Summary:

- AMC Entertainment Holdings invested in Hycroft Mining Holding in March 2021 as part of a larger equity raise.

- Hycroft has been actively exploring its property, but the majority of drill hole results have been underwhelming.

- Hycroft’s stock valuation is difficult to estimate due to their large burn rate, unprofitable operations, and lack of exploration success.

- I break down the AMC-Hycroft horror story, and if Hycroft has any chance of creating shareholder value in 2023.

RgStudio/E+ via Getty Images

AMC’s Hycroft Investment: A Sequel To A Nightmare For Investors

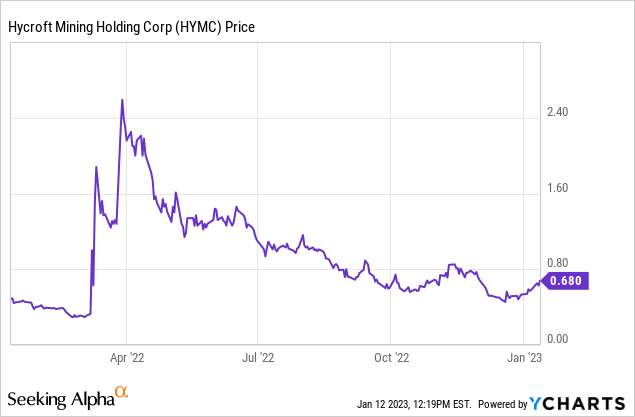

YCharts

This is a follow-up article on my previous coverage of AMC’s speculative investment in the troubled gold company, Hycroft Mining (NASDAQ:HYMC), titled: “AMC Investing In Hycroft Mining: A Horror Movie.”

To recap my previous coverage: Last March, AMC Entertainment Holdings (AMC) agreed to invest $27.9 million in Hycroft Mining Holding as part of a larger equity raise of $138.6 million. The investment likely saved the cash-strapped gold miner from bankruptcy. Notably, legendary precious metals bull Eric Sprott invested $27.9 million and both investors will receive shares and warrants.

However, the move was very surprising to me as it is clearly not in line with AMC’s core competency. The gold mining industry is risky and requires more seasoned, experienced investors to succeed. AMC’s CEO Adam Aron even stated that the investment is not in line with AMC’s usual operations and the move is puzzling.

Looking back, I think it’s more clear now that AMC’s decision to invest in Hycroft was a way to take advantage of the trend of meme stocks, where volatility and financial performance were not as important to some individual investors (in particular, retail investors on Reddit and Twitter).

Since my earlier analysis and recommendation to sell AMC’s stock, it has decreased by 68%, falling behind the S&P 500’s decline of 13.28%. Even with the recent increase of 5% in gold prices, the stock has not recovered from the loss.

However, it is worth noting that Hycroft has been actively exploring its property, announcing Hycroft’s “largest exploration program in a decade.” And, its stock is rising today due to a move higher in gold prices.

Does Hycroft have the potential to generate any value for investors this year? Read more below.

Hycroft Mining: Sinking Money into a Black Hole?

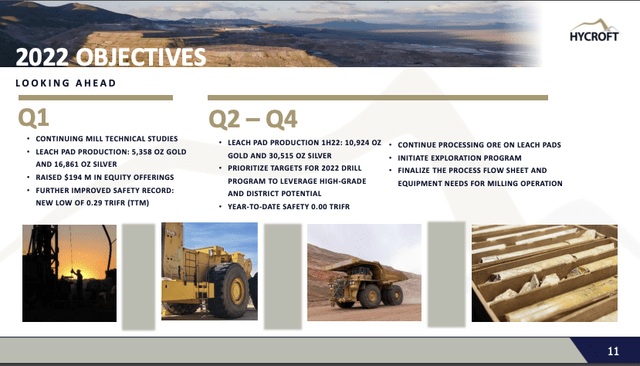

Hycroft’s 2022 achievements and objectives. (Hycroft Mining presentation)

Hycroft’s production is headed in the wrong direction.

In the first quarter of 2022, Hycroft produced 5,358 ounces of gold and 16,861 ounces of silver, raising $194 million in equity offerings. In the second quarter of 2022, production improved slightly with 6,487 ounces of gold and 18,566 ounces of silver recovered. Unfortunately, production decreased in the third quarter of 2022 with only 3,480 ounces of gold and 14,404 ounces of silver recovered.

Yet, it’s spending money on exploration. In July of 2022, Hycroft announced that its exploration program for the upcoming 2022-2023 period will include around 125,000 feet of reverse circulation drilling, as well as 20,000 feet of core drilling.

The company reported initial results two months later. The highlights were mostly underwhelming. Drilling results from Hole 22R-5650 showed 82 meters of 1.03 grams per tonne gold and 30.38 grams per tonne silver, including 3 meters of 1.20 grams per tonne gold and 163.51 grams per tonne silver.

