Summary:

- Amazon’s stock has lost more than half of its value in 2022, and the stock has now produced zero returns over the last four years!

- In this note, we will analyze Amazon on a multitude of factors, including the nature of its business, financial performance (current and projections), valuations (relative and absolute), and technicals.

- Despite near-term macro headwinds likely to persist in 2023, I like the risk/reward on offer at these levels. Hence, I rate Amazon a strong buy at $83 per share.

4kodiak/iStock Unreleased via Getty Images

Introduction

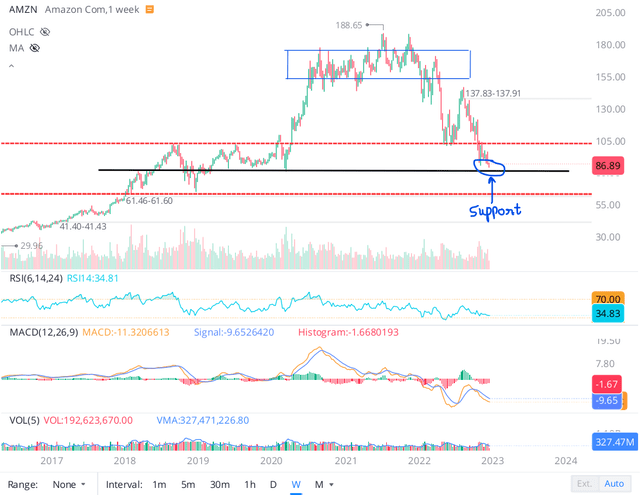

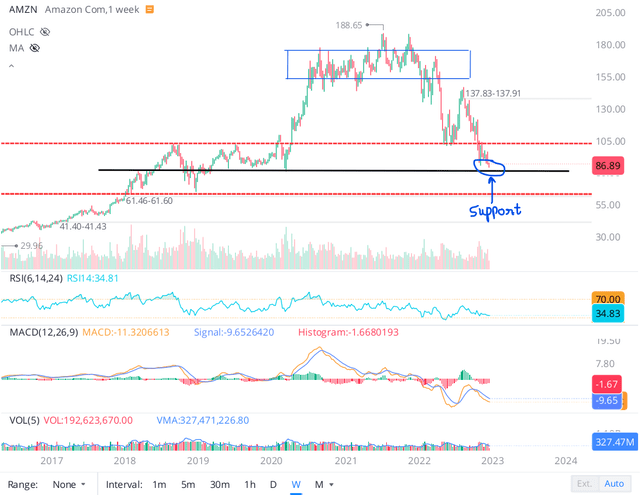

In 2022, high-flying technology stocks have suffered an absolute rout, with rising interest rates playing the role of gravity. Amid this rout, Amazon’s (NASDAQ:AMZN) stock has been cut in half. After a stunning rally in early 2020, Amazon’s stock traded in a box pattern for nearly 12 months, with a couple of fake breakouts to the upside.

WeBull Desktop

However, the final resolution of this pattern was to the downside, and Amazon is now sitting close to multi-year support at $80. Zero returns, yes, you read that right – Amazon’s stock has generated zero returns over the last four years. During this period, Amazon’s TTM Revenue has increased ~2.5x to $502B, and operating cash flows have gone up significantly.

While interest rates are certainly driving a valuation moderation across the tech universe, Amazon’s underperformance is also a function of slowing revenue growth in the post-pandemic world and margin compression from a heavy CAPEX-spending cycle.

With the Fed tightening aggressively into a deeply inverted yield curve, a richly valued equity market faces the double whammy of a multiple contraction and an earnings recession in 2023. As discussed in one of my recent notes, the S&P 500 (SPX) is trading at a forward P/E of 18.5x [historical average is ~16x], and earnings are likely to come in lower by 15-20% in a garden-variety recession. While a recession is never a certainty, it is getting likelier with each passing day as the impact of tighter monetary policies from central banks is felt across the global economy.

I recently laid out my 2023 forecast for tech stocks in the following note:

In this note, we will analyze Amazon on a multitude of factors, including the nature of its business, financial performance (current and projections), valuations (relative and absolute), and technicals, to see if it is a good buy at current levels.

