Summary:

- Taiwan Semiconductor Manufacturing Company Limited offers an attractive value proposition in the AI market.

- Taiwan Semiconductor is the largest contract chip manufacturer in the world, holding a commanding market share and strong growth in the high-performance Computing segment.

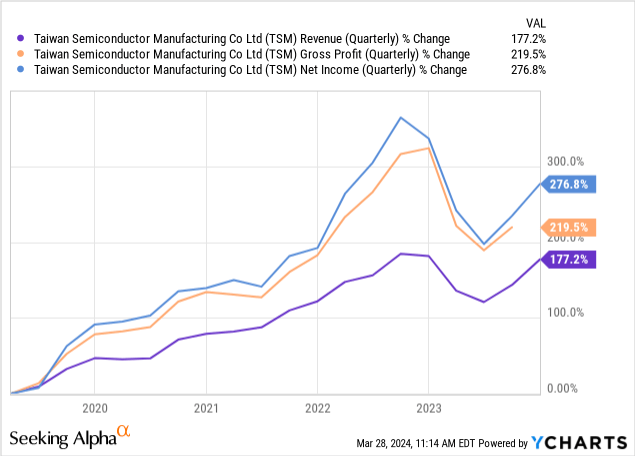

- The chipmaker’s core business is expanding and business trends are favorable. Taiwan Semiconductor also sees a return to double-digit top line growth in FY 2024.

- Taiwan Semiconductor shares have a very reasonable P/E ratio compared to other expensive AI plays, making its stock an affordable entry into the AI stock market.

BlackJack3D

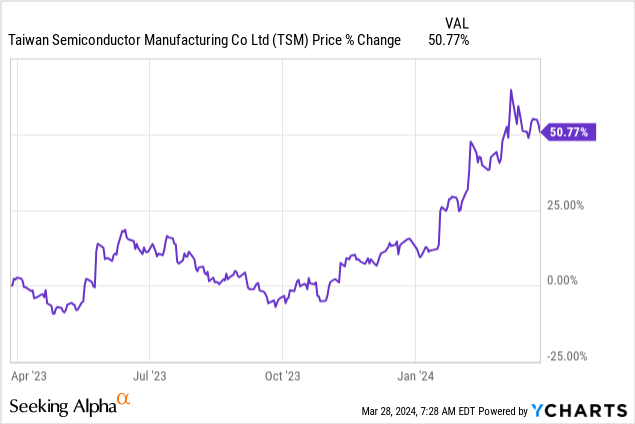

I just made Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) aka TSMC the largest stock holding in my portfolio due to what I believe is an exceptionally strong value proposition in the market for artificial intelligence (“AI”) solutions. Although shares of Taiwan Semiconductor Manufacturing have revalued sharply higher in FY 2024, as part of a major re-pricing of AI companies, I believe TSMC continues to offer investors deep value due to its focus on the AI-driven High-Performance Computing market. With the increasing prevalence of artificial intelligence solutions in the Data Center business, TSMC faces an attractive catalyst for both top line growth and gross margin expansion in the years ahead!

Previous rating

I recommended Taiwan Semiconductor Manufacturing in my work on the semiconductor company in early January 2024 as a buy because market projections indicated recovery potential for the semiconductor industry in “A Top Global Foundry Play Trading At 17X Earnings.” I am upgrading TSMC to strong buy following a strong fourth-quarter, momentum in the HPC segment, and increasingly attractive potential in the AI market.

Solid market position and encouraging business trends

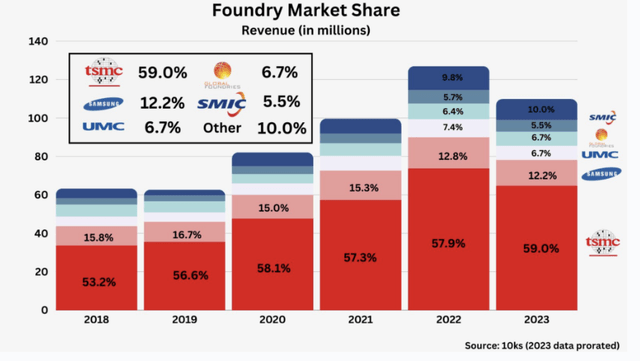

Taiwan Semiconductor Manufacturing is a leading foundry with a commanding market share in the its core industry. The Taiwan-based foundry had a market share of almost 60% in 2023, making it by far the biggest semiconductor manufacturer in the world. The second-largest foundry after TSMC is Samsung (OTCPK:SSNLF), but it is a distant second only, with a market share of slightly above 12%.

