Summary:

- We share another of the 22 Mega Cap stocks with the prospect of higher prices in 2023.

- Lyn Alden provides important insight into the fundamental terrain on which AbbVie Inc. currently sits.

- Although we see potential for higher prices, risks have risen. What would negate the likelihood of this possible upside move?

vzphotos

by Levi at StockWaves; produced with Avi Gilburt.

With a seemingly “positive” reaction to muted earnings, AbbVie Inc. (NYSE:ABBV) has a setup that can take it to new highs from here. What is the current landscape from the fundamental perspective? What are some of the risks that exist?

The Fundamentals With Lyn Alden

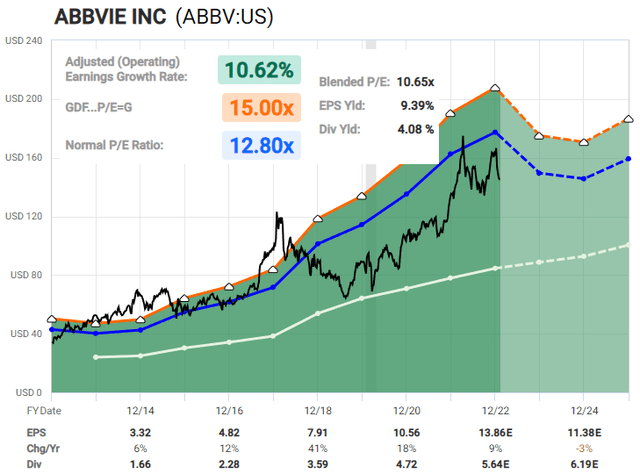

Let’s look at the fundamental terrain. We recently discussed ABBV with Lyn, and she provided these comments:

“At the current time, I would have a hard time making a particularly bullish case for it fundamentally. Their blockbuster drug Humira is now unprotected, allowing many competitors to generic versions. Analysts have no growth expectations for three years. I think there are better stocks with similar valuations that have better underlying growth. For it to make sense fundamentally, an investor should have a strong case for why earnings will significantly outperform analyst expectations.”

In addition, there is another research note to keep in mind. Rinvoq and Skyrizi are likely part of the foundation that CEO Richard Gonzalez referenced in his comments on their Q4 earnings call. He says AbbVie has:

“a strong foundation that will help it absorb the U.S. Humira loss of exclusivity, return to strong top-line growth in 2023 and drive top-tier financial performance over the long term.”

Here’s The Rub

It’s Hamlet, right? Well, perhaps that’s the origin of the phrase. But its colloquial meaning has come to signify that “there is a problem or contradiction which is difficult or impossible to deal with.”

It would appear that we have some unflattering signals from the fundamental viewpoint. This is not to say that we are stuck in this quandary with no path forward. It is our experience that in the case where fundamentals are murky for a moment, sentiment will shine a light through the fog. Could it be that ABBV will indeed find this path to higher profitability as their CEO suggests?

The Technicals With StockWaves

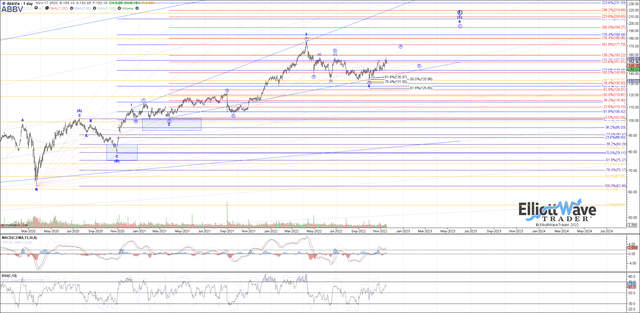

It was back on the 18th of November last year that our lead StockWaves analysts shared their list of the “Top 20 Megacap Stocks” for 2023. Well, that’s not entirely true. The list actually included 22 Megacap stocks, since the team identified 2 more that fit the bill. Our goal for this list was a shorter list of Large Caps that have the greatest potential to succeed in making new highs in the coming year.

