Summary:

- Advanced Micro Devices, Inc. continues to trail behind Nvidia in the technological race for AI chips, and its financial performance is disappointing across three out of four segments.

- The only segment which demonstrates solid top-line performance is Data Center, but its operating margin deteriorated significantly compared to early 2022.

- The management appears to lack a roadmap for handling the high inventory problem, and the sequential pace of inventory level decline in Q1 does not impress me.

- My target price for AMD stock is $117 per share, around 24% lower than the last close.

J Studios

Introduction

I had a Sell-rated thesis about Advanced Micro Devices, Inc. (NASDAQ:AMD) in February, and the stock has declined by 11% over the last three months, compared to +4% from the S&P 500 (SP500). AMD delivered its Q1 report recently, which got positive feedback from Wall Street analysts, and there even might be a bounce back after a recent drawdown. However, there are still several fundamental reasons why I still do not recommend investing in this stock. Substantial overvaluation is not the only reason, but is also important to my bearish thesis. Therefore, I think that AMD is still a “Sell.”

Fundamental analysis

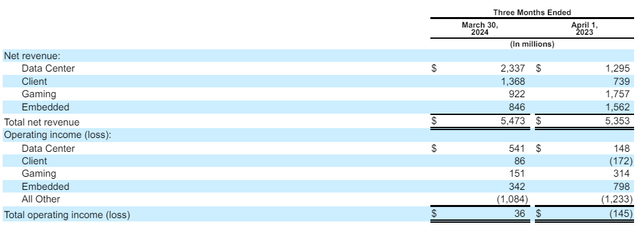

AMD released its latest 10-Q report on May 1, and I want to focus on it first. Revenue grew by a modest $120 million YoY in Q1 2024, which is a 2% increase. That said, considering today’s inflation of above 3%, AMD’s revenue did not grow in Q1.

The only good news here is that Data Center revenue almost doubled, mostly driven by higher sales of AMD Instinct GPUs and 4th Gen AMD EPYC CPUs. All other segments disappointed significantly, in my opinion. Gaming revenue almost halved due to a decrease in semi-custom revenue and lower Radeon GPU sales. Embedded revenue demonstrated about the same dynamic as Gaming in Q1 with a massive decline, as customers continued to manage their inventory levels.

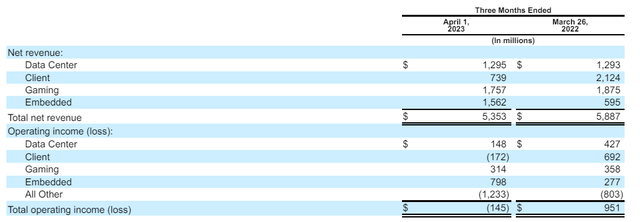

Yes, the rebound in global PC shipments allowed Client revenue to almost double, but I must add context here. If we refer to AMD’s Q1 2023 report, we find out that the Client’s segment revenue was $2.1 billion in Q1 2022. That said, Client revenue is still above 35% lower compared to levels demonstrated before the Fed’s monetary tightening.

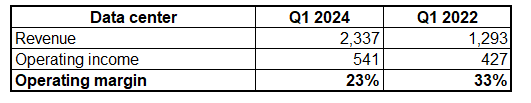

What I would also like to highlight in comparison with Q1 2022 is the operating margin of the company’s most thriving segment, Data Center. Despite Data Center revenue almost doubling in Q1 2024 compared to Q1 2022, the operating income grew much slower, by 26%. This has led to a substantial operating margin deterioration, which might indicate that AMD prioritizes Data Center growth at any cost, which looks like a desperation to me.

Calculated by the author

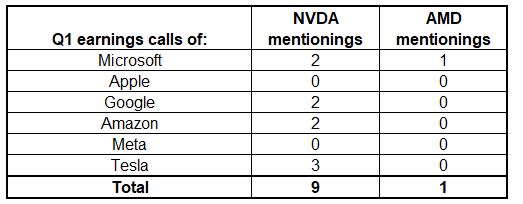

Indeed, recent moves from Nvidia (NVDA) and news from major technological companies likely made the management of AMD more nervous. There is a remarkable fact that during this earnings season, Big Tech companies mentioned NVDA and its H100 GPUs much more frequently than they mentioned AMD or any of its products. I have analyzed all the latest earnings transcripts from the biggest and most technologically advanced U.S. companies, and it was nine NVDA mentions versus only one AMD mention.

Recognition from leaders of the largest technological companies in the world is a clear indication that AMD is nowhere near NVDA in terms of its GPU offerings. For example, During Tesla’s (TSLA) latest earnings call, Elon Musk said that his company plans to buy loads of Nvidia’s H100 GPUs to power Tesla’s disruptive autonomous driving technology. AMD’s offerings were not in the discussion.