That was its best result, and while its a decent assay, it failed to exceed 100 grams x meter (a metric which multiplies grams per ton by the width of the hole). In gold exploration, a drill hole exceeding 100 GxM is considered a strong hole, and Hycroft’s best result returned 84 GxM.

Other results included: 58 meters of 0.58 grams per tonne gold and 24.07 grams per tonne silver; 50 meters of 0.79 grams per tonne gold and 38.74 grams per tonne silver; and 20 meters of 0.10 grams per tonne gold and 90.86 grams per tonne silver.

Several months later, Hycroft reported that it struck higher grades, and I have to admit, the results did improve quite a bit. For example, H22R-5648 returned 189 meters of 1.06 g/t gold and 58.33 g/t silver, which is a great hole, registering close to 200 GxM, and registering some silver credits.

But investors should dig deeper. Its other drill holes didn’t even come close to duplicating that success. While the silver grades are encouraging, not a single other assay returned over 50 GxM:

- H22R-5649 returned 80.8 meters of 0.48 g/t gold and 50.11 g/t silver;

- Including 1.5 meters of 0.10 g/t gold and 358.00 g/t silver

-

H22R-5654 returned 35.1 meters of 0.31 g/t gold and 50.43 g/t silver

-

Including 3.0 meters of 0.35 g/t gold and 293.5 g/t silver

-

-

H22R-5669 returned 48.8 meters of 0.46 g/t gold and 75.79 g/t silver

-

Including 1.5 meters of 1.49 g/t gold and 852.0 g/t silver

-

Including 3.0 meters of 0.53 g/t gold and 222.5 g/t silver

-

-

H22R-5669 also returned a separate intercept of 3.0 meters of 0.90 g/t gold and 228.5 silver.

Recently, on Dec. 20, Hycroft reported that drilling results from H22R-5671 returned 35 meters of 2.83 grams per tonne gold and 35.59 grams per tonne silver, which was a positive outcome. However, just like its previous news releases, it looks like its overall results from the program were not as strong.

The company is planning to revise its resource and will incorporate the results of this recent exploration drilling and historical silver assay data that had not been included in the previous report.

The point is that, while there were a few noteworthy results from the drill program, the majority of the results were underwhelming and it is not clear how this exploration program will lead to a valuable resource or a profitable mining operation for the company.

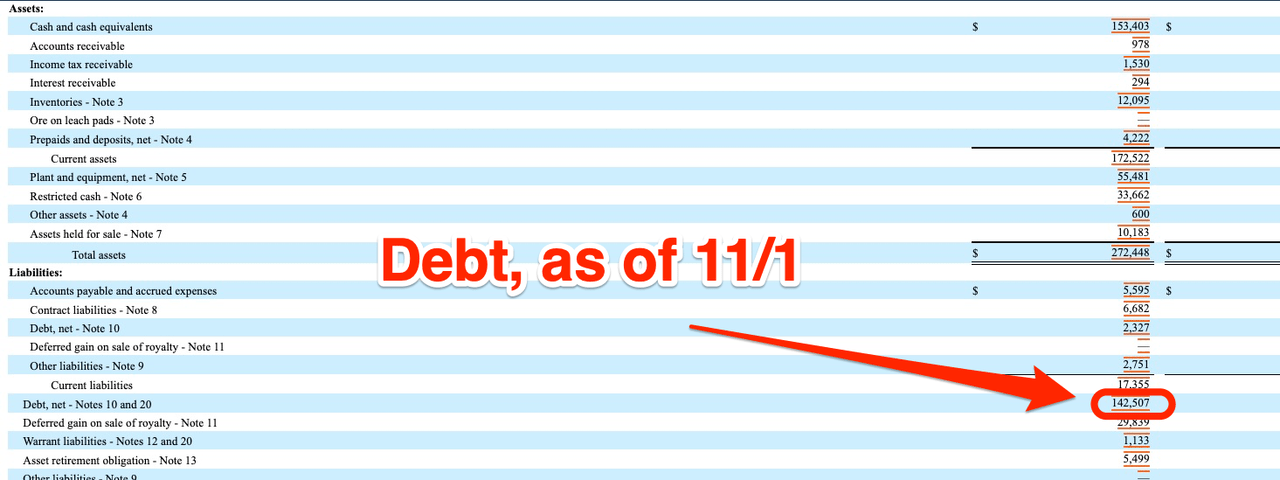

Hycroft Mining: Cash Rich, But Cash Burn High

Hycroft Mining’s cash on hand may appear to indicate a strong financial position, however, this is misleading.

Despite having around $140 million in cash, due to a large equity financing round last year, they still have an outstanding debt of $135 million. After a recent $12.2 million debt reduction, their net cash position is only around $5 million. This is a relatively low amount for a gold exploration and development company.

Hycroft Mining quarterly report

But the situation at Hycroft is worrying for several reasons.

