Summary:

- Although Amazon Inc stock is rapidly approaching its all-time highs (6% left to reach a new ATH) and its multiples look very high, the company seems undervalued to me.

- In fact, Amazon’s total return has been positive at just 5.2% since the start of the “mini-crisis of 2022”. And its fundamentals have improved significantly.

- As Amazon shifts focus from retail to AWS, it aims to stabilize margins and revenue growth, reducing business cyclicality and risk. This shift could sustain a premium to the current valuation.

- AWS should remain perhaps the most obvious go-to solution for AI firms, in my view. The effects of this development can already be seen in the latest order backlog figures.

- I expect AMZN to reach the $210-$220 per share range by the end of 2024 or early 2025, allowing investors to earn even more than the current 15%+ YTD. So Amazon is a ‘Buy’ to me today.

Alex Wong

My Investment Thesis

Although Amazon.com, Inc. (NASDAQ:AMZN) stock is rapidly approaching its all-time highs (6% left to reach a new ATH) and its multiples look very high, the company seems undervalued to me for several reasons, which I’ll discuss in more detail below.

My Reasoning

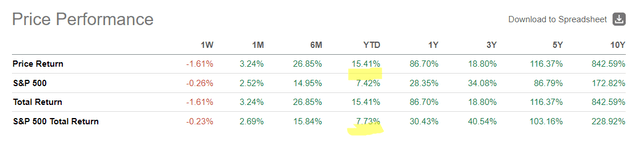

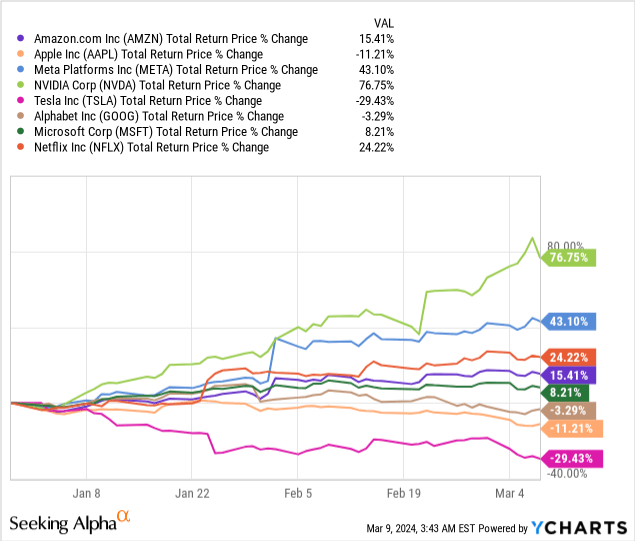

As for most of the “Magnificent 7” stocks, 2024 started very well for Amazon stock – it’s up 15.41% YTD, beating the S&P 500 Index (SPX) (SP500) by 768 basis points (comparing total returns):

As Charlie Bilello’s December 2023 newsletter clearly showed, AMZN’s recovery began in 2023 after a disastrous 2022 when the world was in supply chaos, hurting Amazon’s revenues and bottom line. At the same time, the tight monetary policy led to a serious multiple contraction, not letting the stock sustain its momentum. So cumulatively, based on 2022-2023 results, AMZN’s total return amounted to -8%:

Charlie Bilello’s newsletter [December 2023], Oakoff’s notes![Charlie Bilello's newsletter [December 2023], Oakoff's notes](https://static.seekingalpha.com/uploads/2024/3/9/53838465-17099737921625283.png)

After Amazon finished 2023 with the fourth-best performance among MAG-7 companies, the rally continued in 2024 with the same sequence, except that Netflix (NFLX) became the next-best outperforming stock instead of Tesla (TSLA).

Thus, we can say that Amazon’s total return has been positive at 5.2% since the start of the “mini-crisis of 2022”.

It would be logical to assume that now that AMZN is finally in the black, the fundamentals should have at least slightly improved since the end of 2021 – or hopes for future growth should at least have remained at the same level. Unsurprisingly, this is exactly the case: moreover, the company’s fundamentals and the reasons to be optimistic have improved significantly.

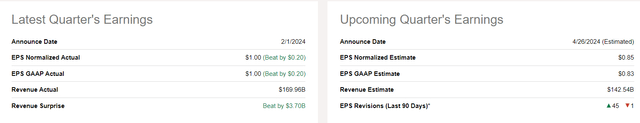

Based on the Q4 FY2023 released on February 1, 2024, Amazon’s revenue of $169.96 billion marked a 14% YoY increase from the previous year’s $149.2 billion. Sequentially, sales also rose by 19%, so the growth rate seems to be only accelerating as of late. This revenue surpassed the upper end of the management’s guidance range ($160-$167 billion) and exceeded the consensus estimate by around $3.7 billion, according to Seeking Alpha data. Also, Amazon’s GAAP EPS for Q4 was $1.00, contrasting with $0.03 in the same period last year; the business turnaround seems to be gaining momentum.

