Summary:

- Unity stock has performed strongly in recent weeks even amidst a broader tech recovery.

- Management believes that it has worked past the operational headwinds it faced in 2022.

- The company has closed its acquisition of ironSource and is projecting positive cash flow generation in 2023.

- I discuss the stock’s valuation in light of the tough macro backdrop.

onurdongel/iStock via Getty Images

Unity (NYSE:U) has bounced strongly off the lows but remains a mere shadow of its stock price from only a year ago. At one point, the metaverse was a hot investing topic and U stood at the center of that. Now, the market is more focused on near term profits, something that the metaverse – and Unity – do not have. U is set to report earnings on Tuesday, February 22nd, with great volatility most nearly guaranteed heading into and out of that release. The latest report seemed to suggest that the company was finally moving past its operational deficiencies of 2022, but investors may be cautious considering the tough macro backdrop. U stock remains buyable here, but it is not for the faint of heart.

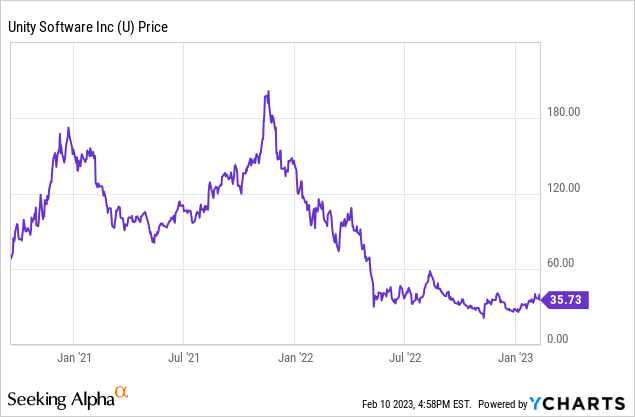

U Stock Price

U stock at one point broke $200 per share, seemingly trading out of the real world and into the metaverse. The stock has since crashed back down into the real world and down to earth.

I last covered U in November where I explained why I was buying heading into earnings. The stock has since returned 38% as a broader tech recovery and volatility boosted the stock. As the business recovers towards long term growth rates, there may be more upside ahead.

U Stock Key Metrics

The most recent quarter saw the company continue to struggle amidst its previous issues regarding monetization. Revenue grew by only 13% YOY to $322.9 million. While Create Solutions revenue grew by 54%, Operate Solutions revenue (where U earns a cut of in-game revenue) declined by 7% YOY. The dollar-based net expansion rate compressed from 142% to 111%. U also saw its non-GAAP operating margin loss increase from 2% to 12%. The company ended the quarter with a sufficient but not necessarily pristine balance sheet position of $1.3 billion in cash versus $1.7 billion in convertible notes.

Looking ahead, U is guiding for strong growth in the fourth quarter, with revenues growing 41% YOY and non-GAAP operating margins expanding to positive 3%. I note that this includes the now-closed acquisition of ironSource, and thus does not reflect organic growth rates. I estimate that this guidance implies “old Unity” to grow at a similar low-teens rate in the quarter.

On the conference call, management noted that they had increased prices of their products between 13% and 25%. Such price increases take time to show in the fundamentals due to the timing of contract expirations – management expects the impact to hit in 2023.

Management did state that the operational challenges previously discussed “have been addressed and are now in our rearview mirror.” Management also reiterated long term guidance for 30% sustainable growth, but noted that they will likely guide far below that number for 2023 due to the macro environment. Management continues to expect cash flow positivity by the end of the fourth quarter with $1 billion in EBITDA by the end of 2024 (this is a run rate number, not full-year 2024 guidance). The company issued 113 million shares and $1 billion of convertible notes to fund the ironSource acquisition. That implies around 562 million fully diluted shares outstanding (the company ended the quarter with 450 million fully diluted shares outstanding).

Why Is Unity Stock Rising?

That earnings report was positive but mostly in sentiment. This has been a market which has not been willing to trust in the long term but instead has been more focused on near term profits. That makes the stock’s strong performance since then rather puzzling. Maybe it had something to do with the company’s 200-plus job layoff in mid-January, most of which were related to the ironSource acquisition. Maybe it was due to the company’s new updates to their Supersonic platform to give game developers “increased access to data, insights, and knowledge.” In my view, the recent price action is very hard to explain and may be more random or due to the 10% short interest than anything else. I expect the upcoming earnings report to be the most important catalyst for near term stock price performance, as investors will be looking to see just how much macro will impact near term growth rates.

Is U Stock A Buy, Sell, or Hold?

Consensus estimates see sales rising 59% in 2023, but again – much of that will come from the ironSource acquisition. I estimate that ironSource alone was generating roughly 50% of U’s revenue base.

Seeking Alpha

Consensus estimates seem to also show little confidence in management’s belief that they can grow revenues at a sustainable 30% rate long term, as they call for mid-teens growth following 2023. If management can deliver against their long term promises, then consensus estimates will prove too low. On the other hand, the recent stock price rally has led the stock to trade at more rich valuations than just several months ago. I note that the above chart is using 450 million shares outstanding and does not yet incorporate the impact of shares issued in the ironSource merger. U is trading at roughly 9x 2023e sales. That valuation looks rich if consensus estimates are correct as the multiple is elevated relative to a mid-teens growth rate and the company is not yet generating robust cash flows to otherwise justify the multiple. On the flipside, that multiple looks undervalued if the company can really grow at a 30% sustainable clip for many years. I don’t see the stock returning to all-time highs so quickly, as it would need to trade at over 40x 2023e sales to do so. Based on projections for 30% long term net margins, 25% growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see U trading at 11.3x sales. That implies just around 20% potential upside over the next 12 months, with upside or downside to that number being mainly based on where growth rates end up.

What are the key risks? I see macro as being the biggest risk. I find it highly likely that U, like many tech peers, will give disappointing guidance for 2023. Businesses and consumers are pulling back spending amidst a tightening environment and this must impact U in one form or another. Another risk is that management’s guidance for 30% sustainable growth over the long term may be based on pure conjecture and have little reliability. It is hard to argue against such an argument considering that many tech names ranging from Okta (OKTA) to Twilio (TWLO) have had to walk back their own long term growth targets. While I find U buyable here, I note that the recent run-up has made the stock richly valued compared to peers and volatility is almost guaranteed, with any perceived disappointment likely to be demonstrated by violent selloffs in the stock price. The stock looks buyable for long-term investors, but those with a weak stomach may wish to stay away.

Disclosure: I/we have a beneficial long position in the shares of U, OKTA, TWLO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long all positions in the Best of Breed Growth Stocks Portfolio.

Growth stocks have crashed. Want my top picks in the market today? I have provided for Best of Breed Growth Stocks subscribers the Tech Stock Crash List Parts 1 & 2, the list of names I am buying amidst the tech crash.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks today!