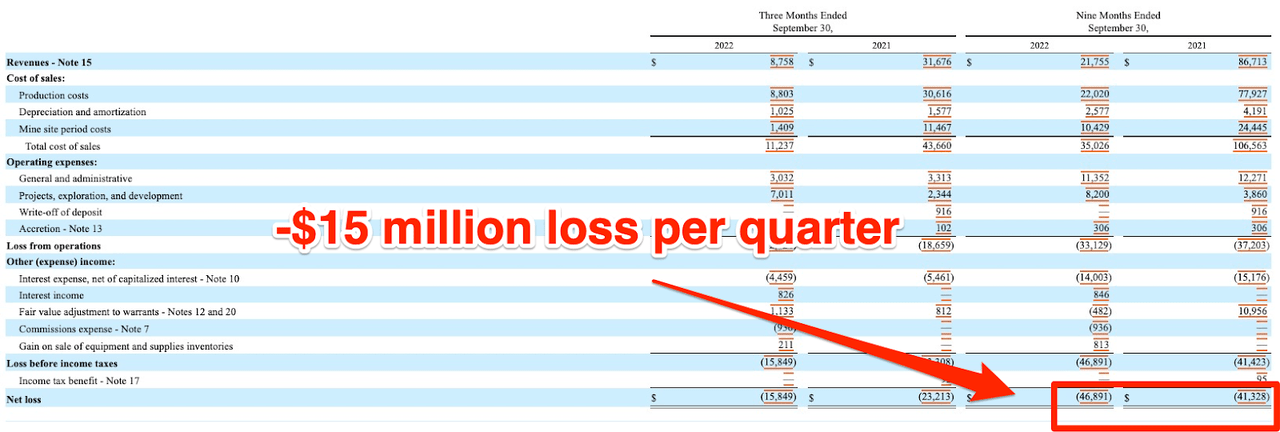

First, the company does not generate any meaningful revenue from gold production, since production is very low (and declining). Additionally, it has been spending large amounts of money on an exploration program that has not yielded strong results.

Lastly, there is no evidence that the company has a plan to increase production and reduce costs at the mine. At present, it appears that Hycroft is taking a huge risk in hoping to achieve a high-grade assay result that boosts interest in its stock.

Hycroft Mining quarterly report

The company has been burning through $5 million each month, which translates to over $60 million per year. According to the company’s quarterly results, if they maintain that level of investment and do not increase their drilling and development, they will have exhausted their funds within two years or so.

Hycroft Mining’s Stock Valuation: Is It Overpriced?

Hycroft has a market capitalization of $148 million and an enterprise value of $142 million, as of the date of this writing (Jan. 12). The company possesses a large gold and silver resource of 15.3 million ounces of gold equivalent (measured and indicated resources).

However, given the fact that Hycroft cannot generate profit from its operations, it is not wise to put any value on this resource. I believe Hycroft is aware of this fact, which is why it has shifted its business strategy to concentrate on finding a high-grade resource.

It can be difficult to estimate the fair value of the stock, since those investing in it are gambling on Hycroft’s success in locating a new high-grade resource. Considering the high risk that comes with owning Hycroft shares, due to its large burn rate and limited exploration successes thus far, I would assign its shares a value equal to its net cash value, plus a slight value for its optionality on gold prices.

If I had to estimate the fair value of Hycroft, I would assign it a value of $5 million for its net cash, plus an additional $5-$10 million for the potential upside that could come with higher gold prices or exploration successes. In total, this would give Hycroft a valuation of around $20 million, which works out to $0.03 per share.

A Horror Movie Sequel Worth Skipping

AMC’s investment in Hycroft Mining has not worked out well, as expected. It’s highly unlikely to make any money from this ill-advised move.

Hycroft Mining is not a good stock to buy, and there are plenty of other producers (GDX), junior miners and developers (GDXJ), and explorers (GEOX) that will give you leverage and upside to gold prices. Hycroft may even be a good candidate for short selling, due to its poor business model, weak financial performance, and lack of indications of profitability in the near future (if ever).

But investors should be aware of the various risks of short-selling a stock, too.

- There’s the chance that gold prices may increase significantly to $2,500/oz or higher, which may drive up Hycroft’s stock price and lead to a small profit from operations, despite its poor fundamentals.

- It’s also possible that Hycroft may release better drill results, which could attract short-term traders and speculative investors looking to make a quick profit.

- Finally, there’s the risk of Hycroft’s stock being affected by interest from retail investors on social media platforms such as WallStreetBets, which could drive up the stock price despite poor fundamentals. This is an illiquid and volatile stock that can move widely in either direction.

Steer clear of Hycroft Mining just as you would try to avoid running into Michael Myers in a Halloween movie.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in HYMC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

So, what gold stocks should you be investing in? Get ready to make smart investments in the gold and silver sector! When you subscribe to The Gold Bull Portfolio, you receive expert analysis on gold mining stocks, access to my top picks, and insights into my personal gold portfolio. You’ll have everything you need to make informed decisions. And, as a special offer for new subscribers, you can take advantage of a free 2-week trial and a 10% discount on annual subscriptions. Don’t miss out on this opportunity – subscribe now!