Summary:

- Cisco has partnered with Nvidia to help enterprises deploy AI infrastructures more rapidly while its acquisition of Splunk could be completed by the middle of this year.

- Nvidia’s witnessing high demand for its H100 GPUs also plays to the advantage of Cisco’s hyperscale-over-Ethernet AI switch and I identify around $3 billion of sales opportunities.

- The Splunk acquisition should help grow the topline as the cybersecurity market adapts to new dynamics because of the high cost of capital.

- On the other hand, this bullish thesis is also based on demand for Cisco’s products like Nexus and Meraki picking up in the fiscal year 2025, after slumping for the last 2-3 quarters as customers consume inventories.

- A lot will also depend on how Splunk is integrated as there are some overlaps in observability, but, there is potential for cost synergies.

rvlsoft/iStock Editorial via Getty Images

While all eyes are on Cisco Systems (NASDAQ:CSCO) boosting capabilities in cybersecurity with the Splunk (SPLK) acquisition, less attention has gone to the partnership with Nvidia (NVDA) for deploying artificial intelligence, as illustrated below.

With its multiple roles as a networking company, provider of monitoring, and end-point solutions to address IT risks, without forgetting that this is also an OEM (original equipment manufacturer) for servers, it stands to benefit as the semiconductor giant’s AI chips gain wider adoption.

Thus, besides the merger with Splunk, this thesis aims to value Cisco based on additional AI-related sales opportunities thanks to its networking gear being a key component for Nvidia’s chips to be used in enterprise data centers.

Opportunities in Ethernet AI fabric as Nvidia Sells more H100 GPUs

During Nvidia’s latest financial results for the fourth quarter of 2024, data center revenues came at $18.4 billion, or about $1.2 billion higher than what was expected by analysts. Equally important, for the first quarter of 2025 it guided $24 billion of sales or $2.1 billion higher than estimated earlier.

This shows insatiable demand for its newest Tensor Core GPUs or the H100 accelerators, which are essential building blocks for Generative AI infrastructures. However, from the stage where the H100 is shipped to customers till it can be used to build large language models or LLMs which then give birth to interactive applications like ChatGPT, a lot of work needs to be done and approaches differ.

In this respect, some customers namely the large CSPs (cloud service providers) like Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOG) (GOOGL) are buying Nvidia’s DGX AI Supercomputers which include a cluster (or several) of H100 chips grouped with the storage and required networking to ultimately host them in data centers operated by collocation providers like Equinix (EQIX) or Digital Realty Trust (DLR).

On the other hand, according to Data Center Frontier, not all customers are adopting this approach, which is analogous to buying a packaged solution. This is especially so for enterprises that, instead of acquiring a DGX H100 costing more than $450K, especially at a time when the cost of capital remains high, prefer to buy discreet Nvidia’s H100 to eventually integrate them into their specific data center setups. In this way, they maximize the value of their investment by adding AI capabilities on a per-need basis.

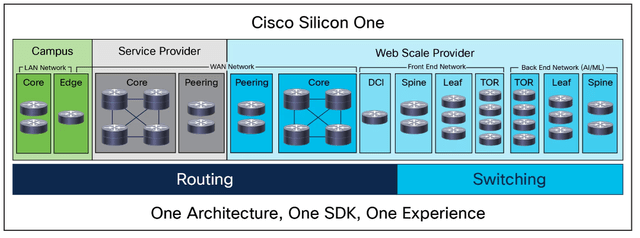

In this context, unlike CSPs that are purchasing the DGX and also inherit Nvidia’s proprietary InfiniBand interconnection technology as part of the package, enterprises opting to acquire H100s to fit in servers supplied by their OEMs need networking based on the Ethernet. For this matter, Cisco can address the interconnection that needs to be done between clusters of H100s. This is different from conventional IT workloads whose connectivity needs are already supported by Nexus or Meraki products.

