Summary:

- Project Kuiper is Amazon’s effort to enter the satellite broadband business, which could be a large opportunity, but it’s taking too much of investor attention.

- Investor worries about Kuiper breaking the margin expansion story seem way overblown but reflect the importance of prudent expense management for Amazon investors.

- With a 20% earnings growth trajectory, Amazon’s current valuation is almost absurd, especially relative to peers like Walmart, Costco, and Apple.

- I reiterate a ‘Strong Buy’ rating ahead of earnings, with a price target of $260 per share by the end of 2025.

georgeclerk

Amazon (NASDAQ:AMZN) is set to report earnings Thursday, a quarter that will bring it one step closer to becoming the largest company in the world in terms of revenue.

And yet, a relatively small project, codenamed Project Kuiper, has been attracting much of the attention from investors recently.

This supports my long-held argument that the primary driver for Amazon’s future performance, by far, will be its ability to deliver consistent margin expansion.

So, let’s prepare for the upcoming report and answer the Kuiper questions.

Revisiting The Amazon Investment Thesis – Margin Remains King

I’ve been covering Amazon on Seeking Alpha since August of last year, maintaining a bullish rating throughout the period.

In a series of articles, I discussed Amazon’s vast opportunities in AI, its transition into its ‘Harvest‘ stage, the huge margin opportunity, and the market’s underappreciation of its long-term trajectory.

In short, after decades of jumping back and forth between investing and harvesting (mostly investing), I estimate that under Andy Jassy, Amazon finally reached the stage where it can strike a balance between both.

This means that I expect Amazon will be able to drive margin expansion through operational leverage and efficiencies while maintaining double-digit growth rates. This is the golden combination in investing, and it results in significant market-beating performance 99 times out of a 100.

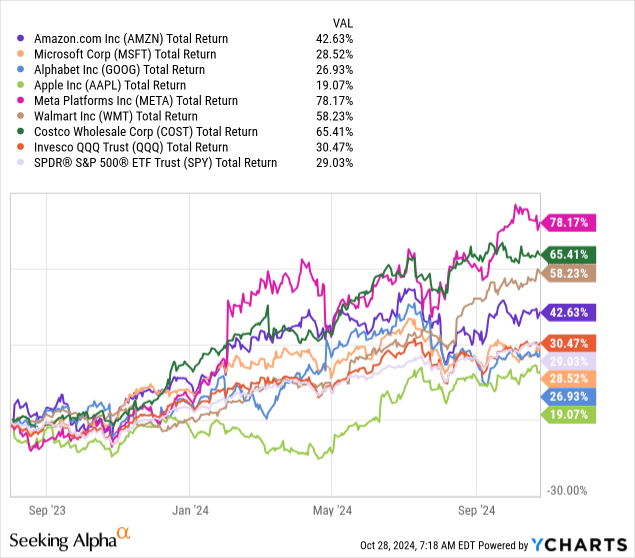

So far, we’ve been correct in our assessment, with Amazon handily beating the market and most of its peers since we initiated coverage:

However, as of late, the stock has been somewhat pressured. This can be partly attributed to large selling by Jeff Bezos every time the stock trades around $200.

But, the bigger reasons are growing concerns about capital expenditures, the near-term margin story, and specifically, Project Kuiper.

What Is Project Kuiper, And Why Is It Scaring Investors?

In recent weeks, Kuiper has made headlines, being cited as a key cost headwind in upcoming quarters. It was also the primary driver for a rating cut at Wells Fargo.

So what is it exactly? From Amazon’s About page:

Project Kuiper is an initiative to increase global broadband access through a constellation of more than 3,000 satellites in low Earth orbit. Its mission is to bring fast, affordable broadband to unserved and underserved communities around the world.

Amazon has 1,000 employees working directly on the project, which is estimated at a total cost in the range of $15-$20 billion.

Many of you probably heard of SpaceX’s Starlink. Well, Kuiper seeks to provide a similar offering, enabling internet access for millions around the world. However, Kuiper is far behind.

Starlink is already in the commercialization stage and available in multiple parts of the world. It already has around 7,000 satellites in orbit. And, it’s a division of SpaceX, which is by far the leader in launch missions, conducting over 90 launches in 2024 alone.

On the contrary, Kuiper only launched two prototypes. It’s projected to start shipping satellites in late 2024, but this won’t become a meaningful revenue stream any time soon. All that said, this has never been even a tiny part of my investment thesis in Amazon, and I highly doubt it was for others.

The risk here is that expenses on the project will get out of hand, and become a hurdle to the overall margin expansion of Amazon. This is really the worry Wells Fargo and others have raised.

On that note, I believe most of the incremental expenses required to facilitate the launch acceleration will be capitalized, which means they’ll be shown on the capex line rather than operating expenses. So it’s somewhat confusing why Wells Fargo chose to focus on operating income.

Still, Amazon said the vast majority of capital spending will go to Azure. It also guided for third-quarter operating margins of 9.5% at the high end (which it constantly beats). That would reflect stable margins, and I highly doubt they didn’t incorporate Kuiper expenses in their targets.

All in all, Kuiper could be a great business, and it’d have a very easy time getting customers as an add-on to the Prime membership. I believe analysts are trying to nitpick here, while the long-term trajectory has little reliance on the Kuiper project.

