Summary:

- Amazon.com, Inc. is the largest ecommerce company in the world and continues to build out its Prime ecosystem.

- Its cloud business, AWS, is the market leader and continues to grow at a rapid pace, while driving the majority of Amazon’s profits.

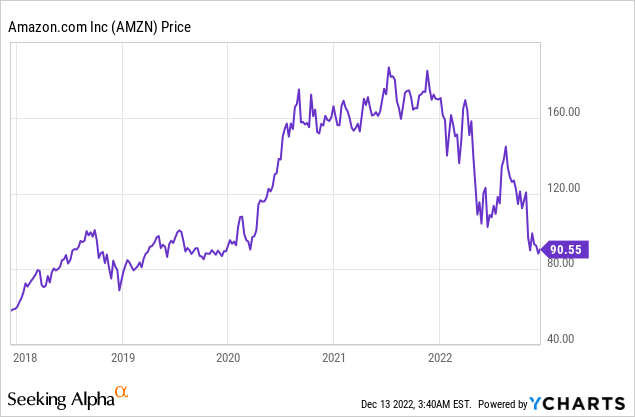

- Amazon stock is deeply undervalued at the time of writing and its stock price trades at similar level to 2018.

HJBC

Amazon.com, Inc. (NASDAQ:AMZN) is the world’s largest eCommerce company and the market leader in cloud infrastructure. The business benefited massively from the lockdown in 2020, as physical retail was closed and people had no choice but to shop online. The stock price more than doubled between the $89 low in 2020 and the $183 high in November 2021. However, since that point the stock has given up all of its gains and now trades at ~$90 per share. This is a “ridiculous” price, given this is the same share price as in 2018. While Amazon’s sales have more than doubled from $233 billion in 2018 to $502 billion in the trailing 12 months. In this post, I’m going to break down Amazon’s financials and valuation, while also discussing its new CEO. Let’s dive in.

New CEO – Andy Jassy

I have received a lot of questions on whether Andy Jassy becoming CEO will impact the future of the company as it is no longer “founder-led,” which is a key part of my investment criteria. Here is what we know so far, in July 2021 founder Jeff Bezos stepped down as CEO and Andy Jassy took the top spot. In a recent interview (November 2022) at a New York Times Event, Jassy tells the story of the transition. Jassy was apparently “shocked” when Bezos informed him that he wanted him to take the top spot. He didn’t accept the position straight away and had to “discuss it with his wife” first. This could be the first red flag in my eyes, as despite my understanding that people’s wives do have a major influence on their lives, the fact he wasn’t hungry for the role is a little concerning. The “hunger,” drive, and vision is what makes great founders great, think about Elon Musk and his drive to do whatever it takes to transform the company. However, Jassy does have a lot of positives, firstly he joined Amazon way back in 1997, just a few short years after its founding in 1994. Andy Jassy joined as a Harvard MBA graduate when Amazon “just sold books” and has been with the company ever since. However, Andy Jassy’s major achievement is the fact that in 2003, he and Bezos came up with the idea of Amazon Web Services [AWS], which was launched in 2006. Andy Jassy headed up the first team of just 57 people and grew the business to become a $60 billion titan and the key profit driver for Amazon even today (which I will discuss more on later). Therefore, in terms of experience and credentials, it is difficult to doubt that Andy Jassy has played a major part in Amazon’s success.

In my opinion, he hasn’t got the charisma and public speaking quality of Bezos but he still is well respected in the company. So to conclude, I would say Jeff Bezos is “better” and I would much rather him to be the CEO. However, Jassy is not a bad alternative. My issue is Amazon is currently going through one of its most challenging periods, despite Jassy seeming like a “nice guy.” I am not sure if he has the cutthroat ability to inspire the company as Bezos has. A positive for now is Jeff Bezos is still the executive chairman and speaks “almost weekly” to Jassy, this is a positive sign as having a mentor like Bezos is fantastic.

Third Quarter Financials

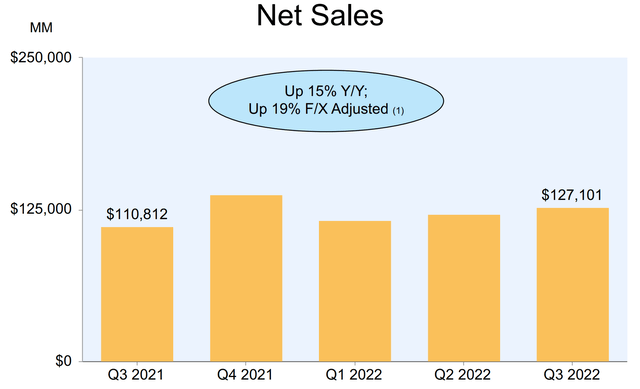

Amazon reported tepid financial results for the third quarter of 2022. Net Sales were $127.1 million, which rose by 15% year over year but came in below analyst consensus estimates by $370 million. The company faced headwinds from “unfavorable” FX exchange rates, as the strong dollar caused international revenue to decline by 5% to $27.7 billion. On a constant currency basis, international sales increased by a solid 12% year over year, and net sales by a greater 19% year over year.