Compiled by the author

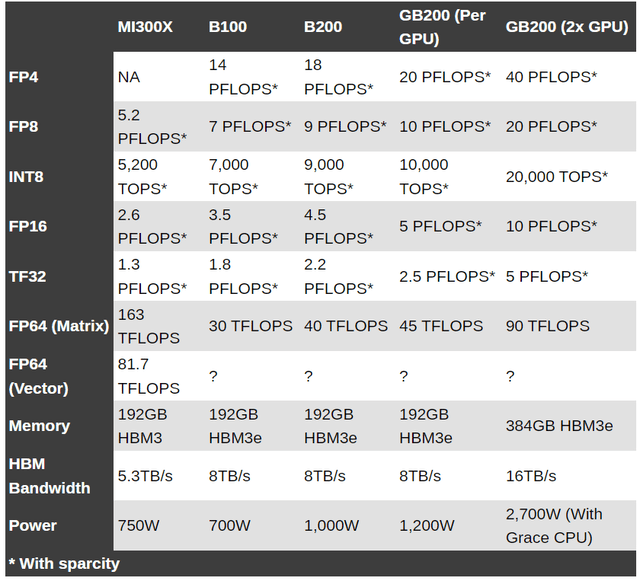

Another factor why I think that AMD is not close to Nvidia is the latest GTC 2024 conference, where Nvidia disrupted the chip industry once again by presenting its Blackwell platform. In the previous paragraph I mentioned that Tesla is willing to buy thousands of H100 GPUs, but Blackwell is on another level since it provides a massive generational leap in computational power, according to Jarred Walton from tomshardware.com. After Blackwell platform’s presentation, JPMorgan (JPM) analysts said that Nvidia “continues to be 1–2 steps ahead of its competitors.” I am not an AI hardware professional, but there is quite an interesting article which provides a comparison of AMD’s most powerful AI accelerator MI300X with the Blackwell chip family. As shown below, the Blackwell GB200 is substantially more powerful across all critical metrics.

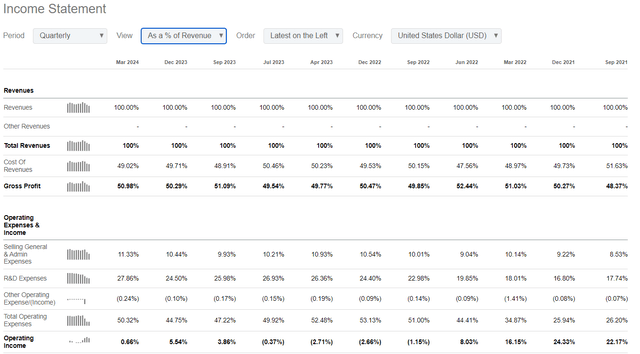

There is another crucial factor which likely indicates that it will become even more difficult for AMD to compete with Nvidia further. AMD’s operating margin has been stellar in 2021 and early 2022, but Q1 2024 was once again weak and close to zero. Of course, it is partially explained by increased investments in R&D, but there was a notable increase in the SG&A to revenue ratio as well.

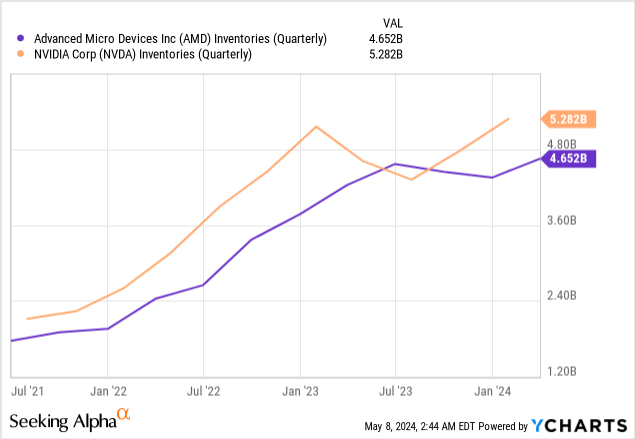

AMD’s operating margin suffered significantly due to sky-high inventories ($4.7 billion as of March 31), and this issue was raised by Wall Street analysts during the Q1 earnings call. To be honest, the management response did not impress me because no clear vision of mitigating high inventory levels was shared. Jean Hu, the CFO, just emphasized that inventory levels decreased by $301 million sequentially. If AMD continues decreasing inventory levels with such a pace, it will take nine more quarters to moderate inventory towards late 2021 levels. This is quite a long timeframe, and AMD’s warehouses might become full of obsolete products over these nine quarters because of the rapid pace of innovation in the industry.

To understand how deep the inventory problem is for AMD, please look at the below chart. Nvidia generates more than four times higher quarterly revenue, but its inventory levels are comparable to AMD.

