Summary:

- Amazon reported solid numbers for the fourth quarter, beating consensus estimates in most metrics.

- However, bears claim that AWS slowdown is devastating as well as the company lacks of showing sustainable profits.

- It seems like many market agents focus on the wrong valuation metrics and therefore draw a false conclusion about Amazon.

- 2023 has the potential to become a real Game-Changer, surprising Investors with strong Cash Flows after a poor 2022.

4kodiak/iStock Unreleased via Getty Images

In my latest analysis about Amazon (NASDAQ:AMZN) in October, I discussed why the Q3 numbers indicated an operating turnaround for the company in Q4 but mainly in 2023. With the latest presented numbers, I continue to stand by my view that 2023 will become a compelling year for Amazon despite macroeconomic concerns. While I have read many words of caution in recent days due to the lack of growth momentum and the high valuation, I believe that AMZN stock is currently very attractively valued. I will explain the details of my thesis below.

Q4 2022: Light & Shadow

The detailed numbers of their earnings report were sufficiently discussed on this platform so I am going deep into them. Despite I am personally convinced by Amazon, it would be ignorant not to note the obvious weaknesses of their report. That’s why I made an overview of factors that were convincing and which were not in their earnings statement.

Pros

- Total Revenues of 149.2b (8.6% YoY Growth) beating expectations by 3.4b and showing a sign of strength against growth concerns

- The Gross Profit growth rate of 16.5% was much higher than revenue growth as the service part further increases leading to a higher margin potential

- Operating Income grew 56% when adjusting it for a 2.7b one-time effect

- Third-Party Business grew 24% YoY is a crucial sign to further shift the focus of the retail business to this segment with higher margins

- Advertising grew 23% YoY despite an overall weak quarter and strongly outperformed Meta (META) and Alphabet (GOOG) (GOOGL) which presented declining numbers

- Fulfillment Costs were only up 3% YoY and lower than revenue growth indicating a slowdown in costs

- Operating Cashflow bounced back with an impressive 32% growth rate

- Meanwhile, CAPEX declined 12.4% indicating that the cost pressure an Amazon most likely saw its peak in Q2 2022

- As a result the most important metric Free Cashflow finally turned positive and tripled YoY to 12.5b

Cons

- While Revenue and Gross Profit grew, operating costs rose slightly more resulting in a decline of 21% to 2.73b, and showed that it is that easy for Amazon to lower their expenses. Mainly driven by Technology & Content

- An additional expense due to Rivian (RIVN) holding resulted in a 98% decline in Net income raising concerns about profitability

- AWS, the main growth and profit driver of the last week saw an alarming growth slowdown to 20% YoY well underperforming Google and Microsoft (MSFT) that reported 30% growth

- NA Business continues to lack showing profits as well as International Business widened its loss

- Additionally, International Sales declined YoY raising concerns about global expansion success

- TTM Free Cashflow still strongly in negative territory

- CAPEX remains at a very high level with 11% of total revenue

- Long Term Debt rose to 67b from 48.7b last year

- Cautious outlook for the first quarter of 2023

Sorting the points according to importance, I would say that the best bull factor was the Cash Flow Situation and the main bear factor was AWS’s growth slowdown. So I will discuss these two points briefly.

AWS Growth Slowdown: The Beginning of the End?

It has been the fear of investors for years, it was predicted for many years and now it has happened. The growth rates of AWS have now finally moved away from the 30-40% that they had been for years and now even the 20% mark is in danger. Additionally, the operating margin massively declined from nearly 30% to 24%.

Author‘s calculations

The cloud division has always been a guarantor for strong results and has already saved some of Amazon’s quarterly reports. But now that even this division is weakening, is the prospect of sustainable profits and growth going for the next years?

No major recovery seems realistic here in the short term according to the statements made in their conference call. Enterprises continue to optimize their cloud spending given the challenging macro-environment. Since this is not a one-time effect, management expects this development to be a headwind in the next quarter, harming AWS growth rates.

They are also indicating a further slowdown in Q1 as they mentioned that January growth was about 15-17% compared to last year’s Q1. With that said there might be the possibility that AWS can be flattish quarterly was a shock for investors to hear. possibility that AWS can be flattish quarterly was a shock for investor to hear.

This statement was the main reason why the share price dropped 8% in the regular session. Investors expected a growth decline but I suppose they did not expect the rates to come down that fast considering we had 40% growth rates in Q421. But in my opinion, many market agents draw the false conclusion that AWS came to an end with these numbers. So they are expecting a linear decline of AWS to minimal growth rates. I assume that the current development is just kind of a sign of cyclicality in the industry.

