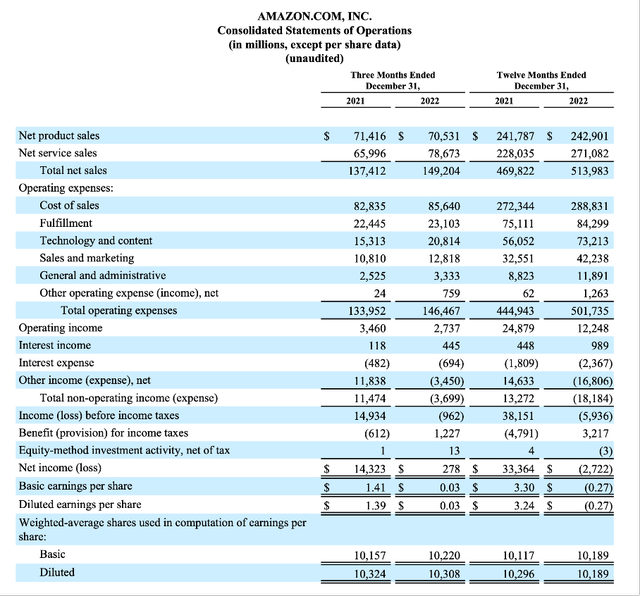

When looking at the annual results for fiscal 2022, Amazon could increase its revenue from $469,822 million in the previous year to $513,983 million reflecting an increase of 9.4% year-over-year. Net product sales increased only slightly from $241,787 million in fiscal 2021 to $242,901 million in fiscal 2022 (resulting in 0.5% year-over-year growth), but net services sales could increase 18.9% year-over-year from $228,035 million in fiscal 2021 to $271,082 million in fiscal 2022.

And while Amazon could still grow its top line, operating income decreased 50.8% from $24,879 million in fiscal 2021 to $12,248 million in fiscal 2022. And diluted earnings per share switched from $3.24 earnings per share in fiscal 2021 to a diluted loss per share of $0.27.

Of course, when interpreting the results, we should not ignore the pre-tax valuation loss of $2.3 billion, which is included in non-operating income (or expenses) from the common stock investment in Rivian Automotive, Inc. (RIVN). And as Amazon could report a pre-tax valuation gain of $11.8 billion in the same quarter last year, this is one of the major reasons why Amazon reported only $0.03 in diluted earnings per share instead of $1.39 in the same quarter last year.

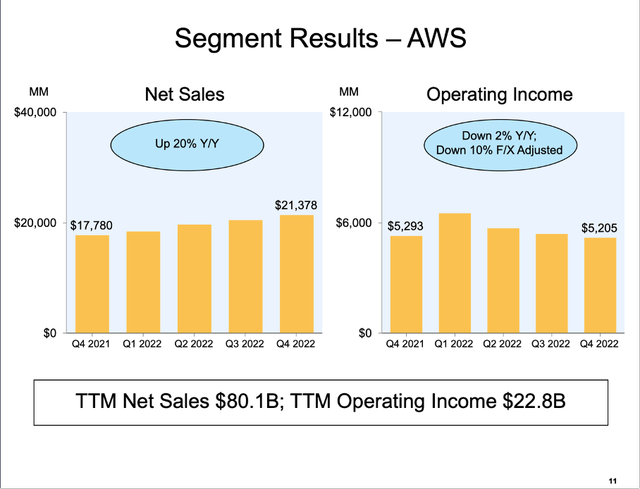

When looking at the three major segments, the picture remains the same as in the last few quarters. AWS is generating operating income for the business, while the other two segments are not profitable. AWS could increase revenue from $17,780 million in Q4/21 to $21,378 million in Q4/22 and while operating income slightly declined, it was still generating $5,205 million in operating income in Q4/22 and $22.8 billion in fiscal 2022.