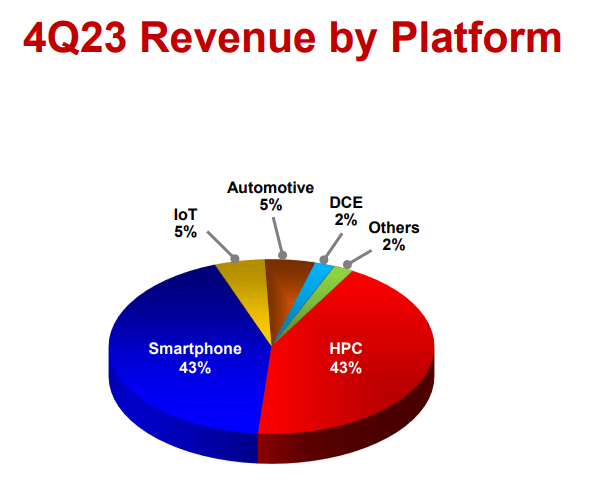

Taiwan Semiconductor Manufacturing produces semiconductors that are used in consumer electronics (like smartphones), in the automotive industry, in Data Centers/High-Performance and Cloud computing as well as the Internet of Things. Additionally, TSMC’s produces AI-optimized chips that are used for a wide range of AI applications, including machine learning models. High-Performance Computing products represented 43% of the company’s revenue mix in the fourth quarter (+1 PP Q/Q), and the segment saw a solid 17% year-over-year growth. The company has equally large exposure to the smartphone market, which recently showed signs of stabilization.

TSMC

Demand for AI-optimized chips is outstripping supply, which puts Taiwan Semiconductor Manufacturing into an admirable position and which could justify further valuation gains. The chipmaker said in January that it expects 20% top line growth in FY 2024 due to a favorable supply-demand imbalances as industries around the world are racing to adapt to the AI revolution.

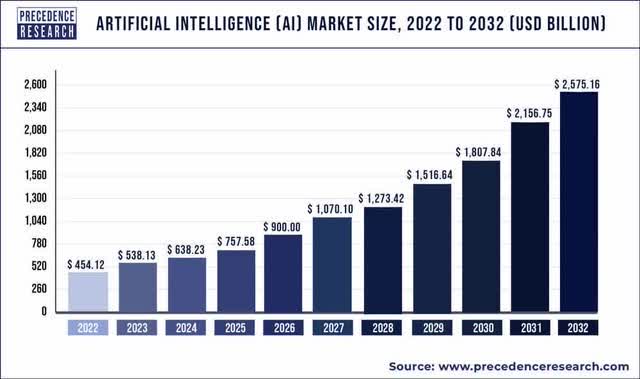

According to projections made by research and analytics company Precedence Research, the artificial intelligence market is set to expand to a market size of $2.6T by FY 2032… which implies a 4.8X factor increase in size due to the adoption of artificial intelligence capabilities. In percentage terms, these projections imply an average annual growth rate of almost 20%.

Precedence Research

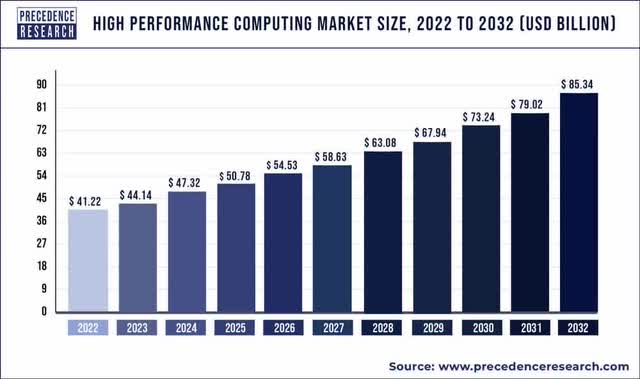

The company’s core market, High-Performance Computing, is also set to see sustained growth over the next decade. The HPC market size is expected to expand by a factor of 2X to $85.3B annually by FY 2032.

Taiwan Semiconductor Manufacturing generated $19.62B in revenues in the fourth-quarter, showing a year over year decline of 1.5%, but the top line came in ahead of the company’s guidance of $18.8-19.6B. TSMC generated a gross margin of 53% in Q4’23, which also came in at the top of the company’s previous margin guidance (51.5-53.5%). The trend in TSMC’s key metrics — revenue, gross profit and net income — is favorable and with a strong outlook for FY 2024 top line growth in place, TSMC has strong potential to out-perform.