Kuiper Worries Prove Margin Is The Number Priority For Investors

Although I find the Kuiper worries overblown, I believe they strengthen the notion that the number one priority for investors is Amazon’s margins.

For a company with such significant market share and leadership across multiple fast-growing verticals in e-commerce, logistics, advertising, AI, and cloud, even the biggest bears will struggle to find a hole in Amazon’s long-term growth prospects.

That leaves investors with one key worry, and that’s profitability and cash flows.

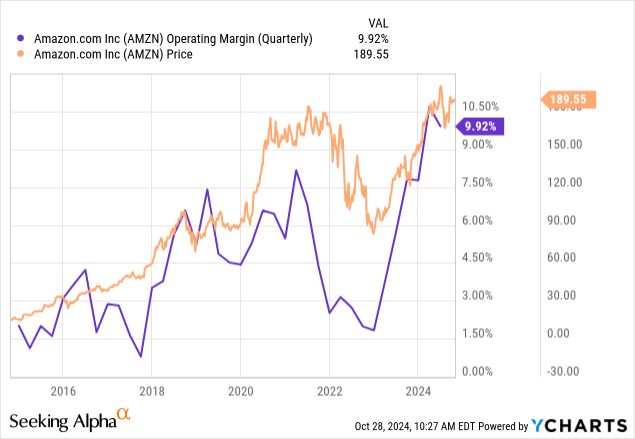

In periods of margin expansion, Amazon’s stock performed exceptionally well. All you need to do is take a look at the following graph:

It’s just simple math, a 1% improvement in operating margins is equal to about 15% growth in revenues.

Right now, I like everything I’m seeing from Jassy and Amazon. They’re extremely aggressive about increasing efficiency, with the recent return-to-office mandate being the latest meaningful development.

They constantly discuss margin improvements and cost-cutting initiatives on calls and have detailed strategies to optimize their use of fixed assets.

Also, it’s just the nature of Amazon’s businesses. Almost all of them are highly scalable, require heavy upfront investments, but carry little marginal costs, which enables significant operational leverage.

Lastly, the higher-margin divisions in advertising, services, and AWS, are all growing faster than the lower-margin ones, which supports a favorable mix shift for years to come.

Earnings Outlook

Amazon guided third-quarter revenues in the range of $154.0-$158.5 billion, reflecting 9.2% growth at the mid-point. For operating income, Amazon guided for $11.5-$15.0 billion, reflecting a margin range of 7.5%-9.5%, which is about a 70 bps improvement from the prior year period.

Consensus estimates stand at the mid-point for revenues and at the high end for margins.

Notably, Amazon is taking an extremely conservative approach to operating income, with a 53% and a 22% beat in the last two quarters.

On revenues, I see Azure accelerating to ~20% growth and ads remaining stable in the 20% range. And, although there have been some worries over consumer weakness and trade-downs, e-commerce continues to take market share and so does Amazon, which leads me to be optimistic.

All in all, I expect a beat on revenues and earnings.

Valuation

Taking a step back, Amazon should grow earnings at a ~20% CAGR for the rest of the decade, on top of ~10% revenue CAGR.

Its primary businesses in retail, logistics, AWS, and advertising, are all resilient, operate in fast-growing markets, and consistently take market share.

On a long-term horizon, I don’t see many businesses better positioned for this level of growth.

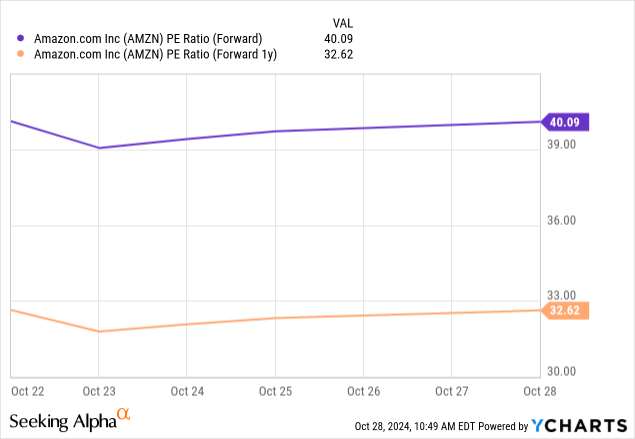

Despite all of that, Amazon is trading at 32x times ’25 projected earnings, reflecting about a 1.3x PEG, which is lower than the supposedly cheapest big-tech stocks in Alphabet (GOOG) and Meta (META), both of which are trading at around 1.5x. And, it’s far cheaper than Apple (AAPL), Microsoft (MSFT), and retail peers like Walmart (WMT) and Costco (COST).

I see a scenario of Amazon trading at 2x PEG, which is where many high-quality names trade, but for the sake of conservatism, let’s just assume a 1.5x PEG, in line with Alphabet and Meta.

This would get us to a 36x multiple on 2026 earnings. Applying that multiple on 2026 estimates brings us to a price target of $260 a share by the end of 2025.

Conclusion

Worries about Project Kuiper dragging down margins are pressuring Amazon’s stock, and reflect just how important the margin expansion path is for investors.

I believe Amazon will have an excellent quarter which should ease some of the worries, and see it as a long-term 20% earnings growth story.

Considering Amazon’s growth prospects, and the valuation of its peers, I see Amazon’s current valuation as almost absurd, and can only attribute it to margin worries, which I believe to be transitory.

Therefore, I reiterate a ‘Strong Buy’ ahead of earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.