Summary:

- China sales data continues to disappoint.

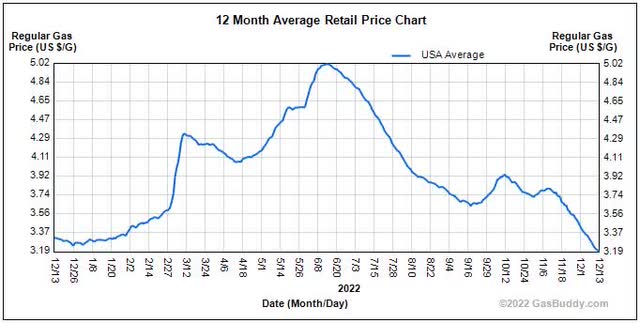

- US gasoline prices continue to fall.

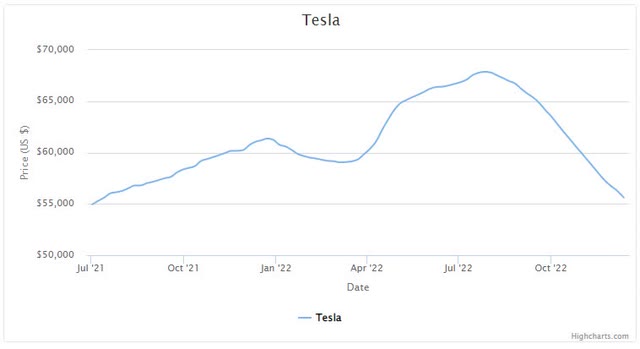

- Used Tesla prices dropping to a multi-year low.

Spencer Platt

Last month, I detailed three key risks I was watching for electric vehicle giant Tesla (NASDAQ:TSLA) as the year came to a close. With the stock near its multi-year low, these headwinds could cause some problems in the new year if they did not improve rather quickly. Unfortunately, recent trends are only getting worse, making management’s upcoming pricing decisions in the next couple of months even more interesting.

Let me first start in China where Tesla seems to have a demand problem. The company has already reduced Model 3 and Y prices this quarter and has implemented various additional incentives as the company’s EV subsidy is set to expire in less than 3 weeks. There are also reports circulating about production cuts, but Tesla has refuted those for now. Each Tuesday we get weekly insurance data, and key Tesla watcher Troy Teslike said that 16,000 units would be as expected for the latest period. Unfortunately the actual number came in just under 13,000 vehicles, falling well short of expectations. It will be interesting to see how pricing fares in the coming months if sales continue to be sluggish.

Another issue I detailed previously was the drop in US gasoline prices. As oil prices have fallen to new 52-week lows recently, prices at the pump have also come down considerably. Since my previous article, the national average has dropped by nearly 50 cents a gallon, with the expectation that we’ll see a 2 handle on the average before the end of the year. As the chart below shows, we are nearing 40% off the peak.

US Average Gasoline Price (GasBuddy)

While electric vehicles will get a nice demand boost from credits in the Inflation Reduction Act starting in 2023, lower gasoline prices could certainly provide a headwind to demand, especially in the seasonally weaker winter months. There are also questions regarding Tesla demand among its core base given Elon Musk’s Twitter antics in recent weeks. As the CEO tries to get the social media site back on track, he appears to be offending more and more groups, hurting Tesla’s brand image in the process.

I also mentioned previously that used Tesla prices have been dropping in recent months. Part of this may be due to some of the items I mentioned above, but also the Fed’s ongoing actions to reduce overall inflation along with fears of an upcoming US recession. Since that article, the used Tesla vehicle index has come down by just over $2,000 as seen in the chart below, basically putting it at a 17-month low.

Used Tesla Vehicle Prices (CarGurus)

There was a time earlier this year where certain used Tesla models were actually more expensive than buying a new Tesla vehicle. Management has previously cited used car sales as a reason why Tesla’s services and other business have done well this year and margins in the segment have improved. With used prices now dropping, that could provide a small headwind to new car demand, and likely will impact margins on the used side a bit.

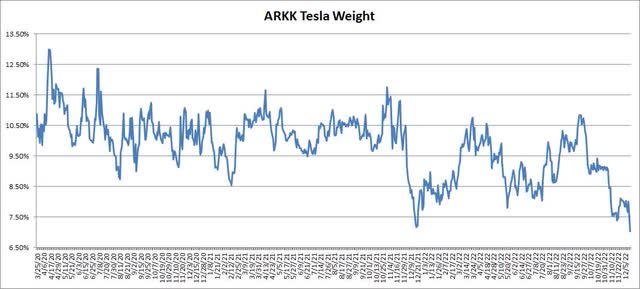

With all of the above-mentioned items swirling, Tesla shares have recently underperformed the markets. Shares on Tuesday morning hit a new multi-year low, and even some of the biggest supporters don’t seem to be doing much buying. As of about 10AM on Tuesday, Tesla’s implied weight in the flagship ARK Innovation ETF (ARKK) was barely above 7.00%, which would be the lowest number seen since I started tracking back in April 2020.

At its peak, as the chart below shows, Cathie Wood’s top ETF had nearly 13% of its assets in the name. Tesla’s implied weight in the ARK Next Generation Internet ETF (ARKW) would also be at a new low over that time at just 6.50%. Tesla shares have crumbled this year since Cathie Wood put a split-adjusted price target of more than $1,500 on the name. Tesla is no longer the top holding in these two Ark Invest ETFs, being the third largest holding in ARKK and 4th largest in ARKW currently

ARKK Tesla Weight (Ark Invest, Author Estimate)

In the end, things are not looking great for Tesla at the moment. Chinese registration data continues to disappoint as demand questions rise in the company’s most important sales market. In the US, falling gasoline prices could hurt EV demand, at a time where Elon Musk’s Twitter antics are not exactly helping. Used Tesla prices continue to fall as well, and one of Tesla’s biggest supporters doesn’t seem interested in buying currently. Shares just hit a new multi-year low, and how much more downside is ahead may depend on when some of these headwinds subside.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.