TSMC’s valuation

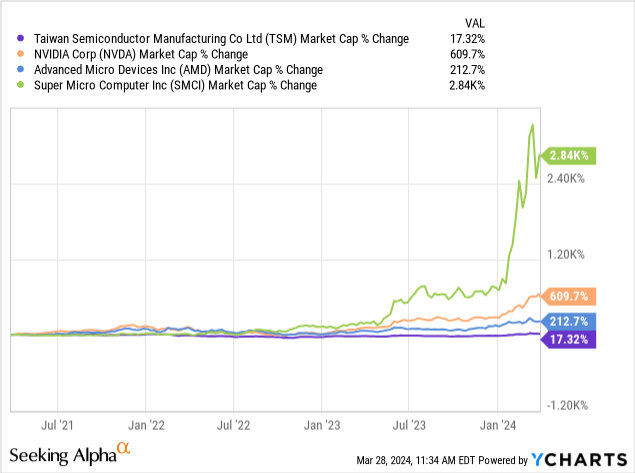

The biggest advantage that Taiwan Semiconductor Manufacturing has relative to other AI plays is its valuation. Names that have done extremely well in the AI market lately include Nvidia (NVDA), which is crushing it due to the early launch of the H100 Data Center GPU, as well as Super Micro Computer (SMCI) which is offering AI-dedicated server infrastructure.

Even Advanced Micro Devices (AMD), which is lagging Nvidia significantly in the GPU Data Center segment, has seen its share price and valuation soar. As a result, top AI plays that have a lot of visibility in the AI space have become prohibitively expensive while Taiwan Semiconductor Manufacturing’s shares are still trading at a relatively reasonable P/E ratio.

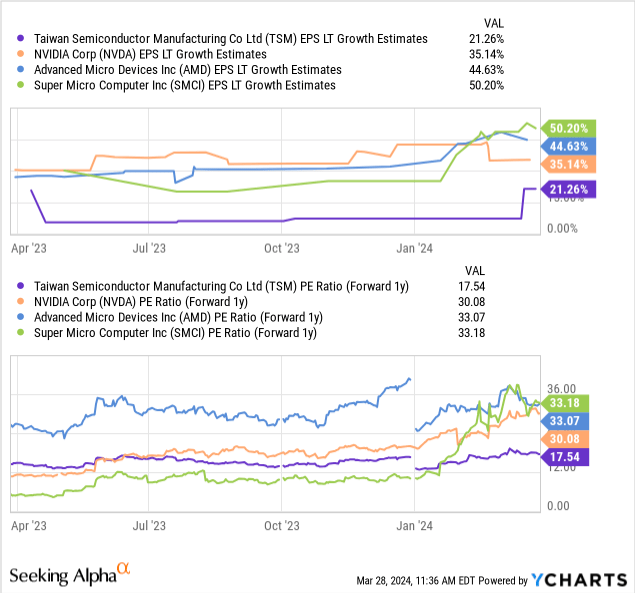

TSMC is projected to see EPS growth of 21% in FY 2024 and 24% in FY 2025 which is driven chiefly by accelerating adoption of AI chips. The company’s long-term EPS growth rate is dramatically below Nvidia’s or AMD’s growth rates, however, due to the company being not entirely focused on AI.

However, TSMC’s low P/E ratio of 17.5X compensates for this, in my opinion, allowing investors an entry into the stock at a much more affordable price. TSMC is much cheaper than the rivals I am using here, in part because the contract chip maker suffered from the consumer electronics industry down-turn in FY 2022 and 2023, but the company is, as per guidance, set to return to double-digit top line growth this year. Slower EPS growth also explains the lower P/E ratio, but with TSMC sitting at the very center of the AI revolution, I believe the chip maker has long term appreciation potential, especially in the context of the expanding total addressable market discussed earlier.

I believe TSMC could have a fair value P/E of 25X given that the company is set to return to double-digit top line growth this year (driven by demand for HPC and Data Centers), which would still be well below the industry group average of 32X. With double-digit EPS projected for this year and next year, TSMC could further expand its valuation multiplier in FY 2024 and beyond, especially if the chip maker saw an acceleration of AI chip demand and higher gross margins as well. A fair value P/E of 25X implies a target price of $195 and 43% upside revaluation potential.

Risks with TSMC

Foundries are at the very core of all economic activity, as semiconductors are used for everything from smartphones to tablets to autonomous driving technology. Since TSMC has such a commanding market share in the foundry industry, countries like U.S. and China are both trying to grow and develop home-grown chip industries in order to become more independent in this vital industry. Intel (INTC) recently received $10B in federal grants in order to expand the U.S.’s chip manufacturing capacity, and in the long run investors must expect TSMC to corner a smaller part of the global foundry market.

Final thoughts

Taiwan Semiconductor Manufacturing is a top, and most importantly, an affordable AI play for investors. The chipmaker is primed to benefit from the increasing adoption of artificial intelligence solutions in its core HPC business. Taiwan Semiconductor Manufacturing is offering growth investors an opportunity to invest in the growth of the AI economy as the company’s products are used for Data Centers and Cloud Computing, both of which will remain highly relevant in the next several years.

Although Taiwan Semiconductor is not growing nearly as fast as either Nvidia or AMD, I believe the lower EPS growth expectations are appropriately reflected in TSMC’s much more affordable P/E ratio. The risk profile, in my opinion, remains highly skewed to the upside!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.