AMD: Near All-Time-High, Yet The Stock Might Be A Bargain

Summary:

- Advanced Micro Devices, Inc. is often overlooked and not given enough credit for being great AI investment play.

- AMD’s MI300 chips are not cutting-edge compared to Nvidia’s H100s, yet have a chance to gain market among small enterprises and governments.

- At a first glance, AMD trading at a blended P/E of 62.5x might seem expensive, but the expected growth should well justify the valuation.

- While many risks remain, if AMD’s data center execution is flawless, the company may potentially reward shareholders with up to 33% annual returns.

JHVEPhoto

As a person who enjoyed playing video games during growing up, Advanced Micro Devices, Inc. (NASDAQ:AMD) has always been a company close to my heart, powering my personal computer.

Today, times are different. I no longer look at the company only through the lens of how well their CPU or GPU is compared to others on the market. Instead, I analyze what market share does the company have, how aggressive is their product development, and whether the company is trading at a reasonable valuation in terms of the forward expected growth.

If you are a value investor, this one might not be for you. The stock is trading at elevated blended P/E of 62.5x, significantly higher compared to its own historical standards.

Yet, the AMD rollout of the cheaper MI300 chips which will compete against Nvidia’s (NVDA) industry-leading H100 and recently announced Blackwell, does stand a good chance of finding its own niche market as the AI spending accelerates and smaller enterprises and governments initiate their investments into the data center infrastructure.

Given the market opportunity in the data center arena, AMD is well positioned to capture some of the market share, which should drive company’s EPS growth at around 39% annually over the next 3 years.

While many risks, especially the execution one, remain, if the growth materializes, AMD is actually trading today as a bargain, potentially capable of delivering up to 33% annual returns.

Let me show you how.

Business Update

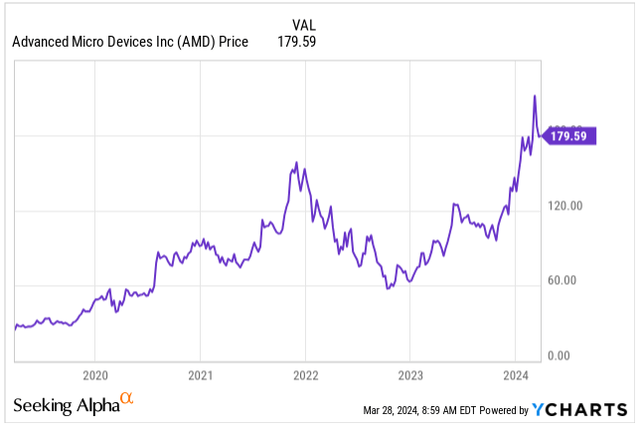

Semiconductor businesses are inherently cyclical, driven by the mood in economic sentiment. This was especially visible during the peak stock trading mania in 2021, when most tech stocks reached their new all-time-highs, followed later by a strong pullback which lasted for most of 2022.

AMD has been no different. The price development graph below shows us very well how volatile the business is, driven in late 2021 and early 2022 by the cyclical decline in PC sales.

On the flip side, 2023 coincides with economic recovery and increased consumer electronic spending, fueling a rally in the stock which is currently trading 26% below its all-time-high of $227.

Yet, improvement in economic sentiment is not the whole story. AMD’s rally has been further propelled by the general artificial intelligence, or AI, mania which was responsible for most of the 26% return delivered by the S&P 500 Index (SP500) in 2023.

Price Development (Seeking Alpha)

The reason why I like high quality cyclical businesses is because, at times, when the market sentiment hits the rock bottom, usually these businesses trade at very attractive valuations. This gives us investors a great chance to buy the stock hand over fist.

To give you a perspective, AMD’s stock has hit a low of 16.7x its blended P/E ratio in 2022, compared to today’s rich blended valuation of 62.5x earnings.

If you bought the stock at its low, you would be sitting on a total return of 221% in a span of only 16 months.

Now, let’s have a deeper look into the business AMD competes in.

AMD is best known for design and development of industry-leading central processing units, or “CPUs,” which are used in personal computers and servers.

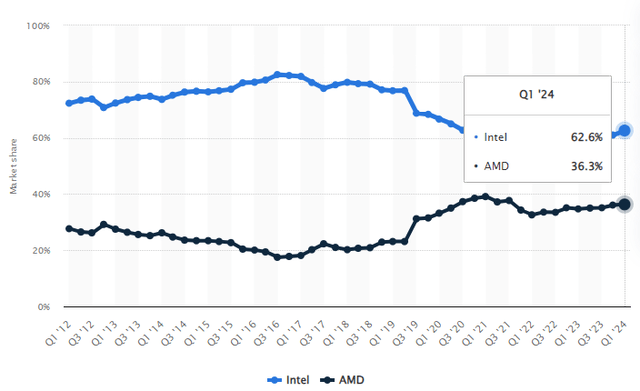

You can think of a CPU as a “brain of a computer.” Here, the main competitor is Intel (INTC) which has been in recent years lagging in innovations, consequently falling behind in the technological race. This further highlights how competitive the tech business indeed is and staying at a forefront innovation and spending heavily in R&D is a key to success.

While Intel still remains the leader in the CPU market with a market share of 62.6%, AMD has been year-after-year gaining on the leader, with a market share currently standing at 36.3%, compared to only 17.5% in 2016.

The other area where AMD competes is with graphics processing units, or “GPUs.” These are predominantly for gaming consoles, and with AI becoming a major field, for data centers now as well. Here the main competitor is Nvidia, which is at the moment the undisputed leader with its H100 chips and recently announced Blackwell platform.