Let’s start our analysis by discussing Amazon’s business.

Nature of Business

Over the last two decades, Amazon has been a true force of disruption. Today, Amazon is the industry leader in several markets – e-commerce (retail), cloud computing, media, and digital advertising.

While we won’t be able to go into all the nitty gritties of Amazon’s business today, you can find my extensive coverage on Amazon on Seeking Alpha:

With a potential recession on the horizon, Amazon’s exposure to secular growth industries like e-commerce and cloud computing renders it a defensive technology play. Now, Amazon’s cloud, e-commerce, and digital advertising businesses are not immune to the macroeconomic environment, which means Amazon will be adversely impacted during a recession too. However, the consumer and enterprise demand risk for Amazon is much lower than other tech titans like Tesla (TSLA), Apple (AAPL), Meta (META), or Alphabet (GOOG).

With the FED hell-bent on fighting inflation, I think Jerome Powell and Co will eventually break something in the economy, causing a severe recession over the next twelve months. However, in a recession, industry leaders like Amazon are likely to take more market share from rivals. From a business standpoint, Amazon sits at the heart of several secular growth trends, and I don’t see why it won’t be a dominant player in its markets in the long run.

Now, in my view, Amazon’s days of rapid sales growth are over. Going forward, I expect Amazon to be a low-growth business (secular compounded with ~5-10% revenue growth per year). That said, Amazon is going to be a spectacular operating leverage story over the next five years with healthy growth in higher-margin businesses (i.e., cloud computing [AWS] and digital ads) powering margins (and, by extension, earnings and free cash flow) higher.

Financial Performance And Liquidity

In this section, we will review Amazon’s recent financial performance, liquidity, and future projections to gauge the underlying strength of its business.

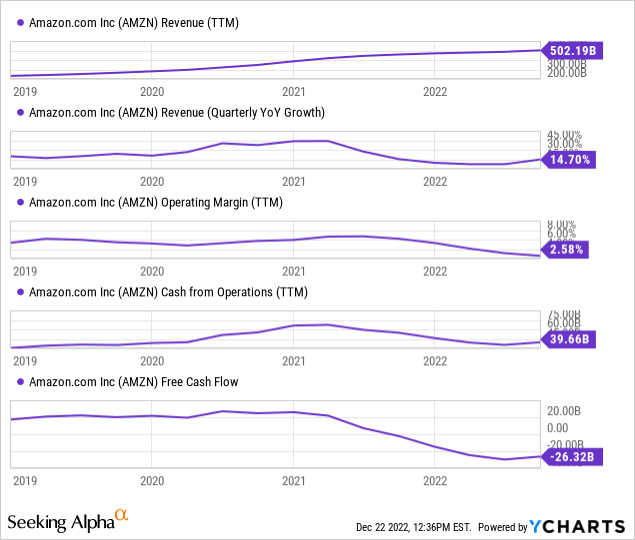

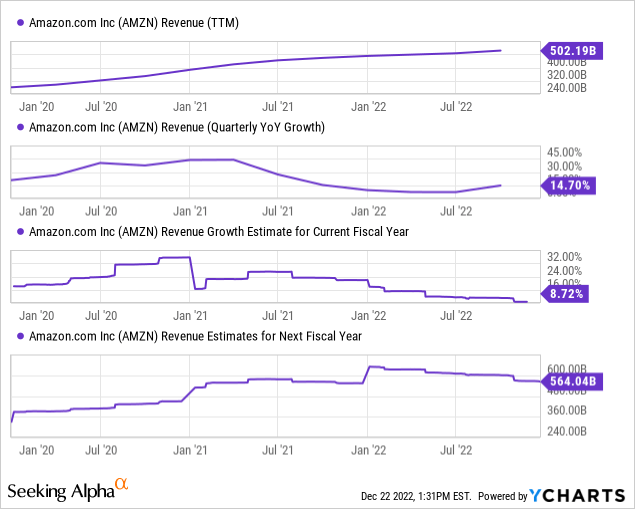

Over the last twelve months, Amazon’s sales growth slowed down to single digits as trends in e-commerce reversed after the pandemic boom. While Amazon’s cloud and digital ads businesses have been pillars of strength during this difficult period, the challenging macroeconomic environment is taking its toll on the growth there too.