During the earnings call, the CEO Andy Jassy said that the regionalization of the U.S. fulfillment network resulted in record-fast package delivery times and reduced delivery costs. Amazon set new sales records on Black Friday and Cyber Monday, thanks to strong customer engagement. Although the international segment reported a loss (albeit with a narrower margin than the previous year), sales in North American retail (AMZN’s largest market segment) increased by 13% YoY and reached an all-time high in operating profit.

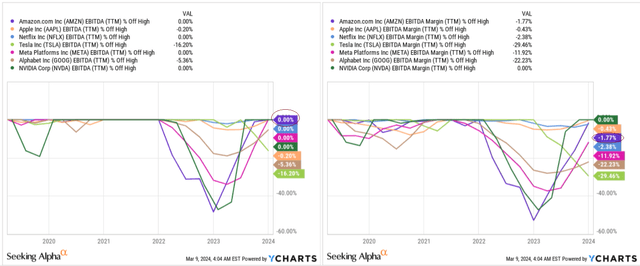

As for the company’s margin recovery momentum, Amazon is actually one of the fastest-growing companies among the ‘Magnificent 7’ group, with TTM EBITDA volumes already at a new record. What strikes me about this whole story is the depth of the EBITDA decline from which the company has had to recover.

I expect that instead of “recovery” we will soon be calling what is happening at Amazon something like “new horizons”. By this I mean that as the company reduces the cyclical nature and over-reliance of its business on retail and focuses on developing AWS, the growth of its margins and stability of topline expansion should become the norm and remove unnecessary risks, potentially maintaining a premium to existing valuation multiples. This is one of the main reasons why I believe that Amazon is still one of the most promising companies among the famous seven.

It’s also important to note, that the company’s non-goods services, such as subscription services, AWS, and advertising, recorded healthy year-on-year growth of 17% and contributed 30% to total revenue. While subscription services grew modestly, advertising saw a robust growth of 27%.

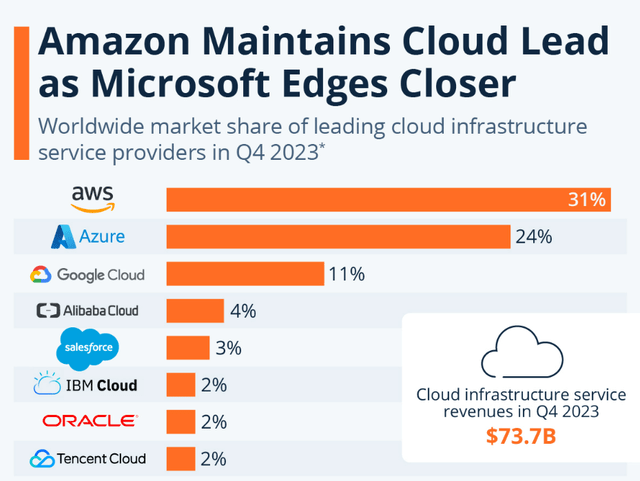

As analysts at Argus Research noted in their February note on the company (proprietary source), while AWS’s revenue growth and margins have slowed, this segment has regained momentum amid the AI mania. AWS now has more than $90 billion in annual revenue and is approaching $100 billion quite fast. So as the number one cloud service provider, AWS is positioned for long-term growth as the era of AI keeps going.

With great confidence, we can say that AWS’s market position is the key to Amazon’s success in the long term, as more and more AI-related companies choose AWS as the main provider of AI foundation models. The company is aware of this and is therefore happy to invest in the creation of new capacities in order to maintain existing demand and keep up with new demand.

In fact, generative AI is expected to contribute to the significant growth in the global GDP of up to US$7 trillion over the next 10 years. As such, AWS is investing US$100 million into the recently announced Generative AI Innovation Center, a program to help customers build and deploy Generative AI solutions.

Source: TechWire Asia

At the end of 3Q23, Amazon announced a $4 billion direct investment in Anthropic, a provider of foundational AI models that will use AWS for model training and deployment, and plans to offer its models to AWS customers through Amazon Bedrock (provides secure access to the industry’s top foundation models).

