Summary:

- Amazon.com, Inc. has struggled to generate positive free cash flow, as the pace of growth of its businesses decreases dramatically.

- The company is continuing to aggressively dilute its shareholders which it needs substantial FCF to account for.

- We don’t see a path to Amazon earning the FCF to justify its valuation and we expect it’ll struggle to generate shareholder returns as a result.

HJBC

Amazon.com, Inc. (NASDAQ:AMZN) continues to sit at around a $1 trillion market capitalization despite some strong structural issues we’ve discussed before. As we’ll see throughout this article, the company’s most recent earnings are quite weak, and as a result, we expect will hurt the company’s ability to drive future returns.

Amazon’s Record Quarter

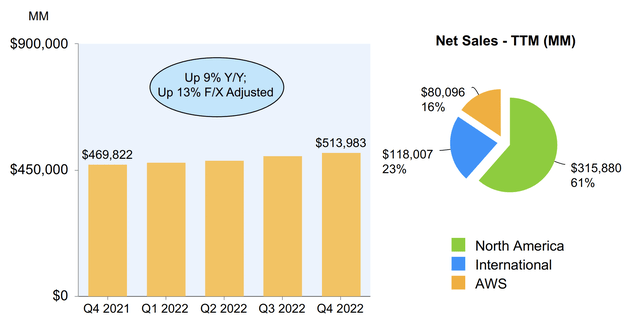

Amazon had record-breaking sales in the TTM for the company, but growth has slowed down.

Amazon saw $510 billion in revenue TTM for the quarter. 61% of that was in North America. The company was hurt by F/X currency adjustments, and the rate of its business growth has slowed down substantially. The slowdown in the company’s revenue will hurt its ability to increase profits without changing its existing business.

There’s another negative indication here. The company’s North American business grew at 13% Y/Y, meaning that its International business has struggled more than its North American business. Given that that’s where the majority of the company’s growth opportunities are, that’s worth paying close attention to.

Amazon AWS

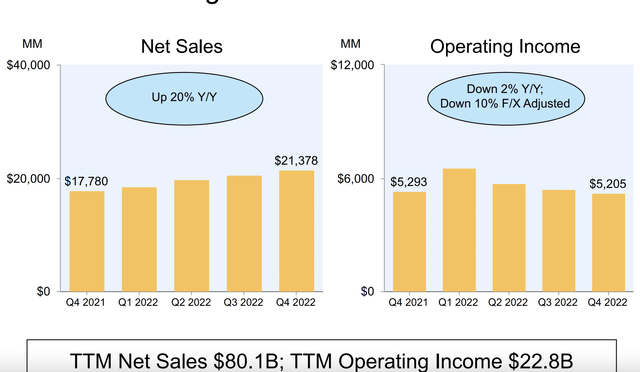

It’s time to take a look at the core of Amazon’s business, AWS.

The company’s AWS business had $80 billion TTM net sales with almost $23 billion in operating income. However, the company’s operating income did drop YoY. The company’s net sales did grow 20% Y/Y, however, that’s a rapid decline in the company’s growth rate from prior years. We expect that growth rate will continue to decline.

AWS is facing massively growing competition from Azure (MSFT) and Google Cloud (GOOG). Chat GPT and the ability to offer unique AI computation and support might accelerate that competition.

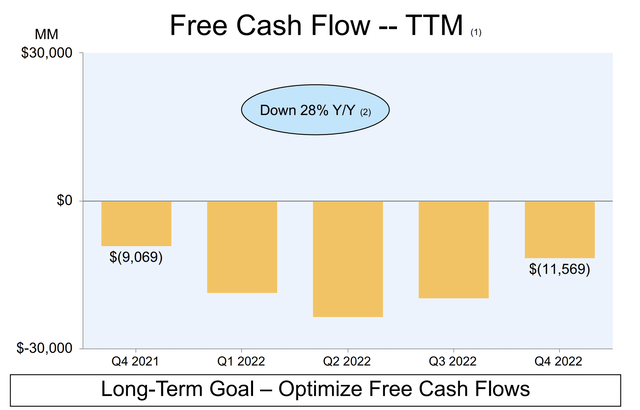

Amazon FCF

Putting this story together, we get Amazon’s free cash flow (“FCF”) weakness.

Amazon’s FCF dropped 28% YoY to -$12 billion. That’s recovered some from earlier in the year, however, it still remains heavily negative. As we’ll see later in this article, that doesn’t include the company’s dilution expenses, either. That’s heavy negative FCF. For a company that’s been around for multiple decades, it’ll need to eventually become positive.

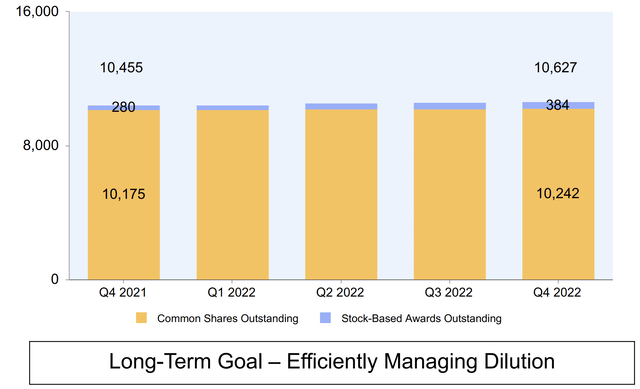

Amazon Dilution

Amazon has increasingly diluted its shareholders without factoring it into its FCF.

The company increased its common shares outstanding by 67 million shares YoY, or almost $10 billion. That’s massive, and it’s a true expense that the company has in order to maintain its business, something that’ll hurt its FCF substantially if the company were properly accommodating for it. It makes the company’s numbers even worse.

The company’s dilution can be expected to be 50% higher on average for the next 4-years.

The Required Numbers

At the end of the day, Amazon is a $1 trillion company that needs to at some point drive proportional shareholder returns. The company would need to generate roughly $80 billion in FCF to justify its valuation, or $100 billion more than current FCF, not even counting the company’s continued share issuances.

The company has strong net sales. Its AWS net sales are $80 billion for the TTM. However, it’d have to earn a 20% FCF margin on its net sales in order to justify its valuation. That’s nearly impossible in the retail industry. Walmart’s FCF yield has long remained in the single-digits for the company. The company’s slowing net growth makes this less likely.

We don’t see a path for Amazon to hit its required numbers, and that’ll eventually pull down its lofty valuation.

Thesis Risk

The largest risk to our thesis is that Amazon is consistently earning substantial negative FCF. However, it’s still earning massive revenue, more than $500 billion annualized. There is a path where it can begin to earn massive FCF by adjusting its margins, and the company does have a strong brand. How this pans out for the company remains to be seen, but the company could meet its FCF targets.

Conclusion

Amazon.com, Inc. is one of the largest companies in the world and the company continues to generate massive and growing revenue. Unfortunately for the company, there hits a point, normally before several decades of existence, where simply growing revenue doesn’t cut it anymore for the company. It needs to generate FCF.

Amazon.com, Inc. has substantial negative FCF and that’s before taking account of the continued dilution. The company needs to be generating $10s of billions worth of FCF in order to justify its valuation, which is incredibly difficult to do. We don’t see a path for Amazon to do that, indicating that, at this time, Amazon stock is heavily overvalued.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.