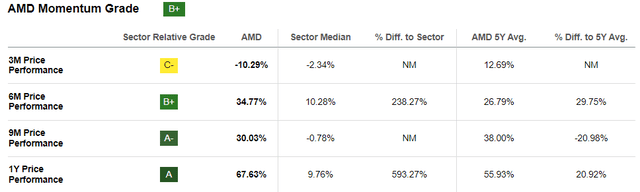

Finally, if we look at AMD’s SA Quant Momentum page, we see that the momentum is certainly cooling down. The shorter the recent timeframe, the weaker is the Quant grade. To me, this is a clear indication that an unjustified hype around AMD is cooling down.

Valuation analysis

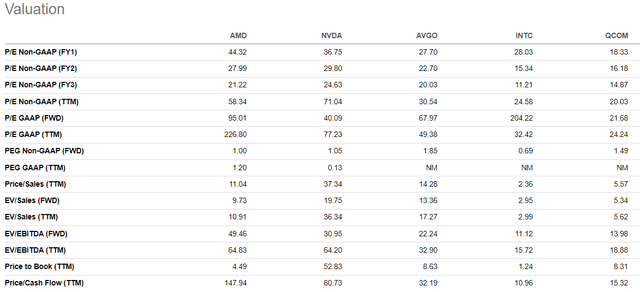

Based on the peer analysis of valuation ratios, AMD appears to be one of the most expensive semiconductor stocks now. Its TTM P/E ratio is by far the highest compared to other prominent chip companies, and its forward P/E ratio is more than two times higher compared to Nvidia’s. Its forward EV/EBITDA ratio is also extremely high compared to rivals. Considering the company’s fundamental weaknesses, I consider AMD’s valuation ratios as unjustified.

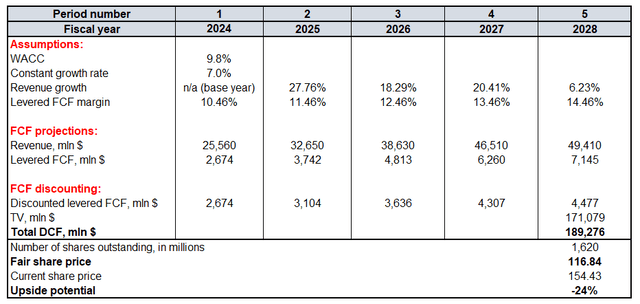

However, AMD’s valuation ratios have been historically elevated and looking at them might not be enough for a fair view. Therefore, I am running a discounted cash flow (“DCF”) model with a 9.8% WACC. For revenue between FY 2024-2028 I rely on consensus estimates because projected growth rates appear realistic to me. I incorporate a 10.46% TTM levered FCF margin and expect that the FCF margin will expand by one percentage point as the top line grows. For the terminal value (“TV”) calculation, I implement a generous 7% constant growth rate because of the robust AI secular shift in the industry. According to SA, there are 1.62 billion AMD shares outstanding.

Even with an extremely high 7% constant growth rate, AMD’s shares are substantially overvalued. According to my DCF model, the stock’s fair price is around $117. This is 24% lower than the current share price, which flags for a substantial downside potential.

Mitigating factors

Nvidia releases its Q1 earnings on May 22, and it is the event that will not only affect Nvidia’s stock price. As an undisputed leader in the GPU field, Nvidia is a trendsetter, and its earnings are likely to affect share prices of its closest competitors as well. Should NVDA deliver another staggering quarter, this will likely lead to a new rally in all prominent semiconductor names, including AMD. This will not be a fundamental reason for AMD’s rally, but still, I would better warn readers that such an opportunity exists.

The optimism around AMD is also supported indirectly by recent publications about the whole semiconductor industry from investment firms. For example, Citi recently reiterated its bullish stance on the semiconductor industry. Big Wall Street names like Citi have a significant impact on the sentiment around the stock market overall or some industries in particular. Therefore, there is a probability that other notable Wall Street analysts will release their bullish reports about the semiconductor industry, or the prospects of AI, which might to a rally in the whole industry, highly likely including AMD.

Conclusion

AMD continues to desperately pursue Nvidia in the AI revolution in GPUs, but it appears that the technological gap is unlikely to narrow in the foreseeable future. I agree with JPMorgan analysts who say that Nvidia is 1–2 steps ahead of the competition. We also see it from the head-to-head comparison of AMD’s and Nvidia’s newest AI accelerators, where Nvidia’s offering is multiple times more powerful across all metrics.

Therefore, the 24% premium to AMD’s fair share price looks unjustified for a GPU laggard. Moreover, three out of four AMD segments performance in Q1 has been disappointing and Data Center operating margin has deteriorated significantly compared to two years ago despite revenue almost doubling. Therefore, I remain bearish about AMD and reiterate ‘Sell’ rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.