As the Cloud Computing market is now so well established among customers that the number of new customers cannot compensate for declining demand from existing customers for the first time. With this temporary saturation, competition is also increasing, which can be seen in the falling margins. While Amazon and Microsoft will get through this phase comfortably, many smaller players who have entered the market due to growth will not be able to maintain their prices. Defragmentation is coming. Gartner calls the current development “The end of the beginning of the initial cloud chapter”.

So despite the temporary weakness, cloud computing is far from reaching the end of its growth. Gartner expects cloud spending to double to over $1 trillion. As the market leader, AWS will escape this trend again and return to growth rates of 25% or even 30% in the next economic upswing. Therefore, one should not make the mistake of writing off AWS as a future growth engine despite the weak expected growth in 2023. It just became a bit more cyclical.

Cash Flow: The result of Cost Optimization

It is reasonable why management decided to use Free Cash Flow as the core metric to focus on because it represents the operating success of the company much better than net income. Although net income is mentioned far more often in articles than Free Cash Flow.

Nevertheless, 2022 was one of the most challenging years for Amazon where they have to deal with normalizing consumer demand while many external factors caused massive rising costs. I already mentioned in my recent analysis that CAPEX rose to 14% of total revenue while it was 6% back in 2019.

Free Cash Flow was negative $16b so it did not look bright but looking at the quarterly reports there is a clear tendency. Amazon took many measures with the target of cost optimization in the second half of 2022 which is already partly shown in the numbers. CAPEX declined this quarter for the first time YoY by 11% despite higher revenues. So the share of CAPEX went back to 11% of total revenue.

Cashflow & CAPEX quarterly (Author‘s calculations, Amazon earnings statements)

While operating Cash Flow showed also strong signs of recovery we likely see a stable amount of Free Cash Flow in 2023 after two years of depression. Even after lowering expectations analysts still expect 65% growth in Operating Cash Flows to $77b and a Free Cash Flow of $20b resulting in CAPEX of $57b. This would mean an 11% decline in CAPEX and further reduce the share of the revenue. Bears might claim correctly that 20b Free Cash Flow is still not impressive for a company valued at $1 trillion (P/FCF=50) but this is just the beginning.

Amazon refers in its call many times that they are trying its best to reach the efficient cost structures it had in 2019. Back in 2019, they had a Free Cash Flow Margin of 8% and CAPEX was 6% of total revenue. So that is still a long way to go but I believe this is a reachable goal. Let’s assume that Amazon can show up these values in FJ 2025. Referring to Analyst consensus total revenues of $708b is the target which would account for $56.5b Free Cash Flow. It would lower P/FCF to 17.7 which does not look that expensive anymore.

But I see still room to improve margins as the company continues to strengthen its share of service sales to retail sales. Even in their retail business they increasingly shift to third-party business which is much less capital intensive. So this development supports the thesis that Free Cash Flow margins can reach higher levels than in 2019. 10% should be possible in the near team while 12-14% is the aim in the long term depending bit AWS capital costs development. All in all, I believe investors should focus on Cash Flows instead of net income to decide if Amazon is a convincing investment.

Valuation

Market agents don’t get exhausted and continue saying Amazon is overvalued after each earnings call by quoting the P/E. The question is when has P/E ever been a reasonable metric in the past that justifies this comparison? The stock showed 0 correlation with this metric which either means investors were mispricing the stock for 20 years or P/E is just not a meaningful metric for Amazon.

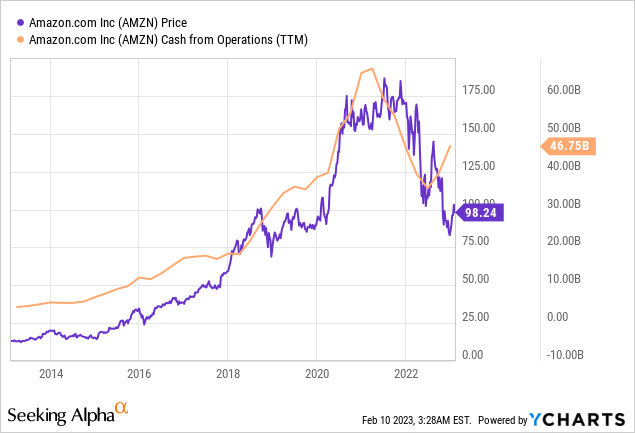

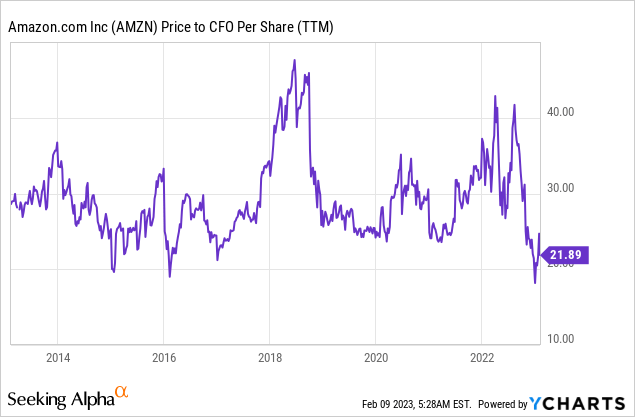

The much better metric is Price/Cash Flow from Operations since there is a decisive correlation between stock price and the value of Operating Cashflow as shown below other than net income.