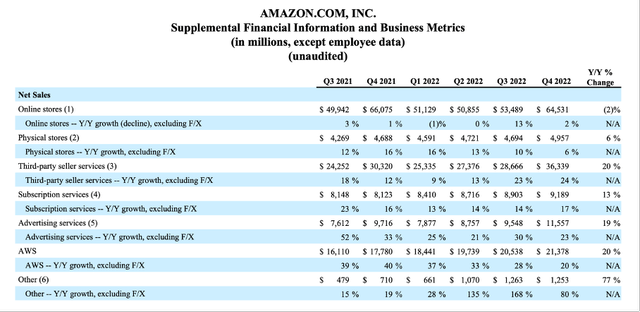

And while the other two segments are generating an operating loss for several quarters in a row now, it is especially troubling that the “International” segment can’t even report increasing sales. In the fourth quarter sales declined from $37,272 million in the same quarter last year to $34,463 million this quarter – resulting in 7.5% YoY decline. At least FX adjusted it would have grown 5% YoY. But for the full year, net sales also declined from $127,787 million in fiscal 2021 to $118,007 million in fiscal 2022 – and these are not great results.

Investing In The Future?

One might now make the argument that Amazon would have much higher earnings per share if it didn’t reinvest most of the dollars it generates back into the business. And it is true, that Amazon is investing heavily into the business. But when comparing Amazon once again to other technology companies: Do you really want to make the argument that Alphabet (GOOG), or Meta Platforms are not investing in the future?

And this is one of the major differences between Amazon and the other former FAANG stocks and major technology businesses. Amazon is not really profitable and not really generating a stable and high free cash flow. Meta Platforms, Alphabet or Apple (AAPL) on the other hand are cash cows and are generating high amounts of free cash flow. And Meta Platforms for example saw its free cash flow almost cut in half, but compared to Amazon, Meta Platforms is still a cash cow.

After Amazon could report a free cash flow in the past, it is now reporting a negative free cash flow for several quarters in a row again and when looking at the trailing twelve months numbers, earnings per share are negative once again. In my last article I already commented on the fact that Amazon is once again not able to generate free cash flow and expressed my irritation:

And I must be honest: I am also a bit irritated that Amazon, a business which is almost 30 years old and one of the major corporations in the world, is failing once again to be profitable. On the other hand, it is good to invest in the future, and we should be confident these investments will pay off.

And in my opinion, we must be really cautious not to get sucked in by a baseless optimism. What if Amazon is not able to increase its margins and if it will struggle to be profitable? What if these high investments will also be necessary in the future and without high investments Amazon will suddenly report only mediocre growth rates and still low margins? What if Amazon has created a cut-throat industry with extremely low prices, quick shipping, and great customer services, but companies that will struggle to be profitable?

I honestly don’t think this is the case, but I am wondering more and more why Amazon can’t manage to be profitable and invest at the same time. And once again, while Amazon is clearly a high growth company and was a great investment in the past decade, growth rates are not outstanding. Among the major technology companies (and the list is certainly subjective), Amazon performed more or less in line with Alphabet and clearly outperformed Apple. But all other selected companies could report higher revenue growth rates.

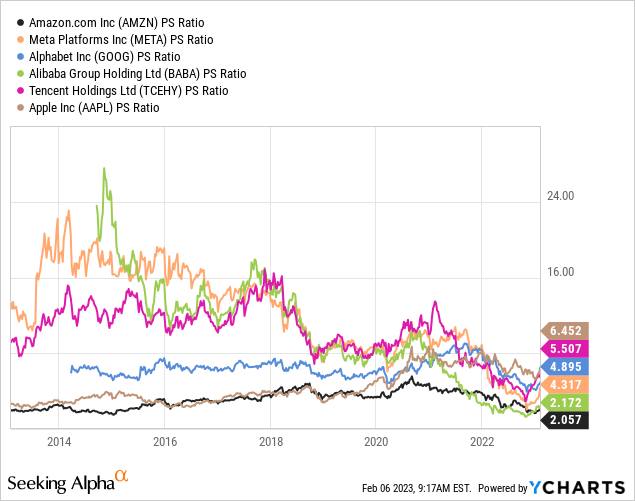

And compared to Amazon, these are highly profitable companies, with much higher margins and the ability to generate huge amounts of free cash flow. The only bright spot for Amazon: It is trading for the lowest price-sales ratio among these six companies. But that is more than justified as Amazon has the lowest margins among these businesses. Only if we consider it realistic for Amazon to catapult its margins in similar regions as its peers, we could really talk about a bargain.