Breaking down the results by region, North America continues to be Amazon’s strongest market contributing approximately 61% of revenue and growing by 20% year over year to $78.8 billion. The bias towards North America is actually a positive sign for a number of reasons from geopolitical volatility to exchange rate exposure.

Amazon has built up a vast ecosystem of third-party sellers which drive ~58% of total paid units sold on the platform. This is a key point to note as even during tough economic times, these sellers will still be on the platform, active and ready to supply more goods as economic conditions improve.

Amazon Prime also continues to provide more value to customers. The benefits include free, fast delivery, Prime reading and a lightweight version of Prime Music. Amazon Prime Video looks to be a key driver of growth as the company has invested heavily in content. Its flagship originals series “The Lord of the Rings: The Rings of Power” had a staggering 25 million viewers on its launch day. But more importantly, the series generated more Prime signups than any other Amazon Original. This is a positive sign, but I wouldn’t like to see Amazon getting on the “content treadmill” and basically being stuck in a cycle like Netflix. I would personally prefer to see them license content or acquire a TV studio/brand to handle this part of the business.

Jeff Bezos on Twitter promoting Lord of the Rings (Twitter)

Cloud is Still King

The “cloud” has become a popular buzzword, but I personally believe most people don’t actually know what is it, so here is my simplified explanation to help you guys out. The “cloud” basically refers to a footprint of data centers owned or leased by a cloud provider such as Amazon Web Services [AWS] in this case. The idea is to basically offer “computing as a service.” Traditionally large organizations have an on-premises or “on-prem” data center or server room that is used to house all of its “compute” and “storage” functions. From a server that is hosting the company’s website, to databases and applications. However, the issue with this model is it isn’t very scalable and also requires regular maintenance. Therefore, by “digitally transforming” to the cloud, companies can effectively take advantage of the unlimited scalability via a pay-as-a-use, consumption model. This makes it a no-brainer for larger organizations as they can improve business performance and ultimately save cost long term, if they have a business with varying demand.

Amazon Web Services has also built out a humongous portfolio of products on top of its platform. This includes machine Learning, Artificial Intelligence, and even Satellite Communications as a Service.

AWS Services (AWs)

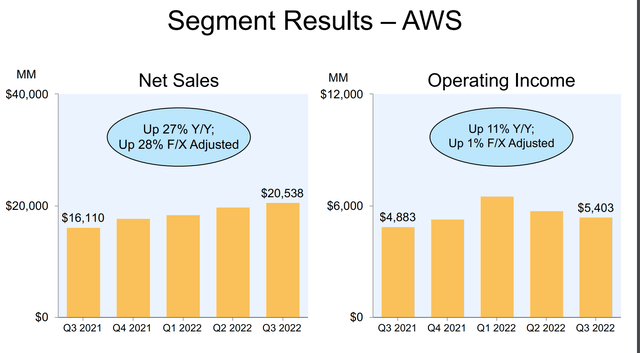

AWS has historically been the fastest-growing part of Amazon’s business and it continues to perform strongly. In the third quarter of 2022, the company reported $20.5 billion in revenue, which increased by a solid 28% year over year. The company also reported $82 billion annualized revenue run rate which is astounding. AWS continues to drive strong profits and generated $5.4 billion in operating income which increased by 11% year over year.

Profitability and Expenses

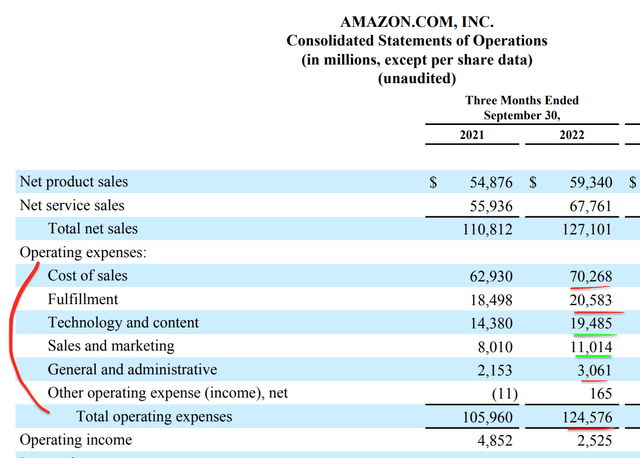

Amazon reported an atrocious 48% decline in net income, from $4.9 billion in Q3,21 to $2.5 billion in Q3 ’22. This was driven by a 17% increase in operating expenses which rose to $124.6 billion. This was further caused by a series of inflationary factors such as higher oil, freight, and labor costs. This resulted in fulfillment costs increasing by 11% year over year to $20.6 billion. Amazon’s e-commerce business runs at tight margins, as the company gives back a lot of its benefits to customers in a virtuous cycle. However, when costs rise the business feels the pain. A positive is management is focusing on addressing the issue and have announced a series of cost-saving initiatives, which are expected to save ~$1 billion.