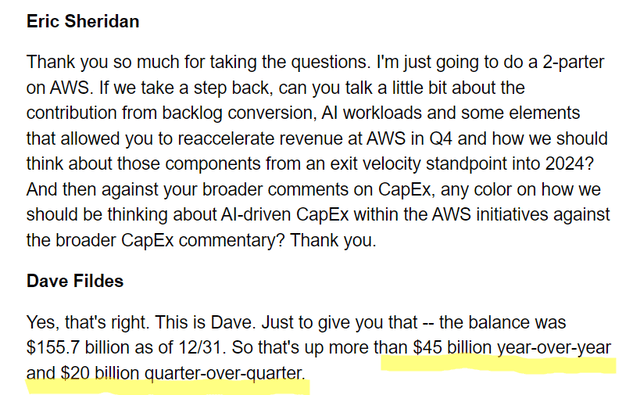

I assume that this AI momentum will be difficult to stop – today different industries are simply in a frenzy to optimize their processes and use their data as much as possible for business decisions. As long as this is the case, AWS should remain perhaps the most obvious go-to solution, in my view. The effects of this development can already be seen in the latest order backlog figures, which rose by $23 billion QoQ or $40 billion YoY (reaching $155.7 billion in Q4 FY2023), which management attributes to the signing of numerous important new contracts.

AMZN’s Q4 FY2023, earnings call, Oakoff’s notes

Incidentally, AWS was able to maintain an EBIT margin of 30% for the second quarter in a row, which I consider to be a very important achievement for the company.

From all this, I make an interim conclusion that the likely acceleration of AWS sales and the stability of margins will remain unchanged – this is another reason why I consider Amazon to be a very interesting pick among other megacaps.

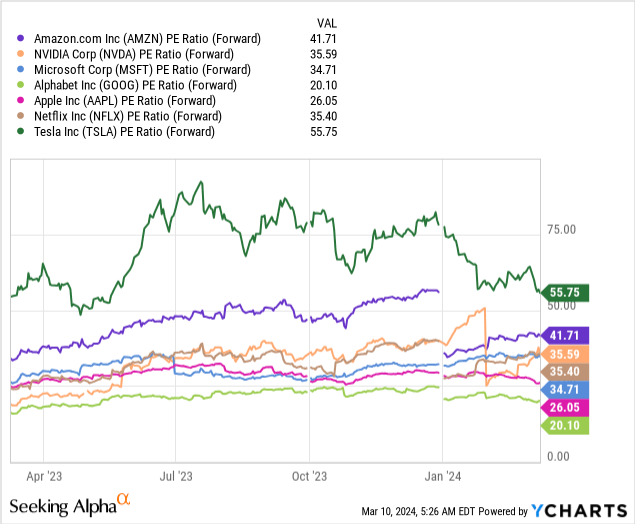

With all this in mind, I would now like to discuss the valuation of the company. You probably noticed the title of this article. I truly believe that AMZN is the cheapest company among the other “Magnificent 7” stocks. You might be wondering why that is, because Amazon’s P/E ratio is the second highest in the sample after Nvidia’s:

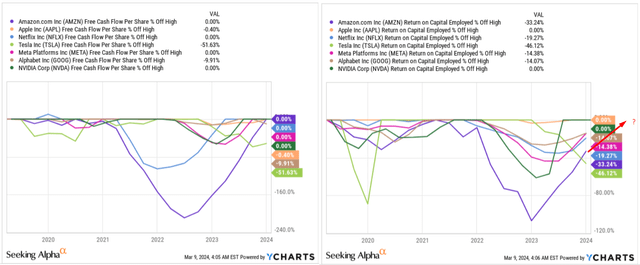

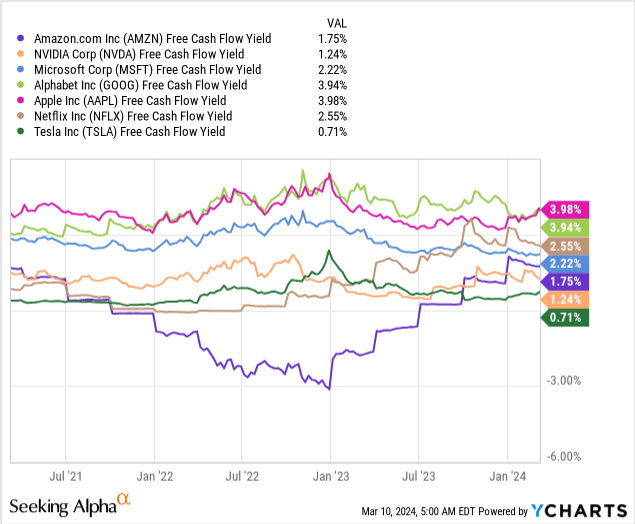

Yes, but the P/E ratio is by far the only thing investors should pay attention to. Let’s recall why we buy equities in the first place. The theory says that we buy them for the sake of future dividends. What is the driving force of future dividends? It’s the free cash flow and its strength. When you look at AMZN’s FCF of just 1.75%, it’s hard to call the company cheap. But watch the momentum: while most companies have been stagnant on this metric since the beginning of last year, Amazon’s FCF yield has been growing stepwise and without interruption, indicating the quality of the business recovery I’ve written about before.