Therefore, Nvidia’s clients who want to connect clusters of H100s to deliver high-speed switching (with low latency) needed for AI models to function optimally and according to their data center standards can use Cisco’s hyperscale over Ethernet AI fabric, a functionality provided by the Silicon One switch.

Looking across the industry, there is competition from other suppliers like Arista Networks (ANET) and HPE (HPE) but, according to its CEO, Cisco differentiates itself as its switches consume relatively less power.

Moreover, since Ethernet is something that data center professionals are already well acquainted with (in contrast to InfiniBand), around $1 billion of related orders were obtained in the first quarter of fiscal 2024. This number may have increased by three times or $3 billion by the second quarter with deliveries to be effected in fiscal 2025.

Opportunities in Servers, Security, and Splunk for Observability

Pursuing further, Cisco is also an OEM just like Super Micro Computer (SMCI) or Dell (DELL), and as such, can work with any GPU manufacturer including Advanced Micro Devices (AMD), or Nvidia. The latter’s GPUs are available in Cisco’s M7 generation of UCS rack and blade servers, for supporting AI and data-intensive workloads. Additionally, Nvidia’s CUDA (Compute Unified Device Architecture) programming software which is popular among AI developers can be purchased through Cisco.

The agreement with Nvidia also creates opportunities for Cisco’s security.

Thus, with more AI workloads residing both in corporate data centers and in the public cloud, monitoring solutions like ThousandEyes (acquired by Cisco in 2020) help in deriving AI-driven insights together with the possibility of automated problem remediation. Staying within the realm of AI, there is the Cisco Observability Platform for leveraging data from logs and other sources to discover problems before they interrupt services.

Going a step further, by acquiring Splunk, Cisco is getting its hands on a company that initially specialized in the analysis of system logs, before shifting towards observability and security. Thus, this acquisition is aligned with its strategy to build a full-stack observability service after previously acquiring AppDynamics and other related companies.

Pursuing further, in an economic context characterized by higher cost of capital and where spending patterns may be shifting from multi-vendor to single-sourced to benefit from bulk purchase-related discounts, this acquisition makes sense. In such a context, it appears normal for Cisco to maximize the number of functionalities it can offer to the same customer ranging from detection and response to threats to the prediction and prevention of risks. Moreover, since its Secure end-point protection currently trails CrowdStrike’s (CRWD) Falcon as per Gartner, acquiring Splunk could be a way to compensate by owning a broader portfolio of cybersecurity products.

However, on a cautious note, heavy-weight Palo Alto (PANW) now offering free products and services in trials to lure customers after a soft guidance that saw its share price suffer shows that the dynamics could change in the industry. Also, for a price of $28 billion, or at a hefty 31% premium relative to Splunk’s pre-deal prices, this remains an expensive transaction and some may find it better to wait for the integration process to work out, namely in addressing the issue of overlapping (observability) products.

On the other hand, Cisco could constitute an opportunity given Splunk’s revenues could offset the demand softness it has been witnessing for the past two to three quarters and there are indications that European regulators, which are normally stringent, may not object to the deal with a possibility of the approval obtained on Wednesday this week. If this happens, then the transaction could be closed within the first half of this year.

Valuing Cisco in Light of Acquisition and AI-related Sales while Not Forgetting Risks

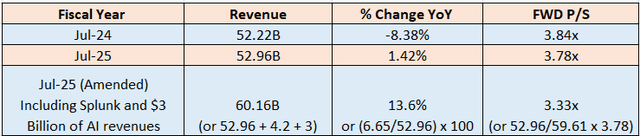

Considering that Splunk generated $4.2 billion during its last fiscal year ending January 2024 together with an estimated $3 billion of AI-related sales identified earlier that could make their way into its FY-2025 income statement, I think Cisco’s YoY revenue could surge to 13.6%, up from the current consensus estimate of 1.42% as tabled below. This could in turn moderate Cisco’s forward P/S from 3.78x to 3.33x.