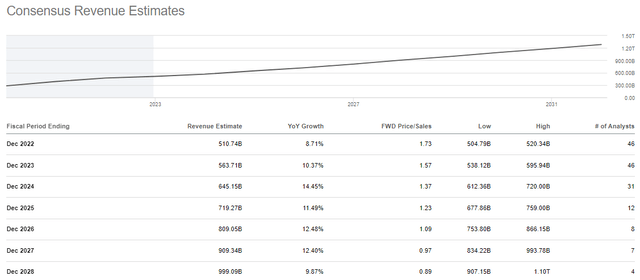

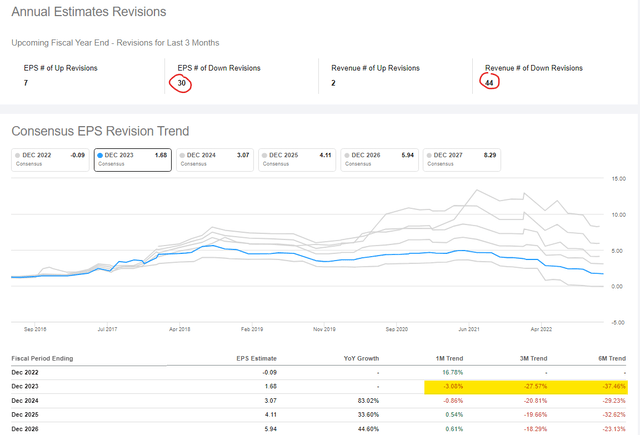

As you can see on the chart above, Amazon’s growth rates have been decelerating for nearly two years now. And consensus analyst estimates for the current fiscal year have declined in recent weeks. That said, Amazon’s revenues are expected to grow by ~10.4% in 2023 (from a 2022 base of $510.74B), which is somewhat of a re-acceleration.

SeekingAlpha

Clearly, Amazon has now entered mature growth phase. Over the next decade, I see Amazon growing revenues at ~5-10% per year. However, the story going forward is all about operating leverage. As Amazon’s higher-margin businesses (i.e., cloud and digital ads) take up a greater share of the revenue mix over the coming years, Amazon will experience gross and operating margin expansion.

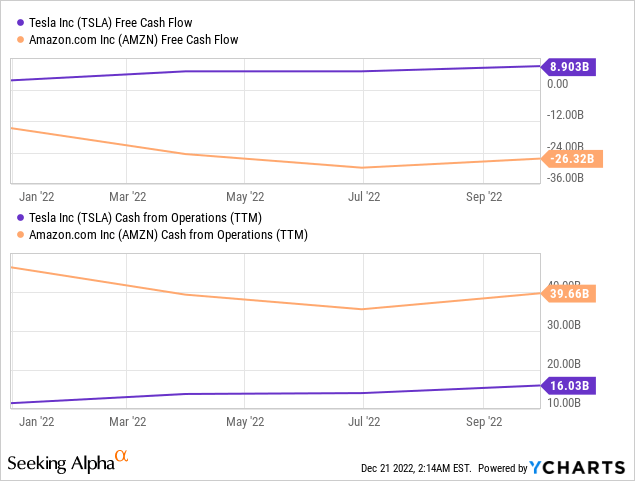

Asset prices are derived by calculating the net present values of their free cash flows, and hence, free cash flow (and growth thereof) is the most important metric for any business. Over the last twelve months, Amazon reported (negative) -$26B in free cash flow. And suddenly, the stock getting cut in half makes a lot of sense.

As revenue growth rates hit a snag over the last couple of years or so, rapidly-growing costs (heavy spending on people and infrastructure in a costly investment cycle) have resulted in Amazon turning free cash flow negative. However, Amazon’s TTM Cash Flow from Operations stands at ~$39.66B, which means the business is still profitable from an operational standpoint. With Amazon exiting its heavy spending cycle, it is expected to deliver positive FCF numbers in 2023.