Without going too much into technical details, Nvidia’s Blackwell platform is 2.67x faster in sparse performance over AMD’s MI300X. While both chips offer 192GB of high bandwidth memory, Blackwell memory is 2.8TB/sec faster, giving it superiority as memory bandwidth has been proven to be major indicator for AI performance.

While Nvidia’s dominance is clearly visible both in technical parameters and in the market share driven by the first mover advantage, today the market is little contested. Nvidia is acting basically as a monopoly with full pricing power. Hence, their latest AI Blackwell chips is expected to cost anywhere between $30,000 to $40,000.

To put it into perspective, AMD’s MI300 chips are being sold to the largest customers such as Microsoft (MSFT) and Meta Platforms (META) on average for $10,000, while other customers pay $15,000 or more due to scarcity.

AMD’s AI chips are on average 65% cheaper compared to Nvidia’s, yet the effect of its massive discount remains to be seen.

For now, Nvidia remains the dominant market force with 52-week filled backlog and a market share around 98%. However, as smaller-sized companies and governments start investing into their data centers for AI purposes Nvidia’s market share is expected to drop to around 94% – 96% by 2026. This would give companies like AMD a chance to find its position in the market, of not offering necessarily cutting-edge chips, but instead offering a cheaper and affordable alternative that gets the job done.

Since the spin-off of GlobalFoundries (GFS) back in 2009, AMD is no longer producing any chips in-house. It has outsourced its production to Taiwan Semiconductor Manufacturing Company Limited (TSM), following the footsteps of other major semis.

Not having control over its own production may pose certain risks such as availability and geopolitical tensions over Taiwan. However, AMD no longer needs to spend heavily on cutting-edge lithography machines from ASML (ASML) to remain at the forefront of chip manufacturing.

Regarding 2023, a year with a mixed demand environment for the personal computers, AMD’s earnings for the full year came in at $2.65, down 24% from a year ago, driven by 4% drop in revenue and 600 basis points lower operating margin.

The full year results are not worth writing home about, but Q4 2023 revenue came at $6.2 billion compared to analyst expectations of $6.14 billion and the EPS were in-line with expectations, at $0.77, potentially signaling the bottom of the lackluster performance.

In-terms of the segment revenue breakdown during Q4:

- Data Center: $2.3 billion, up 38% YoY

- Client Unit: $1.5 billion, up 62% YoY

- Gaming: $1.4 billion, down 17% YoY

- Embedded: $1.1 billion, down 24% YoY

Since the MI300 GPUs chips were announced only during the Q4 2023, now all eyes turn on how well AMD can execute and compete with Nvidia in 2024 in the AI arena and whether the company stands a chance to gain a market share from the market leader.

For Q1 2024, AMD expects revenue to be around $5.4 billion, with Data Center segment remaining relatively flat driven by a seasonal decline in servers sales offset by a strong Data Center GPU ramp-up.

Valuation

Given the cyclicality of the business, investors are always better off by buying semiconductor business during the downturn in the market, when the valuations become very attractive, understanding the future prospects of our lives are becoming more and more digitalized, powered by chips.

Even as we find today ourselves near all-time-highs with many successful semi names, I believe today’s investment landscape in the chip industry is slightly different as we are entering a new stage. AI will accelerate our productivity and heavy capex spending will drive another wave of investments into data center infrastructure and earnings growth for the companies designing and manufacturing chips.

Having said that, AMD is trading today at a blended P/E ratio of 62.5x, which may seem for many, a nosebleed valuation.

Since 2007, the normalized valuation for the company has been around 44.8x its earnings, which indeed signals that today’s valuation is stretched by conventional thinking.

However, since 2007 the company grew its EPS on average by 8% annually, which is not the fastest growth by any means.

The reason for the stretched valuation is that the EPS growth is expected to accelerate driven by the ramp-up of data center GPUs:

- 2024: EPS of $3.58E, YoY growth of 35%

- 2025: EPS of $5.50E, YoY growth of 54%

- 2026: EPS of $6.98E, YoY growth of 27%.

Naturally, if the growth would fail to materialize, the company would witness a significant pullback in its stock price.

Now, let’s look at the forward P/E picture:

- Forward P/E 2024 Earnings: 50x

- Forward P/E 2025 Earnings: 33x

- Forward P/E 2026 Earnings: 25x.

This goes to show us, that despite today’s seemingly high valuation, if the growth prospects materialize, the valuation going forward is not stretched, but instead becomes a reasonable 25x its earnings by end of 2026.

Given that the EPS growth expectations are on average 38.6% over the next 3 years, in my view a P/E of around 55x should be justified. If the growth materializes and the valuation does not contract further, investors could expect up to 33% total annual return over the next 3 years, which from my standpoint presents one of the best opportunities today to play the AI mania.

Takeaway

With the release of MI300 chips, which are expected to compete against Nvidia’s market leading H100 and recently announced Blackwell, AMD has entered the battle for the data center dominance.

While Nvidia is currently undisputed market leader with estimated market share around 98% in the AI data centers, we should not be expecting any significant breakthrough in the market. Instead, AMD with its AI chips might be able to find a niche market for smaller enterprises and governments which are not willing to splurge up to $40,000 for each GPU on their own infrastructure, but instead are looking for cheaper alternative.

AMD’s product offering, which comes at around $15,000 for each GPU for smaller customers, is well positioned to satisfy the need of smaller organizations and should ultimately drive top and bottom-line growth for AMD, which is expected to accelerate to around 39% annually, over the next three years.

While the valuation of 62.5x its blended P/E is not cheap by any means, instead its trading at a significant premium compared to its own historical standards, if the growth materializes, AMD could reward investors handsomely with up to 33% annual returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.