Summary:

- Ambarella, Inc. has fallen 70%, but the valuation multiple isn’t crazy cheap yet.

- The computer vision chip company has a building backlog in the automotive sector, but Ambarella’s business is currently focused on security cameras with inventory problems.

- Ambarella stock would ideally be bought on further weakness, with the current 6.7x EV/S multiple slightly stretched.

Sundry Photography

The chip sector is no longer loved by the market, making Ambarella, Inc. (NASDAQ:AMBA) more compelling after a long period of over-valuation. The computer vision chip company is in the midst of building up their automotive chip business, but struggles in other sectors has caused growth to stall. My investment thesis is slightly Bullish on the stock in the $60s, though Ambarella’s valuation still isn’t a screaming buy.

Back To Struggling

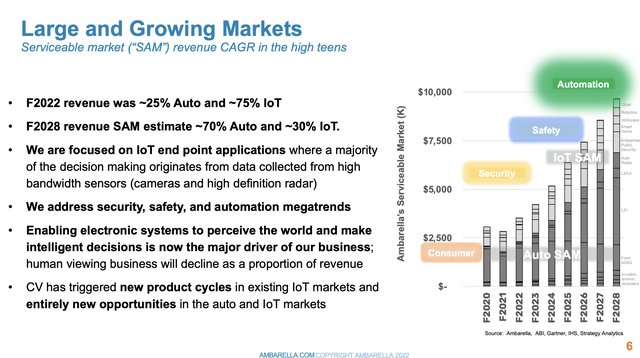

Ambarella only obtains about 25% of revenues from the automotive sector, with a further shift forecast in the years ahead. Unfortunately, the company is now being hit with oversupply in other key sectors such as security cameras.

For years now, Ambarella has constantly run into churn scenarios where the latest video processing market is replaced versus building onto the existing business. The automotive sector promises an area where constant pushes to autonomous driving improvement should necessitate higher performance imaging chips.

For FQ2 ended in July, Ambarella generated $80.9 million in revenues for just 2% growth. The guidance for the just ended quarter was for revenues of ~$83.0 million for a large 10% dip. The company spent 3 quarters with revenues topping $90 million.

Unfortunately the computer vision company just isn’t focused enough on the automotive market yet. NXP Semiconductor (NXPI) and ON Semiconductor (ON) are both expecting close to 10% revenue growth due to the automotive market where supply constraints have limited production providing a tailwind for the business into 2023, not to mention the additional technology content in electric vehicles (“EVs”) will lead to higher semiconductor revenues over time.

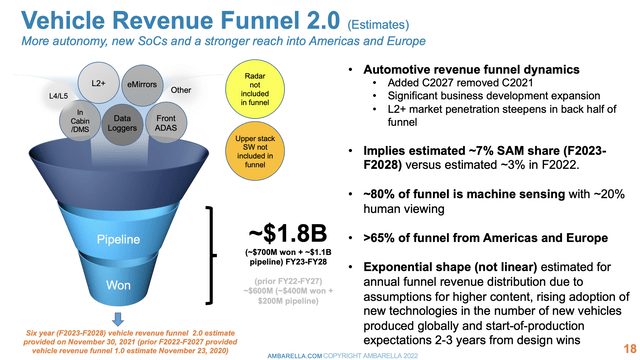

Ambarella soared last year due some exciting news regarding automotive orders, and the lack of updated figures doesn’t help. The company was not providing quarterly updates on the auto backlog recently. Hitting $1.8 billion reduces confidence in the number.

Source: Ambarella Deutsche Bank presentation

The company has won ~$700 million worth of CV chip orders through FY28 with another $1.1 billion in the pipeline. The amount doesn’t even include revenues for the Oculii radar business bought by Ambarella last November. The business contributes about $3 to $4 million in quarterly revenue now.

This large order book compares to the July quarter revenues where the chip company only reported auto revenues in the $20 million range. In addition, Ambarella has long promoted the automotive sector accounting for 70% of the $10 billion SAM opportunity in FY28.

Source: Ambarella Deutsche Bank presentation

Other revenues opportunities in IoT categories like security and automation should grow in this period leading to automotive building upon the current business. In the past, Ambarella has watched key categories like drones and the action camera business disappear over time as the company shuffles business versus new applications building upon the current revenue base.

Elevated Price

As with some of the auto tech companies that went public in the last year, the promise of future revenues based on current orders isn’t good enough for Ambarella’s stock prices anymore. The market wants to see a bigger inflection point on actual revenues considering very limited amounts of the large backlogs have ever proceeded to production revenues.

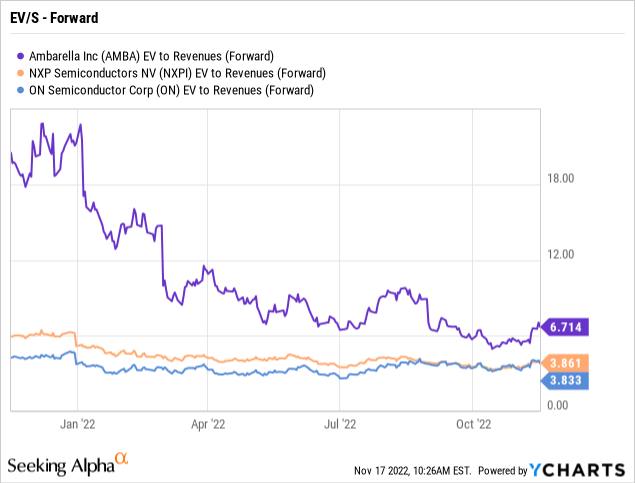

Despite falling 70% from the end of 2021, Ambarella stock still has an elevated valuation compared to peers with stronger growth in the current environment. Ambarella definitely has the potential to double and triple automotive revenues in the next few years to reach the $500 million and $1 billion annual revenue milestones, but one has to wonder if the stock is worth double the forward EV/S multiples of NXP Semi and ON Semi.

Data by YCharts

On the plus side, Ambarella continues to produce positive operating income while other small semiconductor players chasing the automotive market are burning $100+ million annually. In addition, the company has $200 million in cash with positive cash flows providing cash to further invest in building the technology or repurchasing shares.

Takeaway

The key investor takeaway is that Ambarella is far more appealing around $50, but the stock has already run towards $65. The stock valuation isn’t as stretched as back in 2021, but the CV chip company still has the same growth potential in automotive. Ambarella would be far more ideal bought at the recent lows, if the stock slips again.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market during the 2022 sell off, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.