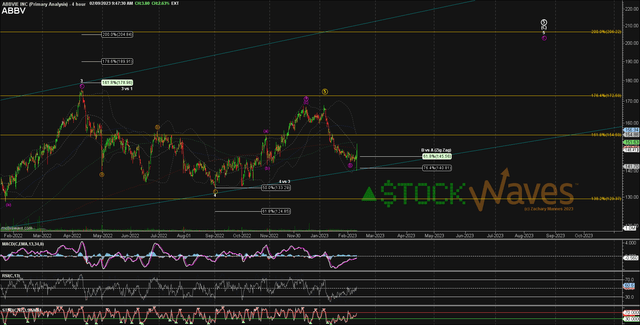

The above chart is from that original post to our members on November 18th, 2022. You can see that we were anticipating an ‘a’ wave up from that moment and then a deep ‘b’ wave retrace.

It would appear that we have seen this play out exactly as drawn up. So, what’s next? Should the structure continue to evolve as illustrated, then we will see an initial wave 1 up followed by a corrective wave 2 pullback, which may provide a low-risk entry point for a swing trade to potentially new highs sometime this year.

Risks Have Risen

One of the main takeaways from the list of 22 Megacap stocks published late last year was that there are not many charts in the overall market that are suggesting that they will see new all-time highs in 2023. We found 22 out of how many? 500? Or more…

That, in and of itself, is a warning that we have set foot on a more treacherous terrain. That is the power of context, but we’ll discuss that further in just a moment.

Specific risks to this scenario would be a continued move below the $140 level in the near term. Yes, this level was seen in the pre-market shenanigans as shares were pushed around in the lighter volume round. But, in the standard trading session, the stock actually gapped up.

Also, it is plausible to see this as forming a wider 4th wave. We are showing the 4th wave as having bottomed in September of last year. Should the price move below $140 it could signal that a wider 4th wave is indeed unfolding.

It a lesser probable scenario, but it is in the realm of possible that high struck in January of this year is actually a truncated 5th wave high and that the larger structure has already completed its upside. We do not find that to be highly likely, but it is something we are aware of at the moment.

Let’s Talk Context

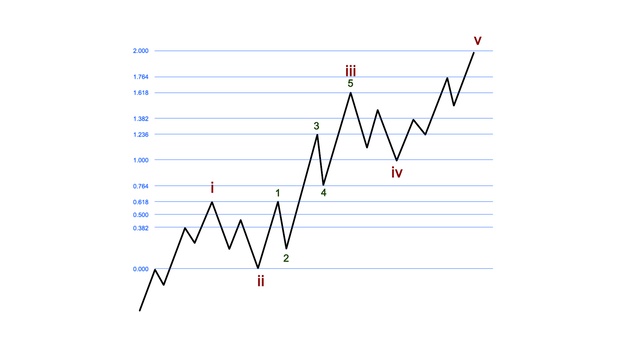

Back in 2018, Avi Gilburt penned a six-part article series for the readership here at Seeking Alpha. If you are interested in having another lens with which to view the markets, we would strongly encourage you to read with an unbiased eye and then let the facts help you make up your mind. In this series, you will come to understand why we use Elliott Wave with Fibonacci Pinball as our preferred lens.

Here is an excerpt from the 6th part of that series:

“As I have said many times before, I know of no other analysis methodology which provides better context to understanding the market than Elliott Wave analysis. Back in the 1930s, R. N. Elliott theorized that markets move through five waves in a primary trend, and three waves in a corrective trend. So, when a five-wave structure is nearing completion, you have the context within the market to be able to prepare for a reversal of the trend.”

Note also his comments from the conclusion of that article:

“While I have seen comments through the years regarding how Elliott Wave analysis was akin to tarot card reading, I hope that this six-part series has opened your eyes as to how Elliott Wave analysis, coupled with our Fibonacci Pinball method and supported by technical analysis, provides a very objective perspective into tracking market sentiment, which I believe is the true driver of market pricing.”

Where does this leave us? From all the factors that we can see at this moment, it would appear that AbbVie Inc. does have a shot at all-time highs in 2023. Should we see the beginnings of a rally phase start with a wave 1 up and a 2nd wave corrective move down, then we would likely see that as a high-probability setup. So, while we do rate this a “buy” at the moment, please keep in mind the caveats shown here and know the terrain on which you are marching.

I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action. And if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment. But here’s the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ABBV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities!

“Thus far, the best stock-picking service I’ve seen–and I’ve been doing this for 35+ years! (Gunfighter)

“Stock Waves has produced more gains in the past month(+) than many sites do in years or decades.” (Keto)

“The amount of trades I’ve been able to take resulting in 100%+ returns is nothing short of amazing. If you do not have Stockwaves, you are only doing yourself a disservice.” (dgriff617)

Click here for a FREE TRIAL.