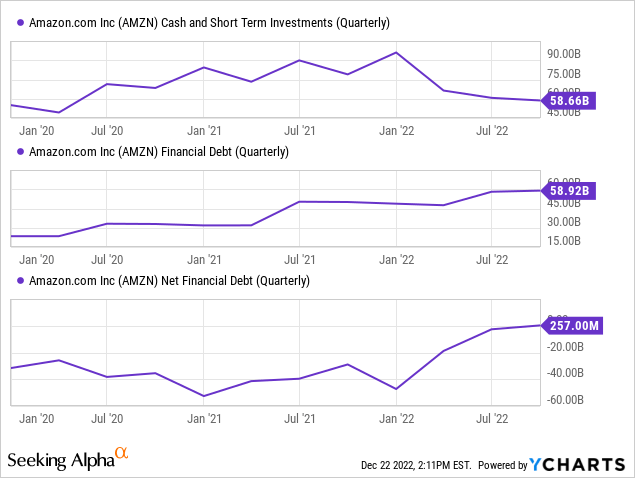

The inflection in cash flows is critically important for Amazon because its liquidity position is not as strong as it used to be. After having a net cash position of ~$50B in early 2021, Amazon has burned through this cushion completely. As you can see above, Amazon has ~$58B in cash and short-term investments and ~$58B in financial debt. Hence, Amazon’s net cash position is virtually zero.

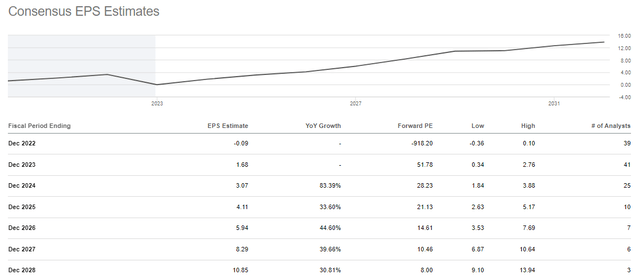

Based on financial performance and liquidity status, Amazon seems to be on shaky ground. However, the future outlook for earnings remains bright. Over the next five years, Amazon’s EPS is projected to grow to $8.29, representing rapid earnings growth.

SeekingAlpha

Over the next decade, Amazon is going to be an incredible free cash flow machine as the company’s focus shifts from sales growth to margin optimization and efficiency.

Suppose Andy Jassy and Co were to adopt shareholder-friendly capital return programs akin to Apple (AAPL) and Microsoft (MSFT). In that case, Amazon’s stock can deliver robust returns for investors buying in at current levels, but we will discuss this subject another day. For now, let’s refocus on Amazon’s outlook for the next year.

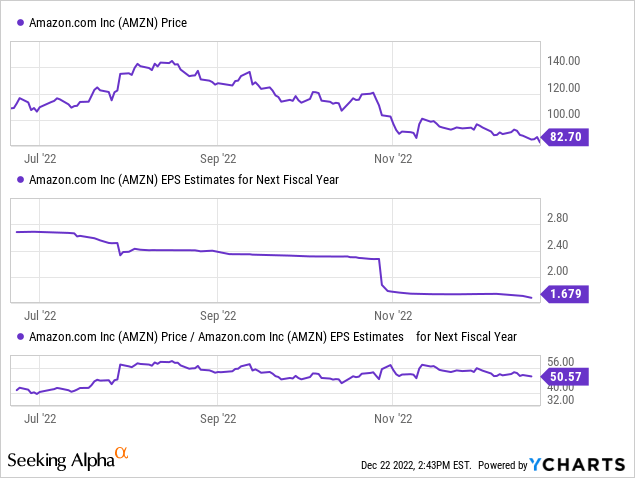

Amazon’s consensus analyst EPS estimates for 2023 have been going lower throughout 2022. The trend in projected earnings has been negative for months, with the 2023 EPS estimate being down by ~37% from where it was just six months ago.

Seeking Alpha

Heading into 2023, Amazon is expected to post positive EPS of $1.68 next year. However, in the event of a recession, things could change very quickly, and as with any Wall Street estimate, these projections should be taken with a pinch of salt.

Now, let’s review valuations to see if the current entry point is a buying opportunity or not!

Amazon’s Valuation [Relative And Absolute]

For 2023, the consensus analyst EPS estimate for Amazon currently stands at $1.68. Based on this estimate, Amazon is trading at ~50x forward P/E. With future revenue growth rates of ~10% per year, Amazon’s stock looks expensive based on trading multiples.