Amazon Expenses (Q3 ’22 report)

Sales and Marketing expenses also increased by a substantial 37% to $11 billion. I suspect this was mostly due to the launch of new products, Prime video series etc. Sales & Marketing are discretionary expenses for the most part and thus I don’t deem this will be a major issue, assuming the company is generating positive ROAS (Return on Ad Spend) long term.

Technology and Content expenses increased by a substantial 45% year over year to $19.5 billion. This was driven by Prime Video content, AWS product investments, and the launch of new regions such as the Dubai AWS region. Investments into these factors are not necessarily “bad” assuming the company generates a return long term.

Amazon has a strong balance sheet with $58.6 billion in cash and short term investments. The company does have high debt of $164 billion but “just” $4.5 billion of this is current debt, due within the next two years, and thus is manageable.

Advanced Valuation

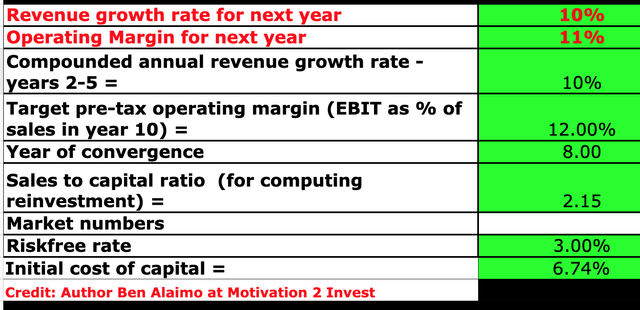

I have inputted Amazon’s financials into my discounted cash flow (“DCF”) model. I have forecasted 10% annual revenue growth over the next 1 to 5 years. This is fairly conservative given prior growth rates of above 15%. I expect the cloud business to continue to grow at a rapid pace, and Amazon’s marketplace place to recover as consumer demand improves.

Amazon Stock valuation 1 (created by author Ben at Motivation 2 invest)

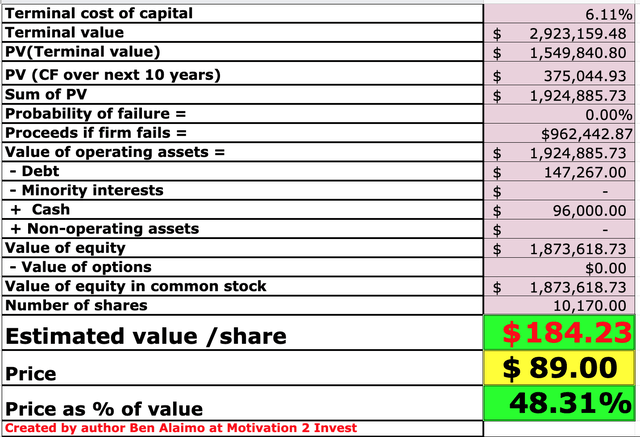

I have also capitalized Amazon’s R&D expenses, which has moved these expenses to the balance sheet and boosted the net income. Over the next 8 years, I have forecasted its operating margin to increase by 1%. This is fairly conservative as the increase could easily be over 5%, as the company is executing a series of cost-saving programs. In addition, I expect inflationary effects to reduce over time as the Federal Reserve raises interest rates.

Amazon stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these financials and forecasts, I get a fair value of $184 per share. Amazon stock is trading at $89 per share at the time of writing and thus is ~52% undervalued.

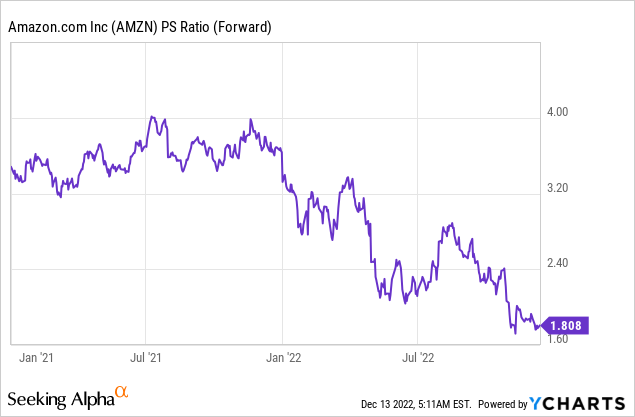

Amazon is also trading at a Price to Sales ratio = 1.8 which is ~51% cheaper than its 5 year average.

Risks

Recession/High Inflation environment

Many analysts are forecasting a recession in 2023, due to the high inflation and rising interest rate environment. This means Amazon is likely to continue to fast cost pressures and consumer demand is likely to wane.

Conclusion

Amazon is an outstanding company and arguably one of the greatest businesses that has ever existed. However, the company does have fundamental issues with its fulfillment center and cost structure. Its crown jewel is AWS, as this is the rapidly growing, highly profitable portion of the business. I would love to invest into AWS alone, and have written past posts which urged Amazon to spin off this unit. However, if we have to invest into the entire company, it is undervalued substantially right now. Things could get worse before they get better, but long-term, Amazon is in a formidable position.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.