The company very quickly reached its peak in terms of FCF per share, while its profitability still lags about 1/3 behind what it once was at its historical maximum. As AWS evolves and Amazon continues to improve the quality of its supply chains and tries to manage costs more efficiently, I expect the top in ROCE is also about to be reached shortly.

The continued recovery growth in ROCE and ROE that I expect justifies the company’s current valuation and even makes AMZN somewhat cheap compared to its peers in my view.

My conclusions about Amazon’s undervaluation are confirmed by the calculations of the analysts of the major banks. Goldman Sachs was one of the first to react to Q4 FY2023 (proprietary source), updating their price target to $220/sh. from $200/sh. previously. According to their DCF model, the base case scenario assumes 3 years of year-end forecasts with a sales CAGR of 10.4%, resulting in an undervaluation of ~25.5% (adjusted to the last closing price) – that’s against the backdrop of a discount rate of 12%.

GS [February 2024 – proprietary source]![GS [February 2024 - proprietary source]](https://static.seekingalpha.com/uploads/2024/3/10/53838465-17100651029087682.png)

Argus Research analyst Jim Kelleher, CFA also stated that Amazon stock should trade around the $210s given its comparable valuation multiples.

AMZN trades at 48.8 times our 2024 GAAP EPS forecast and at 43.1 times our 2025 GAAP projection. The two-year forward P/E of 45.9 is below the trailing five-year multiple (2019-2023) of 67.9. Additionally, the relative P/E of 2.4 on our two-year average EPS forecast is lower than the historical relative P/E of 3.5. Our historical comparables valuation sits in the $210s, following an upward trend and surpassing current levels.

I expect AMZN to reach the $210-$220 per share range by the end of 2024 or early 2025, allowing investors to earn even more than the current 15%+ YTD.

Risks To My Thesis

The biggest risk to my thesis lies in my assumptions about Amazon’s rising sales and stable margins. Yes, the broad diversification of the business undoubtedly benefits the company, but in moments of a supply chain crisis, as was the case recently, or a slowdown in the growth of the cloud business, my conclusions could become irrelevant.

This leads to another risk – the sensitivity of my conclusions about the company’s undervaluation is too great to ignore. Pay attention to the results of the Goldman model and its bear-case scenario. The 49% downside (adjusted to the last closing price) is a real risk to consider.

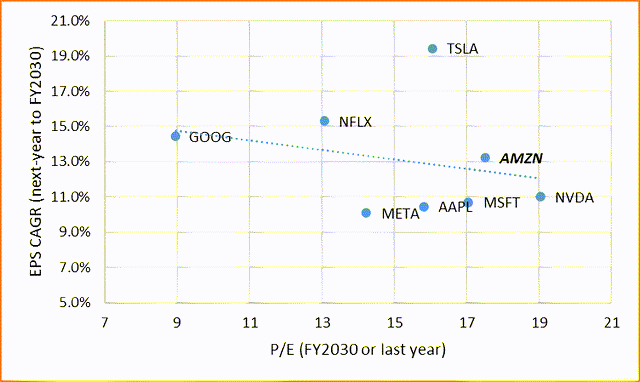

Another concern I had after working with Seeking Alpha Premium’s data is the likelihood that the stock is already ahead of itself. If you put Wall Street’s consensus EPS growth (long-term CAGRs) on the Y-axis and implied P/E ratios on the X-axis, AMZN looks overvalued compared to Google (GOOG) or Netflix, let alone Tesla:

Seeking Alpha data, Oakoff’s notes

Your Takeaway

My thesis cannot be described as risk-free – especially not today when mega-caps make up a great share of the entire stock market and the “top-10 relative values” reach those of 20-25 years ago. Nevertheless, I believe that Amazon’s “recovery growth” should soon turn into “just growth”: Margin expansion is likely to continue as management has worked to optimize the retail segment and is also doing everything it can to boost AWS growth amid the AI trend we see around us today. At the same time, AMZN stock is up only about 5.2% since the 2022 crisis, which still doesn’t reflect what the company is really capable of. The fair valuation of Amazon stock, in my opinion, is in the $210-220 range, which implies a median growth potential of ~22.6%. That’s what I’m hoping to see over the next few months.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.