However, Amazon will be coming out of a heavy investing cycle next year, and so, we will not be done with the temporary EPS compression in 2023. If we look at Amazon’s 2024 projected EPS of ~$3.10, Amazon is trading at ~27x earnings. Now, even this valuation doesn’t look cheap on a relative basis, with S&P500 (SPX) trading at ~18.5x forward earnings.

From a relative valuation standpoint, Amazon looks expensive; however, let us now consider its absolute valuation.

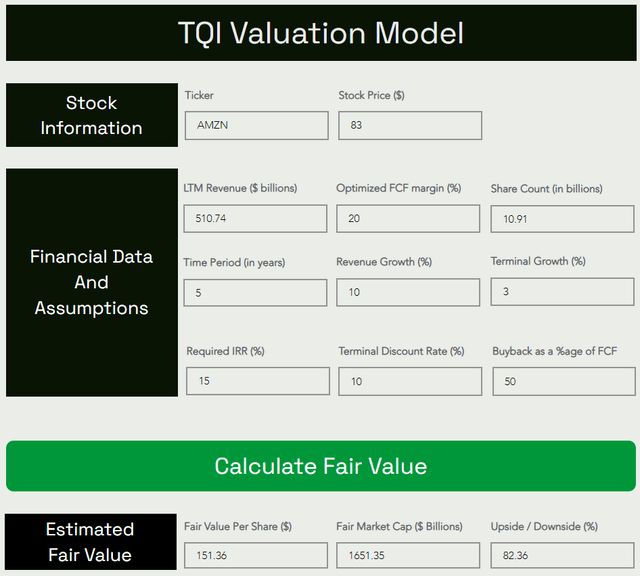

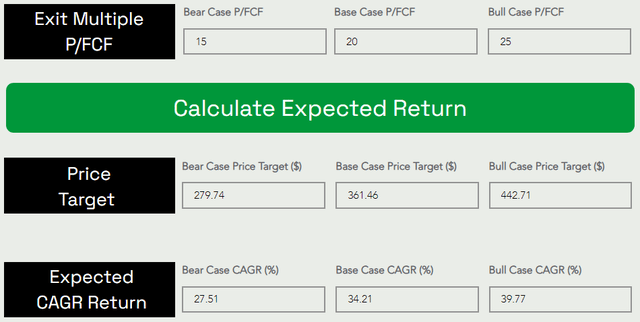

TQI’s Fair Value and Expected Returns for Amazon, Inc

TQI Valuation Model (TQIG.org)

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Amazon is worth $1.65T (or $151.36 per share), which means the stock has an upside of ~82% to its fair value.

With 5-yr expected CAGR returns of ~34.2%, well ahead of my investment hurdle rate of 15%, I think Amazon is an asymmetric risk/reward opportunity for long-term investors.

Technical Analysis For AMZN

With Amazon down ~50% year-to-date, it is fair to assume that we are going to look at a broken chart. However, we must still analyze the chart to get a sense of the current entry points.

As we discussed earlier, Amazon’s stock has fallen back to 2018 levels over the last year or so. After a stunning rally in early 2020, Amazon’s stock traded in a box pattern for nearly 12 months, with a couple of fake breakouts to the upside. However, the final resolution of this pattern was to the downside, and Amazon is now sitting close to multi-year support at $80.

WeBull Desktop

If the support at $80 were to break down, the $60-$65 range would be the next notable support level. While the downtrend in Amazon’s stock is firmly intact, and the stock may go lower in the near term, I think the risk/reward for long-term investors getting in at current levels is highly favorable.

Key Takeaway: I rate Amazon a “Strong Buy” at current levels, with a preference for staggered accumulation.

As always, thank you for reading, and happy investing. Please feel free to share any questions, concerns, or thoughts in the comments section below.

Disclosure: I/we have a beneficial long position in the shares of AMZN, TSLA, GOOGL, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our marketplace service – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

TQI’s core idea is to generate wealth sustainably through tailored portfolio strategies that meet investor needs across different investor lifecycle stages. Each of our five model portfolios comes with thoroughly vetted investment ideas, embedded risk management, and specialized financial engineering for alpha generation.