Table built using revenue estimates from (www.seekingalpha.com)

Well, this is still higher than the median of 2.95x for the IT sector, but, with double-digit growth, it is likely for analysts to upgrade revisions which would be positive for the stock. Thus, based on the FY-2024 topline consensus being downgraded by 5.6% (from $57.87 billion to $54.61 billion) causing a 10.5% downside on November 16, a 13.6% upgrade could produce the opposite effect for FY-2025, or a 21% upside, or double the 10.5% figure. Incrementing the current share price of $49.5 by 21%, I have a target of $59.9.

However, this upside is conditional to demand for its products (including networking, security, collaboration, and observability) picking up in FY-2025 as expected. To this end, according to the management during the second quarter’s earnings call, customers were still digesting the inventories they hastily built after the supply chain disruptions of 2020-2022 that followed soon after the COVID-19 pandemic. In my bullish thesis of June 2022, I detailed how the company would benefit from such a normalization, and the stock has climbed by 15.6% since.

Now, these large inventories are expected to be consumed only by the end of the current fiscal year which ends in July 2024 and demand from CSPs and telcos is expected to resume in the first half of fiscal 2025. Consequently, in case of any delay in demand picking up and analysts downgrading their revenue expectations for FY-2025 accordingly, do expect volatility.

Cisco is a Buy As New Opportunities Offset Soft Demand

Still, I remain optimistic for the following three reasons.

First, with the hyperscale over Ethernet AI fabric pipeline growing 300% in the space of just one quarter and demand for Nvidia’s GPUs being sustained, Cisco could see more orders. For this purpose, AMD which could emerge as the most likely competitor for Nvidia also supports an open Ethernet interface, as opposed to proprietary switches using InfiniBand.

Second, even if companies like Super Micro and Dell may have a head start as OEMs as detailed in a recent thesis, one cannot ignore an all-rounder like Cisco, especially with the Nvidia partnership which could see more demand for its AI-driven observability solutions together with some server tailwind.

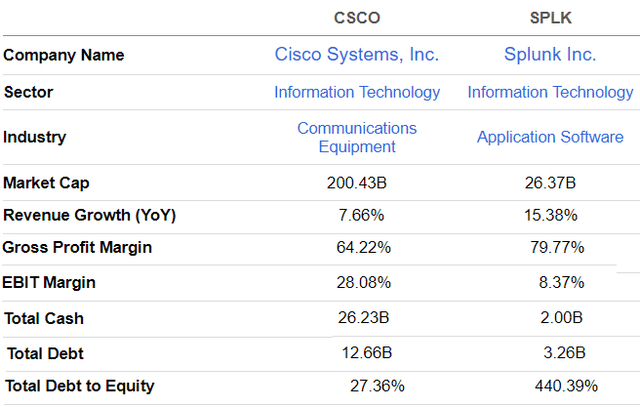

Third, as a high-growth company as shown in the table below, Splunk can contribute to Cisco’s topline. Additionally, its gross profit margins of nearly 80% show high efficiency in platform service delivery, but most of this is eaten away by relatively high operating costs (which include marketing and administrative expenses) resulting in EBIT margins of only 8.4%. This is an area where there is potential to generate cost synergies, notably by using Cisco’s global sales channel to distribute Splunk’s products at scale. This signifies that, as a result of no longer having to fund large sales teams, the merger can trim marketing expenses considerably while Cisco’s partnership with Nvidia also opens more avenues for Splunk’s products.

Comparison of key metrics (seekingalpha.com)

Looking at Cisco’s balance sheet, with more cash than debt as shown above, this means that the deal need not be entirely financed using debt. Also, Splunk carries a net debt of $1.26 billion or a total financing cost of approximately $29.26 billion (28 + 1.26). Finally, Cisco boasts a debt-to-equity ratio of only 27.36x, and it can also offload some overlapping observability-related assets to alleviate the balance sheet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.