Therefore P/CFO gives us a much better overview of the current Amazon valuation as it usually trades in a corridor between 20 and 40. Dips below 20 have been a great entry point in the last 10 years, most recently in December 2022. Currently, Amazon seems still cheaply priced at 21.9 and it does not even include the expected 65% growth in Operating Cash Flow for 2023 which would strongly lower this metric. Forward P/CFO is 12.9 a level only reached during the financial crisis.

Currently, Amazon seems still cheaply priced at 21.9 and it does not even include the expected 65% growth in Operating Cash Flow for 2023 which would strongly lower this metric. Forward P/CFO is 12.9 a level only reached during the financial crisis which makes Amazon look quite attractive at the moment. However, just using a single valuation metric is not helpful, so I present my updated sum of the parts model.

Sum of the Parts

| Revenue 2022 | P/S Multiple | Fair Value | 2023e Revenue | Fair Value 2023 | |

| Online Stores | $ 220.004 | 0.8 | $ 176.003 | $ 228.000 | $ 182.400 |

| Physical Stores | $ 18.963 | 1 | $ 18.963 | $ 18.800 | $ 18.800 |

| Third-Party | $ 117.716 | 2.5 | $ 294.290 | $ 124.000 | $ 310.000 |

| Subscription | $ 35.218 | 4 | $ 140.872 | $ 38.900 | $ 155.600 |

| AWS | $ 80.096 | 7 | $ 560.672 | $ 90.378 | $ 632.646 |

| Advertising | $ 37.739 | 6 | $ 226.434 | $ 47.500 | $ 285.000 |

| Others | $ 4.177 | 2 | $ 8.354 | $ 4.000 | $ 8.000 |

| $514.000 | $1.425.588 | $551.000 | $ 1.592.446 | ||

| Marketcap. | $1.000.000 | 43% | 59% |

I used pretty similar numbers to in my recent analysis but I lowered the multiples for AWS and Ads due to the expected cyclicality of the Cloud Business and macroeconomic uncertainty. Also, I lowered revenue expectations to emphasize the high potential of the stock despite cautious assumptions. The model indicates a strong upside of 60% for the upcoming fiscal year. Last but not least I present a discounted Cashflow model.

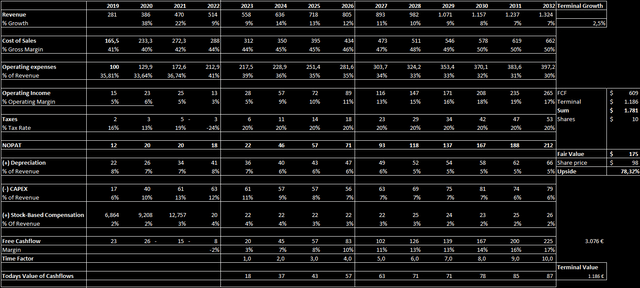

Discounted Cashflow

The model has the following assumptions:

- Weak sales growth in 2023, rebound in 2024 followed by declining growth rates

- Gross Margin can grow to 50% in 2032 due to higher service sales share

- Operating expenses reduce their share of total revenues to 30% as Amazon leaves the growth phase behind and reduces investments

- Tax Rate 20%

- The depreciation share of total revenue declines to 5%

- CAPEX can slowly bounce back to 6% of total revenues until 2032

- SBC stops its massive increases and remains relatively constant

- WACC of 10%

Free Cashflow Model Amazon (Author‘s calculations)

Discounted Cashflows indicate an upside potential of 79% which is in line with the other methods and strengthen the bull case for Amazon.

Favorite pick for 2023

All in all, I stick with my Strong Buy recommendation despite those mixed results in the fourth quarter. AWS’s growth slowdown is likely to stop in 2024 and Cash Flow Statement indicates that the company successfully initiated the turnaround after the poor year 2022.

The cost optimization programs, strong growth in Advertising, and the general shift to less capital-heavy businesses will ensure that Amazon will show up with strong Cash Flows and Operating Income.

Since this is just the beginning and 2024 might be even better, I am convinced that Amazon is a top investment and my favorite for 2023.

Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.