Bullish Side

And while I am quite sceptic, one can also make rather bullish arguments about Amazon. We all know that Amazon has been able to grow its core business with a high pace but was seldom profitable. AWS is mostly responsible for the operating income Amazon is generating. And over time, Amazon added several services to its core business that might driver profitability – aside from AWS, we should mention subscription services, third-party seller services and advertisement services.

When looking at the fourth quarter results, we see the core business struggling. Reported sales in online stores declined and could grow only 2% when excluding FX effects. On the other hand, subscription services increased 17% YoY (excluding FX effects). And especially advertisement sales could grow 23% YoY (FX-adjusted) which is especially interesting. In times when other businesses, which are depending on advertising revenue, were struggling, such growth rates are worth noticing as it is implying that Amazon might be able to gain market shares in the advertising business. Alphabet for example could report only a top line growth of only 0.96% in the last quarter and Meta Platforms had to report a 4.5% decline (two businesses which are heavily dependent on advertising revenue).

Amazon could actually use its retail presence only as platform to sell its other services, which are profitable and could be high margin businesses. Like consulting firms are offering low-margin services just to have a foot in the door and sell high-margin consulting contracts. And Amazon could certainly generate high margins with its subscription services or third-party seller services.

And I could not find out of third-party sellers, subscription services and advertising services are generating an operating income (as Amazon does not disclose this information as far as I can tell). But I would assume these three segments could be highly profitable in the years to come. And AWS, subscription services as well as third-part seller services are also rather sticky businesses with Amazon being able to increase prices quite easily. Although Amazon might have trouble to be profitable selling its own items, it could become very profitable for third-party seller services. As Amazon is offering one of the best e-commerce platforms in the world sellers will have a hard time to switch to another platform – the network effects are too strong. And with referral fees being between 8% and 15% right now what would sellers do if Amazon is increasing these fees to 15% or 20%?

Intrinsic Value Calculation

As I have mentioned above, Amazon is reporting neither a price-earnings ratio nor a price-free-cash-flow ratio right now (at least not useful numbers). Instead, we can use a discount cash flow calculation to determine what free cash flow Amazon must generate in the years to come to be fairly valued right now. As always, we assume a discount rate of 10% and the number of diluted outstanding shares is 10,308 million right now.

Let’s be optimistic and assume Amazon will follow Mark Zuckerberg and 2023 will also be the year of the efficiency and we take $26.96 billion in free cash flow as basis in our calculation (the highest amount Amazon could report so far). Amazon still must grow between 12% and 13% annually for the next ten years followed by 6% growth till perpetuity to be fairly valued (10% discount rate). And when looking at past growth rates this should be no problem for Amazon. On the other hand, 12% to 13% growth are rather high rates and not necessarily the growth rates I would calculate with. And when calculating with these assumptions, Amazon would only be fairly valued.

When comparing Amazon with Meta Platforms once again: Meta Platforms must grow its current free cash flow only in the mid-single digits to be fairly valued and in case of Meta Platforms we are using a depressed free cash flow of the last four quarters and not cherry-pick the best number of the past. Amazon might be a great business with a wide moat, but there are still better investments out there.

Conclusion

And like I pointed out in my last article, I see further downside risk for Amazon. I identified two support levels for the stock – between $65 and $72 as well as a much lower target around $45. Right now, I am certainly not willing to buy Amazon for a higher price than $70 and I don’t know if I will already pull the trigger at that price level. As long as Amazon is not declining about 30% to 40% from its current price levels, I would rather look at stocks like Alphabet (which could be a better investment) and Meta Platforms (which is most likely undervalued).

Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.